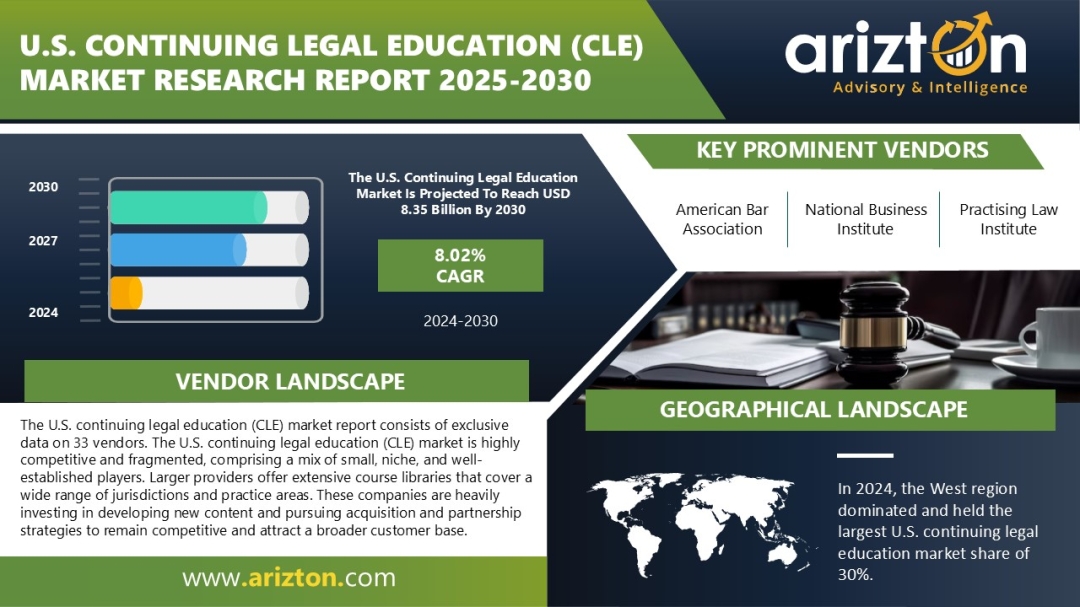

According to Arizton’s latest research report, the US CLE market will grow from USD 5.26 billion in 2024 to USD 8.35 billion by 2030, at a CAGR of 8.02% during forecast period 2024-2030.

Looking for More Information? Click: https://www.arizton.com/market-reports/continuing-legal-education-market

Report Summary:

Market Size (2030): USD 8.35 Billion

Market Size (2024): USD 5.26 Billion

CAGR (2024-2030): 8.02%

Historic Year: 2021-2023

Base Year: 2024

Forecast Year: 2025-2030

Largest Region (2024): West

Fastest-Growing Region: South

Market Segmentation: Delivery Mode, Providers, And Region

Regional Analysis: West, Northeast, South, And Midwest

AI and Cloud Technologies Reshape US Continuing Legal Education (CLE) Market

The US continuing legal education (CLE) market is undergoing significant transformation as providers integrate AI, cloud technologies, and competency-based learning to expand access, strengthen course delivery, and unlock new revenue streams. Modern CLE platforms leverage machine learning, virtual classrooms, and data analytics to deliver flexible, personalized content in high-demand areas such as cybersecurity, data privacy, and AI law.

Interactive tools like breakout rooms, polls, and real-time quizzes boost knowledge retention, while on-demand access supports lawyers in rural and underserved regions. This digital-first, data-driven model is elevating lawyer skills, ensuring compliance, and driving growth for CLE providers across the US legal profession.

US Continuing Legal Education Market News

• In 2025, the American Bar Association (ABA) offers over 2,000 CLE-accredited virtual and in-person events across multiple legal topics and locations through more than 40 groups.

• In 2025, the Practising Law Institute (PLI) launched a redesigned PLI.edu platform, providing easier access to thousands of hours of CLE content with new personalization features.

Competency-Based Learning Elevate Standards in US (CLE) Market

Competency-based education (CBE) is reshaping the US continuing legal education (CLE) market by shifting focus from mandatory credit hours to proven mastery of practical legal skills. With clear objectives, tailored learning paths, and measurable outcomes, CBE helps law students and attorneys strengthen real-world competencies in critical areas such as cybersecurity law, data privacy, AI, and legal ethics.

As competition in the legal field intensifies, lawyers increasingly use competency-based CLE to demonstrate skills, meet evolving compliance standards, and boost career prospects. By addressing real industry challenges and supporting flexible, high-impact learning, CBE continues to drive growth and higher standards across the US CLE market.

Western US Emerges as Key Growth Hub for Continuing Legal Education Market

The Western region leads the US continuing legal education (CLE) market, accounting for 30% of total market share in 2024. This growth is driven by California’s large base of over 175,000 practicing lawyers and strict mandatory CLE requirements, alongside strong demand for specialized programs in technology law, data security, intellectual property, and venture capital.

States such as Washington, Oregon, and Colorado further support steady market expansion by enforcing higher CLE hour mandates. With the region’s status as a hub for technology, entertainment, and clean energy creating complex legal challenges, CLE providers have strong opportunities to deliver targeted, high-value programs that meet evolving professional needs across the Western US.

Innovation and Expansion Drive Competition in the US CLE Market

Amid Rising demand for flexible, high-quality continuing legal education is pushing key players to expand through acquisitions and digital upgrades. In 2022, CeriFi strengthened its position by acquiring West LegalEdcenter and Checkpoint Learning from Thomson Reuters, broadening its reach across legal, tax, and accounting education.

Meanwhile, Practising Law Institute (PLI) is boosting its digital delivery, launching a redesigned PLI.edu in 2025 with a simpler interface, better personalization, and easier access to thousands of accredited CLE hours. These moves show how leading providers are blending growth strategies and tech innovation to stay competitive in the evolving US CLE landscape.

Access deeper insights and detailed forecasts: https://www.arizton.com/market-reports/continuing-legal-education-market

Key Vendors

- American Bar Association

- CeriFi

- Lawline

- National Business Institute

- Practising Law Institute

Other Prominent Vendors

- ALM Global, LLC.

- American Law Institute

- Attorney Credits

- Lorman Education Services

- mylawCLE

- National Academy of Continuing Legal Education (NACLE)

- RELX

- TRTCLE, Corp.

- National Institute of Trial Advocacy (NITA)

- BARBRI, Inc.

- American University

- CALIFORNIA STATE UNIVERSITY, EAST BAY

- Duquesne University

- Elisabeth Haub School of Law

- Institute of Continuing Legal Education

- Pennsylvania Continuing Legal Education

- Seyfarth Shaw LLP

- Strafford LLC

- Sterling Analytics

- St. John’s University

- University of Miami

- University of San Diego

- University of California (Irvine)

- University of North Dakota

- University of Houston Law Center

- University of Pennsylvania Carey Law School

- University of Pittsburgh School of Law

- USC Gould School of Law

Market Segmentation & Forecasts

By Delivery Mode

- Classroom Training

- Distance Learning

- Other Delivery Modes

By Providers Market

- Educational Companies

- Multi-disciplinary Educational Institutes

- Standalone Law Schools

- Other Providers

By Region Market

- West

- Northeast

- South

- Midwest

Other Related Reports that Might be of Your Business Requirement

Brazil E-Learning Market – Focused Insights 2024-2029

https://www.arizton.com/market-reports/brazil-e-learning-market

E-Learning Market – Global Outlook & Forecast 2024-2029

https://www.arizton.com/market-reports/e-learning-market-size-2025

What Key Findings Will Our Research Analysis Reveal?

- How big is the U.S. continuing legal education (CLE) market?

- What is the growth rate of the U.S. continuing legal education (CLE) market?

- Which delivery mode segment has the largest share in the U.S. continuing legal education (CLE) market?

- Which region holds the largest share in the U.S. continuing legal education (CLE) market?

- Which provider segment provides more business opportunities in the U.S. continuing legal education (CLE) market?

- Who are the major players in the U.S. continuing legal education (CLE) market?

Why Arizton?

100% Customer Satisfaction

24×7 availability – we are always there when you need us

200+ Fortune 500 Companies trust Arizton’s report

80% of our reports are exclusive and first in the industry

100% more data and analysis

1500+ reports published till date

Post-Purchase Benefit

- 1hr of free analyst discussion

- 10% off on customization

About Us:

Arizton Advisory and Intelligence is an innovative and quality-driven firm that offers cutting-edge research solutions to clients worldwide. We excel in providing comprehensive market intelligence reports and advisory and consulting services. We offer comprehensive market research reports on consumer goods & retail technology, automotive and mobility, smart tech, healthcare, life sciences, industrial machinery, chemicals, materials, I.T. and media, logistics, and packaging. These reports contain detailed industry analysis, market size, share, growth drivers, and trend forecasts.

Arizton comprises a team of exuberant and well-experienced analysts who have mastered generating incisive reports. Our specialist analysts possess exemplary skills in market research. We train our team in advanced research practices, techniques, and ethics to outperform in fabricating impregnable research reports.

Media Contact

Company Name: Arizton Advisory & Intelligence

Contact Person: Jessica

Email: Send Email

Phone: +1 3122332770

Country: United States

Website: https://www.arizton.com/market-reports/continuing-legal-education-market