There are three simple ingredients behind successful investing. One, find the companies that are impacting an industry. Second, make sure they are doing so in a lucrative sector. Investors checking those boxes are already off to a great start to scoring investment wins. However, there’s a third box to check for those more diligent investors. It’s the ability to differentiate between the ambitious and those who can actualize those ambitions, a skill that ultimately separates winning investors from so-so performers. Still, truth be told, it’s not that easy. While utilizing the three-ingredient strategy can help score investment wins, there is still the need to actually find that exceptional company. In the junior-mining space, low-priced, asset-rich Scotch Creek Ventures (OTC Pink: SCVFF) (CSE: SCV) is worthy of consideration. They do, after all, check all three boxes.

That’s an intentional result of building a portfolio of projects and partnerships that can rival some of the prominent miners in the space. And with its goal to discover and provide the lithium needed to power the green revolution, SCVFF’s value is now a near and long-term proposition. Hence, catching its share price at current levels may be an opportunity too good to ignore. By the way, investors looking for exposure to this lucrative long-term sector aren’t ignoring SCVFF and its potential. Its shares are higher by over 20% since October lows.

Interest In Scotch Creek Is Warranted

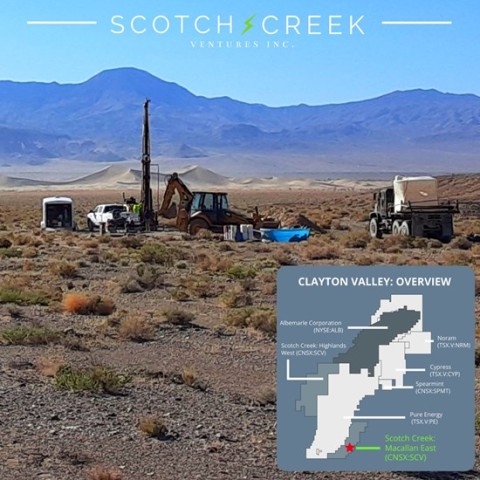

While an impressive move higher, the best may be yet to come. Several announcements show that Scotch Creek Ventures has moved onto the fast track to expedite exploration, recently announcing the start of its Phase I drill program on its 100% owned Highlands West Lithium Project (“Highlands”). It’s big news to those who know the area. Its Highlands project is directly adjacent to Albemarle’s Silver Peak lithium mine, North America’s only lithium-producing operation. And there’s better news beyond proximity. Recent positive geophysics results from the detailed gravity, seismic, and Hybrid-Source Audio-Magnetotellurics (HSAMT) surveys identified key subsurface features within the central area of the Highlands property, triggering SCVFF’s decision to expand the Highlands claims by an additional 400 acres and design the phase one drill program. It’s a calculated investment intended to generate significant returns. And they made it for a reason.

The combined results of the comprehensive geophysical survey at Highlands show a subsurface dominated by strongly layered basin-fill units. These highly prospective sedimentary rocks are interpreted as claystone, mudstones, and volcanic beds that have accumulated in a series of fault-bounded basins underlying the property. In mining speak, that’s excellent news. It also perpetuated SCVFF’s first drill program on its promising Highlands lithium project.

According to Scotch Creek management, the goals of this initial detailed exploration program within the Western portion of the Clayton Valley are to drill a large diameter core through well-layered sequences of basin fill stratigraphy, similar to its previously collected seismic data. The collected core and groundwater samples will then be logged and assayed with the prospect of discovering a significant lithium deposit.

Fingers crossed. Face it, the EV, green, and clean-energy sectors need what SCVFF wants to bring to market. Thus, rooting for success from any of these miners is the right thing to do. But from an investment perspective, the best choice may be to root for the companies best positioned to win. That’s another box SCVFF checks. And for them, a potentially huge score could come sooner than later from a drill program targeting lithium brine and claystone with six high-quality drill targets, where phase 1 drilling will exploit three targets for an estimated 6,000 feet total. That’s just for starters.

Exploring A Potentially Massive Highlands Score

There’s plenty of data supporting that Highland could unearth a major lithium score. The property spans 318 placer claims, totaling 6,360 acres, and is located on the southeast side of southern Clayton Valley, where it can be accessed by paved roads from Tonopah and Goldfield. That accessibility is a critical advantage, money, and time saver that will keep the project moving. Notably, its Highlands West project is located on the west side of Southern Clayton Valley consisting of 298 placer claims totaling 5,960 acres.

This project is strategically located among many top-tier exploration companies, including Pure Energy and Spearmint Resources. It’s a case where being in good company matters. Being in the Clayton Valley matters too. SCVFF benefits from both. Its properties border Pure Energy’s Lithium Project, opening the potential to host multiple types of lithium mineralization at its 100% owned landholding, most recently totaling 9,140 total acres in Clayton Valley, representing two of the most significant under-explored projects in the valley that border major lithium discoveries.

The Clayton Valley is a lithium brine district hosted within the Esmeralda Formation, a sequence of lake basin-fill rocks that contain zones of volcanic ash-rich stratigraphy and salty evaporite units. Regionally, these Esmeralda rocks are of late Miocene to early Pleistocene age, from 1 million to 5 million years before the present. The Albemarle brine production field at Clayton is sourced from weakly to non-lithified volcanic ash horizons, which have high porosity. Most importantly, Scotch Creek believes that both of its projects are strategically positioned within the Clayton “cereal bowls,” getting that name by being a closed-basin brine deposit that acts like cereal bowls full of lithium. The properties above these bowls should provide access to the lithium brine beneath them.

Of course, as a lithium exploration company focused on acquiring and developing critical North American Lithium properties, that’s potentially excellent news. Moreover, it serves well in Scotch Creek’s mission to become Nevada’s best-in-class lithium exploration company. Here’s the better news: size doesn’t matter. Sitting on top of assets does, however, and SCVFF believes it is.

Indeed, SCVFF is operating within one of the largest land packages in North America’s only lithium-producing jurisdiction. Better yet, they don’t have only a single chance to prove it. Scotch Creek has three projects totaling 14,500 acres and is being explored by a team of mining veterans that can leverage over 80 years of combined experience. Incidentally, two team members are lithium experts in place to guide development and expedite the advancement of its projects to the next stage.

Having those team members is what can change small exploration companies into producers. And with the transition to clean energy and lithium as the new oil, the faster SCVFF makes that transition, the more excellent the opportunity to develop, partner, or lease its proven assets. Either scenario is shareholder value waiting to happen.

Nevada- Right Place, Right Time

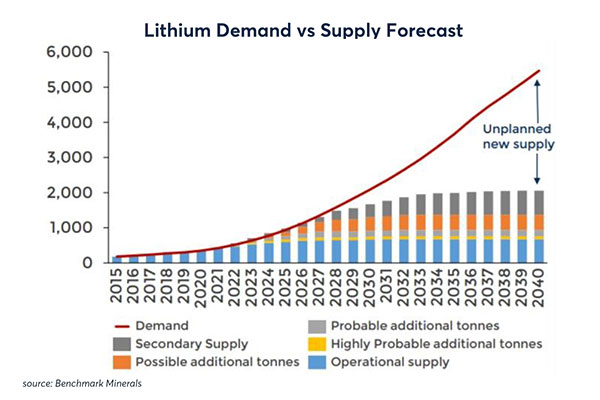

Keep this in mind, too. Scotch Creek is exploring Mining-Friendly Nevada, currently ranked #1 of 83 mining jurisdictions. That position has been integral to the state becoming the potential lithium production capital of the world; as such, it is rapidly becoming the hub for manufacturing energy storage, clean energy, and greener transportation. All of that is important to the SCVFF value proposition, especially because lithium demand is surging as global initiatives to go green far outstrip the amount of lithium mined.

Recent news shows that Tesla (NASDAQ: TSLA) is considering investing in lithium exploration companies. Makes sense, knowing that their EV cars can’t even leave the showroom floor without lithium power to move it. Of course, the EV sector is just one needing what Scotch Creek is after.

Global business giants like General Motors (NYSE: GM), Ford (NYSE: F). and even aerospace companies like Lockheed Martin (NTSE: LMT) need to secure access to lithium to power their programs, whether they be EV, battery development initiatives, or creations to help power a new technology. Simply stated, green energy independence without lithium will not happen anytime soon. So, back to the early premise – root for companies like Scotch Creek.

Ideally Positioned To Capitalize On Lithium Frenzy

If all goes as expected, SCVFF could deliver what is best described as a win-win-win proposition. Scotch Creek wins big financially, the clean and green-energy sector gets the lithium it needs, and SCVFF investors get a potential windfall financially in the process. With at least two lithium properties in Clayton Valley, Nevada, its Miranda Project near the Silverpeak Lithium operation, and those opportunities created through its MACALLAN East project, which borders Pure Energy’s operations in known lithium deposits, there’s multiple shots on goal.

With only about 42.2 million shares outstanding and 64.9 million fully diluted after warrant exercises, this small-cap miner is positioned operationally and from a capital structure to do big things. Hence, enormous opportunities do come in small packages.

But in this case, the only thing small about Scotch Creek is its share price. From all other measures, this company has the size and assets to be a breakout star by contributing to a scorching hot battery-metals sector showing no signs of cooling. And for those liking quick returns, perhaps the best news about Scotch Creek Ventures is that they are positioned and capitalized for potentially substantial growth in 2023. In other words, while investing in miners often includes a dose of patience, some companies are better positioned than others to deliver on goals sooner than later.

Based on updates and initiatives already in play, SCVFF may be one of those. And better still, in a sector where news can drive value higher in minutes, investing in companies with several updates in the queue may be the wisest consideration. That’s a fourth box Scotch Creek Valley checks. And it’s an excellent one, too.

Disclaimers: Shore Thing Media, LLC. (STM, Llc.) is responsible for the production and distribution of this content. STM, Llc. is not operated by a licensed broker, a dealer, or a registered investment adviser. It should be expressly understood that under no circumstances does any information published herein represent a recommendation to buy or sell a security. Our reports/releases are a commercial advertisement and are for general information purposes ONLY. We are engaged in the business of marketing and advertising companies for monetary compensation. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The information made available by STM, Llc. is not intended to be, nor does it constitute, investment advice or recommendations. The contributors may buy and sell securities before and after any particular article, report and publication. In no event shall STM, Llc. be liable to any member, guest or third party for any damages of any kind arising out of the use of any content or other material published or made available by STM, Llc., including, without limitation, any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages. Past performance is a poor indicator of future performance. The information in this video, article, and in its related newsletters, is not intended to be, nor does it constitute, investment advice or recommendations. STM, Llc. strongly urges you conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D. For some content, STM, Llc., its authors, contributors, or its agents, may be compensated for preparing research, video graphics, and editorial content. STM, LLC has been compensated up to five-thousand-dollars cash via wire transfer by a third party to produce and syndicate content for Scotch Creek Ventures, Inc. for a period of one month. As part of that content, readers, subscribers, and website viewers, are expected to read the full disclaimers and financial disclosures statement that can be found on our website.

The Private Securities Litigation Reform Act of 1995 provides investors a safe harbor in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events or performance are not statements of historical fact may be forward looking statements. Forward looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward looking statements in this action may be identified through use of words such as projects, foresee, expects, will, anticipates, estimates, believes, understands, or that by statements indicating certain actions & quote; may, could, or might occur. Understand there is no guarantee past performance will be indicative of future results. Investing in micro-cap and growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investors investment may be lost or impaired due to the speculative nature of the companies profiled.

Media Contact

Company Name: STM, LLC.

Contact Person: Michael Thomas

Email: contact@primetimeprofiles.com

Phone: 973-820-3748

Country: United States

Website: https://primetimeprofiles.com/