Introduction

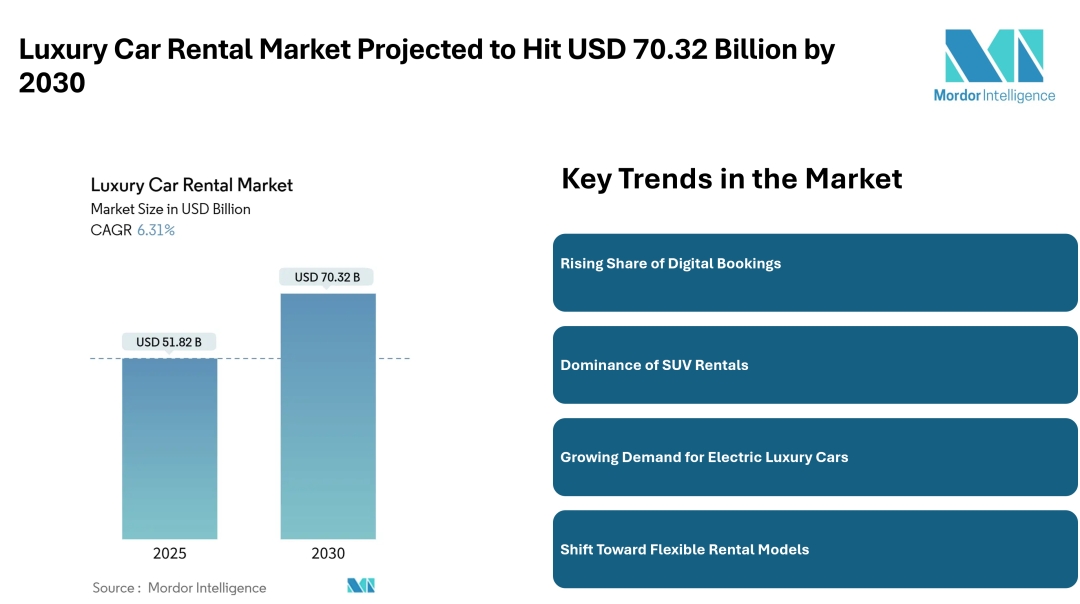

Mordor Intelligence, in its latest Luxury Car Rental Market market report, forecasts the industry will grow from USD 51.82 billion in 2025 to USD 70.32 billion by 2030, riding on rising demand for premium travel, digital booking channels, and growth in high-net-worth travelers

The luxury car rental market caters to customers seeking premium vehicles for short-term or long-term use, offering high-end brands such as Mercedes-Benz, BMW, Audi, Rolls-Royce, and Lamborghini. These rentals are popular among business travelers, tourists, and individuals looking for a luxury experience for special occasions or events.

Key Market Trends

Rising Share of Digital Bookings: The share of online bookings in luxury car rentals is growing rapidly as customers prioritize convenience, transparency, and flexibility. Aggregator platforms and brand-owned websites allow travelers to browse models, compare prices, and confirm reservations instantly. This shift is particularly strong among younger, tech-savvy customers and frequent travelers who prefer mobile-first booking solutions.

Dominance of SUV Rentals: SUVs account for the largest segment in luxury car rentals, driven by their blend of spacious interiors, advanced features, and premium comfort. These vehicles cater to both leisure travelers seeking family-friendly options and corporate clients looking for status-enhancing rides. Their versatility makes them ideal for long-distance journeys, urban travel, and even special events.

Growing Demand for Electric Luxury Cars: The inclusion of electric vehicles in luxury rental fleets is gaining momentum as environmental awareness rises and governments promote green mobility. Customers are increasingly drawn to models that combine sustainability with high performance, advanced technology, and unique driving experiences. While adoption is still in its early stages compared to traditional ICE vehicles, the growth rate for electric rentals is notably high.

Shift Toward Flexible Rental Models: Subscription-based and long-term rental plans are becoming more common as customers seek flexibility and value. These arrangements offer benefits like fixed monthly fees, maintenance coverage, and the ability to switch between models. Such options appeal to corporate clients with ongoing mobility needs and individual customers who prefer access to luxury vehicles without the commitment of ownership.

Market Segmentation

By Vehicle Model Style

-

Hatchback – Compact and agile, hatchbacks cater to customers seeking luxury in a smaller form factor, ideal for city driving and shorter trips. They often feature high-end interiors and advanced infotainment systems despite their smaller size.

-

Sedan – A popular choice for business travelers and leisure renters, sedans offer a balance of comfort, performance, and sophistication. They are well-suited for long-distance travel and corporate transfers.

-

Sport Utility Vehicle (SUV) – SUVs dominate the luxury rental segment, offering spacious cabins, higher seating positions, and versatile performance. They appeal to families, groups, and customers looking for both style and practicality.

-

Multi-Purpose Vehicle (MPV) – MPVs provide ample seating capacity and luggage space, making them an attractive choice for group travel, events, and tourist excursions where comfort and convenience are priorities.

-

Sports & Super-car – This category serves customers seeking high-performance, exotic driving experiences. Rentals often include brands like Ferrari, Lamborghini, or Porsche for special occasions, leisure drives, or prestige events.

By Rental Duration

-

Short-term (Less Than 30 Days) – The most common rental duration, catering to tourists, business visitors, and customers renting for events or weekend getaways. These rentals emphasize flexibility and quick availability.

-

Long-term / Subscription (More Than 30 Days) – A growing segment where customers pay a fixed fee for extended use, often including maintenance and insurance. This appeals to corporate clients and individuals wanting access to luxury cars without ownership commitments.

By Booking Channel

-

Online Direct (Own Website / App) – Customers book directly via the rental company’s platform, often benefiting from loyalty programs, special offers, and the ability to select specific models.

-

Online Aggregator / OTA – Third-party platforms allow users to compare prices, availability, and features across multiple providers, boosting transparency and convenience. This channel is gaining rapid traction globally.

-

Offline Travel Agent / Walk-in – Traditional booking methods remain relevant, especially in tourist-heavy locations and for customers who prefer face-to-face service or last-minute rentals.

By Drive Type

-

Self-drive – The preferred choice for most customers, offering full control and privacy. Popular among leisure travelers and business users who want independence and flexibility during their trips.

-

Chauffeur-drive – Targeted at customers who value convenience and a premium service experience. Commonly chosen for corporate events, weddings, VIP transfers, and special occasions.

By Propulsion Type

-

Internal Combustion Engine (ICE) – Still the dominant choice in luxury rentals, offering a wide range of models and established refueling infrastructure.

-

Battery-Electric Vehicle (BEV) – Growing in popularity as customers seek eco-friendly yet luxurious driving experiences. Increasingly included in fleets in regions with strong EV adoption.

-

Hybrid and Plug-in Hybrid Vehicle (PHEV) – Combining fuel efficiency with performance, hybrids cater to environmentally conscious customers who also want the convenience of traditional refueling.

By Customer Type

-

Leisure Individual – Includes tourists, special-occasion renters, and those seeking a unique driving experience for personal use. This segment values variety, comfort, and brand prestige.

-

Corporate / MICE – Corporate travelers and Meetings, Incentives, Conferences, and Exhibitions (MICE) clients rent luxury vehicles for executive transport, events, and high-profile business needs.

By Service Location

-

Airport – A major rental hub, catering to arriving travelers seeking immediate access to premium vehicles for business or leisure.

-

Urban Downtown – Increasingly popular for local residents, corporate clients, and visitors who prefer city-center pick-up and drop-off points.

-

Resort / Tourist Hotspot – Locations near luxury resorts, coastal areas, and popular attractions cater to vacationers looking to enhance their stay with a premium car rental.

By Geography

-

North America – Significant share led by the United States, supported by a mature travel industry, affluent clientele, strong corporate demand, and popular SUV/premium sedan rentals. Canada benefits from tourism and events, while Mexico grows through urban and tourism-driven rentals.

-

South America – Steady growth in Brazil and Argentina driven by tourism in coastal cities and resorts, plus events like motorsport and cultural festivals. Urban and airport rentals are adopting more premium models.

-

Europe – One of the largest markets, with Germany, the UK, France, Italy, and Spain leading demand. Seasonal peaks in the Mediterranean and Alps boost rentals of convertibles, SUVs, and sports cars.

-

Asia-Pacific – Largest and fastest-growing region. China, Japan, Thailand, and India see strong demand from rising incomes, affluent populations, and tourism recovery. Increasing BEV adoption and online bookings strengthen growth.

-

Middle East – High demand for ultra-luxury and exotic cars in the UAE, Saudi Arabia, and Qatar. Popular hubs include Dubai and Abu Dhabi, with SUVs, sports cars, and chauffeur-driven services favored by residents and VIP tourists.

Major Players

-

Enterprise Holdings Inc.

-

The Hertz Corporation

-

Avis Budget Group Inc.

-

Sixt SE

-

Europcar Mobility Group

Conclusion

The luxury car rental market is set to witness steady growth over the coming years, fueled by rising disposable incomes, expanding tourism, and the growing appetite for premium travel experiences. The combination of digital booking convenience, a wider variety of high-end vehicle models, and the increasing presence of SUVs and electric cars in rental fleets is reshaping customer expectations.

For more information: https://www.mordorintelligence.com/ja/industry-reports/luxury-car-rental-market?utm_source=abnewswire

Industry Related Reports

India Car Rental Market: The India Car Rental Market is categorized by Booking Type (Online and Offline), Application Type (Tourism and Commuting), Vehicle Type (Luxury/Premium Cars and Economy/Budget Cars), and Rental Duration (Short Term and Long Term). The report provides market size and value forecasts in USD for each of these segments.

Middle East Car Rental Market: The Middle East Car Rental Market is segmented by Booking Type (Online Booking, Offline Booking), Application (Leisure/Tourism, Daily Utility), Vehicle Type (Economy Cars, Luxury Cars), End-User Type (Self-Driven, Chauffeur), and Country (Saudi Arabia, Kuwait, United Arab Emirates, Qatar, and Rest of Middle East). The report includes five years of historical data along with five-year market forecasts.

Get More insights: https://www.mordorintelligence.com/industry-reports/middle-east-car-rental-market?utm_source=abnewswire

UAE Car Rental Market: The report covers car rental market companies in the UAE and segments the industry by Rental Duration (Short Term and Long Term), Booking Type (Online and Offline), Application Type (Self-driven and Chauffeur-driven), and Vehicle Type (Budget/Economy and Premium/Luxury). It provides the market size and value forecasts (USD million) for the United Arab Emirates car rental market across these segments.

About Mordor Intelligence:Mordor Intelligence is a trusted partner for businesses seeking comprehensive and actionable market intelligence. Our global reach, expert team, and tailored solutions empower organizations and individuals to make informed decisions, navigate complex markets, and achieve their strategic goals. With a team of over 550 domain experts and on-ground specialists spanning 150+ countries, Mordor Intelligence possesses a unique understanding of the global business landscape. This expertise translates into comprehensive syndicated and custom research reports covering a wide spectrum of industries, including aerospace & defense, agriculture, animal nutrition and wellness, automation, automotive, chemicals & materials, consumer goods & services, electronics, energy & power, financial services, food & beverages, healthcare, hospitality & tourism, information & communications technology, investment opportunities, and logistics.

For any inquiries or to access the full report, please contact: media@mordorintelligence.com

https://www.mordorintelligence.com/

Media Contact

Company Name: Mordor Intelligence Private Limited

Contact Person: Jignesh Thakkar

Email: Send Email

Phone: +1 617-765-2493

Address:5th Floor, Rajapushpa Summit, Nanakramguda Rd, Financial District, Gachibowli

City: Hyderabad

State: Telangana 500008

Country: India

Website: https://www.mordorintelligence.com/