The Hyperphosphatemia Market was valued at approximately USD 4 billion in 2023, according to DelveInsight

Key companies active in the Hyperphosphatemia space include Phosphate Therapeutics, Bayer, Shire, Kyowa Kirin Co., Ltd., Shanghai Alebund Pharmaceuticals Limited, Ardelyx, Kissei Pharmaceutical Co., Ltd., Taisho Pharmaceutical Co., Ltd., Sanofi, Chugai Pharmaceutical, Astellas Pharma Inc., Alebund Pharmaceuticals, Mitsubishi Tanabe Pharma Corporation, KDL Inc., Denver Nephrologists, CM&D Pharma Limited, Daiichi Sankyo, and several others.

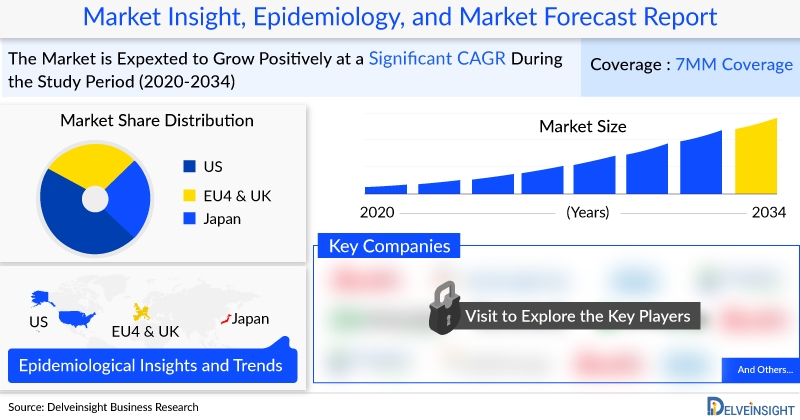

The Hyperphosphatemia market across the seven major markets (7MM) is expected to witness steady expansion, primarily fueled by the growing prevalence of chronic kidney disease (CKD) and an increasing patient population. In 2023, the United States represented the largest share of the Hyperphosphatemia market within the 7MM, with revenues of around USD 2.4 billion. Hyperphosphatemia – characterized by elevated serum phosphate levels above 4.5 mg/100 mL – commonly develops in CKD patients due to reduced renal phosphate excretion. The US accounted for close to half of the total patient population in 2023, making it the dominant market, followed by the EU4, the United Kingdom, and Japan. Market growth is anticipated to be supported by stronger adoption of existing therapies, improved disease awareness, and the expected introduction of next-generation treatments, including potential one-time gene-based therapies. In 2023, approximately 600,000 end-stage renal disease (ESRD) patients in the US were receiving dialysis, a figure projected to increase over time. Currently approved phosphate binders include KIKLIN, AURYXIA/RIONA, and VELPHORO/P-TOL. More recently, XPHOZAH received FDA approval for dialysis patients who are unable to tolerate conventional binders, while Oxylanthanum Carbonate (OLC) is gaining attention as an emerging treatment option.

DelveInsight’s “Hyperphosphatemia Market Insights, Epidemiology, and Market Forecast–2034” report provides a comprehensive analysis of the disease, examining historical trends, future epidemiological estimates, and market performance across the United States, EU5 (Germany, Spain, Italy, France, and the United Kingdom), and Japan. The report evaluates current standards of care, pipeline assets, market share dynamics, and projected market size from 2020 to 2034 across the seven major markets. It further assesses existing treatment pathways, key growth drivers, prevailing challenges, and unmet medical needs that collectively influence strategic decision-making and long-term market potential.

The USD 4 billion Hyperphosphatemia market is rapidly transforming with the emergence of innovative therapies such as XPHOZAH and OLC. Explore DelveInsight’s latest Hyperphosphatemia Market Forecast (2020–2034) for detailed insights into growth patterns, pipeline developments, and strategic opportunities @ Hyperphosphatemia Market Outlook

Key Highlights from the Hyperphosphatemia Market Report

- According to DelveInsight, the Hyperphosphatemia market across the 7MM was valued at nearly USD 4 billion in 2023.

- Major companies engaged in Hyperphosphatemia research and commercialization include Phosphate Therapeutics, Bayer, Shire, Kyowa Kirin Co., Ltd., Shanghai Alebund Pharmaceuticals Limited, Ardelyx, Kissei Pharmaceutical Co., Ltd., Taisho Pharmaceutical Co., Ltd., Sanofi, Chugai Pharmaceutical, Astellas Pharma Inc., Alebund Pharmaceuticals, Mitsubishi Tanabe Pharma Corporation, KDL Inc., Denver Nephrologists, CM&D Pharma Limited, Daiichi Sankyo, and others.

- Prominent Hyperphosphatemia therapies include Oxylanthanum Carbonate (OLC), KIKLIN, VELPHORO/P-TOL, AURYXIA/RIONA, among several others.

- In June 2025, Unicycive Therapeutics, Inc. (Nasdaq: UNCY), a clinical-stage biotechnology company focused on kidney disease therapies, announced that the US FDA issued a Complete Response Letter (CRL) for its New Drug Application (NDA) for Oxylanthanum Carbonate (OLC) for the treatment of Hyperphosphatemia in dialysis-dependent CKD patients.

- Also in June 2025, Alebund Pharmaceuticals reported the successful database lock on June 16, 2025, for the pivotal Phase III clinical trial of AP301, its next-generation oral iron-based phosphate binder, in dialysis patients with Hyperphosphatemia. The study achieved its primary endpoint, demonstrating statistically significant and clinically meaningful improvements in serum phosphorus control. AP301 also exhibited a favorable safety profile consistent with earlier studies.

- In February 2025, Ardelyx announced that China’s National Medical Products Administration (NMPA) approved tenapanor for the management of serum phosphorus levels in dialysis patients with chronic kidney disease.

Hyperphosphatemia Overview

Hyperphosphatemia is defined by abnormally elevated phosphate concentrations in the bloodstream and is most frequently observed in patients with chronic kidney disease due to impaired phosphate elimination. Excess phosphate disrupts mineral homeostasis and can result in serious complications, including vascular calcification, bone abnormalities, and cardiovascular disorders. Standard management approaches include dietary phosphate restriction, phosphate binders, dialysis, and emerging therapeutic interventions aimed at better phosphate regulation. Despite available treatment options, many patients fail to achieve adequate phosphate control, underscoring a significant unmet clinical need. Ongoing research and novel therapeutic strategies aim to improve disease management and reduce long-term complications.

Gain comprehensive insights into Hyperphosphatemia key stakeholders, therapeutic options, growth drivers, challenges, and opportunities across the 7MM @ Hyperphosphatemia Clinical Trials and FDA Approvals

Hyperphosphatemia Market Outlook

Within the Hyperphosphatemia market landscape, companies such as Unicycive Therapeutics are advancing lead candidates through multiple stages of clinical development to broaden available treatment options. The 7MM market is primarily driven by the widespread use of phosphate binders – both calcium-based and non-calcium-based – along with select off-label therapies. In 2023, the United States held the largest market share, with revenues of approximately USD 2.4 billion. Among the EU4 and the UK, Germany emerged as the leading contributor, generating close to USD 150 million.

Hyperphosphatemia Market Drivers

- Rising prevalence of CKD and ESRD: Increasing rates of chronic and end-stage renal disease continue to expand the patient population requiring long-term phosphate control.

- Advances in phosphate binder therapies: Development of binders with better tolerability, lower pill burden, and improved safety profiles is supporting higher adherence.

- Improved awareness and screening: Enhanced diagnostic capabilities and earlier CKD detection are driving increased treatment initiation.

- Technological progress in dialysis: Innovations in dialysis techniques are improving phosphate management and supporting market growth.

- Robust pipeline activity: Novel therapies targeting phosphate absorption and regulation present significant opportunities for improved outcomes.

Hyperphosphatemia Market Barriers

- High pill burden and adherence issues: Many phosphate binders require multiple daily doses, negatively impacting compliance.

- Gastrointestinal adverse effects: Side effects such as nausea, constipation, and bloating limit sustained therapy use.

- Limited treatment differentiation: Existing options often share similar mechanisms of action, offering minimal innovation.

- Cost and reimbursement constraints: High therapy costs and inconsistent reimbursement policies restrict patient access.

- Ongoing unmet needs: Achieving optimal phosphate control remains challenging for a large proportion of patients.

Curious about how emerging diagnostic approaches may influence the growing diagnosed Hyperphosphatemia population? Download the report @ Hyperphosphatemia Patient Pool

Hyperphosphatemia Epidemiology

The epidemiology section of the report analyzes historical and current Hyperphosphatemia prevalence and forecasts trends across seven major countries. It examines the underlying drivers of observed and projected patterns by reviewing published literature and expert opinions. In 2023, the United States reported the highest number of Hyperphosphatemia cases in the 7MM, with approximately 500,000 patients, alongside nearly 2.4 million individuals with CKD stages 3–5. Japan ranked second with around 300,000 cases, while Germany had the highest burden among the EU4 and the UK, accounting for nearly 56,000 cases.

Hyperphosphatemia Epidemiology Segmentation

- Total prevalent cases of chronic kidney disease (CKD)

- Total diagnosed prevalent cases of CKD

- Stage-wise distribution of CKD

- Total prevalent cases of end-stage renal disease (ESRD)

- Number of ESRD patients receiving dialysis

- Total prevalent cases of Hyperphosphatemia

Hyperphosphatemia Drug Uptake

VELPHORO/P-TOL (Fresenius Medical Care/Vifor Pharma) VELPHORO (sucroferric oxyhydroxide) was approved in the United States in 2013 and in Europe in 2014, followed by global expansion. In Japan, it has been marketed as P-TOL by Kissei since 2018. Currently available in more than 30 countries, the therapy supports over 100,000 patients annually. Its iron-based formulation enables effective phosphate binding with a relatively low pill burden.

KIKLIN (Astellas Pharma) KIKLIN (bixalomer), an amine-functional polymer, was launched in 2012 for dialysis-dependent CKD patients and later received expanded approval in 2016 for Hyperphosphatemia across all CKD stages. It functions by binding dietary phosphate in the gastrointestinal tract, thereby reducing absorption and maintaining serum phosphate levels.

Oxylanthanum Carbonate (OLC, Unicycive Therapeutics) OLC is a novel nanoparticle-based phosphate binder designed to significantly lower pill burden through smaller tablet sizes. Phase II clinical trials have demonstrated favorable safety and tolerability. Unicycive aims to seek FDA approval through the 505(b)(2) regulatory pathway to accelerate development.

Explore how VELPHORO, KIKLIN, and OLC are influencing the Hyperphosphatemia market. Access insights on therapy uptake, pipeline evolution, and growth prospects by downloading a sample report @ Hyperphosphatemia Medication and Companies

Hyperphosphatemia Therapeutics Assessment

Several major pharmaceutical and biotechnology companies are actively developing innovative therapies within the Hyperphosphatemia treatment landscape. Key players include Phosphate Therapeutics, Bayer, Shire, Kyowa Kirin Co., Ltd., Shanghai Alebund Pharmaceuticals Limited, Ardelyx, Kissei Pharmaceutical Co., Ltd., Taisho Pharmaceutical Co., Ltd., Sanofi, Chugai Pharmaceutical, Astellas Pharma Inc., Alebund Pharmaceuticals, Mitsubishi Tanabe Pharma Corporation, KDL Inc., Denver Nephrologists, CM&D Pharma Limited, Daiichi Sankyo, and others.

Discover how leading pharmaceutical innovators are redefining the Hyperphosphatemia treatment paradigm with next-generation therapies. Download a sample report @ Hyperphosphatemia Clinical Trials and FDA Approvals

Hyperphosphatemia Report Key Insights

- Hyperphosphatemia patient population analysis

- Market size and growth trends

- Competitive landscape assessment

- Market dynamics, including key drivers and restraints

- Market opportunities

- Therapeutic strategies

- Pipeline evaluation

- Current treatment practices and algorithms

- Impact of emerging therapies on market evolution

Table of Contents

- Key Insights

- Executive Summary

- Hyperphosphatemia Competitive Intelligence Analysis

- Hyperphosphatemia Market Snapshot

- Disease Background and Overview

- Patient Journey

- Epidemiology and Patient Population

- Treatment Algorithm and Current Medical Practices

- Unmet Medical Needs

- Key Treatment Endpoints

- Marketed Therapies

- Emerging Treatments

- Seven Major Market Analysis

- Attribute Analysis

- Market Outlook Across the 7MM

- Access and Reimbursement Landscape

- Key Opinion Leader Perspectives

- Market Drivers

- Market Barriers

- Appendix

- DelveInsight Capabilities

- Disclaimer

About DelveInsight

DelveInsight is a leading life sciences market research and business consulting firm, known for delivering high-quality syndicated reports and tailored research solutions to organizations across the global healthcare industry.

Media Contact

Company Name: DelveInsight Business Research LLP

Contact Person: Ankit Nigam

Email: Send Email

Phone: +14699457679

Address:304 S. Jones Blvd #2432

City: Albany

State: New York

Country: United States

Website: https://www.delveinsight.com/consulting/competitive-intelligence-services