Lupus Nephritis Market Summary

The Lupus nephritis market size in Japan was USD ~49 million in 2024, which is expected to rise during the forecast period (2025–2034). Lupus nephritis, a severe complication of SLE, affects 40–60% of patients, with 10–30% potentially progressing to end-stage renal disease (ESRD) despite treatment. While incidence peaked around 2020, prevalence continues to rise due to improved survival, indicating a growing but stabilizing patient burden. Class IV is the most common and severe histological subtype, linked to high relapse and non-remission rates, whereas Classes I and II are milder, and Class V poses challenges from proteinuria and overlap with proliferative forms. In 2024, approximately 385,000 diagnosed cases were reported across the 7MM, with Spain having the highest prevalence in the EU4 and UK. Currently, BENLYSTA (belimumab) and LUPKYNIS (voclosporin) are FDA-approved treatments, while a robust pipeline—including ianalumab, FABHALTA, CAR-T therapy, GAZYVA, and SAPHNELO—promises to expand therapeutic options.

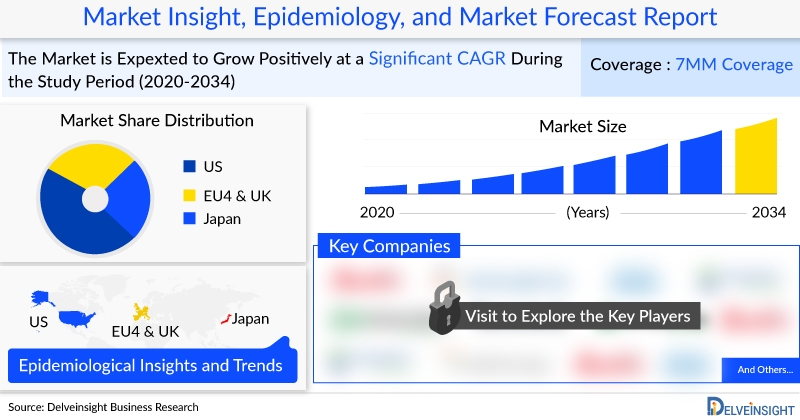

DelveInsight’s report, “Lupus Nephritis Market Insights, Epidemiology, and Market Forecast-2034,” offers a comprehensive analysis of Lupus Nephritis, including historical and projected epidemiology, as well as market trends across the United States, EU5 (Germany, Spain, Italy, France, and the United Kingdom), and Japan. The report details current treatment approaches, emerging therapies, market share of individual treatments, and the Lupus Nephritis market size from 2020 to 2034 across seven key markets. Additionally, it examines treatment algorithms, market drivers, barriers, and unmet medical needs, highlighting potential opportunities and evaluating the overall growth prospects within the Lupus Nephritis market.

Explore DelveInsight’s comprehensive Lupus Nephritis Market Report 2034 to understand current treatment trends, emerging therapies, and market growth opportunities across the US, EU5, and Japan @ Lupus Nephritis Market Forecast

Some facts of the Lupus Nephritis Market Report are:

- According to DelveInsight, Lupus Nephritis market size is expected to grow at a decent CAGR by 2034.

- The Lupus nephritis market was valued at around USD 1.8 billion in 2024 and is expected to grow during 2025–2034 due to these emerging therapies in 7MM.

- In the total market size of Lupus Nephritis in the 7MM, the United States accounted for the highest market share that is more than 80% in 2023, followed by Japan and the Spain.

- Leading Lupus Nephritis companies working in the market are Aurinia Pharmaceuticals, Roche, AstraZeneca, Boehringer Ingelheim, GlaxoSmithKline, Novartis, Otsuka Pharmaceutical, MorphoSys, Vertice Pharma, Pharmaceutical Associates Inc., Sun Pharmaceutical, Abbott, Johnson & Johnson Private Limited, Bayer, Sanofi, Sumitomo Corporation, LEO Pharma A/S, Cipla, and Nimble Pharmaceuticals, and others.

- Key Lupus Nephritis Therapies expected to launch in the market are BENLYSTA (belimumab), LUPKYNIS (voclosporin), Ianalumab (VAY736), SAPHNELO (anifrolumab), GAZYVA/GAZYVARO (obinutuzumab), Anifrolumab and others.

- In June 2025, GSK plc (LSE/NYSE: GSK) today announced that the US Food and Drug Administration (FDA) has approved a 200 mg/mL autoinjector of Benlysta (belimumab), a B-lymphocyte stimulator (BlyS)-specific inhibiting monoclonal antibody, for subcutaneous injection in patients five years of age and older with active lupus nephritis (LN) who are receiving standard therapy. With this approval, GSK is expanding choices for belimumab treatment, offering pediatric lupus nephritis patients and caregivers a first-of-its-kind subcutaneous option that can be administered at home. The 200 mg/mL autoinjector was approved for pediatric patients with active systemic lupus erythematosus (SLE) in 2024.

- In March 2025, Roche (SIX: RO, ROG; OTCQX: RHHBY) announced today that the US Food and Drug Administration (FDA) has accepted the company’s supplemental Biologics License Application (sBLA) for Gazyva®/Gazyvaro® (obinutuzumab) for the treatment of lupus nephritis. The filing acceptance is based on positive results from the phase III REGENCY study, which showed improved complete renal response (CRR) with Gazyva/Gazyvaro plus standard therapy compared with standard therapy alone.1 The FDA is expected to make a decision on approval by October 2025.

- In February 2025, the FDA cleared Allogene Therapeutics’ investigational new drug (IND) application for ALLO-329, an allogenic CAR-T cell therapy. Researchers are set to begin the Phase 1 RESOLUTION trial in mid-2025 for autoimmune diseases, including systemic lupus erythematosus (SLE), lupus nephritis (LN), idiopathic inflammatory myopathies, and systemic sclerosis.

- In November 2024, Adicet Bio announced that the first LN patient had been dosed in the Phase I clinical trial evaluating ADI-001 in autoimmune diseases.

- In November 2024, Kyverna Therapeutics announced that it would present updated clinical data from LN patients treated with KYV-101 in ongoing Kyverna-sponsored KYSA-1 and KYSA-3 Phase I/II studies and named patient treatments.

- In October 2024, Kezar Life Sciences suspended subject enrolment and patient dosing in the Phase II PALIZADE trial of zetomipzomib for active lupus nephritis.

- In June 2024, Nkarta announced the initiation of Ntrust-I, a multi-center clinical trial of NKX019 in lupus nephritis, with the first patient in screening. The company also announced the clearance by the U.S. Food and Drug Administration (FDA) of its second Investigational New Drug (IND) application for NKX019 in autoimmune disease.

Lupus Nephritis Overview

Lupus nephritis (LN) is a severe kidney complication of systemic lupus erythematosus (SLE), caused by autoimmune-mediated inflammation of the kidneys. It affects 40–60% of SLE patients and can progress to end-stage renal disease (ESRD) if untreated. Lupus nephritis Symptoms include proteinuria, hematuria, edema, fatigue, and hypertension, though some patients remain asymptomatic in early stages. Lupus nephritis Diagnosis relies on urinalysis, blood tests, kidney function assessment, and often a renal biopsy to determine histological subtype. Lupus nephritis Treatment involves immunosuppressive therapies, including corticosteroids, cyclophosphamide, and mycophenolate mofetil, alongside FDA-approved agents like BENLYSTA (belimumab) and LUPKYNIS (voclosporin). Emerging therapies and personalized approaches aim to improve outcomes and reduce relapse rates.

Learn more about Lupus Nephritis treatment algorithms in different geographies, and patient journeys. Contact to receive a sample @ Lupus Nephritis Treatment Market

Lupus Nephritis Market

In the 7MM, the lupus nephritis market was valued at approximately USD 1.8 billion in 2024, led by the US. Spain holds the largest market share in the EU4 and UK, with Japan’s market at USD ~49 million. Emerging therapies are expected to address current unmet needs and drive market growth through 2034.

Currently, only two FDA-approved therapies—BENLYSTA and LUPKYNIS—are available for lupus nephritis, which is managed in induction and maintenance phases. Standard induction treatments include mycophenolate mofetil (MMF) and cyclophosphamide, with corticosteroids controlling flares but offering limited long-term benefit. There is a trend toward intensive combination therapies, particularly for Class III/IV and V disease, using regimens like glucocorticoids with MMF or BENLYSTA, MMF with a CNI, or low-dose cyclophosphamide with BENLYSTA. The treatment landscape is rapidly evolving, with companies such as Novartis, Roche, and AstraZeneca advancing next-generation therapies aimed at improving outcomes.

Lupus Nephritis Epidemiology

In 2024, the US had the largest diagnosed population with approximately 218,000 cases, representing about 60% of the 7MM total. The EU4 and UK together had around 130,000 cases, with Spain showing the highest prevalence and France the lowest. Epidemiology trends indicate a steady increase in diagnosed lupus nephritis cases across these regions throughout the forecast period, reflecting growing disease recognition and improved survival rates.

Dive into comprehensive Lupus Nephritis epidemiology across the 7MM, analyze total and age-specific cases, class-wise prevalence, and treatment patterns. Explore now @ Lupus Nephritis Prevalence

Epidemiology Segmented by:

- Total Diagnosed Prevalent Cases

- Age-specific Diagnosed Prevalent Cases

- Diagnosed Prevalent Cases by Class

- Total Treated Cases of Lupus Nephritis

Lupus Nephritis Emerging Drugs

Ianalumab (VAY736) – Novartis

Ianalumab is a fully human HuCAL antibody administered subcutaneously that targets the BAFF receptor (BAFF-R). Engineered for direct ADCC-mediated B-cell depletion, it is being investigated for lupus nephritis, SLE, autoimmune hepatitis, and idiopathic pulmonary fibrosis. The drug is currently in Phase III trials, with Novartis planning submission by 2028.

GAZYVA/GAZYVARO (obinutuzumab) – Roche

GAZYVA (marketed as GAZYVARO in Europe) is an intravenous monoclonal antibody designed to target the CD20 protein on lymphoma and leukemia cells. By binding to Type 2 CD20 antibodies, obinutuzumab enhances antibody-dependent cytotoxicity and exerts stronger direct cytotoxic effects compared to traditional CD20 antibodies. Its mechanism involves B-cell destruction via immune effector cell engagement, activation of intracellular death pathways, and/or the complement cascade. The drug is currently under evaluation in two Phase III trials. In March 2025, the FDA accepted Roche’s supplemental Biologics License Application for lupus nephritis, supported by data from the Phase III REGENCY study. FDA approval is expected by October 2025, with EMA submission also under review.

Lupus Nephritis Market Drivers:

- Rising Prevalence of SLE and LN: Increasing diagnosed cases globally, especially in the 7MM (US, EU5, Japan), are driving demand for effective treatments.

- Advancements in Treatment Options: FDA approvals of BENLYSTA (belimumab) and LUPKYNIS (voclosporin), along with a robust pipeline of emerging therapies, are expanding therapeutic choices.

- Unmet Medical Needs: Severe disease subtypes, high relapse rates, and partial responses to conventional therapy create demand for novel, targeted therapies.

- Growing Awareness and Diagnosis: Improved disease recognition, diagnostic tools, and patient monitoring are increasing the number of treated patients.

Uncover Lupus Nephritis market trends, emerging therapies, and opportunities across major global markets @ Lupus Nephritis Drugs Market

Lupus Nephritis Market Barriers:

- High Treatment Costs: Biologics and emerging therapies are expensive, limiting accessibility in certain regions.

- Complex Disease Management: LN heterogeneity and varying patient responses complicate treatment standardization.

- Regulatory Challenges: Approval timelines and rigorous clinical trials can delay the introduction of new therapies.

- Adverse Effects of Therapies: Immunosuppressive treatments can cause significant side effects, impacting patient compliance.

Lupus Nephritis Therapeutics Assessment

Major key companies are working proactively in the Lupus Nephritis Therapeutics market to develop novel therapies which will drive the Lupus Nephritis treatment markets in the upcoming years are Aurinia Pharmaceuticals, Roche, AstraZeneca, Boehringer Ingelheim, GlaxoSmithKline, Novartis, Otsuka Pharmaceutical, MorphoSys, Vertice Pharma, Pharmaceutical Associates Inc., Sun Pharmaceutical, Abbott, Johnson & Johnson Private Limited, Bayer, Sanofi, Sumitomo Corporation, LEO Pharma A/S, Cipla, and Nimble Pharmaceuticals, and others.

Learn more about the emerging Lupus Nephritis therapies & key companies @ Lupus Nephritis Clinical Trials and Advancements

Lupus Nephritis Report Key Insights

1. Lupus Nephritis Patient Population

2. Lupus Nephritis Market Size and Trends

3. Key Cross Competition in the Lupus Nephritis Market

4. Lupus Nephritis Market Dynamics (Key Drivers and Barriers)

5. Lupus Nephritis Market Opportunities

6. Lupus Nephritis Therapeutic Approaches

7. Lupus Nephritis Pipeline Analysis

8. Lupus Nephritis Current Treatment Practices/Algorithm

9. Impact of Emerging Therapies on the Lupus Nephritis Market

Table of Contents

1. Key Insights

2. Executive Summary

3. Lupus Nephritis Competitive Intelligence Analysis

4. Lupus Nephritis Market Overview at a Glance

5. Lupus Nephritis Disease Background and Overview

6. Lupus Nephritis Patient Journey

7. Lupus Nephritis Epidemiology and Patient Population

8. Lupus Nephritis Treatment Algorithm, Current Treatment, and Medical Practices

9. Lupus Nephritis Unmet Needs

10. Key Endpoints of Lupus Nephritis Treatment

11. Lupus Nephritis Marketed Products

12. Lupus Nephritis Emerging Therapies

13. Lupus Nephritis Seven Major Market Analysis

14. Attribute Analysis

15. Lupus Nephritis Market Outlook (7 major markets)

16. Lupus Nephritis Access and Reimbursement Overview

17. KOL Views on the Lupus Nephritis Market

18. Lupus Nephritis Market Drivers

19. Lupus Nephritis Market Barriers

20. Appendix

21. DelveInsight Capabilities

22. Disclaimer

About DelveInsight

DelveInsight is a leading Life Science market research and business consulting company recognized for its off-the-shelf syndicated market research reports and customized solutions to firms in the healthcare sector.

Media Contact

Company Name: DelveInsight Business Research LLP

Contact Person: Ankit Nigam

Email: Send Email

Phone: +14699457679

Address:304 S. Jones Blvd #2432

City: Albany

State: New York

Country: United States

Website: https://www.delveinsight.com/consulting/competitive-intelligence-services