Video Conferencing Industry Overview

The global video conferencing market size was valued at USD 4.21 billion in 2020 and is expected to reach USD 9.95 billion by 2028 with a CAGR of 11.4% over the forecast period. Factors such as the globalization of businesses, geographically scattered operations, and the rising adoption of remote working models are expected to drive market growth over the forecast period. The rapid adoption of video conferencing solutions in the telemedicine and education sectors is also anticipated to play a pivotal role in the growth of the market. Furthermore, lockdowns implemented amid the COVID-19 pandemic globally have resulted in a massive rise in demand for video conferencing and teleconferencing solutions as businesses and individuals sought ways of remaining connected.

The sudden shift of several businesses to the remote working model created an exponential demand for cloud conferencing software and services. Applications such as Zoom and Microsoft Teams have witnessed exponential growth during the first half of 2020. Despite the vast growth witnessed by the software segment, the overall market growth suffered in 2020 due to a decline in the demand for video conferencing hardware and related peripherals. In the hardware segment, the demand for enterprise endpoints was impacted negatively due to the temporary closure of organizations and other industries. This, in turn, resulted in a significant rise in demand for consumer hardware such as webcams and headsets.

Gather more insights about the market drivers, restrains and growth of the Global Video Conferencing market

Moreover, the increased use of cloud-based video conferencing solutions has given organizations access to vast amounts of data about video meeting habits. The use of conferencing platforms integrated with AI and machine learning is allowing companies to optimize the use of the collaboration platform and increase the efficiency of meetings by deploying virtual assistants and facial recognition technologies. Artificial Intelligence (AI) in conferencing solutions has enabled organizations to gain insights about aspects such as the optimal length of a meeting, the ideal number of participants, and the best time of the day to hold a meeting. Additionally, developments in the field of voice recognition are helping enterprises analyze the content of meetings, draw a comparative analysis between meetings in an organization, and make suggestions regarding connections among people with complementary skills.

The growing need for effective enterprise communication and large-scale investment by various organizations for modernizing communication networks are expected to propel the market. Rising mobility requirements of remote workers and workforces are driving the need for mobile devices, which has amplified the use of conferencing solutions among consumers. Conferencing and collaboration solutions, along with advanced hardware, have become an integral part of a range of businesses for delivering next-generation communication capabilities.

Video Conferencing Market Segmentation

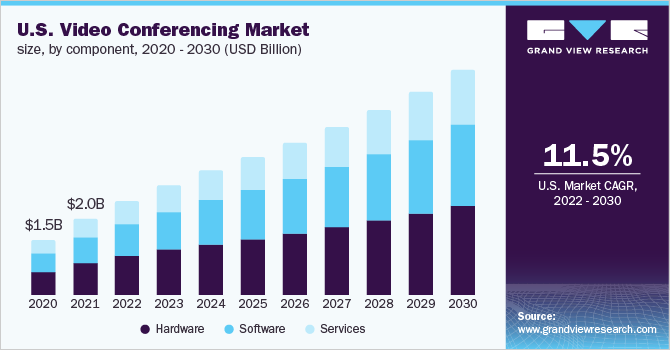

Based on the Component Insights, the market is segmented into Hardware, Software, and Service.

- The hardware segment dominated the market in 2020 with a revenue share of over 47%. The growth can be attributed to the increasing development and adoption of endpoints such as laptops, smartphones, and desktops equipped with high-resolution cameras, microphones, and speakers.

- The hardware segment is further segmented into cameras and microphones/headphones. The microphones/headphones segment witnessed sudden growth in 2020 due to the need for effective communication and the deployment of the work from home model.

Based on the Deployment Insights, the market is segmented into On-premise, and Cloud.

- The on-premise segment dominated the video conferencing market in 2020 by capturing a revenue share of over 59%. This can be attributed to the increasing adoption of on-premise deployment by large organizations in response to the growing concerns regarding data theft and effective maintenance of information security systems.

- The cloud segment is estimated to witness exceptional growth over the next few years. These solutions offer increased accessibility to the end-users by allowing easy access to video conferencing services through multiple channels, such as laptops and mobile devices.

Based on the Enterprise Size Insights, the market is segmented into Large Enterprises, and Small and Medium Enterprises.

- The large enterprises segment captured a revenue share of over 77% in 2020. Large enterprises are the primary clientele of video conferencing services as they need reliable and secure conferencing solutions.

- The Small and Medium Enterprises (SMEs) segment is expected to provide lucrative opportunities to key players over the next few years. SMEs are realizing the benefits of collaboration and conferencing, especially due to the COVID-19 pandemic.

Based on the Application Insights, the market is segmented into Consumer, and Enterprise.

- The enterprise segment dominated the market in 2020 by capturing a revenue share of over 84%. Conference video endpoints are room-based hardware solutions that are fixed, installed, and configured in meeting rooms and boardrooms.

Based on the End-use Insights, the market is segmented into Corporate, Education, Healthcare, Government & Defense, BFSI, Media & Entertainment, and Others.

- The corporate segment dominated the market in 2020 and acquired a revenue share of over 28%. The growth can be attributed to the rapid advancement of the cloud-based communication and collaboration software industry, opening up the market for new players.

- The government and defense sector is another promising sector expected to witness increased adoption in the forthcoming years.

- Cloud-based solutions are expected to witness an increased demand in the government sector as governments globally are prioritizing control over cost, moving away from aging telecom equipment, and seeking improved connectivity with their mobile workforce.

Based on the Video Conferencing Regional Insights, the market is segmented into North America, Europe, Asia Pacific, Latin America, and MEA.

- North America dominated the market for video conferencing in 2020 and acquired a revenue share of over 39%. The regional market is mature in terms of the adoption of video conferencing solutions.

- The Asia Pacific regional market is expected to witness the fastest growth over the forecast period. Although the business communities and governments in the region were already encouraging work style innovation prior to the COVID-19 pandemic; the pandemic acted as a catalyst for developing high-quality internet infrastructure in the region enabling people to work remotely.

Market Share Insights:

- October 2020: Cisco Systems, Inc. acquired BabbleLabs to improve the functionality of the Cisco WebEx Platform via speech enhancement and noise removal technology.

- July 2020: Zoom announced the launch of its hardware devices category. The first device launched in the category was Zoom for Home – DTEN ME, an all-in-one personal collaboration device for remote workers.

Key Companies Profile:

The COVID-19 pandemic has encouraged market players to restructure their business strategies and operations. Market players are investing heavily in cloud-based solutions to address the need for creating a digital workplace for remote employees. Some of the prominent players operating in the global video conferencing market are:

- Avaya, Inc.

- Cisco Systems, Inc.

- Huawei Technologies Co., Ltd.

- Logitech International S.A.

- Microsoft Corporation

- Polycom Inc.

- Zoom Video Communications, Inc.

Order a free sample PDF of the Video Conferencing Market Intelligence Study, published by Grand View Research.

About Grand View Research

Grand View Research is a full-time market research and consulting company registered in San Francisco, California. The company fully offers market reports, both customized and syndicates, based on intense data analysis. It also offers consulting services to business communities and academic institutions and helps them understand the global and business scenario to a significant extent. The company operates across multitude of domains such as Chemicals, Materials, Food and Beverages, Consumer Goods, Healthcare, and Information Technology to offer consulting services.

Web: https://www.grandviewresearch.com

Media Contact

Company Name: Grand View Research, Inc.

Contact Person: Sherry James, Corporate Sales Specialist – U.S.A.

Email: Send Email

Phone: 1888202951

Address:Grand View Research, Inc. 201 Spear Street 1100 San Francisco, CA 94105, United States

City: San Francisco

State: California

Country: United States

Website: https://www.grandviewresearch.com/industry-analysis/video-conferencing-market