Seychelles, Mahe. A dire warning abounds on asset broker services: “99% of traders lose money on margin accounts.” Trading strategy and adequate capitalization are strong buffers against losses; however the human element accounts for most of portfolio wipe-outs. Trading psychology overrides the most disciplined trading plans. Mistakes are made, and balances erode.

In March 2020, global lockdowns triggered economic meltdowns. Among those affected were Joseph R. Plazo, Bertrand S. Fong, Mark J. Sullivan, Richard Wakefield, and Xavier M. Roche. All five lawyer-entrepreneurs saw their primary sources of livelihood decimated.

A silver lining remained. All five held exemplary trading skills across all asset classes, including indices, commodities, and forex. Each one of them individually grew their accounts with profit factors of over 20. It was a chance discussion over Forex Factory discord chat that they launched the Omega Initiative.

The Omega Initiative

The founding members of the Omega Initiative agreed to turn their unique trading styles into fully automated algorithms deployable on the Metatrader and Ctrader platforms. Joseph Plazo got the ball rolling with a trading system that monitored 8 ADX modules and 6 EMAs. The algorithm, dubbed Pandora, looked for ADX levels above 25 on the trading time frame and matched them with price action on up to five higher time frames. The system won 97% of the time, especially on the 15-minute chart.

Joseph Plazo and Bertrand Fong then worked on the Hydra Project for the next three months. Hydra’s directive was to execute long positions when the Bill Williams Aligator Oscillator signaled, the Aligator lines spread out, and the ADX went over 25. Like Pandora, Hydra got 97% of the wins.

After two years, Plazo, Fong, Sullivan, Wakefield, and Roche churned out more than 42 algorithms from their homes and collaborated over Github and Zoom. These 42 algorithms led to the creation of more than 300 specialized indicators, which the founders gave away for free on the Ctrader repositories and other platforms. No algorithm was sold to make money. It was an intellectual pursuit in and of itself.

“We joined forces for survival. Due to the COVID outbreak, our pooled funding was small,” explains Joseph Plazo, the head of the informal collaboration. “What began as a concerted attempt to safeguard and expand our capital evolved into an intellectual quest. As soon as we had enough money to meet our fundamental necessities, we were driven by a desire to create and grow. After the thirtieth algorithmic production, our releases were considered works of art.”

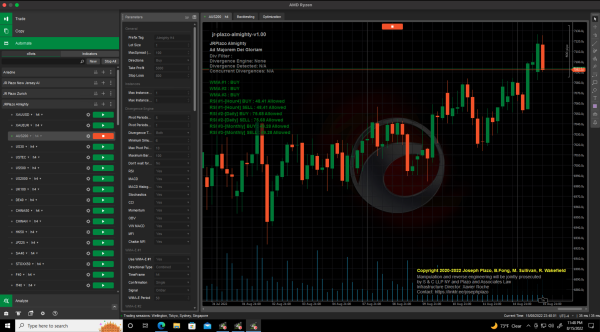

The Founders temporarily discontinued the development of new algorithms with the pinnacle of their trading styles on December 2021. The final program, dubbed the Almighty AI, examines up to eleven divergences, including the RSI, MFI, CCI, and MACD. A trade is executed when a technical divergence is detected that coincides with EMAs on several timeframes as well as ADX and Volume criteria. Alternately, Almighty enters trades based on harmonic patterns like the crab or Gartley. Despite the Ukraine War, Almighty has achieved a 200 Profit Factor to date.

Serving Retail Traders This 2022.

After satisfying intellectual pursuits and ensuring fundamental needs were met, the company’s founders established a non-stock, non-profit organization on the island of Mahe in the Seychelles. The entity, Plazo Sullivan Roche Capital, envisions to initiate research on machine learning for the financial markets. Beta distribution to the public is not expected to take place for another five years. The group endeavors to provide retail traders with free access to fully automated, machine learning powered trading systems. Removing the element of emotion from trading and delegating it to mathematically powered artificial intelligence brings winning results. Nonetheless, expect a public release of the ctrader and metatrader algorithms late in 2022.

Reach out to Plazo Sullivan Roche Capital at Mahe, Seychelles on LinkedIn and visit Mr. Plazo’s LinkTree for other concurrent projects.

Media Contact

Company Name: Plazo Sullival Roche Capital

Contact Person: Phoebe K.L. Randall

Email: Send Email

City: Mahe

Country: Seychelles

Website: www.linkedin.com/company/plazo-sullivan-roche-capital/