Miami, Florida, 10 Sep 2025 Accounts Payable (AP) automation is playing a critical role for U.S. businesses by simplifying invoice processing, approvals, and payments, while lowering operational errors and costs. Centralized invoice intake and real-time financial visibility allow organizations to manage increasing volumes of vendor invoices efficiently, maintain compliance, and achieve better insights into spending. Across sectors, ap automation services have become indispensable for improving operational efficiency, controlling finances, and ensuring smooth business operations. Leading providers continue to deliver these solutions, helping businesses optimize their accounts payable processes and overall financial management.

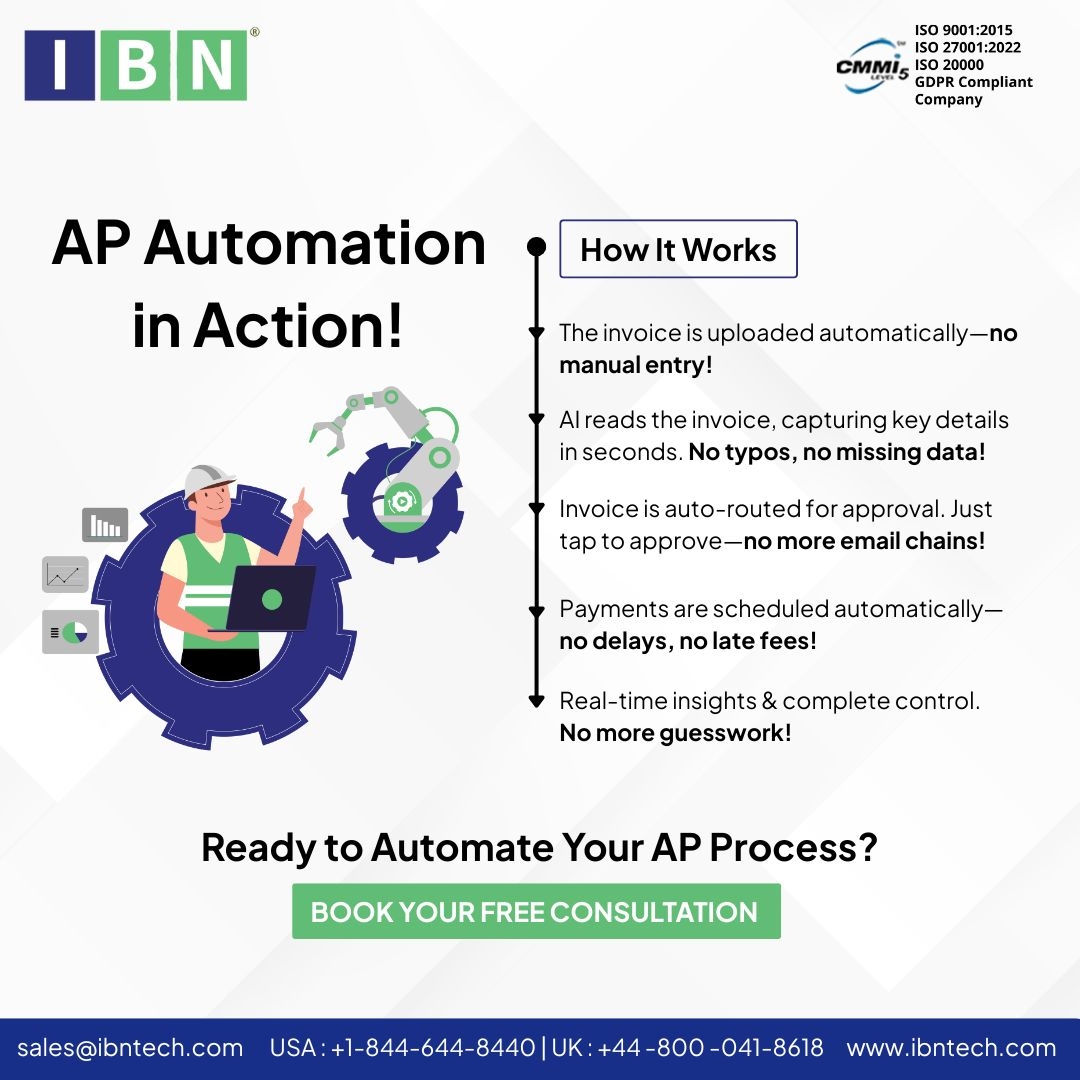

Moreover, AP automation supports smarter decision-making by offering in-depth analytics on payment behaviors, outstanding obligations, and cash flow trends. Automated workflows accelerate invoice approvals by routing them to the correct personnel, reducing bottlenecks and delays. Providers like IBN Technologies deliver ap automation services that integrate with existing financial platforms, ensuring consistent and accurate accounting. With automated reminders and alerts, businesses can avoid late fees, strengthen vendor relationships, and allow finance teams to focus on strategic planning instead of manual processing.

Learn ways to improve invoice processing and reduce errors today.

Get a free consultation: https://www.ibntech.com/free-consultation-for-ipa/

Key Financial Functions Supported by AP Automation

Accounts Payable automation plays a critical role in helping businesses manage intricate financial tasks, including project accounting and cash flow management. These platforms provide clear operational insights, optimize revenue tracking, and simplify assessment of departmental or project-level profitability. By automating routine processes and centralizing financial information, organizations can make faster and more accurate financial decisions. Workflow automation solutions offered by leading ap automation companies further enhance operational performance.

Functionality includes:

• Managing project-based and complex financial transactions

• Overseeing cash flow for large-scale initiatives and obligations

• Tracking profitability across multiple departments or projects

• Maintaining accurate records of income and expenses

By increasing accuracy and consolidating data, ap automation services enable companies to respond to financial challenges efficiently, improving overall operational and strategic performance.

Smart AP Solutions for Real Estate Firms

U.S. real estate professionals recognize the need for accurate and timely financial management to navigate the sector’s complexities. To address inefficiencies, delayed approvals, and disjointed processes, many firms collaborate with specialized ap automation services providers for full-cycle support. These solutions provide structured workflows, faster approvals, and enhanced visibility into financial operations.

Core functionalities include:

✅ Processing invoices in alignment with contracts and payment terms

✅ Centralized AP oversight for multiple properties and developments

✅ Three-way matching for invoices related to construction, maintenance, and property management

✅ Real-time tracking of liabilities and vendor balances

✅ Ensuring timely payments to preserve vendor relationships

✅ Unified financial data for audits, reconciliations, and compliance

✅ Scalable support for project and seasonal management expenses

✅ Compliance with U.S. tax laws and vendor agreements

✅ Continuous reporting to improve budgeting and profitability analysis

✅ Expert support from experienced AP automation providers

Real estate organizations leveraging these ap automation solutions experience streamlined processes, minimized financial risk, and scalable systems designed to support sustainable growth.

Enhanced AP Automation Features for Businesses and Real Estate

Accounts payable automation process solutions provide tools to simplify tasks, increase accuracy, and give clear financial visibility. Using advanced analytics and automation, companies can efficiently handle payments, monitor cash positions, and maintain compliance standards.

✅ Invoice automation via email, EDI, and portal submissions

✅ Flexible payment methods including ACH, UPI, cards, and digital wallets

✅ Follow-up automation reducing DSO by up to 30%

✅ Dispute resolution with collaborative workflows

✅ Cash application with accuracy exceeding 95%

✅ Real-time forecasting and cash flow analytics

✅ Integration with ERP and CRM systems like Salesforce, SAP, Oracle, Dynamics

✅ Audit-ready compliance with GAAP, tax, and revenue regulations

✅ Streamlined AP automation for large property developments

These features support businesses in achieving operational efficiency, reducing errors, and enhancing financial control with the help of ap automation solutions.

AP Automation Drives Real Estate Financial Performance

In the fast-paced Georgia real estate market, streamlining accounts payable is key to operational success. Companies adopting accounts payable invoice automation have reported:

• A reduction of AP approval cycles by 86%

• Elimination of 95% of manual data entry, enhancing accuracy and efficiency

These benefits translate into cost savings, improved compliance, and enhanced transparency, highlighting ap automation services as a critical tool for real estate businesses across Georgia.

Access the real estate case study to discover faster AP workflows.

Get the Case Study: Improve Real Estate and Construction Engineering Success

AP Automation: Enhancing Growth and Financial Agility

As the U.S. real estate and general business environment shifts, business process automation services are becoming increasingly strategic. Organizations adopting advanced ap automation workflow solutions can expect accelerated financial cycles, improved operational control, and stronger alignment between cash management and corporate growth strategies. Forward-thinking companies view automation to streamline existing workflows while establishing scalable systems capable of managing complex projects and future growth.

Experts emphasize that firms utilizing ap automation services are more agile in responding to market volatility, regulatory changes, and industry demands. Such solutions provide improved financial insight, better resource allocation, and enhanced operational resilience. AP automation is evolving beyond a cost-reduction tool to a strategic driver that empowers businesses to implement scalable financial systems and sustain a competitive advantage.

Related Services:

-

Intelligent Process Automation: https://www.ibntech.com/intelligent-process-automation/

-

Sales order processing: https://www.ibntech.com/sales-order-processing/

About IBN Technologies

IBN Technologies LLC, an outsourcing specialist with 26 years of experience, serves clients across the United States, United Kingdom, Middle East, and India. Renowned for its expertise in RPA, Intelligent process automation includes AP Automation services like P2P, Q2C, and Record-to-Report. IBN Technologies provides solutions compliant with ISO 9001:2015, 27001:2022. The company has established itself as a leading provider of IT, KPO, and BPO outsourcing services in finance and accounting, including CPAs, hedge funds, alternative investments, banking, travel, human resources, and retail industries. It offers customized solutions that drive AR efficiency and growth.

Media Contact

Company Name: IBN Technologies LLC

Contact Person: Pradip

Email: Send Email

Phone: +1 844-644-8440

Address:66, West Flagler Street Suite 900 Miami, FL, USA 33130 FL, USA 33130

City: Miami

State: Florida

Country: United States

Website: https://www.ibntech.com/