Silane Market Industry Overview

The global silane market size was valued at USD 1.1 billion in 2019 and is expected to reach USD 1.4 billion by 2027, expanding at a CAGR of 4.0% over the forecast period.

The global market is driven by increasing product demand from rapidly developing end-use sectors. Rising demand for paint & coating products from the growing construction sector, which uses silane-based coatings is projected to drive the demand over the forecast period. New construction project outcomes in the Asia Pacific coupled with increasing infrastructural renovation activities in North America and Western Europe have led to a surge in demand for various industrial coatings, adhesives, plastic components, and more. Furthermore, growing demand for automobiles in the Middle East and South America regions has led to a surge in demand for various light-weight, durable plastic components, and tires, which requires a significant amount of silane products for continued production operations.

Gather more insights about the market drivers, restrains and growth of the Global Silane Market

The global demand for silane is observed to be growing due to high product requirements from paints & coating formulators, followed by adhesive & sealant manufacturers. Asia Pacific is the fastest-growing market due to increasing penetration of paint & coating and adhesives & sealant formulators across countries, such as China, Japan, South Korea, India, Thailand, and Malaysia. Factors, such as the construction of green buildings, residential complex expansions, and rising renovation activities, have resulted in increased demand for adhesives used in the construction sector in the region.

Furthermore, the product is a key component in the electronics industry, wherein silane gas is widely utilized in semiconductors, which are eventually an integral component in the electronics industry. The growing requirement for electronic gadgets and devices across the globe is projected to remain a major contributing factor to the market.

Rising environmental awareness has fueled the demand for highly efficient, solvent-free, and UV-cured coatings, thereby increasing the use of silane in the formulation of solvent-free coatings. These factors are projected to drive the paints & coatings application segment.

In addition, with the advancements in technology and growing urbanization, the requirement for electronic gadgets & devices is rapidly rising. Silane is widely utilized in the electronics segment in lithography & processing auxiliaries and as an insulating layer in the components of semiconductors. These factors are projected to increase the consumption of silane in the global electronics & semiconductors application segment over the coming years.

Silane Market Segmentation

Based on the Application Insights, the market is segmented into paints & coatings, adhesives & sealants, rubber & plastics, fiber treatment, electronics & semiconductor and others

- In terms of volume, paints & coatings application led the market with a share of 29.7% in 2019. This is attributed to high demand for various silane products from different coatings applications, such as emulsion paints and automotive, aircraft, marine, interior & exterior decorative coatings.

- The increasing demand for cargo and defense aircraft, particularly from developing countries in North America and Europe, is expected to have a positive impact on the segment growth over the next few years.

- Adhesives & sealants are used as crosslinking agents, adhesion promoters, reinforcers, and drying agents in a wide range of end-use industries. Silanes have a considerable impact on the properties of adhesives & sealants.

- Silane is used in the crosslinking of polyethylene and its copolymers for application in cable insulation and electrical wires. Silane-based plastic compounds are used in places where high-temperature resistance is required. In addition, these plastic compounds are used in hot & cold water pipes and natural gas carrier pipes.

- Expanding the electrical sector, especially in the Asia Pacific, is expected to drive the industry over the forecast period. Technological advancements in the construction and transport sectors are expected to further fuel the product demand, wherein plastic and rubber components are critically used across multiple application points.

- Multiple large-scale manufacturers are constantly investing in research activities to enhance their product portfolios to meet the extensive product requirement from growing end-use industries. Paints & coatings followed by adhesives & sealants are among the largest consumers of the product globally due to the product’s ability to provide excellent adhesion boost as well as it is a highly effective coupling agent.

- Increasing construction activities across all major economies are promoting the demand for various industrial sealants and coating formulations, which is anticipated to boost the market growth over the coming years.

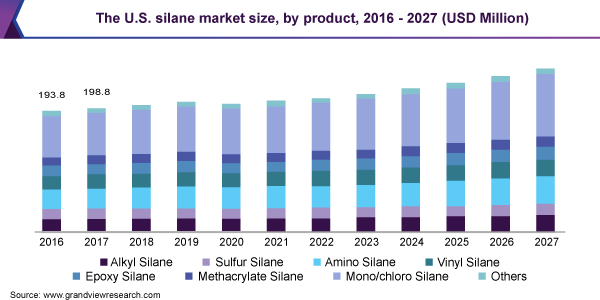

Based on the Product Insights, the market is segmented into alkyl silane, sulfur silane, amino silane, vinyl silane, epoxy silane, methacrylate silane, mono/chloro silane and others

- In terms of volume, mono/chloro silane products led the market with a share of over 35% in 2019. It is generally used to produce siloxanes. Mono/chloro product type also acts as intermediates in the production of ultrapure silicon, which used in the semiconductor industry, and as protecting agents for intermediates in the pharmaceutical industry. Mono/chloro silanes are used as coatings for glass surfaces & silicon and in the production of silicon polymers.

- Amino products find application as a coupling agent, adhesion promoter, resin additive, and surface modifier. It improves the chemical bonding of resins in reinforcing materials and inorganic fillers. Amino-based product is also stable and reacts well with water, which makes it suitable for various applications. Several major players in the market manufacture amino silane for the paints & coatings applications.

- Vinyl silanes are used as crosslinking agents in the manufacturing of cross-linked polyethylene (PEX). They are also used as adhesion promoters and coupling agents in various end-use applications, such as paints & coatings.

- The growing demand for various silane products as crosslinking agents, adhesion promoters, and as coupling agents is projected to drive growth over the foreseeable future. Amino silanes are anticipated to reflect the highest consumption, globally, in terms of volume, on account of their widespread use in reinforcing materials, inorganic fillers, and more, across industries, such as plastic and rubber.

- Furthermore, with technological advancements by key product manufacturers worldwide, such as PCC Group, Evonik Industries, and Shin-Etsu Chemicals, to serve a broader market base, the demand for various products is projected to grow over the coming years.

Based on the Regional Insights, the market is segmented into North America, Europe, Asia Pacific, Central & South America and Middle East & Africa

- Asia Pacific dominated the market and accounted for 53.1% of the global volume in 2019. This is attributed to the expanding manufacturing sector in Vietnam, South Korea, Thailand, China, Japan, and India, which fueled the demand for plastic compounds and rubber substrates in the automotive, industrial machinery, construction, packaging, and electrical & electronics industries.

- In the recent past, India and China have witnessed a spike in automotive production owing to technology transfer to the sector from the Western regions. In addition, a well-established manufacturing base for electrical & electronics in Taiwan, China, and South Korea is anticipated to provide further impetus to the automotive sector in the region.

- The market in North America is driven by the growing automotive and construction sectors. Residential construction is the fastest-growing sector, with countries, such as Canada and Mexico, witnessing significant development over the last five years. To cope up with the growing demand for adhesives & sealants from the regional construction market, there is a sizeable increase in the number of large-scale plant manufacturing adhesives as compared to other geographies, which mostly have subsidiary units.

- Europe exhibits a substantially high demand for adhesives & sealants from applications, such as construction, automobile, medical, engineering, and electronics sectors.

- Germany, Finland, and Italy are the major revenue-generators in the European market. Moreover, the strong presence of key companies, such as Helios Group, 3M Company, and SABA BV, in the region will drive the market.

Market Share Insights:

- March 2015: Evonik expanded the production facilities of specialty silicone in China and Germany with a view to serving various end-use industries, such as construction, coating, furniture, and textile. Through this facility, the company will be benefited in terms of the silanes market in end-use industries in both European and Asia-Pacific markets.

- November 2012: EU regulation required all tire manufacturers to label all tire characteristics indicating energy efficiency in terms of fuel consumption and CO2 emission, wet grip, and noise emission level. The tires will be categorized according to lowest to the highest standard from the red G category to green A category, respectively.

Key Companies Profile:

The global market is concentrated with multiple companies that have an international presence. These multinationals have an extensive product portfolio. The industry also has a few small- & medium-scale enterprises across the Asia Pacific and Central America regions who are innovating new products to cater to the native markets.

Some of the prominent players in the silane market include:

- Gelest, Inc.

- Shin-Etsu Chemical Co. Ltd.

- Nitrochemie Aschau GmbH

- Silar (Entegris)

- Dow Corning

- Evonik Industries

- Wacker Chemie AG

- Power Chemical Corp.

Order a free sample PDF of the Silane Market Intelligence Study, published by Grand View Research.

About Grand View Research

Grand View Research is a full-time market research and consulting company registered in San Francisco, California. The company fully offers market reports, both customized and syndicates, based on intense data analysis. It also offers consulting services to business communities and academic institutions and helps them understand the global and business scenario to a significant extent. The company operates across multitude of domains such as Chemicals, Materials, Food and Beverages, Consumer Goods, Healthcare, and Information Technology to offer consulting services.

Web: https://www.grandviewresearch.com

Media Contact

Company Name: Grand View Research, Inc.

Contact Person: Sherry James, Corporate Sales Specialist – U.S.A.

Email: Send Email

Phone: 1888202951

Address:Grand View Research, Inc. 201 Spear Street 1100 San Francisco, CA 94105, United States

City: San Francisco

State: California

Country: United States

Website: https://www.grandviewresearch.com/industry-analysis/silane-market