U.S. Steel Merchant And Rebar Market Growth & Trends

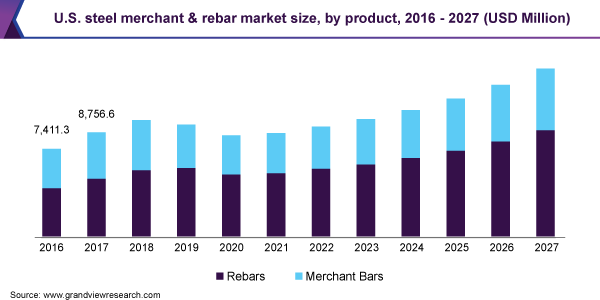

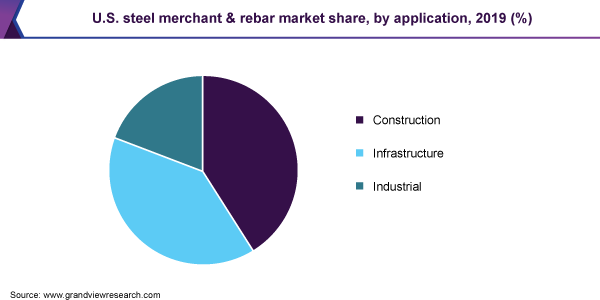

The U.S. steel merchant and rebar market size is anticipated to reach USD 14.1 billion by 2027, expanding at a CAGR of 5.2%, according to a new report by Grand View Research, Inc. The construction segment dominated the market with the highest revenue share in 2019. Construction is one of the largest end-use industries of steel products. As per the World Steel Association, it accounts for more than 50% of the global demand for steel.

Various infrastructure and construction sites require massive amounts of steel to enhance the strength of structures. Steel is affordable, easily available, and has various properties including versatility, durability, high strength, and 100% recyclability. Steel rebars have a wide range of applications in infrastructure development and residential and commercial construction sectors in high-rise structures, highways, braces, brackets, and ornamental work.

Due to the recent COVID-19 outbreak, numerous businesses and governments were operating at limited capacity in the first half of 2020. However, the construction sector has shown positive signs of recovery in the second half of 2020. For instance, as per the U.S. Census Bureau, completions of privately-owned housing projects increased by 3.6% in July 2020 from the previous month. Similarly, completions of single-family housing projects witnessed a rise of 1.8% during the same period.

Rising demand for Fiber-Reinforced Polymer (FRP) rebars is likely to restrain the market growth over the coming years. Corrosion of steel rebars affects the life expectancy of reinforced concrete structures. In some cases, repair costs can be double of the original construction costs. Corrosion leads to faster degradation of reinforced structures, which increases the costs associated with it. To reduce the infrastructure gap, the U.S. government is introducing various investment plans.

For instance, in the 2019 budget, USD 100 billion were provided as incentives to prioritize infrastructure maintenance, generation of revenue streams, and modernization of procurement practices. Also, USD 50 billion funds were allocated for the development of the rural infrastructure of the country, and additional funds were dedicated to various infrastructure needs of the country. Thus, long-term investment in infrastructure development is projected to boost the demand for steel merchant & rebars over the coming years.

Request a free sample copy or view report summary:

www.grandviewresearch.com/industry-analysis/us-steel-merchant-rebar-market/request/rs1

U.S. Steel Merchant And Rebar Market Report Highlights

-

In terms of volume, the infrastructure segment is projected to register the fastest CAGR of 4.7% from 2020 to 2027

-

Key driving factors for the segment are increasing investments by the U.S. Federal government in the infrastructure segment

-

The industrial segment accounted for a considerable revenue share in 2019. Demand for commercial spaces in high-rise buildings is projected to push the product demand in this segment

-

Rebars was the largest product segment and accounted for a volume share of 60.4% in 2019

-

A moderate boost to the residential construction after the first half of 2020 is likely to push the demand for rebars over the short term

-

In the merchant bar product segment, angles & channels were the fastest-growing subsegments and are anticipated to expand further on account of rising spending in public and private infrastructure development

-

Sluggishness in the economic activities in 2019 and the outbreak of COVID-19 in 2020 have created an impact on the U.S. steel merchant & rebar demand in the recent past. In terms of volume, the market has declined by 2.1% from 2018 to 2019.

Inquire before purchase: www.grandviewresearch.com/inquiry/450913/ibb

U.S. Steel Merchant And Rebar Market Segmentation

Grand View Research has segmented the U.S. steel merchant and rebar market on the basis of product and application:

U.S. Steel Merchant & Rebar Product Outlook (Volume, Kilotons; Revenue, USD Million, 2016 – 2027)

-

Rebars

-

Merchant Bars

-

Angles

-

Channels

-

Rounds

-

Flats

-

Beams

-

U.S. Steel Merchant & Rebar Application Outlook (Volume, Kilotons; Revenue, USD Million, 2016 – 2027)

-

Construction

-

Infrastructure

-

Industrial

List of Key Players of U.S. Steel Merchant And Rebar Market

-

Gerdau S.A.

-

Nucor

-

CMC Steel

-

Steel Dynamics, Inc.

-

Schnitzer Steel Industries, Inc.

-

Nippon Steel Corp.

-

JFE Steel Corp.

Media Contact

Company Name: Grand View Research, Inc.

Contact Person: Sherry James, Corporate Sales Specialist – U.S.A.

Email: Send Email

Phone: 1-415-349-0058, Toll Free: 1-888-202-9519

Address:201, Spear Street, 1100

City: San Francisco

State: California

Country: United States

Website: https://www.grandviewresearch.com/industry-analysis/us-steel-merchant-rebar-market