Osteoarthritis Market Summary

The total Osteoarthritis Treatment Market Size in the United States is expected to increase with a CAGR of 3.3% during the study period. Within EU4 and the UK, Germany held the largest Osteoarthritis market share, followed by Spain and France. Opioids dominated therapy-wise, generating around USD 9.2 billion in the US. Key developments include Bioventus’ nationwide DUROLANE contract with Aetna Medicare Advantage, Levicept completing Phase II trials of LEVI-04, and BioSolution planning FDA conditional approval for CARTILIFE after Phase II completion. Numerous companies are advancing cell therapies, potentially offering disease-modifying or curative options for Osteoarthritis.

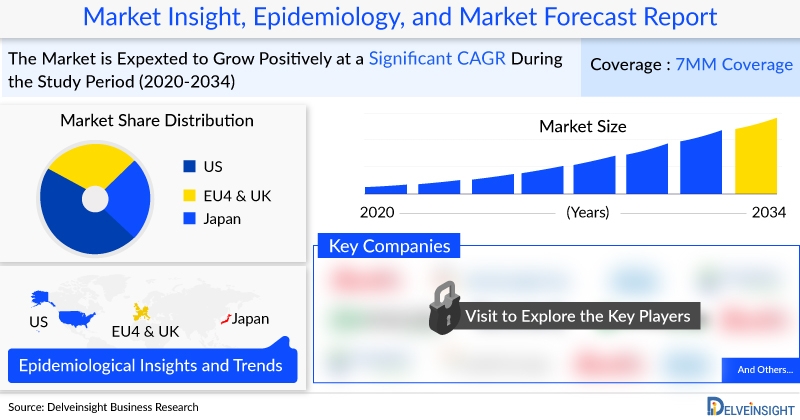

DelveInsight’s “Osteoarthritis Market Insights, Epidemiology, and Market Forecast-2034” report offers a comprehensive analysis of osteoarthritis, encompassing historical and projected epidemiological trends as well as market dynamics across the United States, EU5 (Germany, Spain, Italy, France, and the United Kingdom), and Japan. The report details current treatment paradigms, emerging therapeutic candidates, and the market share of individual therapies. It provides quantitative assessments of the osteoarthritis market size from 2020 to 2034 across seven key markets. Additionally, the report examines prevailing treatment algorithms, identifies market drivers and barriers, and highlights unmet clinical needs, enabling the identification of high-potential opportunities and a robust evaluation of the osteoarthritis market landscape.

Explore DelveInsight’s comprehensive Osteoarthritis Market Report 2034 to understand current treatment trends, emerging therapies, and market growth opportunities across the US, EU5, and Japan @ Osteoarthritis Market Forecast

Some facts of the Osteoarthritis Market Report are:

- According to DelveInsight, Osteoarthritis market size is expected to grow at a decent CAGR by 2034.

- In 2023, the osteoarthritis US market size was approximately USD 19,000 million, which is further expected to increase by 2034.

- Leading Osteoarthritis companies working in the market are Novartis, Ampio Pharmaceuticals, Taiwan Liposome Company, Centrexion Therapeutics, Biosplice Therapeutics, Organogenesis, Kolon Tissuegene, Paradigm Biopharma, Novo Nordisk, Amzell, Nature Cell, Tissuetech, Techfields Pharma, Sorrento Therapeutics, Merck Kgaa, Anika Therapeutics, Trialspark, Akl Research And Development, Flexion Therapeutics, OliPass Corporation, Pacira BioSciences, Medipost, Medivir, and others.

- Key Osteoarthritis Therapies expected to launch in the market are ZILRETTA, CINGAL, TRIVISC, VISCO-3, LNA043, ReNu (Amniotic Suspension Allograft), JointStem, CNTX-4975, and others.

- In April 2025, Pacira BioSciences, Inc. (Nasdaq: PCRX), the industry leader in its commitment to deliver innovative, non-opioid pain therapies to transform the lives of patients, today announced new data demonstrating its locally administered gene therapy candidate, PCRX-201 (enekinragene inzadenovec), provided sustained improvements in knee pain, stiffness, and function for up to two years following a single local administration in patients with mild, moderate, as well as severe osteoarthritis of the knee. The data was presented during a poster session at the 2025 Osteoarthritis Research Society International (OARSI) World Congress in Incheon, South Korea, on Friday, April 25, and Saturday, April 26.

- In February 2025, Zydus Lifesciences (NSE: ZYDUSLIFE) received final approval from the U.S. Food and Drug Administration (FDA) to produce Ibuprofen and Famotidine tablets (800 mg/26.6 mg), marketed under the brand name Duexis. This drug combination is indicated for the management of symptoms associated with rheumatoid arthritis and osteoarthritis, while also minimizing the risk of upper gastrointestinal ulcers in patients taking ibuprofen for these conditions.

- Also in February 2025, Aurora Pharmaceutical (Private) introduced EquiCoxib, its FDA-approved generic version of Equioxx® (firocoxib)—a non-steroidal anti-inflammatory drug (NSAID) designed to relieve pain and inflammation due to osteoarthritis

- On November 12, 2024, Genascence Corporation (Private)—a clinical-stage biotech company specializing in gene therapy for musculoskeletal disorders—announced that the FDA has granted Fast Track Designation (FTD) to GNSC-001, a novel gene therapy candidate currently under development for treating knee osteoarthritis.

- In December 2023, Bioventus agreed to a nationwide contract with Aetna Medicare Advantage plans. Beginning January 1, 2024, over 3 million Aetna Medicare Advantage plan members will have access to DUROLANE to treat knee osteoarthritis pain.

- In December 2023, Levicept announced that it had completed recruitment in its Phase II clinical trial of LEVI-04, a novel neurotrophin-modulating biological agent. Top-line data are expected to be announced in the late first half of 2024.

- In Jan 2023, OliPass Corporation announced a study which is designed to evaluate the efficacy, safety and tolerability of OLP-1002 Subcutaneous (SC) injections for reducing moderate to severe pain due to osteoarthritis in a hip and/or knee joint.

- In October 2022, Eupraxia Pharmaceuticals Inc. announced updates to its Phase II trial, which is evaluating EP-104IAR’s efficacy and safety for the treatment of osteoarthritis (“OA”) of the knee.Eupraxia announced that its ongoing Phase II study has successfully completed all DSMB reviews, with no drug-related Serious Adverse Events noted and a clean safety profile.

Osteoarthritis Overview

Osteoarthritis (OA) is the most common form of arthritis, primarily affecting older adults but can also occur in younger individuals due to injury or other factors. It is a degenerative joint disease characterized by the breakdown of cartilage in the joints, leading to pain, stiffness, and reduced mobility. Risk factors include age, genetics, obesity, joint injury, and repetitive stress on the joints.

The hallmark feature of Osteoarthritis is the gradual loss of cartilage, which normally cushions the ends of bones and allows smooth joint movement. As cartilage deteriorates, bones may rub against each other, causing pain, swelling, and inflammation. Osteoarthritis commonly affects weight-bearing joints such as the knees, hips, spine, and hands.

Osteoarthritis Diagnosis is based on symptoms, physical examination, and imaging studies such as X-rays or MRI scans. Treatment aims to manage symptoms, improve joint function, and slow disease progression. This may include lifestyle modifications (e.g., exercise, weight management), physical therapy, pain relievers, corticosteroid injections, and in severe cases, joint replacement surgery.

Although Osteoarthritis is chronic and progressive, early diagnosis and intervention can help alleviate symptoms and improve quality of life. Research continues to explore new therapies and interventions to better manage this prevalent condition.

Learn more about Osteoarthritis treatment algorithms in different geographies, and patient journeys. Contact to receive a sample @ Osteoarthritis Treatment Market

Osteoarthritis Market Outlook

The knee Osteoarthritis pipeline is active, with numerous clinical trials exploring new therapies or optimizing existing ones. Global healthcare spending growth is expected to influence the Osteoarthritis treatment market dynamics. The United States represents the largest Osteoarthritis treatment market, projected to grow at a CAGR of 3.3%, while Germany leads the EU4 and UK market, which is expected to expand at 2.3% CAGR. Future Osteoarthritis therapies aim to address current unmet patient needs and improve treatment outcomes.

Common treatments for knee osteoarthritis (OA) include NSAIDs, opioids, intra-articular corticosteroids, and hyaluronic acid injections. Several FDA-approved sodium hyaluronate products are available, including SUPARTZ (2001), ORTHOVISC (2004), EUFLEXXA (2005), GEL-ONE (2011), and ZILRETTA (2017), which demonstrated significant pain relief for up to 12–16 weeks. In Japan, CYMBALTA was approved in 2016 for Osteoarthritis-related pain, though its regulatory data and patent expired in 2020.

The osteoarthritis market is primarily driven by the rising global prevalence of the disease, especially among the aging population, coupled with increasing obesity rates and sedentary lifestyles that contribute to joint degeneration. Advancements in treatment modalities—including regenerative medicine, intra-articular therapies, and novel drug delivery systems—are also fueling market growth.

Additionally, greater awareness, improved diagnostic tools, and ongoing research and development activities by pharmaceutical companies are expanding therapeutic options. However, the market faces significant barriers such as the high cost of advanced therapies, limited efficacy and side effects of current medications, and the lack of disease-modifying treatments. Regulatory hurdles, reimbursement challenges, and variability in treatment accessibility across regions further hinder market expansion.

According to DelveInsight, the Osteoarthritis market in 7MM is expected to witness a major change in the study period 2020-2034.

Osteoarthritis Epidemiology

In 2023, the US had approximately 38.6 million osteoarthritis (OA) cases, with mild osteoarthritis being most common, followed by moderate cases. Females accounted for the majority, contributing around 24.3 million cases. In the EU4 and UK, osteoarthritis prevalence was highest among those aged 70 and above, followed by the 60–69 and 50–59 age groups. In Japan, there were about 8.6 million mild osteoarthritis cases in 2023, with numbers expected to rise over the study period. Overall, osteoarthritis cases are projected to increase steadily from 2020 to 2034.

Osteoarthritis Epidemiology Segmentation:

- Total Diagnosed Cases of Osteoarthritis

- Joint Site–Specific Prevalence of Osteoarthritis

- Gender-Specific Prevalence of Osteoarthritis

- Age-Specific Prevalence of Osteoarthritis

- Severity-Specific Prevalence of Osteoarthritis

Discover Key Osteoarthritis Insights! Explore detailed epidemiology data, including total diagnosed cases, joint-specific prevalence, and age- and gender-based trends across the 7MM @ Osteoarthritis Patient Pool

Osteoarthritis Pipeline Outlook and Drugs Uptake

LNA043 – Novartis

LNA043 is an ANGPTL3 (angiopoietin-like 3) agonist designed to target damaged cartilage and regulate multiple pathways involved in cartilage regeneration. It is being developed as a potential first-in-class disease-modifying therapy for osteoarthritis. Part of Novartis’s early-stage portfolio addressing cartilage damage and inflammation, LNA043 received Fast Track Designation (FTD) from the US FDA in 2021 for knee osteoarthritis. A Phase IIb study (ONWARDS) is currently ongoing, with a data readout expected in 2024 and an anticipated NDA submission projected for 2026 or later.

ReNu (Amniotic Suspension Allograft) – Organogenesis

ReNu is a cryopreserved amniotic suspension allograft (ASA) for managing symptomatic knee osteoarthritis. It contains amniotic fluid cells, micronized amniotic membrane, growth factors, and extracellular matrix components. In January 2021, ReNu was granted Regenerative Medicine Advanced Therapy (RMAT) designation by the US FDA for knee osteoarthritis.

CNTX-4975 – Centrexion Therapeutics

CNTX-4975, a synthetic ultra-pure trans-capsaicin, is being investigated for moderate to severe knee osteoarthritis pain through direct site injection. It received Fast Track Designation from the US FDA in January 2018. Centrexion completed patient enrollment ahead of schedule in its pivotal Phase III VICTORY-1, VICTORY-2, and VICTORY-3 trials between 2018 and 2019.

JTA-004 – BioSenic (Bone Therapeutics)

JTA-004 is an intra-articular injectable for knee osteoarthritis pain, combining plasma proteins, hyaluronic acid, and a fast-acting analgesic to improve joint lubrication, protect cartilage, and reduce pain. In March 2023, BioSenic re-analyzed its Phase III trial using Artialis analytics to evaluate patients with the most painful and inflammatory forms. The Marketing Authorization Application (MAA) could be submitted around three years post-Phase III, potentially bringing JTA-004 to market by 2027.

Discover Emerging Knee Osteoarthritis Therapies! Learn about LNA043, ReNu, CNTX-4975, and JTA-004 and their potential to relieve pain and repair cartilage @ Osteoarthritis Companies and Medication

Osteoarthritis Therapeutics Assessment

Major key companies are working proactively in the Osteoarthritis Therapeutics market to develop novel therapies which will drive the Osteoarthritis treatment markets in the upcoming years are Novartis (NVS:NYSE), Ampio Pharmaceuticals (AMPE:OTC), Taiwan Liposome Company (4152:TPEX), Centrexion Therapeutics, Biosplice Therapeutics, Organogenesis (ORGO:NASDAQ), Kolon TissueGene (950160:KQ), Paradigm Biopharma (PAR:ASX), Novo Nordisk (NVO:NYSE), Amzell, Nature Cell (007390:KQ), Tissuetech, Techfields Pharma (688221:SSE), Sorrento Therapeutics (SRNEQ:OTC), Merck KGaA (MRK:XETRA), Anika Therapeutics (ANIK:NASDAQ), TrialSpark, AKL Research and Development, Flexion Therapeutics (acquired by Pacira BioSciences), OliPass Corporation (244460:KQ), Pacira BioSciences (PCRX:NASDAQ), Medipost (078160:KQ), Medivir (MVIR-B:OMXSTO), among others.

Learn more about the emerging Osteoarthritis therapies & key companies @ Osteoarthritis Clinical Trials and FDA Approvals

Osteoarthritis Report Key Insights

1. Osteoarthritis Patient Population

2. Osteoarthritis Market Size and Trends

3. Key Cross Competition in the Osteoarthritis Market

4. Osteoarthritis Market Dynamics (Key Drivers and Barriers)

5. Osteoarthritis Market Opportunities

6. Osteoarthritis Therapeutic Approaches

7. Osteoarthritis Pipeline Analysis

8. Osteoarthritis Current Treatment Practices/Algorithm

9. Impact of Emerging Therapies on the Osteoarthritis Market

Table of Contents

1. Key Insights

2. Executive Summary

3. Osteoarthritis Competitive Intelligence Analysis

4. Osteoarthritis Market Overview at a Glance

5. Osteoarthritis Disease Background and Overview

6. Osteoarthritis Patient Journey

7. Osteoarthritis Epidemiology and Patient Population

8. Osteoarthritis Treatment Algorithm, Current Treatment, and Medical Practices

9. Osteoarthritis Unmet Needs

10. Key Endpoints of Osteoarthritis Treatment

11. Osteoarthritis Marketed Products

12. Osteoarthritis Emerging Therapies

13. Osteoarthritis Seven Major Market Analysis

14. Attribute Analysis

15. Osteoarthritis Market Outlook (7 major markets)

16. Osteoarthritis Access and Reimbursement Overview

17. KOL Views on the Osteoarthritis Market

18. Osteoarthritis Market Drivers

19. Osteoarthritis Market Barriers

20. Appendix

21. DelveInsight Capabilities

22. Disclaimer

About DelveInsight

DelveInsight is a leading Life Science market research and business consulting company recognized for its off-the-shelf syndicated market research reports and customized solutions to firms in the healthcare sector.

Media Contact

Company Name: DelveInsight Business Research LLP

Contact Person: Ankit Nigam

Email: Send Email

Phone: +14699457679

Address:304 S. Jones Blvd #2432

City: Albany

State: New York

Country: United States

Website: https://www.delveinsight.com/consulting/primary-research-services