In 2023, NAR Chief Economist Lawrence Yun expects home sales to decline by 7%, while the national median home price will increase by 1% in his recent 2023 market update. On the flip side the most recent federal reserve economic commentary classifies the current housing market as a bubble and notes that housing prices will fall up to around 20%. Who is correct? Will prices increase or decrease in 2023?

What were the key points in the NAR economic review:

Amid the backdrop of high inflation, elevated mortgage rates and slowing sales activity, severely limited housing inventory will prevent large home price drops for most of the country next year, according to NAR Chief Economist Lawrence Yun.

Yun analyzed the current state of the residential real estate market and shared his 2023 outlook today at 2022 NAR NXT, The Realtor® Experience, in Orlando, Florida.

- Sales volumes will decline in 23 by 7%

- The national median home price will increase by 1%, with some markets experiencing price gains and others price declines.

- A strong rebound for housing in 2024, with a 10% jump in home sales and a 5% increase in the national median home price

The key assumptions by NAR economists are:

- Inventory will continue to remain low

- Signs point to a “topping out” of mortgage rates

Federal reserve forecast is drastically different:

The Federal reserve economic commentary is polar opposite the National Association of Realtors with talks of a housing bubble sprinkled throughout their commentary:

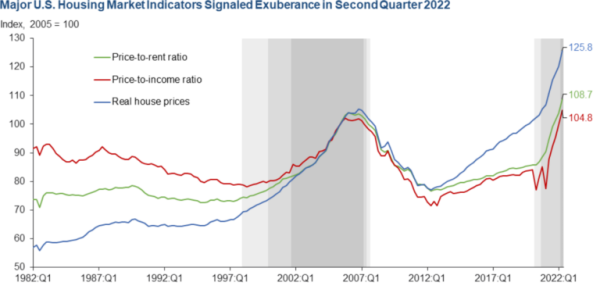

“Prices adjusted for inflation rose 24.3 percent from first quarter 2020 to second quarter 2022, the largest nine-quarter gain since the mid–1970s and more than three times the rate of growth of the prior nine-quarter period (fourth quarter 2017 to first quarter 2020). This pace of acceleration cannot be easily reconciled with fundamentals, which did not display comparable behavior.

Moreover, the latest statistics from second quarter 2022 closely parallel the preceding housing bubble, with the data once again showing evidence of explosive behavior in the price-to-rent and price-to-income ratios as well. Accordingly, the pandemic surge before summer 2022 exhibited widening symptoms of a FOMO-driven bubble, one that extends beyond the U.S.

Plausible estimates of the direct impact on housing wealth suggest that a pessimistic scenario—with a real price correction of 15–20 percent—could shave as much as 0.5–0.7 percentage points from real personal consumption expenditures. Such a negative wealth effect on aggregate demand would further restrain housing demand, deepening the price correction and setting in motion a negative feedback loop.”

Federal Reserve analysis closer to reality:

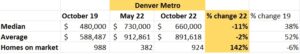

The two main drivers of the NAR analysis are that inventory will remain low and rates will top out. I do not agree with either of these assumptions. Below is what is happening in Denver, from May through October inventory increase 142% putting it only 6% below the same month in 2019. Increasing inventory is not unique to Denver as this is happening in basically every metro market throughout the country. With inventory rising, it is not possible that prices will remain flat/slightly increase next year. From below it is clear that both the median and average sales prices have decreased from the peak. I know there is some seasonality, but seasonality accounts for less than half of the decrease. Unfortunately there will be considerably more inventory coming online in the spring as rates remain high and unemployment starts to tick up, the chart below is the beginning of the trend.

Furthermore, rates look to remain at their current levels and/or increase further as the federal reserve is steadfast in their path to get inflation back down to their 2% target. Rates today are around 6.75%, this is well over double the low of 3%, with such a huge increase in rates, very few can now afford the median home which will decrease demand at the same time inventory is rising leading to a price correction.

Based on the NAR and Federal Reserve analysis, where will prices head in 2023?

The NAR predictions were extremely rosy while the federal reserve was much more realistic based on historical price trends. Based on what I am seeing in our portfolio, prices will decline nationwide around 10-15% with some “hot markets” losing as much as 20% and others that did not have the huge price appreciation losing in the 5-10% range.

Summary

Currently we do not have the same economic factors as 2008 which will lead to a milder price correction of about half of what occurred in 2008. The authors of the fed study put in nicely: “A severe housing bust from the frothy pandemic run-up isn’t inevitable. Although the situation is challenging, there remains a window of opportunity to deflate the housing bubble while achieving the Fed’s preferred outcome of a soft landing. This is more likely to happen if the worst-case scenario of a price-correction-induced economic downturn can be avoided.”

Unfortunately this window is rapidly closing as inflation remains stubborn, spending remains robust, and the unemployment rate remains at historic lows. The longer it takes for the economy to start letting out air, the greater the likelihood of a harder correction.

Additional Reading/Resources

- https://www.nar.realtor/newsroom/nars-lawrence-yun-predicts-us-home-prices-wont-experience-major-decline-could-possibly-rise-slightly

- https://www.dallasfed.org/research/economics/2022/1115

We are a Private/ Hard Money Lender funding in cash! If you were forwarded this message, please subscribe to our newsletter

I need your help! Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linkedin, twitter, facebook, and other social media and forward to your friends.

Media Contact

Company Name: Fairview Lending

Contact Person: Glen Weinberg

Email: Send Email

Phone: +1 (404) 846-4718

Country: United States

Website: www.fairviewlending.com