MENA Fintech Market Outlook

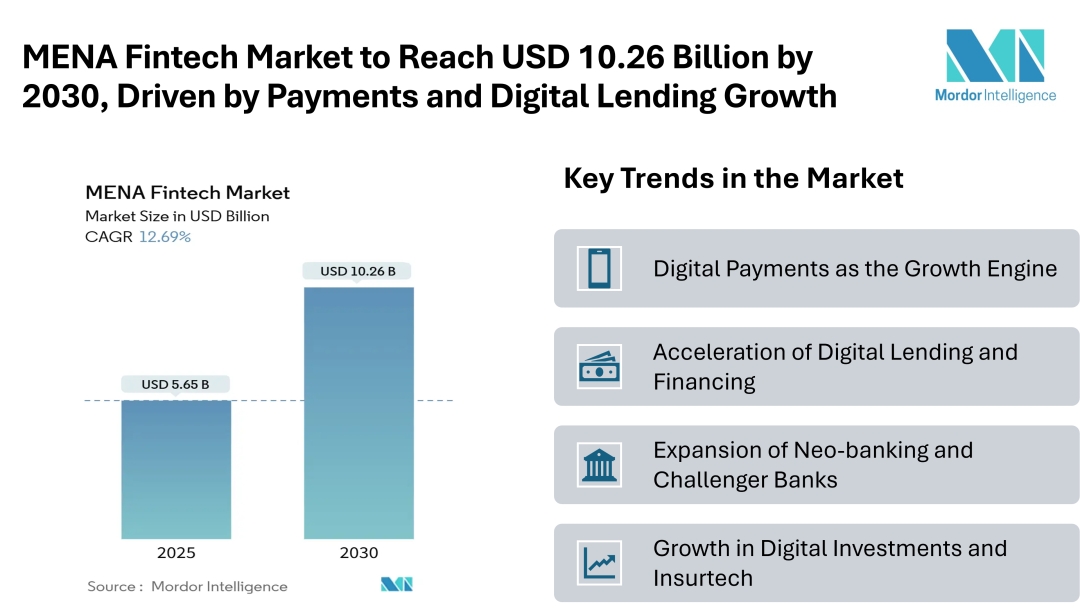

The MENA fintech market size is valued at USD 5.65 billion in 2025 and is forecast to reach USD 10.26 billion by 2030, advancing at a 12.69% CAGR. This momentum is underpinned by a young and digitally engaged population, supportive government policies, and increased investor activity across the Middle East and North Africa. With the rapid rise of neobanks, mobile-first solutions, and digital lending platforms, the region is transitioning from traditional financial structures toward a diversified fintech ecosystem.

As a result, the MENA Fintech Market Growth reflects both demand-side enthusiasm and supply-side innovation. Consumers are embracing digital solutions for payments, loans, savings, and investments, while businesses are turning to fintech to streamline operations and reach new customers.

Key Trends in the MENA Fintech Market

1. Digital Payments as the Growth Engine

Digital payments remain the cornerstone of fintech in MENA. Widespread smartphone penetration, expanding e-commerce, and consumer preference for convenient transactions are fueling adoption. Contactless technologies, QR-based systems, and mobile wallets are gaining ground in urban centers, while cross-border remittances are increasingly shifting to digital platforms. Payment providers are also forging partnerships with retailers and service platforms to enhance customer loyalty and boost transaction volumes. This segment not only commands the largest share but also acts as the entry point for users to explore additional fintech services.

2. Acceleration of Digital Lending and Financing

Access to credit has long been a challenge in many parts of the region, especially for small and medium enterprises. Digital lending platforms are filling this gap by offering alternative credit-scoring methods, quick loan approvals, and personalized repayment solutions. Buy Now, Pay Later (BNPL) models are particularly popular among younger consumers, enabling flexible payments for online and offline purchases. As confidence in fintech lending grows, the sector is expected to capture an increasingly significant share of the overall MENA Fintech Market Size.

3. Expansion of Neo-banking and Challenger Banks

Neobanks are transforming how consumers engage with financial services. With mobile-first approaches, these banks offer simplified account openings, transparent fee structures, and features such as budgeting tools and instant transfers. Younger demographics, especially digital-native millennials and Gen Z, are leading this adoption curve. Neobanks are also focusing on underserved populations, giving access to those previously excluded from formal banking systems. Their rise contributes significantly to overall MENA Fintech Market Growth.

4. Growth in Digital Investments and Insurtech

Digital investment platforms are seeing increased traction as consumers seek to diversify savings and access global financial markets. Robo-advisory services, micro-investment platforms, and Sharia-compliant investment tools are becoming mainstream across urban populations. Insurtech, though at an earlier stage, is gradually improving insurance penetration through online distribution, policy customization, and simplified claims processes. These segments highlight the broadening scope of fintech beyond payments and lending, reinforcing the strength of the MENA Fintech Market Share.

5. Government Support and Regulatory Sandboxes

Several MENA governments are actively fostering fintech ecosystems through sandboxes, incubators, and national fintech strategies. Countries such as the United Arab Emirates and Saudi Arabia are leading with forward-looking regulations, while North African nations are also implementing frameworks to encourage market entry. The presence of supportive policies reduces barriers to entry, fosters investor confidence, and creates a safer environment for consumers to adopt digital finance solutions. This regulatory clarity is a key driver of MENA Fintech Market Growth.

6. Embedded Finance and Cross-Sector Collaboration

Non-financial platforms such as e-commerce sites, ride-hailing services, and gig-economy apps are embedding payment, lending, and insurance services directly into their offerings. This integration creates seamless experiences for consumers while opening new revenue streams for fintech players. By integrating fintech into everyday services, adoption becomes effortless, and user trust grows faster. This trend ensures that fintech is not limited to standalone applications but becomes an integral part of daily consumer and business activities.

7. Regional Differences in Market Growth

While the GCC dominates the MENA Fintech Market Share due to higher income levels and advanced infrastructure, North Africa is expected to post the fastest growth. Egypt, Morocco, and Algeria are seeing rising interest in mobile money and digital credit solutions, supported by young populations and increasing smartphone penetration. In the Levant, markets such as Jordan and Lebanon are becoming testbeds for fintech innovation, particularly in remittances and SME-focused services. These variations highlight the importance of localized strategies to capture opportunities in diverse markets.

Market Segmentation in the MENA Fintech Market

By Service Proposition

-

Digital Payments

-

Digital Lending & Financing

-

Digital Investments

-

Insurtech

-

Neo-banking

By End-User

-

Retail

-

Businesses

By User Interface

-

Mobile Applications

-

Web / Browser

-

POS / IoT Devices

By Geography

-

GCC: Saudi Arabia, United Arab Emirates, Qatar, Bahrain, Kuwait, Oman

-

North Africa: Egypt, Morocco, Algeria, Tunisia

-

Levant: Jordan, Lebanon

This segmentation demonstrates how fintech spans both consumer and business segments, with mobile applications serving as the dominant channel. Regional diversity ensures that different strategies are required for each sub-market.

Key Players in the MENA Fintech Market

Competition in the MENA fintech sector is intensifying, with both homegrown and international players vying for market share.

-

Fawry: A pioneer in Egypt’s digital payments space, offering payment solutions and financial services to millions of users. Its extensive agent network allows it to reach underserved populations effectively.

-

PayTabs: Based in the Gulf, PayTabs provides secure online payment solutions to businesses and is expanding its reach across international markets.

-

Checkout.com: A global payments player with a strong presence in the region, catering to merchants and supporting the growth of cross-border e-commerce.

-

Tabby: A leading BNPL provider, Tabby is rapidly scaling across multiple countries by tapping into consumer demand for flexible purchasing options.

-

STC Pay: Backed by one of the largest telecom providers in the region, STC Pay combines mobile payments with wallet services, giving it a strong foothold in everyday transactions.

These companies illustrate the diversity of fintech solutions in the region, ranging from payments and lending to BNPL and wallet services. Their ongoing innovations and partnerships are reshaping consumer behavior and reinforcing the growth trajectory of the MENA Fintech Market.

Conclusion

The MENA Fintech Market is moving from a niche sector to a mainstream component of financial services. With a strong base in digital payments, growing momentum in digital lending, and the rise of neo-banking, the market is diversifying rapidly. Government support, increasing consumer trust, and expanding access to mobile technology provide a foundation for continued expansion.

As the market size advances toward its 2030 target, competition will intensify, but so will opportunities for differentiation. Players that can adapt offerings to local needs, maintain regulatory alignment, and integrate with broader digital ecosystems will secure a stronger share of this growing market.

In the years ahead, the MENA fintech industry is set to redefine how individuals and businesses access, use, and interact with financial services, making it one of the most dynamic growth stories within the global fintech landscape.

For complete market analysis, please visit the Mordor Intelligence page: https://www.mordorintelligence.com/industry-reports/mena-fintech-market?utm_source=abnewswire

Industry Related Reports:

Global Fintech Market: The Fintech Market is Segmented by Service Proposition (Digital Payments, Digital Lending and Financing, Digital Investments, Insurtech, and Neo-banking), by End-User (Retail and Businesses), by User Interface (Mobile Applications, Web / Browser, and POS / IoT Devices), and by Region (North America, South America, Europe, Asia-Pacific, & Middle East and Africa).

UAE Fintech Market: The UAE Fintech Market Report is Segmented by Service Proposition (Digital Payments, Digital Lending and Financing, Digital Investments, Insurtech, Neo banking), End-User (Retail, Businesses), User Interface (Mobile Applications, Web/Browser, POS/IoT Devices), and Geography (Dubai, Abu Dhabi, Rest of UAE).

United States Fintech Market: The United States Fintech Market Report is Segmented by Service Proposition (Digital Payments, Digital Lending & Financing, Digital Investments, Insurtech, Neo banking), End-User (Retail, Businesses), User Interface (Mobile Applications, Web/Browser, POS/IoT Devices), and Geography (Northeast, Midwest, South, West).

About Mordor Intelligence:

Mordor Intelligence is a trusted partner for businesses seeking comprehensive and actionable market intelligence. Our global reach, expert team, and tailored solutions empower organizations and individuals to make informed decisions, navigate complex markets, and achieve their strategic goals.

With a team of over 550 domain experts and on-ground specialists spanning 150+ countries, Mordor Intelligence possesses a unique understanding of the global business landscape. This expertise translates into comprehensive syndicated and custom research reports covering a wide spectrum of industries, including aerospace & defense, agriculture, animal nutrition and wellness, automation, automotive, chemicals & materials, consumer goods & services, electronics, energy & power, financial services, food & beverages, healthcare, hospitality & tourism, information & communications technology, investment opportunities, and logistics.

For any inquiries or to access the full report, please contact:

media@mordorintelligence.com https://www.mordorintelligence.com/

Mordor Intelligence, 11th Floor, Rajapushpa Summit, Nanakramguda Rd, Financial District, Gachibowli, Hyderabad, Telangana – 500032, India.

Media Contact

Company Name: Mordor Intelligence Private Limited

Contact Person: Jignesh Thakkar

Email: Send Email

Phone: +1 617-765-2493

Address:11th Floor, Rajapushpa Summit, Nanakramguda Rd, Financial District, Gachibowli

City: Hyderabad

State: Telangana 500008

Country: India

Website: https://www.mordorintelligence.com/