Big Data is referred to as the huge amount of abundant data that is getting generated due to the digitalization of the economy. Whereas, artificial intelligence in the field of making computers make decisions without explicitly programmed, usually with the help of machine learning techniques. Big Data and AI actually complement each other because machine learning models require data, in some cases a huge amount of data to create accurate modes.

In this post, we will see how the finance and banking industry is leveraging both Big Data and AI to their advantage.

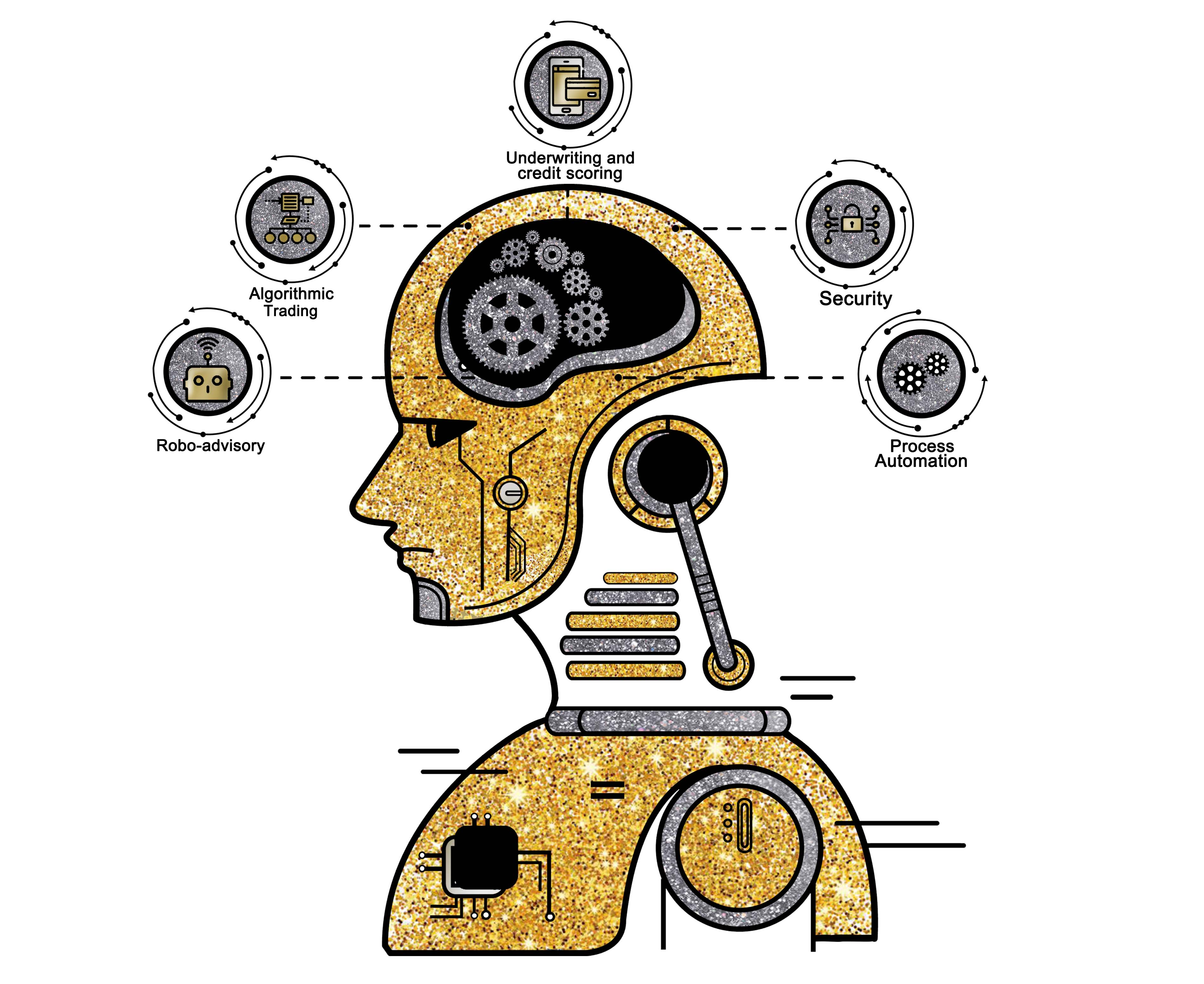

Impact of AI and Big Data

Decision Makings

Banks and financial institutes are leveraging Big Data and AI for doing advanced analytics on their customer and operations data. Such analytics helps banks to make important business and operational decisions. For example, German company Kreditech uses such machine learning and big data enabled system for evaluating customers’ credit and loan performance, thus adjusting their creditworthiness. It is not only the decision making, but finance companies are also using Big Data and AI for revenue forecasts and project their growths to the stakeholders.

Risk Management

According to Deltec Bank, Bahamas – “Artificial intelligence and big data can be combined to create powerful predictive machine learning models that can be used for predicting risks associated with loan default, market crash, customer churn, fraudulent transactions, money laundering to name the few.” Such predictions help banks to respond appropriately in a timely manner to avoid financial loss. For example, United Overseas Bank of Singapore is leveraging these technologies to enhance cross border AML measures.

Customer Segmentation

Banks have a great amount of customer transactional data that can be leveraged to understand customer’s buying habits using advanced analytics and machine learning. Companies like Endor are using big data analytics to find out more about their customers and their buying habits. This analysis is helping the companies to know which customers are most likely to purchase their product and can be targeted accordingly. Therefore, Big Data has made the marketing and sales strategy much focused and result-oriented.

24×7 Customer Service Chat Bots

Traditionally, banks employ customer support service where an executive guide the customer for their queries or concerns. But now chatbots are gradually replacing the human-based customer support. AI-based chatbots have become more sophisticated and banks are deploying them on their websites to deal with most of the recurrent general queries of customers, 24×7. This helps support executive to be available more for the customers who have more severe concerns. Bank of America has already introduced a virtual assistant, known as Erica, this chatbot helps the bank’s customer with queries related to transactions. Though chatbots are yet to evolve more to completely replace human customer support completely, this future is not very far.

Conclusion

AI and Big Data is surely the way in which all industries are moving forward with and finance sector too is looking to leverage these technologies for maximum benefits. A lot of finance companies have already realized the potential and are investing heavily in AI and Big Data to reap the benefits in the future.

Disclaimer: The author of this text, Robin Trehan, has an Undergraduate degree in economics, Masters in international business and finance and MBA in electronic business. Trehan is Senior VP at Deltec International www.deltecbank.com. The views, thoughts, and opinions expressed in this text are solely the views of the author, and not necessarily reflecting the views of Deltec International Group, its subsidiaries and/or employees.

About Deltec Bank

Headquartered in The Bahamas, Deltec is an independent financial services group that delivers bespoke solutions to meet clients’ unique needs. The Deltec group of companies includes Deltec Bank & Trust Limited, Deltec Fund Services Limited, and Deltec Investment Advisers Limited, Deltec Securities Ltd. and Long Cay Captive Management.

Media Contact

Company Name: Deltec International Group

Contact Person: Media Manager

Email: Send Email

Phone: 242 302 4100

Country: Bahamas

Website: https://www.deltecbank.com/