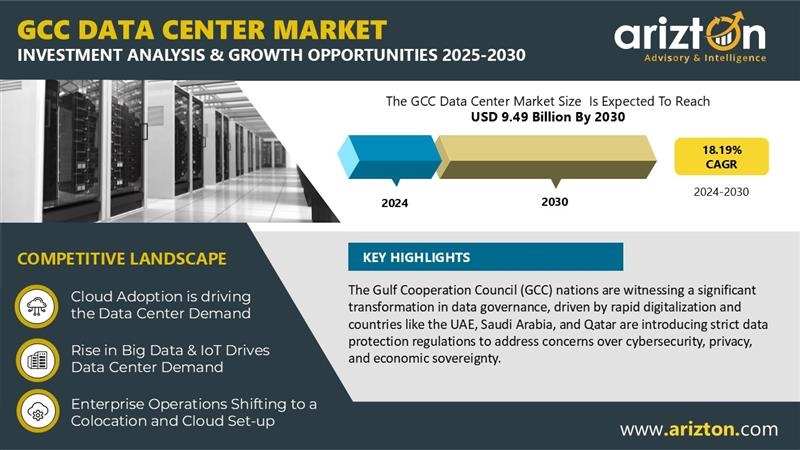

According to Arizton’s latest research report, the GCC data center market is growing at a CAGR of 18.19% during 2024-2030.

To Know More, Click: https://www.arizton.com/market-reports/gcc-data-center-market-investment-analysis-report

Report Summary

Market Size – Investment (2030): $9.49 Billion

Market Size – Area (2030): 2,014 Thousand Sq. ft.

Market Size – Power Capacity (2030): 483 MW

CAGR – Investment (2024-2030): 18.19%

Colocation Market Size (2030): $2.11 Billion

Historic Year: 2021-2023

Base Year: 2024

Forecast Year: 2025-2030

Market Overview

The growth of the GCC countries’ data center market is driven by factors such as increased cloud adoption, government initiatives, and robust infrastructure, including strong inland and submarine cable connectivity. Key cities fueling this growth include Dubai, Abu Dhabi, Riyadh, Jeddah, Neom, and Kuwait City, with emerging hubs like Doha and Sharjah gaining attention. Investments in data centers are growing due to rising internet penetration and demand for cloud services, with major operators such as Batelco, Ooredoo, and Mobily leading the market. The region’s smart cities are driving the need for edge and modular data centers.

The GCC currently has 64 submarine cables, with more expected in 2025-2027, including prominent cables like 2Africa, SeaMeWe-6, and ANDROMEDA. Several subsea cable projects have been announced, such as partnerships between Telecom Egypt, Mobily, and Ooredoo to enhance regional connectivity.

Global cloud giants, including Google, AWS, Microsoft, Oracle, Alibaba, and Huawei, are also investing in dedicated cloud regions and data centers across the region. Notable upcoming developments include Du’s deployment of Oracle Alloy in the UAE and Tencent Cloud’s planned expansion into the UAE market.

Rise of AI Adoption in GCC Data Centers and the Need for Advanced Cooling Solutions

In 2024, the GCC region witnessed significant advancements in AI infrastructure development. Qatar, Saudi Arabia, and the UAE have been at the forefront of AI initiatives, with Qatar investing $2.5 billion to enhance AI capabilities, Saudi Arabia planning to develop AI-powered data centers like Oxagon, and the UAE setting up AI centers with Microsoft and G42. This surge in AI adoption is driving a substantial increase in the demand for advanced data center technologies, including higher rack power density and more powerful servers. As a result, cooling solutions, such as liquid immersion cooling, are essential to handle the heat generated from increased computational power, with traditional cooling methods needing to be replaced to maintain efficiency. Additionally, efficient power supply management is critical to support the expanding AI infrastructure in the region.

Expanding Data Center Market in the GCC: Saudi Arabia and UAE Lead Growth

Saudi Arabia and the UAE are the primary investment hubs in the rapidly growing GCC data center market. The UAE, particularly Dubai and Abu Dhabi, is set to account for more than half of the upcoming data center space, with leading companies like Khazna Data Centers, Gulf Data Hub, Moro Hub, and Equinix driving the expansion.

The GCC data center construction market is projected to grow from 802,000 square feet in 2024 to 2,014,000 square feet by 2030, at a CAGR of 16.59%. The UAE’s robust infrastructure and global connectivity make it a key regional hub for data centers. Additionally, brownfield development in industrial parks and free trade zones, especially in Abu Dhabi, supports this growth. Meanwhile, modular data centers are on the rise, particularly in Abu Dhabi. Emerging economies like Kuwait, Bahrain, and Oman are also increasing data center investments, signaling the GCC’s strategic importance in cloud services, edge computing, and global data networks.

Why Should You Buy this Research?

This research provides a comprehensive analysis of the GCC data center market, focusing on key metrics such as market size, area, power capacity, and colocation revenue. It offers a detailed assessment of data center investments by colocation, hyperscale, and enterprise operators, including insights into existing and upcoming data center facilities across six GCC countries. The study covers 92 existing facilities and 83 upcoming ones, with in-depth forecasts for data center area, IT load capacity, and colocation revenue from 2021 to 2030.

The report highlights investments in IT, power, cooling, and construction services, with detailed market forecasts. It also explores the latest industry trends, growth opportunities, and challenges. Additionally, the research provides an overview of prominent IT infrastructure providers, contractors, and investors, offering a transparent research methodology that analyzes both demand and supply dynamics in the industry.

Buy this Research @ https://www.arizton.com/market-reports/gcc-data-center-market-investment-analysis-report

The Report Includes the Investment in the Following Areas:

IT Infrastructure

- Server Infrastructure

- Storage Infrastructure

- Network Infrastructure

Electrical Infrastructure

- UPS Systems

- Generators

- Transfer Switches & Switchgears

- PDUs

- Other Electrical Infrastructure

Mechanical Infrastructure

- Cooling Systems

- Rack

- Other Mechanical Infrastructure

Cooling Systems

- CRAC and CRAH Units

- Chillers Units

- Cooling Towers, Condensers and Dry Coolers

- Other Cooling Units

Cooling Techniques

- Air-based Cooling

- Liquid-based Cooling

General Construction

- Core & Shell Development

- Installation & Commissioning Services

- Building & Engineering Design

- Fire Detection & Suppression Systems

- Physical Security

- Data Center Infrastructure Management (DCIM)

Tier Standard

- Tier I & Tier II

- Tier III

- Tier IV

Geography

- The UAE

- Saudi Arabia

- Bahrain

- Oman

- Kuwait

- Qatar

Vendor Landscape

IT Infrastructure Providers

- Arista Networks

- Atos

- Broadcom

- Cisco Systems

- Dell Technologies

- Fujitsu

- Hewlett Packard Enterprise

- Hitachi Vantara

- Huawei Technologies

- IBM

- Inspur

- Lenovo

- NetApp

- Oracle

Data Center Construction Contractors & Sub-Contractors

- AECOM

- AESG

- Al-Balagh Trading and Contracting Co. WLL

- Aldar

- Al Latifia Trading & Contracting Co

- ALEC Engineering & Contracting

- Arcadis

- Arup

- Ashi & Bushnag Co.

- ASU

- AtkinsRealis

- BG&E

- Black & White Engineering

- CADD Emirates

- Capitoline

- Condor Group

- Core Emirates

- Critical Facilities Consulting & Services

- Dar

- DC PRO Engineering

- Direct Services

- Edarat Group

- EGEC

- EGIS

- Exyte

- Galfar Al Misnad

- Group AMANA

- HATCO

- HHM Group

- Hill International

- ICS Nett

- INT’LTEC GROUP

- JAMED

- James L Williams

- John Paul Construction

- Laing O’Rourke

- Laith Electro Mechanical

- Linesight

- Mace

- Marafie Group

- McLaren Construction Group

- Meinhardt Group

- MEMA Architecture

- MIS – Al Moammar Information Systems

- Qatar Site & Power

- Raghav Contracting

- Red Engineering Design

- Rider Levett Bucknall

- RW Armstrong

- SANA Creative Systems

- Site & Power DK

- STS Group

- Sudlows

- Syska Hennessy Group

- Telal Engineering & Contracting

- Turner & Townsend

- UBIK

- Jacobs

Support Infrastructure Providers

- ABB

- Airedale

- Alfa Laval

- Canovate

- Caterpillar

- Chatsworth Products

- Cummins

- Delta Electronics

- Eaton

- Envicool

- Enrogen

- Grundfos

- HITEC Power Protection

- Honeywell

- Johnson Controls

- Legrand

- Mitsubishi Electric

- Rittal

- Rolls-Royce

- Schneider Electric

- Siemens

- STULZ

- Vertiv

Data Center Investors

- Amazon Web Services

- Batelco

- Core42

- Center3

- du

- Edgnex Data Centres by DAMAC

- Equinix

- Khazna Data Centers

- Gulf Data Hub

- KEMS Zajil Telecom

- MEEZA

- Moro Hub

- Microsoft

- Mobily

- Oman Data Park

- Ooredoo

- Pacific Controls

- Quantum Switch Tamasuk

- stc

- Tonomus

- Zain

New Entrants

- Agility

- DataVolt

- Desert Dragon Data Centers

- Pure Data Centres

- Qareeb Data Centres

- Sahayeb Datacenters

Key Questions Answered in the Report:

How big is the GCC data center market?

What is the growth rate of the GCC data center market?

What factors are driving the GCC data center market?

How much MW of power capacity will be added across the GCC during 2025-2030?

Which countries are included in the GCC data center market report?

Check Out Some of the Top Selling Reports of Your Interest:

Saudi Arabia Data Center Market – Investment Analysis & Growth Opportunities 2025-2030

https://www.arizton.com/market-reports/saudi-arabia-data-center-market-investment-analysis

Middle East Data Center Construction Market – Industry Outlook & Forecast 2025–2030

https://www.arizton.com/market-reports/middle-east-data-center-construction-market

Why Arizton?

100% Customer Satisfaction

24×7 availability – we are always there when you need us

200+ Fortune 500 Companies trust Arizton’s report

80% of our reports are exclusive and first in the industry

100% more data and analysis

1500+ reports published till date

Post-Purchase Benefit

- 1hr of free analyst discussion

- 10% off on customization

About Us:

Arizton Advisory and Intelligence is an innovative and quality-driven firm that offers cutting-edge research solutions to clients worldwide. We excel in providing comprehensive market intelligence reports and advisory and consulting services.

We offer comprehensive market research reports on consumer goods & retail technology, automotive and mobility, smart tech, healthcare, life sciences, industrial machinery, chemicals, materials, I.T. and media, logistics, and packaging. These reports contain detailed industry analysis, market size, share, growth drivers, and trend forecasts.

Arizton comprises a team of exuberant and well-experienced analysts who have mastered generating incisive reports. Our specialist analysts possess exemplary skills in market research. We train our team in advanced research practices, techniques, and ethics to outperform in fabricating impregnable research reports.

Media Contact

Company Name: Arizton Advisory & Intelligence

Contact Person: Jessica

Email: Send Email

Phone: +1 3122332770

Country: United States

Website: https://www.arizton.com/market-reports/gcc-data-center-market-investment-analysis-report