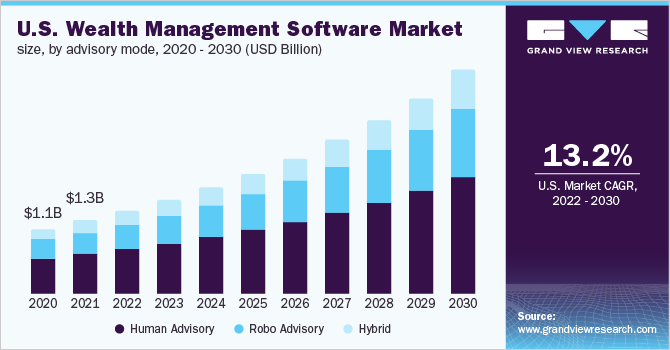

According to a report,“Wealth Management Software Market Size, Share & Trends Analysis Report By Advisory Mode (Human, Robo), By Deployment (Cloud, On-premise), By Enterprise Size, By End Use, By Application, And Segment Forecasts, 2019 – 2025”, published by Grand View Research, Inc., The global wealth management software market size is expected to reach USD 5.80 billion by 2025, registering a CAGR of 15.3% from 2019 to 2025. Growing need for digital tools that can automate the wealth management process is expected to drive the global market over the forecast period. Banks, trading houses, brokerage firms, forex traders, and asset management firms are some of the major end users of wealth management software. Apart from being cost-effective, these platforms can benefit end users by helping in wealth management and workflow automation. These platforms can also enhance digital engagement by providing omnichannel access and an open architecture, which can integrate seamlessly across various wealth management applications.

Key Takeaways from the report:

-

Robo advisory mode is anticipated to record the highest CAGR of 16.0% from 2019 to 2025 as it is cost-effective and can potentially help investors by providing information on assets in real time

-

The cloud segment is expected to emerge as the largest segment over the forecast period as cloud-based deployment helps in minimizing the operational costs and ensures easy access to the data

-

The financial advice and management segment is anticipated to expand at the highest CAGR of 16.0% from 2019 to 2025 due to growing demand for tools to manage finances

-

The trading and exchange firms segment is anticipated to reach USD 1.01 billion by 2025 as individuals are increasingly investing in equity and forex to augment their financial gains

-

North America is expected to be the dominant market over the forecast period and is anticipated to reach USD 2.09 billion by 2025 as advisory firms in the region are increasingly adopting wealth management software

-

Some of the key industry participants include Fiserv, Inc.; Temenos Headquarters SA; Fidelity National Information Services, Inc.; Profile Software; SS&C Technologies Holdings, Inc.; SEI Investments Company; Finantix, Comarch SA; Objectway S.p.A.; and Dorsum Ltd.

Browse More Reports in Next Generation Technologies:

• Food Robotics Market: The growing demand for packaged food, need for automation, increasing food safety regulations, and high labor costs are expected to drive the food robotics market.

• Wireless Charging Market: Increase in the demand for hassle-free charging pads is driven by factors including entangling of charging cable, insufficient availability of electric sockets in public places and malfunctioning ports due to continuous usage.

Such benefits bode well for the market growth. Wealth management software can also serve as advisory tools that ensure compliance with local and international regulatory requirements, help in tracking the market, and capture the investment opportunities for the users. Such capabilities are expected to drive their demand further. A wealth management software can typically provide the infrastructure necessary to support all the processes and operations asset managers have to undertake. Moreover, advances in technology are allowing financial advisors to introduce chatbots, intuitive client portals, biometrics, and enhanced mobile apps as part of the efforts to improve the customer experience as well as to attract new clients.

Grand View Research has segmented the global wealth management software market on the basis of advisory mode, deployment, application, end use, and region:

Wealth Management Software Advisory Mode Outlook (Revenue, USD Billion, 2014 – 2025)

-

Human Advisory

-

Robo Advisory

-

Hybrid

Wealth Management Software Deployment Outlook (Revenue, USD Billion, 2014 – 2025)

-

Cloud

-

On-premise

Wealth Management Software Application Outlook (Revenue, USD Billion, 2014 – 2025)

-

Financial Advice & Management

-

Portfolio, Accounting, & Trading Management

-

Performance Management

-

Risk & Compliance Management

-

Reporting

-

Others

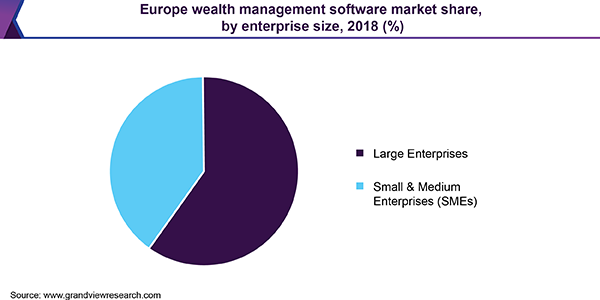

Wealth Management Software Enterprise Size Outlook (Revenue, USD Billion, 2014 – 2025)

-

Large Enterprises

-

Small & Medium Enterprises (SMEs)

Wealth Management Software End Use Outlook (Revenue, USD Billion, 2014 – 2025)

-

Banks

-

Investment Management Firms

-

Trading & Exchange Firms

-

Brokerage Firms

-

Others

Wealth Management Software Regional Outlook (Revenue, USD Billion, 2014 – 2025)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

Explore wealth management software market research database, Navigate with Grand View Compass, by Grand View Research, Inc.

About Grand View Research

Grand View Research provides syndicated as well as customized research reports and consulting services on 46 industries across 25 major countries worldwide. This U.S.-based market research and consulting company is registered in California and headquartered in San Francisco. Comprising over 425 analysts and consultants, the company adds 1200+ market research reports to its extensive database each year. Supported by an interactive market intelligence platform, the team at Grand View Research guides Fortune 500 companies and prominent academic institutes in comprehending the global and regional business environment and carefully identifying future opportunities.

For more information: www.grandviewresearch.com

Media Contact

Company Name: Grand View Research, Inc.

Contact Person: Sherry James, Corporate Sales Specialist – U.S.A.

Email: Send Email

Phone: 1-415-349-0058, Toll Free: 1-888-202-9519

Address:201, Spear Street, 1100

City: San Francisco

State: California

Country: Switzerland

Website: www.grandviewresearch.com/industry-analysis/wealth-management-software-market