Roots Analysis has announced the addition of “Continuous Manufacturing Market (Small Molecules and Biologics), 2020-2030” report to its list of offerings.

The COVID-19 pandemic has severely impaired the overall pharmaceutical supply chain, mostly owing to the absence of workers at manufacturing sites and restrictions imposed on distribution networks. In this context, continuous manufacturing offers a viable solution given the fact that continuous processes are largely automated. In fact, the FDA (and other regulatory bodies) have also expressed interest in advocating a shift to the use of advanced manufacturing technologies, such as continuous manufacturing.

To order this 310+ page report, which features 110+ figures and 200+ tables, please visit the website

Key Market Insights

Around 65 companies claim to have expertise in continuous manufacturing of small molecule / biologic drugs

The continuous manufacturing market landscape is dominated by well-established players (founded before 1990), which represent more than 50% of the total number of stakeholders. Amongst these, close to 55% players are headquartered in Europe, followed by those based in North America (36%).

Close to 45 partnerships were inked between 2013 and 2019

More than 55% of such agreements were focused on technology improvements and research. Further, 58% of the recent partnerships were established for drug product manufacturing, while the remaining were focused on the production of API / intermediate.

Nearly 55 expansion initiatives were undertaken in the period 2013-2020 (till January)

Most such projects (55%) were reported to be focused on establishment of a new facility / plant, followed by those carried out for incorporating continuous manufacturing technologies (28%) into the existing facilities of different companies. It is worth mentioning that more than 45% of the total number of expansions captured in the report, were observed to have been carried out in Europe.

Around 165 grants were awarded to support ongoing R&D activities in continuous manufacturing, between 2014 and 2019

Collectively, the capital amount awarded to support R&D in this field was estimated to be worth USD 69.7 million. It is worth noting that 35 grants were awarded in 2019 alone. A significant proportion of grants identified in the report (22%) were awarded to the Illinois Institute of Technology, followed by those awarded to Purdue University (12%).

Several patents have been filed / granted related to continuous manufacturing

It is worth noting that majority of patents (187) were filed / granted in 2019; of these, close to 75% represented the intellectual capital of industry players. Further, around 50% of the total number of patents were filed / granted in North America, followed by Europe (35%).

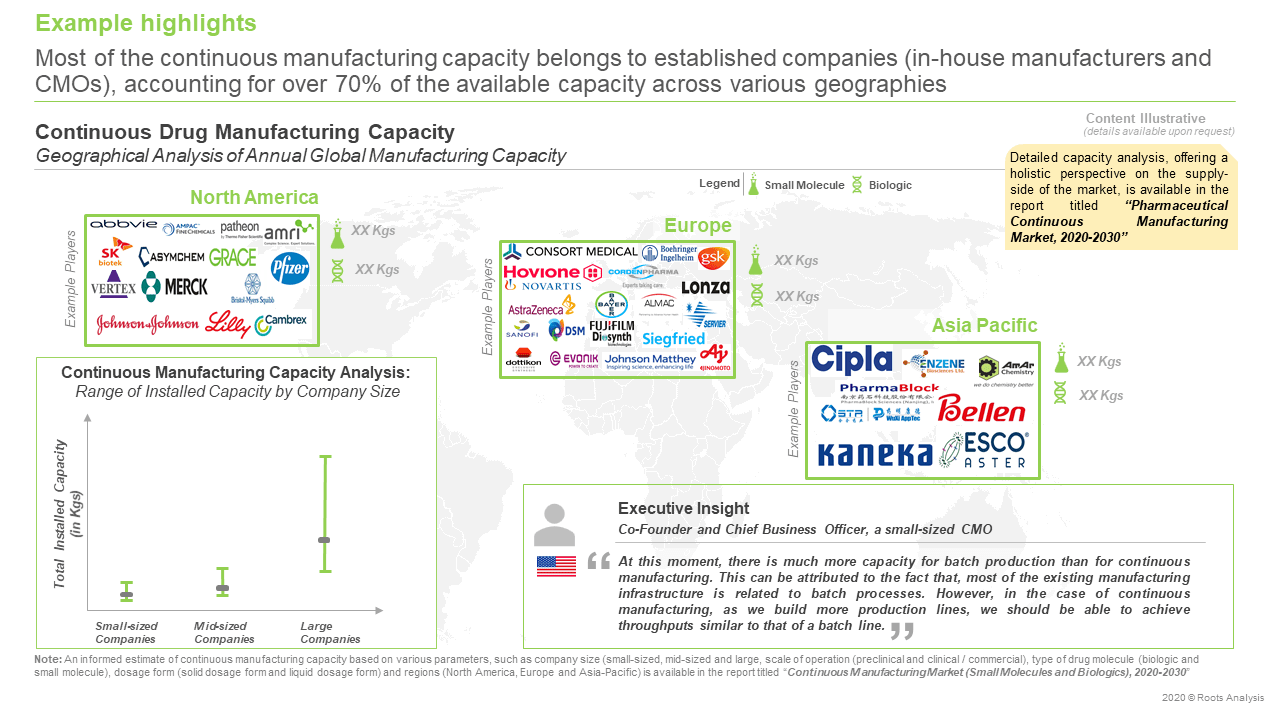

Over 70% of the installed continuous manufacturing capacity belongs to established players

More than 95% of the annual continuous manufacturing capacity was observed to be dedicated to the production of small molecules. In addition, nearly 70% of the overall capacity is installed in Europe, followed by North America (28%).

In 2030, revenues from sales of small molecule drugs produced via the continuous approach are likely to contribute to over 80% of total market value

Presently, the use of continuous manufacturing is largely restricted to the developed nations, and the majority of sales-based revenues from drugs manufactured via this approach are distributed between North America (53%) and Europe (38%). Once this process is adopted for biologics, estimates in the report suggest that this segment of the continuous manufacturing market is likely to grow at an annualized rate of 23%.

To request a sample copy / brochure of this report, please visit the website

Key Questions Answered

- Who are the key players engaged in continuous manufacturing of small molecules and biologics?

- What is the installed, global capacity for continuous manufacturing?

- What are the key growth drivers within this domain?

- What are the various paths to evolution within this industry?

- Who are the other key stakeholders (modular facility providers and technology / equipment developers) in this domain?

- How is the current and future market opportunity likely to be distributed across key market segments?

The USD 1.9 billion (by 2030) financial opportunity within the continuous manufacturing market has been analyzed across the following segments:

- Purpose of Manufacturing

- In-House

- Contract service

- Scale of Operation

- Commercial

- Preclinical / Clinical

- Type of Continuous Manufacturing related Service

- API Manufacturing

- End Product manufacturing

- Type of Drug Molecule

- Biologic

- Small Molecule

- Type of dosage form

- Solid

- Liquid

- Key Geographical Regions

- North America

- Europe

- Asia Pacific

The report features inputs from eminent industry stakeholders, according to whom, the number of products manufactured via continuous processes, moving into the market, is likely to increase in the next 5-10 years. The report includes detailed transcripts of discussions held with the following experts:

- Andrea Adamo (Founder and Chief Executive Officer, Zaiput Flow technologies)

- Bayan Takizawa (Co-Founder and Chief Business Officer, CONTINUUS Pharmaceuticals)

- Nick Thomson (Senior Director Chemical Research and Development, Pfizer)

- Himanshu Gadgil (Director and Chief Scientific Officer, Enzene Biosciences)

- Eric Fang (Chief Scientific Officer, Snapdragon Chemistry)

- Ian Houson (Technical Project Manager, Continuous Manufacturing and Crystallization, University of Strathclyde)

The research covers tabulated profiles of key players (listed below); each profile features an overview of the company, information related to its service portfolio, continuous manufacturing capabilities and facilities, and recent developments, and an informed future outlook.

- AbbVie Contract Manufacturing

- Ajinomoto Bio-Pharma Services

- Almac

- Boehringer Ingelheim BioXcellence

- Cambrex

- CordonPharma

- Hovione

- Kaneka

- Lonza

- Patheon

- SK biotek

- WuXi AppTec

For additional details, please visit

https://www.rootsanalysis.com/reports/view_document/continuous-manufacturing/308.html or email sales@rootsanalysis.com

You may also be interested in the following titles:

- Biopharma Contract Manufacturing Market (3rd Edition), 2019 – 2030

- Pharmaceutical Contract Manufacturing Market (2nd Edition), 2018-2028

- Oligonucleotide Synthesis, Modification and Purification Services Market: Focus on Research, Diagnostic and Therapeutic Applications, 2020-2030

Media Contact

Company Name: Roots Analysis

Contact Person: Gaurav Chaudhary

Email: Send Email

Phone: +1 (415) 800 3415, +44 (122) 391 1091

City: London

Country: United Kingdom

Website: https://www.rootsanalysis.com