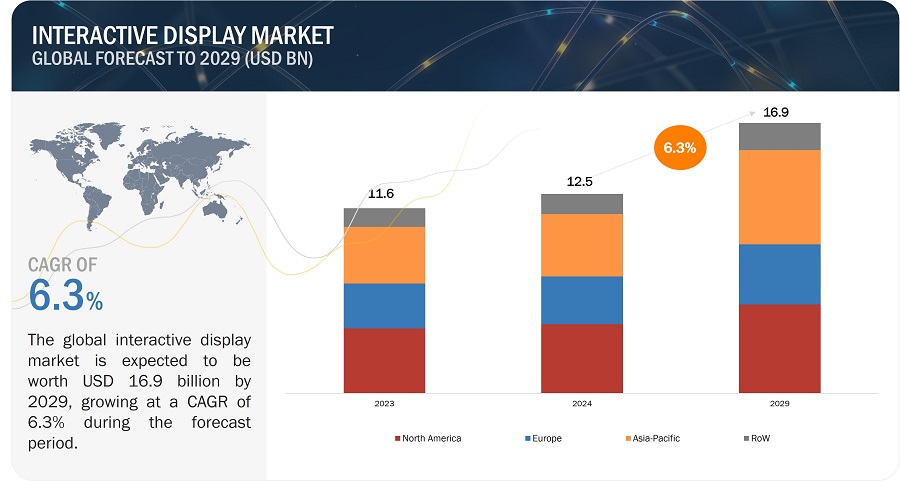

The report “Interactive Display Market Share by Product (Interactive Kiosk, Whiteboard, Table, Video Wall, Monitor), Technology (LCD, LED, OLED), Panel Size, Panel Type (Flat, Flexible, Transparent), Vertical (Retail, Corporate) and Geography – Global Forecast to 2029” The global interactive display market size was valued at USD 12.5 billion in 2024 and is projected to reach USD 16.9 billion by 2029, registering a CAGR of 6.3% during the forecast period.

Within the healthcare domain, interactive displays find application in medical imaging, patient education, and collaborative dialogues among healthcare professionals. These displays play a pivotal role in improving communication and encouraging a more interactive approach to healthcare services. Ongoing advancements in display technology, touch sensitivity, and interactive functionalities have significantly increased the versatility and practicality of these displays in the healthcare vertical.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=36223528

Browse 155 market data Tables and 63 Figures spread through 228 Pages and in-depth TOC on “Interactive Display Market by Product (Interactive Kiosk, Whiteboard, Table, Video Wall, Monitor), Technology (LCD, LED, OLED), Panel Size, Panel Type (Flat, Flexible, Transparent), Vertical (Retail, Corporate) and Geography – Global Forecast to 2029”

View detailed Table of Content here – https://www.marketsandmarkets.com/Market-Reports/interactive-display-market-36223528.html

By Product: Interactive Video Walls is projected to grow at the highest CAGR during the forecast period.

Interactive video walls have emerged as dynamic platforms that enable users to actively engage with content through touch, gestures, and other interactive features. Particularly in retail environments, these interactive video walls have proven to be potent marketing tools. Consumers can engage actively in product displays, interact with promotions, and connect with brand messages. This active involvement goes beyond influencing purchasing decisions; it plays a crucial role in creating an enriched and memorable shopping experience. The immersive and interactive qualities of video walls within retail settings serve to captivate customers, establishing a deeper and more meaningful connection between the brand and the consumer. This heightened engagement contributes to a positive and lasting impression, fostering brand loyalty and affinity.

By Panel Size: A panel size above 65 inches accounts for the highest CAGR during the forecast period.

The above 65 inches segment holds the highest CAGR during the forecast period. Various advantages, including improved visibility, impactful presentations, collaborative environments, enhanced engagement in education, interactive exhibits, effectiveness in trade shows and events, suitability for control rooms and monitoring, immersive experiences in gaming and entertainment, technological advancements, and versatility across industries drive the rising preference for above 65 inches panel size in interactive displays. These factors drive the increasing popularity of larger interactive displays, making them a preferred choice in a diverse array of professional and recreational settings.

By Vertical: The BFSI is projected to register the highest CAGR during the forecast period.

The increasing integration of interactive displays in the Banking, Financial Services, and Insurance (BFSI) sector is driven by the aspiration to enhance customer engagement, operational efficiency, and the overall banking experience. Specifically, interactive displays are found extensive use in self-service kiosks, empowering customers to carry out diverse transactions autonomously. These transactions include checking account balances, initiating fund transfers, making bill payments, and obtaining printed statements. Using interactive displays in self-service kiosks contributes to a more streamlined and convenient customer banking experience, aligning with the sector’s commitment to modernizing and digitizing financial services.

By Region: North America will hold a larger market share in 2023.

North America stands out as the fastest-expanding interactive display industry sector. The region’s tech-savvy culture and emphasis on innovation create an environment where businesses and institutions seek advanced technology solutions to remain competitive and deliver enhanced user experiences. This tech-driven culture and continuous technological advancements foster a landscape where interactive displays find versatile applications across various sectors. As the demand for more engaging and interactive experiences continues to grow, interactive displays play a pivotal role in meeting these expectations and shaping the way businesses and institutions interact with their audiences.

The major players in the interactive display companies include SAMSUNG (South Korea), LG DISPLAY CO., LTD. (South Korea), BOE Technology Group Co., Ltd. (China), Panasonic Corporation (Japan), LEYARD (China), SHARP CORPORATION (Japan), Elo Touch Solutions, Inc. (US), Crystal Display Systems Ltd (UK), ViewSonic Corporation (US), AUO Corporation (Taiwan).

Media Contact

Company Name: MarketsandMarkets™ Research Private Ltd.

Contact Person: Mr. Aashish Mehra

Email: Send Email

Phone: 18886006441

Address:630 Dundee Road Suite 430

City: Northbrook

State: IL 60062

Country: United States

Website: https://www.marketsandmarkets.com/Market-Reports/interactive-display-market-36223528.html