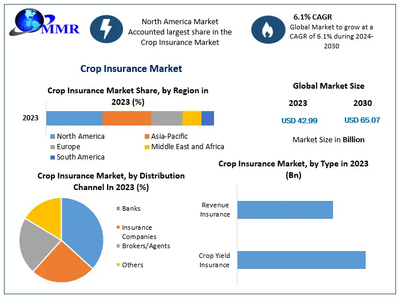

Maximize Market Research, a leading Healthcare business consultancy and research firm has published a report on the “Crop Insurance Market ”. The total market opportunity for Crop Insurance Market was USD 42.99 Bn in 2023 and is expected to grow at a CAGR of 6.1 percent through the forecast period, reaching USD 65.07 Bn by 2030. As per the report, the global Crop Insurance Market is expected to be dominated by the North American regions at a significant growth rate through the forecast period.

Global Crop Insurance Market Report Scope and Research Methodology

Market Size in 2023: USD 42.99 Billion

Market Size in 2030: USD 65.07 Billion

CAGR: 6.1 Percent

Forecast Period: 2024-2030

Base Year: 2023

Number of Pages: 215

No. of Tables: 137

No. of Charts and Figures: 190

Segment Covered: By Coverage Type, Distribution Channel, and Type

Regional Scope: North America, Europe, Asia Pacific, Middle East and Africa, South America

Report Coverage: Market Share, Size and Forecast by Revenue | 2023−2030, Market Dynamics, Growth Drivers, Restraints, Investment Opportunities, and Key Trends, Competitive Landscape, Key Players Benchmarking, Competitive Analysis, MMR Competition Matrix, Competitive Leadership Mapping, Global Key Players’ Market Ranking Analysis.

Get a free sample copy to fully comprehend the format of the report, which includes the table of contents and summary:https://www.maximizemarketresearch.com/request-sample/148613

Global Crop Insurance Market Scope and Research Methodology

The study offers a thorough overview of the crop insurance market, including a competitive analysis that focuses on the financial results, product portfolios, company profiles, and strategic initiatives of the industry’s top competitors. Important insights are also covered, including the main drivers of market growth, participation obstacles, and prospects for international expansion. Furthermore, the study provides a comprehensive evaluation of industry participants’ investments intended to increase their global footprint, which makes it a vital tool for investors looking for insightful market data.

The Crop Insurance Market study looks at the Coverage Type, Distribution Channel, and Type. Primary research was used to validate secondary research findings, and both primary and secondary research methodologies were used in the data gathering process. A bottom-up technique was used to estimate the size of the crop insurance market.

Crop Insurance Market Overview

The global crop insurance market is experiencing significant growth because of rising demand from farmers and producers seeking protection against unforeseen setbacks. The growth of agricultural risks is crucial for market growth, as agriculture is vital to every economy. Commercialization of agriculture is also driving demand for insurance coverage. The emergence of harmful insects and viruses affecting crops is also boosting the market. Government initiatives are raising farmer awareness about crop insurance and enhancing agricultural financial stability, fostering market expansion.

Crop Insurance Market Dynamics

The global crop insurance market is experiencing a significant shift because of the increasing value of crop protection. This involves using pesticides and other agricultural inputs to protect crops from pests and diseases. Effective crop protection measures reduce the risk of yield losses, making crop insurance more appealing as a risk management tool. Improved crop protection practices often lead to enhanced crop productivity, making crop insurance more feasible for farmers. The increased value of crops also positively impacts farmers’ financial conditions, making crop insurance premiums more affordable and enabling a larger number of farmers to invest in insurance coverage.

Crop Insurance Market Regional Insights

The North American Crop Insurance Market is dominated in 2023, is expected to grow rapidly because of strategic initiatives by major manufacturers targeting specific patient subsets. The region’s established healthcare facilities, access to advanced technology, increased demand for diagnostic procedures, and disease management are expected to drive growth. However, healthcare reforms could reduce operations by imposing acceptable use standards to prevent unnecessary treatments.

Instant access is available by downloading your exclusive sample copy of the report right now.

Crop Insurance Market Segmentation

by Coverage Type

- Multi-peril Crop Insurance (MPCI)

- Crop-hail Insurance

Based on Coverage Type, The report analyzes the multi-peril crop insurance market, focusing on coverage against various risks such as adverse weather, pests, and diseases. Multi-peril crop insurance is the most popular because of its comprehensive coverage, promoting financial stability and sustainable farming practices. It simplifies the claims process by covering a range of risks under a single policy, reducing administrative complexities for insurers and farmers. Government agencies also support and subsidize multi-peril crop insurance programs. Overall, this comprehensive risk management solution is highly sought after by farmers.

by Distribution Channel

- Banks

- Insurance Companies

- Brokers/Agents

- Others

by Type

- Crop Yield Insurance

- Revenue Insurance

Crop Insurance Market Key Competitors include:

North America

- American Finlands Group Inc

- American International Group Inc

- AmTrust Financial Services Inc

- VANE (Insurance)

- Duck Creek Technologies

Europe

- axa insurance

- Chubb Ltd

- groupama assurances mutuelles

- Zurich Insurance Co. Ltd

- The Co-operators

APAC

- Agriculture Insurance Co. of India Ltd.

- ICICI Bank Ltd.

- Indian Farmers Fertiliser Cooperative Ltd. (IFFCO)

- QBE Insurance Group Ltd

- Sompo Holdings In

- The New India Assurance Co. Ltd.

- Tokio Marine Holdings Inc.

- Zking Insurance

- SBI

- QBE Insurance Group

MEA

- Santam Ltd.

- Royal Exchange General Insurance

- Farmcrowdy

- inc

Key questions answered in the Crop Insurance Market are:

- What are the opportunities for the Crop Insurance Market ?

- What are the strategies used by competitors in the Crop Insurance Market ?

- What are Global Crop Insurance Market Devices?

- What is the current growth rate of the Crop Insurance Market ?

- Who are the key players in the Crop Insurance Market ?

- What are the growth prospects in developing countries for the Crop Insurance Market ?

- Which segment is expected to witness the fastest growth and why in the Crop Insurance Market ?

- What are the factors affecting growth in the Crop Insurance Market ?

- Who held the largest market share in the Crop Insurance Market ?

Key Offerings:

- Past Market Size and Competitive Landscape (2018 to 2023)

- Past Pricing and price curve by region (2018 to 2023)

- Market Size, Share, Size & Forecast by Different Segments | 2023−2030

- Market Dynamics – Growth Drivers, Restraints, Opportunities, and Key Trends by Region

- Market Segmentation – A detailed analysis by Coverage Type, Distribution Channel, Type, and Region

- Competitive Landscape – Profiles of selected key players by region in a strategic perspective

- Competitive landscape – Market Leaders, Market Followers, Regional player

- Competitive benchmarking of key players by region

- PESTLE Analysis

- PORTER’s analysis

- Value chain and supply chain analysis

- Legal Aspects of business by region

- Lucrative business opportunities with SWOT analysis

- Recommendations

Maximize Market Research is leading Consumer Goods & Services research firm, has also published the following reports:

Kids Furniture Market– The market size is expected to reach USD 82.71 Bn by 2030 at a CAGR of 9.2 percent during the forecast period. Rise in disposable income, increasing urbanization, and changing consumer preferences are the primary drivers of the kid’s furniture market.

Direct To Consumer Technology Market– The market size is expected to reach USD 432.24 Bn by 2030 at a CAGR of 16.3 percent during the forecast period. This market plays a transformative role in reshaping business-consumer dynamics, enhancing brand loyalty, and enabling businesses to adapt to evolving consumer demands.

About Maximize Market Research:

Maximize Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include medical devices, pharmaceutical manufacturers, science and engineering, electronic components, industrial equipment, technology and communication, cars and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

Media Contact

Company Name: MAXIMIZE MARKET RESEARCH PVT. LTD.

Contact Person: L Godage

Email: Send Email

Phone: +91 9607365656

Address:3rd Floor, Navale IT Park, Phase 2, Pune Banglore Highway, Narhe,

City: Pune

State: Maharashtra

Country: India

Website: https://www.maximizemarketresearch.com/market-report/crop-insurance-market/148613/