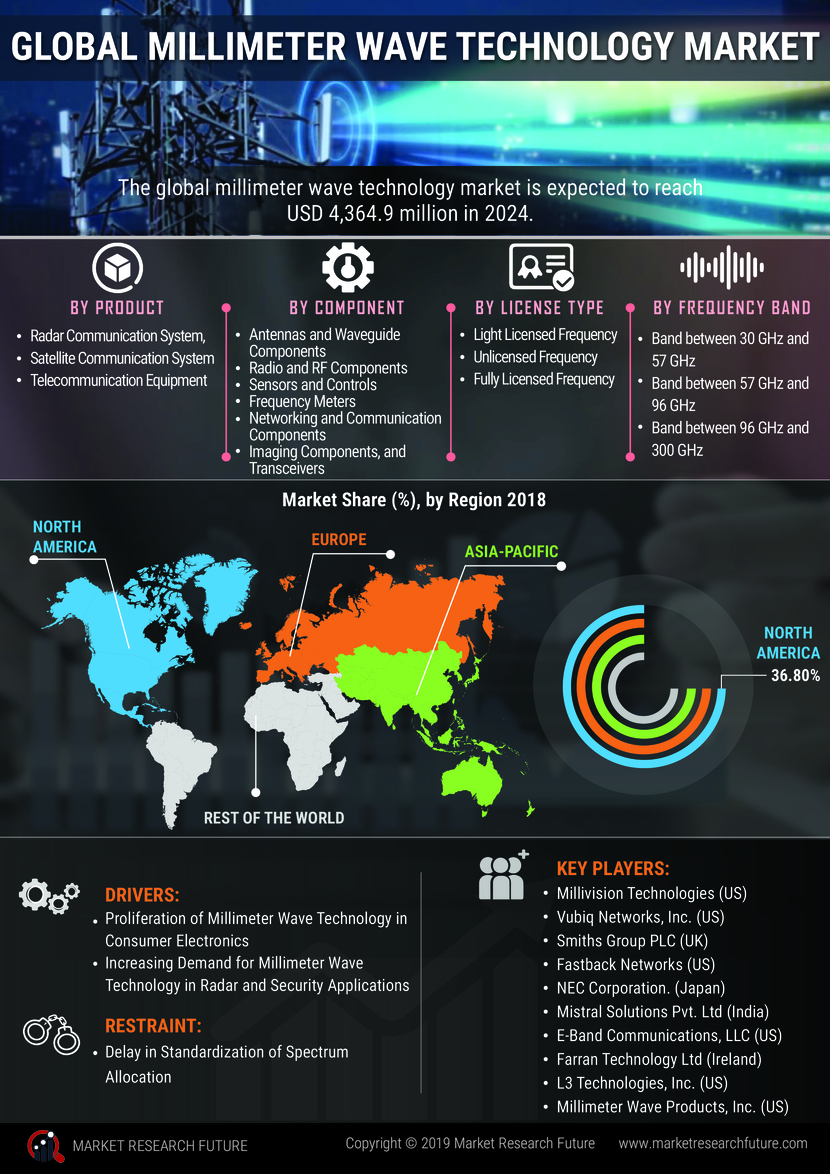

Millimeter wave technology market 2020 can record significant growth at a rate of 35.64% between 2019 and 2024 (evaluation period), anticipates Market Research Future (MRFR). MRFR also evaluates the market worth, which can reach USD 4364.9 million by 2024. We will provide covid-19 impact analysis with the report. The COVID-19 outbreak and its effects are outlined in the millimeter wave overview, providing a detailed review of the market post the coronavirus disease outbreak.

Renowned companies that are active in the millimeter wave technology industry are Farran Technology Ltd (Ireland), Mistral Solutions Pvt. Ltd (India), NEC Corporation. (Japan), Millivision Technologies (US), Vubiq Networks, Inc. (US), Smiths Group PLC (UK), Fastback Networks (US), SAGE Millimeter, Inc. (US), E-Band Communications, LLC (US), Keysight Technologies Inc. (US), Millimeter Wave Products, Inc. (US), BridgeWave Communications, Inc. (US), L3 Technologies, Inc. (US), to name a few.

Know More About COVID-19 Outbreak Impact on this Report

The Final Report will include Continue feed research analysis for covid-19 impact

Get a FREE Report Sample with Table of Contents and Figures @ https://www.marketresearchfuture.com/sample_request/3908

COVID-19 Analysis

Compared to industries the semiconductor and the data center communications industry has remained buoyant post SARS-CoV-2, backed by the increasing strategic investments to facilitate the rising data usage and network traffic while working remotely during the lockdown period. Closing down of educational institutes to curb the spread of the pandemic has led to higher use of virtual offerings, while governments are progressively deploying business analytics services to communicate virus updates. Therefore, despite the novel coronavirus outbreak, communication services and semiconductor products have observed an unprecedented surge.

Although the millimeter wave technology market has felt the COVID-19 impact to some extent, the rising popularity of digital services such as telemedicine and the increasing use of satellite communication system and radar communication system can ensure a smooth run in the coming time.

Recent News

- June 2020, Telstra has made available its first 5G hotspot that supports mmWave frequencies. This is a big achievement since the company owns only three testing sites in Australia that make use of the mmWave technology, however it is expected that the mmWave deployments can shoot up by the year 2021.

- In April 2019, NEC and Ceragon, a company that delivers innovative wireless backhaul solutions, collaborated to enhance the technologies and solutions for 5G wireless backhaul in microwave and millimeter wave spectrum. This collaboration helps NEC to access the solutions which are different from their own solutions and technologies.

- In April 2019, Mistral’s Sensor Fusion Kit launched an integrated platform using camera vision and a RADAR module featuring Texas Instruments (TI) mmWave sensors and Jacinto TDA3x processors, for automotive advanced driver assistance systems (ADAS). This will provide the accuracy required for autonomous driving applications.

- In March 2019, The Smiths Detection business division added two scanners with ECAC standard 3.1 for its CTX 9800 DSi to hold baggage explosives detection systems. It will provide additional flexibility and productivity while maintaining the highest level of security.

- In January 2019, Vubiq developed a hardware/software millimeter wave hyper imaging system. This system is able to code and decode chipless radio frequency identification (RFID) tags with a higher order of magnitude as compared to the existing solutions.

- In May 2016, Farran Technology Ltd collaborated with Copper Mountain Technologies, a developer of innovative RF test and measurement solutions to launch CobaltFx—an advanced technology which provides millimeter-wave frequency extension solution built on a 9 GHz Vector Network Analyser (VNA).

Top Boosters and Main Challenges

The intense research and development in the millimeter wave MMW technology along with the persistent rise in the need for bandwidth-intensive applications has rendered a positive industry landscape. The need for bandwidth-intensive applications has risen particularly in consumer electronic products, such as wearable electronics and smartphones, which in turn, boost the demand for high-speed internet in the telecom industry.

Data-backed services like video conferencing, video streaming, online gaming and media exchange are gaining high prevalence across the globe, especially after the COVID-19 outbreak, thus resulting in a bolstered demand for the MM wave technology.

The market also stands to profit from the surge in infrastructural deployment for faster access to videos, data, services and voice combined with the mounting need for high-speed and extremely high frequency network to access smart systems across the commercial and residential sectors. The rising penetration of e-governance services, cloud computing and internet services also add to the market value.

Market Segmentation

The mmWave industry can be considered for product, component, license type, frequency band, as well as end user.

The products listed in the report are Satellite Communication System, Radar Communication System and Telecommunication Equipment.

The key components discussed in the market study are sensors and controls, antennas and waveguide components, frequency meters, imaging components, transceivers, radio and rf components, and networking and communication components. In 2018, the report confirms that the radio and RF segment secured the highest valuation of USD 144.2 Mn and can procure the fastest expansion rate over the evaluation period.

The various license types covered by MRFR experts are unlicensed frequency, fully licensed frequency and light licensed frequency. Out of these, the lading segment was that of unlicensed frequency, and it is presumed that the segment can gain at the best rate in the coming years. The same year, the second lead was taken by the light licensed frequency segment.

The market, depending on frequency band, can be narrowed down into band between 57 GHz and 96 GHz, band between 96 GHz and 300 GHz and band between 30 GHz and 57 GHz. The 57 GHz and 96 GHz frequency band was the top segment in 2018, with the most potential to attain the fastest CAGR over the given period. The second position was taken by the 30 GHz and 57 GHz segment in the same year.

The significant end users in the worldwide market are government & defense, healthcare, automotive and aerospace, IT & telecommunication, consumer & commercial, and more. In 2018, the most prominent end-user in the market emerged to be IT & telecommunication, while also exhibiting the capacity to post the highest CAGR from 2019 and 2024. In the same year, the automotive & aerospace segment held the second-largest share in the global market.

Regional Study

The regional study of the millimeter wave technology market encompasses APAC/Asia Pacific, MEA/the Middle East & Africa, South America, Europe and North America.

It is anticipated that North America could be the biggest gainer in the global market, on account of the intense mobile data traffic that require higher bandwidth, the introduction of more advanced millimeter wave-based security and radar products and the high consumption in small-cell backhaul network.

The APAC market is performing incredibly backed by the frequent upgradations and innovations in the telecom industry. The increasing installation of innovative telecom equipment that is based on the mmWave technology also encourages market growth in the region. The growing uptake of MMW scanners to deal with the rising terrorism issue in the region can also bolster the demand for the technology in the ensuing years.

Ask for your specific company profile and country level customization.

Assure yourself with latest market data through free annual update – Covid Update package !

Browse Complete Report “Global Millimeter Wave Technology Market Research Report – Forecast till 2024” @ https://www.marketresearchfuture.com/reports/millimeter-wave-technology-market-3908

About Market Research Future:

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research & Consulting Edibles.

MRFR team have supreme objective to provide the optimum quality Market research and intelligence services to our clients. Our Market research studies by products, services, technologies, applications, end users, and Market players for global, regional, and country level Market segments, enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Media Contact

Company Name: Market Research Future

Contact Person: Abhishek Sawant

Email: Send Email

Phone: +1 646 845 9312

Address:Market Research Future Office No. 528, Amanora Chambers Magarpatta Road, Hadapsar

City: Pune

State: Maharashtra

Country: India

Website: https://www.marketresearchfuture.com/reports/millimeter-wave-technology-market-3908