Interest rates on most types of loans have been lower since the start of the pandemic, but are still an important factor in who and where to get a loan from.

RateBunni wanted to understand which states have the lowest and highest interest rates for three major types of loans: used auto, mortgage, and personal loans. To do this, RateBunni gathered and analyzed data, to see if any trends were emerging.

“This report not only provides really valuable information for consumers that are shopping for auto, personal, or home loans, but also shows the power of RateBunni platform in helping people find the best deal offered by a bank,” said Nish Krishna, the CEO of Konduit Works, Inc. “In just a few short months, we have collected information on 500+ lenders, with more coming in each day. Aside from creating a product people love, we can tell these data-driven stories.”

Here are our findings about the lowest interest rates advertised by hundreds of lenders across the country.

Key findings:

- Montana, Nebraska, North Dakota, and South Dakota are tied for the lowest average mortgage rate (2.45 percent). North Dakota also has the lowest average rate for a used-car loan (1.99 percent).

- Alabama has the lowest average personal loan rate (5.89 percent).

- All of the states with the highest rates in each product category are Northeastern states — Delaware has the highest average mortgage rate (3.93 percent), Rhode Island has the highest average auto loan rate (5.46 percent), and Maine has the highest personal loan rate (11.95 percent).

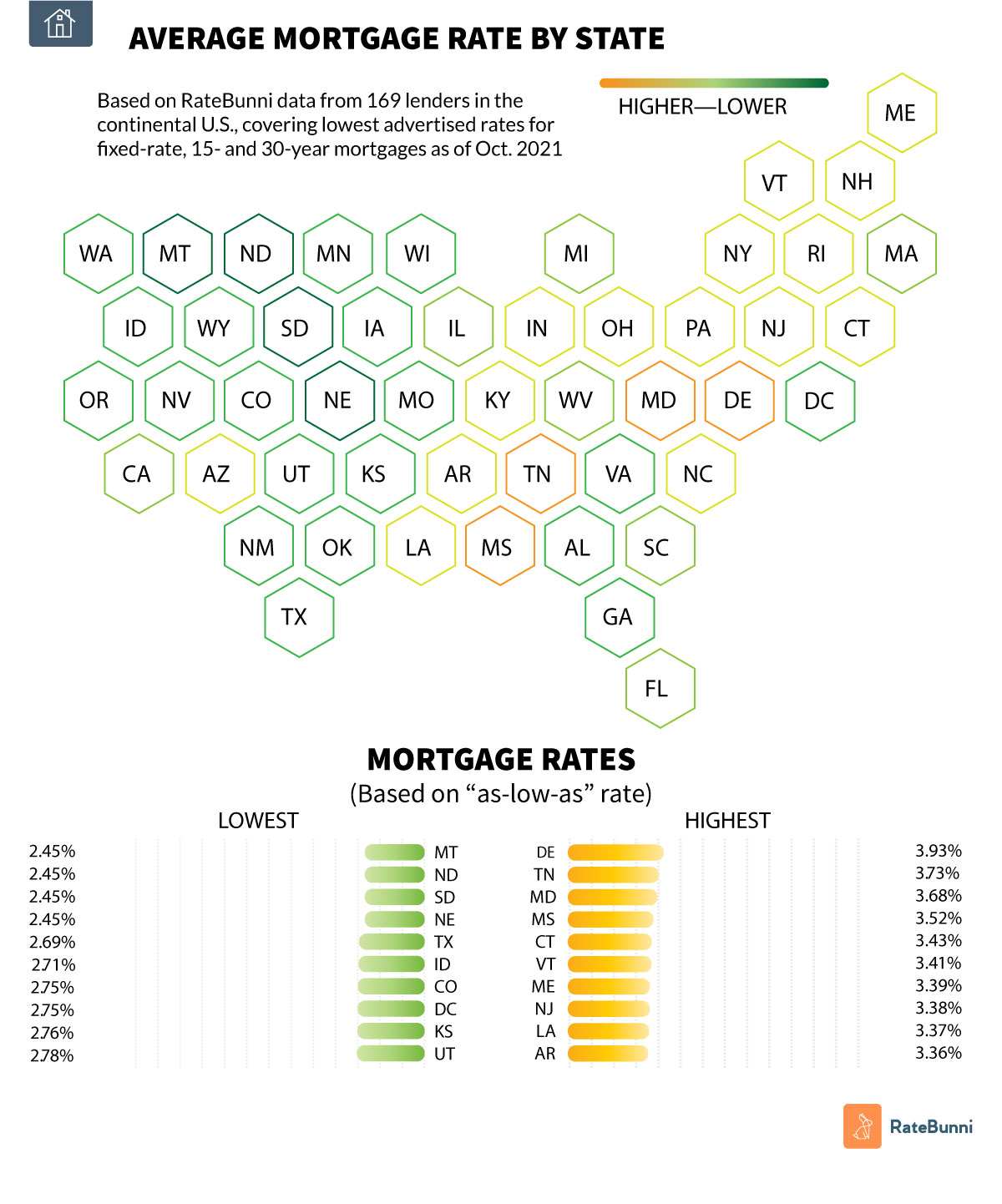

Mortgage Rates

A house is the biggest purchase most people will make in their lifetimes, so getting a great interest rate can be the difference between buying the home of one’s dreams or having to stay out of the market entirely.

Montana, Nebraska, North Dakota, and South Dakota have the lowest average mortgage loan rate at 2.46 percent, which is considerably lower than the national average of 3.07 percent.

Delaware has the highest mortgage rates, an average of 3.93 percent. Given the average mortgage size, which is continuing to rise in most places across the country, the savings can be significant.

For example, for a mortgage of $240,000, someone buying a home in North Dakota, Nebraska, Montana, or South Dakota (at 2.46 percent APR) would pay almost $78 less per month than a counterpart in Delaware (at 3.07 percent APR). due to their lower interest rate, which is about $28,000 over a 30-year mortgage term.

Lowest average advertised mortgage interest rates:

|

Lowest |

Highest |

|||

|

Montana |

2.46% |

Delaware |

3.93% |

|

|

Nebraska |

2.46% |

Tennessee |

3.73% |

|

|

North Dakota |

2.46% |

Maryland |

3.68% |

|

|

South Dakota |

2.46% |

Mississippi |

3.52% |

|

|

Texas |

2.69% |

Connecticut |

3.43% |

|

|

Idaho |

2.71% |

Vermont |

3.41% |

|

|

Colorado |

2.75% |

Maine |

3.39% |

|

|

District of Columbia |

2.75% |

New Jersey |

3.38% |

|

|

Kansas |

2.76% |

Louisiana |

3.37% |

|

|

Utah |

2.78% |

Arkansas |

3.36% |

|

Used Auto Loan Rates

Though it’s less of a long-term financial commitment than purchasing a house, getting a great interest rate on an auto loan is just as important. The average new-car buyer holds on to their vehicle for about six years and likely even longer in the near future.

The average U.S. interest rate for a used car is 3.46 percent, with North Dakota (1.99 percent) and Rhode Island (5.46 percent) falling on the opposite ends of the spectrum. With a lower loan term than for mortgages, interest rates have a less eye-popping impact, but even a slight difference can add up. With a purchase price of $25,000 for used car financing, a Rhode Island driver (at 5.46 percent APR) spend about $1,400 more than their North Dakota counterpart (at 3.46 percent APR) over the 60-month loan term.

In our analysis, the South and West account for all but one of the ten lowest advertised auto loan rates, while Northeastern states account for all but one (Kentucky) of the ten highest.

Lowest average advertised auto loan rates:

|

Lowest |

Highest |

|||

|

North Dakota |

1.99% |

Rhode Island |

5.46% |

|

|

Texas |

2.50% |

Maine |

5.17% |

|

|

Alabama |

2.59% |

Connecticut |

5.16% |

|

|

California |

2.61% |

New Hampshire |

5.14% |

|

|

Tennessee |

2.66% |

New Jersey |

4.85% |

|

|

New Mexico |

2.71% |

Massachusetts |

4.78% |

|

|

Washington |

2.74% |

New York |

4.60% |

|

|

Oregon |

2.77% |

Vermont |

4.55% |

|

|

South Carolina |

2.81% |

Pennsylvania |

4.40% |

|

|

Oklahoma |

2.84% |

Kentucky |

4.13% |

|

Personal Loan Rates

Personal loans are much more flexible than either auto or mortgage loans, with consumers using them for everything from debt consolidation to wedding expenses to home repairs. They tend to have higher interest rates because they aren’t secured by collateral, like home and car loans are.

The average lowest advertised personal loan rate in the U.S. is 8.54 percent, much higher than the average rates for auto loans (3.46 percent) and mortgages (3.07 percent). Alabama has the lowest average advertised rate for personal loans (5.89 percent), while Maine has the highest (11.95 percent). In Maine, we found more lenders offering loans only to subprime borrowers, which drove up their average.

Depending on how much you borrow, the difference between rates could be minor, though if you do get a large personal loan in some of these high-rate states, you could end up paying quite a bit.

Lowest average advertised personal loan rates:

|

Lowest |

Highest |

|||

|

Alabama |

5.89% |

Maine |

11.95% |

|

|

Louisiana |

6.51% |

New Hampshire |

11.68% |

|

|

District of Columbia |

6.61% |

Vermont |

11.10% |

|

|

North Carolina |

6.73% |

Massachusetts |

10.90% |

|

|

Tennessee |

6.88% |

Rhode Island |

10.77% |

|

|

Kentucky |

6.92% |

Connecticut |

10.71% |

|

|

Mississippi |

7.06% |

Wyoming |

10.52% |

|

|

Oregon |

7.18% |

Nebraska |

10.13% |

|

|

Arkansas |

7.19% |

New Mexico |

10.05% |

|

|

West Virginia |

7.24% |

Kansas |

9.69% |

|

Conclusion

Though interest rates have been pretty low since the start of the pandemic, in many places, they are inching up, and consumers should always do their research before taking on any debt. RateBunni is a free, unbiased resource for locating banks and credit unions that serve your area and can help you save money every month.

RATE BUNNY CTA Methodology

RateBunni’s analysis is based on publicly-available data we’ve collected on hundreds of lenders across the country. We also factored in regulatory sources such as FDIC and NCUA to analyze lender geography, product offerings, and lender size. Additionally, our analysis was limited to the segment of banks with assets between $600 million and $180 billion, which includes 479 financial institutions, though not every institution offers every loan type. Our analysis included 304 lenders offering personal loans, 169 offering 15- or 30-year fixed-rate mortgages, and 345 offering loans for used vehicles. Data in this analysis is from October 2021.

We used the lowest average rates these banks and credit unions advertise, which may not be the rates they offer most consumers. Not all lenders offer loans to all credit tiers, and as a result, their state’s average of lowest advertised rate might be impacted. We recommend shopping around to find the best rates based on your credit score and financial history. This article is for informational purposes only and should not be used for making financial decisions. Loan rates change regularly, and because advertised rates vary from rates that may be offered, consumers should not assume that they will be able to get a loan with the rates listed here.

Media Contact

Company Name: RateBunni

Contact Person: Nish Krishna

Email: Send Email

Phone: 833-536-3479

Country: United States

Website: https://www.ratebunni.com/home