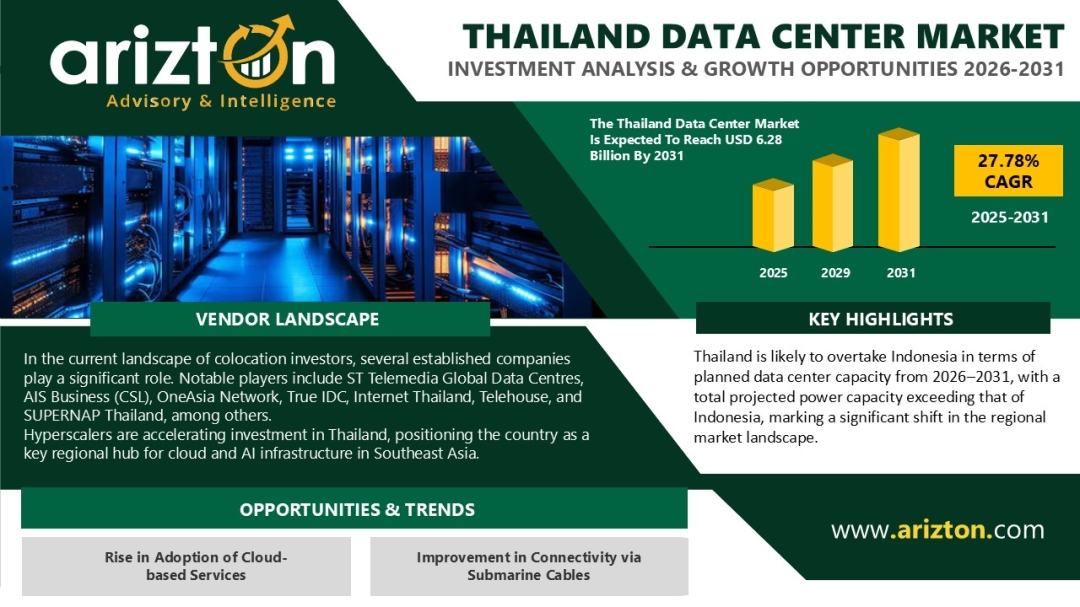

Arizton’s latest research highlights the rapid growth of Thailand’s data center market, projected to expand from USD 1.44 billion in 2025 to USD 6.28 billion by 2031, at a robust CAGR of 27.78%. Thailand has emerged as a major colocation hub in Southeast Asia, with 39 operational data centers as of September 2025, led by Bangkok. The country’s data center landscape is set for significant expansion, driven by rising demand for digital infrastructure and high-density computing capacity.

Explore the Full Market Insights: https://www.arizton.com/market-reports/thailand-data-center-market-size

Report Summary:

Market Size (Investment): USD 6.28 Billion (2031)

Market Size (Area): 1,160 Thousand Sq. Feet (2031)

Market Size (Power Capacity): 290 Mw (2031)

CAGR – Investment (2024-2030): 27.78%

Colocation Market Size (Revenue): USD 1.91 Billion (2031)

Historic Year: 2022-2024

Base Year: 2025

Forecast Year: 2026-2031

Thailand’s Cloud Transformation: Advancing Toward an $8.5 Billion Digital Economy

Cloud services are becoming the backbone of fast-growing businesses, offering the flexibility, security, and cost efficiency needed to scale without heavy investments in physical infrastructure. Thailand is accelerating this shift through its cloud-first policy under the Thailand 4.0 initiative, which pushes government agencies to prioritize cloud adoption to boost efficiency, strengthen cybersecurity, and build a more agile digital ecosystem. As a result, Thailand’s public cloud market is on a sharp upward trajectory, expected to generate nearly $3.0 billion in 2025 and reach $8.5 billion by 2030, growing at a strong 23.7% CAGR. IaaS continues to lead this expansion, contributing more than $950 million in 2025. Today, the country’s cloud landscape is largely shaped by major Chinese providers, with Alibaba Cloud, Tencent Cloud, and Huawei Cloud operating multi-zone regions across Bangkok, laying the foundation for Thailand’s next phase of digital innovation.

Thailand’s Digital Market Accelerates into the Next Wave of AI-Driven Maturity

Thailand’s digital economy is entering a high-growth phase, with AI adoption emerging as a defining market catalyst. he 2024 AI Readiness for Digital Services Survey shows that 17.8% of organizations have already adopted AI, while another 73.3% are preparing to implement it, clear evidence of strong enterprise demand for intelligent, data-driven solutions. Global tech leaders such as Microsoft, Google, NVIDIA, and TikTok are accelerating this shift by expanding their AI footprints in the country. Backed by coordinated public and private sector initiatives, Thailand’s digital landscape continues to scale at speed. By early 2025, the country’s digital penetration exceeded 91%, with over 65.4 million users, underscoring a rapidly expanding market fueled by government incentives, advancing technologies, and rising digital adoption across education, healthcare, and commerce.

Thailand Advances a Bold Sustainability Agenda with Clear National Climate Targets

Thailand is advancing a bold sustainability agenda, setting clear national targets to peak greenhouse gas emissions by 2030, achieve carbon neutrality by 2050, and reach net-zero emissions by 2065. This long-term vision is reshaping the country’s digital infrastructure market, especially as data centers increase their demand for clean and reliable power. In June 2024, the government launched a landmark pilot program allowing data centers to purchase renewable energy directly from producers, a move that strengthens Thailand’s appeal to global tech players looking to meet aggressive sustainability commitments. Operators are already responding. Etix Everywhere, for instance, has installed solar panels spanning more than 64,580 sq ft at its ETIX Bangkok #1 facility, generating 11% of its power needs and targeting 100% renewable energy use by 2025. These developments position Thailand as a rapidly evolving hub for low-carbon digital infrastructure.

Thailand’s Urban Transformation Gains Momentum with Major Smart City Investments

Thailand is accelerating its smart city transformation, fueled by rapid urbanization and the evolving needs of a population that surpassed 215 million in early 2024. With more than 55% of citizens now living in urban areas, the country is prioritizing modern mobility, public safety, energy efficiency, and sustainable urban development. This shift is guided by government-led frameworks such as Thailand 4.0 and the Smart City Development Plan, which together support the national goal of developing 100 smart cities by 2040.

The results of these efforts are already visible. The Phuket Tinicon Valley Project recently earned the ‘Smart Area’ certification for its use of digital technologies to enhance everyday living, reflecting the tangible impact of Thailand’s smart city strategy. Market momentum is further strengthened by major investments, including the $37 billion Chonburi smart city project, which aims to integrate clean energy, advanced technologies, and next-generation business hubs by 2032.

Request for a free sample? here: https://www.arizton.com/market-reports/thailand-data-center-market-size

The Malaysia Data Center Market Report Includes Size in Terms of

- IT Infrastructure: Servers, Storage Systems, and Network Infrastructure

- Electrical Infrastructure: UPS Systems, Generators, Transfer Switches & Switchgears, PDUs, and Other Electrical Infrastructure

- Mechanical Infrastructure: Cooling Systems, Rack Cabinets, and Other Mechanical Infrastructure

- Cooling Systems: CRAC & CRAH Units, Chiller Units, Cooling Towers, Condensers & Dry Coolers, Economizers & Evaporative Coolers, and Other Cooling Units

- General Construction: Core & Shell Development, Installation & Commissioning Services, Engineering & Building Design, Fire Detection & Suppression Systems, Physical Security, and Data Center Infrastructure Management (DCIM)

- Tier Standard: Tier I & Tier II, Tier III, and Tier IV

- Geography: Selangor, and Johor

Vendor Landscape

IT Infrastructure Providers

- Arista Networks

- Atos

- Cisco

- Dell Technologies

- Fujitsu

- Hewlett Packard Enterprise

- Huawei Technologies

- IBM

- Inspur

- Lenovo

- NetApp

- NVIDIA

Data Center Construction Contractors & Sub-Contractors

- Arup

- Architects 49

- Aurecon

- Chaan

- Finishing Touch Design Studio

- Infraset

- Meinhardt Group

- Plan Architect

- PPS Group

- QTCG

- Syntec Construction

- THAI KAJIMA

- Taikisha

- Tarnas

- WT Asia

Support Infrastructure Providers

- ABB

- Airedale

- Caterpillar

- Cummins

- Cyber Power Systems

- Delta Electronics

- Eaton

- Fuji Electric

- HITEC Power Protection

- Rehlko (Kohler)

- Legrand, Mitsubishi Electric

- Piller Power Systems

- Rittal

- Schneider Electric

- Siemens

- STULZ

- Vertiv

Data Center Investors

- AIS Business

- Alibaba Cloud

- Bridge Data Centres

- Etix Everywhere

- Internet Thailand

- NTT DATA

- OneAsia Network

- ST Telemedia Global Data Centres

- SUPERNAP Thailand

- Tencent Cloud

- True Internet Data Center (True IDC)

- Telehouse and WHA Group

New Entrants

- Amazon Web Services

- CloudHQ

- CtrlS Datacenters

- Doma Infrastructure Group

- DAMAC Digital

- DayOne (GDS Services)

- Digital Edge DC

- Epoch Digital (Actis)

- Equinix

- Empyrion Digital

- Evolution Data Centres

- Galaxy Data Centers

- Haoyang Data

- Microsoft

- NEXTDC

- Nxera

- SC Zeus Data Centers

- TikTok

- ZDATA Technologies

Related Reports That May Align with Your Business Needs

Japan Data Center Market – Investment Analysis & Growth Opportunities 2025-2030

https://www.arizton.com/market-reports/japan-data-center-market-investment-analysis

Malaysia Data Center Market – Investment Analysis & Growth Opportunities 2025-2030

https://www.arizton.com/market-reports/malaysia-data-center-market-size-analysis

What Key Findings Will Our Research Analysis Reveal?

- What factors are driving the Thailand data center market?

- What is the growth rate of the Thailand data center market?

- How much MW of power capacity will be added across Thailand in 2031?

- How big is the Thailand data center market?

- Who are the key investors in the Thailand data center market?

Why Arizton?

100% Customer Satisfaction

24×7 availability – we are always there when you need us

200+ Fortune 500 Companies trust Arizton’s report

80% of our reports are exclusive and first in the industry

100% more data and analysis

1500+ reports published till date

Post-Purchase Benefit

- 1hr of free analyst discussion

- 10% off on customization

About Us:

Arizton Advisory and Intelligence is an innovative and quality-driven firm that offers cutting-edge research solutions to clients worldwide. We excel in providing comprehensive market intelligence reports and advisory and consulting services.

We offer comprehensive market research reports on consumer goods & retail technology, automotive and mobility, smart tech, healthcare, life sciences, industrial machinery, chemicals, materials, I.T. and media, logistics, and packaging. These reports contain detailed industry analysis, market size, share, growth drivers, and trend forecasts.

Arizton comprises a team of exuberant and well-experienced analysts who have mastered generating incisive reports. Our specialist analysts possess exemplary skills in market research. We train our team in advanced research practices, techniques, and ethics to outperform in fabricating impregnable research reports.

Media Contact

Company Name: Arizton Advisory & Intelligence

Contact Person: Jessica

Email: Send Email

Phone: +1 3122332770

Country: United States

Website: https://www.arizton.com/market-reports/thailand-data-center-market-size