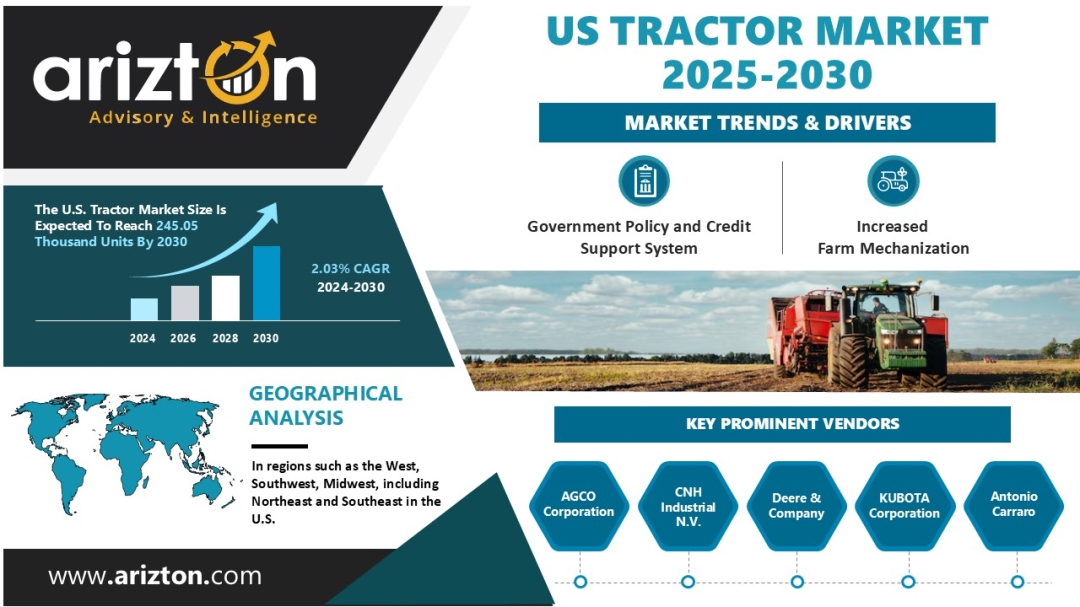

According to focus report store, the U.S. tractor market is growing at a CAGR of 2.03% during 2024-2030. This growth is fueled by advances in mechanization, the adoption of precision farming technologies, and supportive government policies. Emerging technologies such as real-time data monitoring, GPS, and smart sensors are enabling farmers to enhance efficiency and productivity. In addition, ongoing labor shortages and government initiatives to increase agricultural output are encouraging greater investment in modern tractors.

To Know More, Click: https://www.arizton.com/market-reports/us-tractors-market

Report Summary

Market Size (2030): 245.05 Thousand Units

Market Size (2024): 217.20 Thousand Units

CAGR (2024-2030): 2.03%

Historic Year: 2021-2023

Base Year: 2024

Forecast Year: 2025-2030

Market Segmentation: Horsepower, Drive Type, And Geography

Geographic Analysis: Northeast, Midwest, Southwest, West, And Southeast

US Tractor OEMs Adopt Multi-Fuel Strategy to Meet Sustainability Targets

Sustainability targets and evolving emission regulations are reshaping the US tractor market, pushing manufacturers to expand electric and alternative fuel offerings to meet demand for cleaner, more efficient machinery. Major players such as New Holland, John Deere, and Case IH are rolling out electric tractors, with Case IH’s Farmall 75C already active and New Holland developing an electric T4 with autonomous capabilities. At the same time, alternative fuel solutions are gaining traction, Kubota plans to launch hydrogen-powered fuel cell tractors in 2025, while New Holland is preparing to introduce natural gas and methane-powered models.

This shift marks a significant step toward reducing agriculture’s carbon footprint and signals how OEMs are aligning innovation pipelines with the broader push for sustainable farming across the US.

Smart Tractor Adoption Gains Momentum, Enhancing Precision and Efficiency in US Farming

Adoption of smart tractors in the US is gaining momentum as farmers respond to rising pressure to increase yields, cut costs, and meet stricter sustainability targets. Modern tractors now integrate GPS, sensors, AI, and telematics systems that provide real-time insights into machine performance, fuel use, and field operations, helping farmers optimize fleet management, reduce downtime, and extend equipment life.

Leading players such as Kubota and Yanmar are expanding their smart machinery portfolios to meet this demand, Kubota’s tractors use telematics for theft prevention, predictive maintenance, and operational monitoring, while Yanmar is advancing electric agricultural machinery focused on zero-emission solutions and higher fuel efficiency. As farms face tighter margins and evolving environmental regulations, smart tractors are set to play a critical role in modernizing operations and supporting the industry’s broader shift toward precision and sustainable farming in the years ahead.

US Tractor Market: Key Developments

Recent developments in the US tractor market highlight how leading OEMs are advancing smart technologies, automation, and operator-focused innovations to strengthen their competitive edge and meet evolving farming challenges.

- In February 2025, Kubota Corporation launched the FARMTRAC PROMAXX Tractor Series, featuring enhancements such as the Smart Pro Lift Switch, best-in-class hydraulics with helical gears and advanced lubrication, as well as improved operator comfort through upgraded floor mats and ergonomic seating. This launch reinforces Kubota’s position in delivering high-performance, operator-friendly machinery.

- In 2024, AGCO acquired an 85% stake in Trimble Inc. for USD 2 billion, forming a joint venture aimed at accelerating the development of autonomous technologies and other advanced solutions for farm equipment.

- In 2024, AGCO also introduced the new S7 Series combines and updated 9RX tractors, designed to boost customer value and tackle key agricultural challenges such as labor shortages, variable weather, and rising operational costs. The S7 Series includes advanced automation packages, while the updated 9RX tractors feature new engine options to expand their appeal in the market.

Regional Analysis: US Tractor Market Outlook

The US tractor market is shaped by distinct regional characteristics that determine demand for modern equipment and mechanization solutions. In 2024, the Midwest remained the largest regional market, accounting for approximately 27% of total demand. Strong production of corn, soybeans, and wheat, supported by fertile soil and stable rainfall, drives consistent investment in high-capacity tractors and precision equipment.

The Southwest market is expected to expand at a CAGR exceeding 2% between 2025 and 2030. Cotton production across Texas, Arizona, and New Mexico, along with specialty crops such as New Mexico’s Hatch green chiles, continues to support steady equipment upgrades as farms prioritize productivity and cost control in a climate-challenged region.

The Western US captured a significant market share in 2024, led by high-value crops such as almonds, grapes, and other specialty fruits and nuts. Reliance on irrigation to offset low rainfall keeps demand stable for efficient, reliable tractors and advanced attachments.

The Northeast sustains tractor demand through a strong dairy sector, particularly in New York and Vermont, where modern equipment supports feed, hay, and farm management operations.

The Southeast, which recorded sales of around 19,000 units in 2024, benefits from favorable soil and warm weather that enable diverse crops including cotton, peanuts, tobacco, and soybeans.

Download the full report for strategic insights, segment forecasts, and growth opportunities: https://www.arizton.com/market-reports/us-tractors-market

Key Company Profiles

- AGCO Corporation

- CNH Industrial N.V.

- Deere & Company

- KUBOTA Corporation

Other Prominent Company Profiles

- YANMAR HOLDINGS CO., LTD

- JCB

- Antonio Carraro

- Action Construction Equipment Ltd.

- CLAAS KGaA

- Deutz-Fahr

- ISEKI & CO.,LTD

- KIOTI

- Daedong-USA, Inc

- TAFE

- Jiangsu Yueda Intelligent Agricultural Equipment Co., Ltd.

- SOLIS

- LOVOL

- Sonalika

Market Segmentation and Forecast

Segmentation by Horsepower

- Less Than 50 HP

- 50-100 HP

- Above 100 HP

Segmentation by Drive Type

- 2-Wheel-Drive

- 4-Wheel-Drive

Segmentation by Geography

The U.S.

- Northeast

- Midwest

- Southwest

- West

- Southeast

Other Related Reports that Might be of Your Business Requirement

U.S. Electric Tractor Market – Industry Outlook & Forecast 2024-2029

https://www.arizton.com/market-reports/us-electric-tractor-market

U.S. Tractor Tires Market – Industry Analysis & Forecast 2024-2029

https://www.arizton.com/market-reports/united-states-tractor-tires-market

What Key Findings Will Our Research Analysis Reveal?

- What are the significant trends in the U.S. tractor market?

- Who are the key players in the U.S. tractor market?

- What is the growth rate of the U.S. tractor market?

- Which region dominates the U.S. tractor market share?

- How big is the U.S. tractor market?

About Us:

Arizton Advisory and Intelligence is an innovative and quality-driven firm that offers cutting-edge research solutions to clients worldwide. We excel in providing comprehensive market intelligence reports and advisory and consulting services.

We offer comprehensive market research reports on consumer goods & retail technology, automotive and mobility, smart tech, healthcare, life sciences, industrial machinery, chemicals, materials, I.T. and media, logistics, and packaging. These reports contain detailed industry analysis, market size, share, growth drivers, and trend forecasts.

Arizton comprises a team of exuberant and well-experienced analysts who have mastered generating incisive reports. Our specialist analysts possess exemplary skills in market research. We train our team in advanced research practices, techniques, and ethics to outperform in fabricating impregnable research reports.

Media Contact

Company Name: Arizton Advisory & Intelligence

Contact Person: Jessica

Email: Send Email

Phone: +1 3122332770

Country: United States

Website: https://www.arizton.com/market-reports/us-tractors-market