Pushing open the door to Slkor’s new headquarters, what first catches the eye isn’t chips, but the spatial layout imbued with Song Dynasty aesthetics.

Large floor-to-ceiling windows, minimalist yet refined materials, and meticulously “finished” lines exude an air of “elegance” and “tranquility,” making one momentarily forget this is the headquarters of a semiconductor company in Shenzhen, resembling more the sales office of a real estate firm. With the famous Song Dynasty painting “A Thousand Li of Rivers and Mountains” as the theme, and architectural elements like flying eaves, bracket sets, begonia patterns, and lozenge lattices adorning the space, Slkor founder Song Shiqiang sat on one side of a long table and said to the author with a hint of pride, “We spent a considerable amount of money and effort on the decoration and layout of this office.”

In the eyes of many, this might seem like just a boss who loves “tinkering with decoration.” But in Song Shiqiang’s narrative, the office is an externalization of corporate temperament:

The lines, light, and materials of the space all remind the team to “strive for perfection”; the demanding attention to detail follows the same logic as the requirements for parameters, yield rates, and packaging quality when making chips and connectors. It’s also about providing a good working environment and enabling everyone to focus on making products well and serving customers excellently.

And the term “culture” is frequently on Slkor’s lips—not merely referring to “hanging a few paintings,” but to the team’s cultural cultivation, aesthetic sense, judgment, and long-termism.

He even half-jokingly said, “Many bosses in our integrated circuit industry are very wealthy, but not necessarily cultured. Without culture, you can’t create a good company, good products.”

This statement carries a mix of jest and sincerity: money isn’t the only metric; how money is made, how it is spent, and the manner and pace used to build a company’s “temperament” are equally important.

This seemingly jesting remark is actually a microcosm of his two major career crossovers:

To develop his semiconductor enterprise, he repeatedly poured the money earned from over a decade in the real estate industry into “houses on silicon wafers”: selling properties in Shenzhen for tape-outs and cash flow, gritting his teeth through the long-term investments in silicon carbide and power devices. First, he transformed from an architect “building houses” into a real estate professional manager overseeing tens of billions in assets; then, he pivoted from real estate to semiconductors, entering highly specialized and fiercely competitive segments like ESD, TVS diodes, power management ICs, connectors, and antennas.

Today, the brands he leads, Slkor and Kinghelm, have become familiar names in the industry—the former delving deep into power devices and third-generation semiconductors, the latter focusing on Beidou/GPS antennas, RF connectors, and related products. The “SLKOR” brand alone serves approximately fifteen thousand users at home and abroad; both companies are National High-Tech Enterprises, having successively obtained numerous patents and qualifications.

Beyond various external titles—Member of the Electronic Information Expert Database of the China Association for Science and Technology, Science Popularization Lecturer for the Chinese Institute of Electronics, Huaqiangbei Business Research Expert, Tech Media Columnist—what impresses peers more are his few “hard-hitting quotes”:

“Before, I was building houses on land; now, I’m building houses on silicon wafers.”

“Real estate builds houses on land; semiconductors build houses on silicon wafers.”

“Semiconductors are the basic means of production in the information age; integrated circuits will be the convergence point of resources in the future information society.”

After Understanding the Industry Cycle, He Sold His House to Make Chips

Unlike the “trained engineer” background of many semiconductor founders, the first half of Song Shiqiang’s life had almost nothing to do with chips.

He came from an architecture background, starting as a grassroots technician and spending many years in design institutes and construction sites: drawing blueprints, supervising engineering quality, calculating costs, running to sites, turning buildings from drawings into physical structures. Later, he joined a large Hong Kong-funded real estate group. As the company expanded, he rose from engineering management to senior leadership, leading a team of nearly a hundred design engineers, participating in project design, bidding, material selection, and full-process management. At its peak, the company’s market value in Hong Kong approached two hundred billion HKD, with over ten thousand employees at one point.

This experience gave him a strong intuition for “heavy-asset, long-cycle industries”—including the risks at cycle peaks and the value of long-termism.

He witnessed the golden age of the real estate industry. But as a firsthand participant, he also experienced the industry’s “weight of cycles”: land dividends, leverage, regulations, price wars, wave after wave. So when the industry entered a period of high volatility, he began seriously pondering a question—which track should his next career phase be in?

When choosing a direction for his second entrepreneurship, Song Shiqiang spent a long time doing his homework.

He strongly agrees with Warren Buffett’s concept of a “long slope, thick snow”: “long slope” means the industry has vast space and a long cycle, not ending with a passing trend; “thick snow” means the industry has sufficient profit margins, not yet at the stage of bloody price wars.

He consulted a vast amount of domestic and international materials, created complex mind maps and data models, and focused on several core facts:

Around 2015, China’s chip import value had already surpassed that of oil, indicating massive semiconductor consumption; there remained a significant gap between China and developed countries in key segments of the semiconductor supply chain, implying development space and policy dividends; among various IC segments, power devices had moderate technical barriers, a huge market volume, and a relatively good foundation for localization, with equipment requirements satisfied by lithography machines of 40nm and above—”technically feasible, with industrial space.”

“My conclusion at the time was that the technological gap between Chinese and international power device products wasn’t huge, the equipment requirements for fabs and packaging/testing plants weren’t too high, lithography machines below 40nm were fully sufficient, and the market capacity in the China region was nearly a trillion yuan. The localization degree of power devices was already relatively high, and the introduction and conversion of foreign advanced technology were also relatively convenient, meeting my requirements for Slkor’s technology path: ‘independent and controllable.'”

Based on this analysis, he made the decision later frequently mentioned: “I gritted my teeth and stomped my foot, deciding to sell my house to invest in semiconductor power devices.”

The Birth of “Kinghelm + Slkor”: From Trader to Chip Manufacturer

Around 2012-2014, Song Shiqiang began frequently appearing in Huaqiangbei, engaging with component traders, shanzhai phone brands, design houses, and entrepreneurs. At that time, Huaqiangbei was slowly bidding farewell to the feature phone era; Xiaomi and Redmi were making inroads online, impacting the traditional “front shop, back factory” business model of Huaqiangbei with a new generation of internet phones.

Before truly entering the field, Song Shiqiang first attended a “social university” class in Huaqiangbei.

In his words, he started with the most downstream parts sourcing business—”customers gave us a complete BOM list with dozens to hundreds of part numbers, and we helped them procure all the materials. That was ‘parts sourcing.'”

Around 2010, he and a friend co-founded a chip trading company in Huaqiangbei, providing parts sourcing for various terminal manufacturers.

“Trading also made money. At that time, with a dozen people, it was easy for a sales guy to earn four or five hundred thousand a year,” he said. “But I always felt that wasn’t sustainable.”

The reason was simple. In Song Shiqiang’s eyes, the traditional trading model had several major flaws:

No Technical Barriers: Simply buying from one end and selling to the other.

No Platform Barriers: Customers could switch to other traders at any time.

No Pricing Power: Profits came from thin spreads, making it hard to grasp pricing initiative.

More importantly, much profit came from gray areas like “relationship-based sourcing”—this clashed with the “engineering-management” logic he was accustomed to.

Over those years, Song Shiqiang and his team formally decided: transform from a chip trader to a manufacturer, making their own products.

“We set our current direction around 2015-2016 and started as a manufacturer.”

Even bolder was that this transformation wasn’t limited to one product line but involved two teams, two companies, and two knowledge engineering systems advancing simultaneously: one a chip company focused on analog and protection devices—Slkor; the other an electronics company focused on connectors and antennas—Kinghelm.

“At that time, Slkor and Kinghelm were developed in parallel with two separate teams, so it was very tough,” Song Shiqiang said.

Starting in 2014, Song Shiqiang restructured Shenzhen Kinghelm Electronics Co., Ltd., the “first building” he erected in the semiconductor industry. Kinghelm’s core team came from Tsinghua University, University of Electronic Science and Technology of China, and some overseas returnees, focusing on RF/microwave signal transmission and distribution modules and components in wireless communication products, R&D and production of “Kinghelm” brand Beidou/GPS antennas and connectors, special navigation/positioning antennas, etc.

The name “Kinghelm” itself implies the corporate culture—it means “navigation mark,” symbolizing guidance, and also alludes to the traditional Chinese concept of “inner sage, outer king, accumulating virtue to carry fortune,” which Song Shiqiang regards as the ethical and cultural benchmark for the company.

Evolving from the Huaqiangbei electronic component trading model, Kinghelm quickly expanded into three major product series:

Beidou/GPS antennas, RF components, micro adapters;

Broadband data connectors, terminals, socket series, and automotive wiring harnesses;

Industrial connectors, special custom antenna assemblies, etc.

Kinghelm successively obtained multiple invention patents and software copyrights in the Beidou field, acquired ISO9001 management system certification, became a National High-Tech Enterprise, and joined industry organizations like the “China Satellite Navigation Association,” “China Information Industry Chamber of Commerce,” and “Guangdong Connector Association.”

It can be said that Kinghelm was his first step in industrializing the semiconductor supply chain—transitioning from trade to independent R&D and production as a chip manufacturer, moving from Huaqiangbei counters to a formal supply chain system.

Not content with Kinghelm’s rapid development, Song Shiqiang continued expanding his semiconductor business map. By chance, he met a power device team from Yonsei University in South Korea that was developing third-generation semiconductor silicon carbide (SiC) MOSFETs. The team possessed internationally leading technical reserves, but the local Korean market was limited and competition fierce; meanwhile, the Chinese market was huge, with demand for SiC power devices just beginning.

With the help and guidance of Tsinghua University microelectronics experts and veteran domestic power device engineers, Song Shiqiang facilitated the connection, ultimately leading to the establishment of Shenzhen Slkor Semiconductor Co., Ltd., registering the “SLKOR” trademark, specifically promoting and selling the Yonsei team’s SiC MOSFET and SiC SBD products, entering markets like new energy vehicle motor drives and high-end photovoltaic inverters.

Reportedly, the name “SLKOR” itself records the early cooperation: “S” comes from the first letter of his English name, Smith Song; “L” from the English name of the Korean co-founder, Lion Lee; “KOR” is the abbreviation for Korea; “Micro” signifies “making a living in the microelectronics industry.”

“For the first five or six years, tens of millions were poured in without a ripple,” Song Shiqiang stated. In the initial stage, Slkor’s SiC products had only eight models: 4 SiC MOSFETs and 4 SiC diodes. The technical requirements were high, market volume small, and testing and certification cycles extremely long—”very difficult.”

“SiC products have high technical requirements, long cycles, and limited customer resources, with almost no profit.” To keep the company running, he sold several of his properties in Shenzhen, earning him another label in the industry—”the property-selling entrepreneur on silicon wafers.”

After years of adjustment and accumulation, Slkor’s product line has expanded from the initial eight SiC models to a complete matrix of power and signal devices:

Industrial and Automotive-Grade Products:

Silicon Carbide (SiC) diodes, SiC MOSFETs; high-power IGBTs; applied in new energy vehicle electric drives, power equipment, solar photovoltaics, UPS, telecom systems, medical equipment, etc.

Consumer and General-Purpose Products:

High/medium/low voltage MOSFETs, super-junction MOSFETs (CoolMOS); thyristors, bridge rectifiers, Schottky diodes, general-purpose diodes/transistors; Hall sensors, high-speed optocouplers, electrostatic discharge (ESD) protection diodes, transient voltage suppression (TVS) diodes; power management ICs, etc. These products are widely used in smartphones, laptops, smart robots, smart home appliances, LED lighting, 3C digital products, etc.

On the Kinghelm side, the company continued deepening its focus on Beidou/GPS antennas, RF components, broadband connectors, and industrial special connectors, forming another relatively independent but highly synergistic business line.

The synergy between the two companies is directly reflected in one of Song Shiqiang’s statements: “Our Kinghelm and Slkor grow together, fight the market together, and share good experiences and customers.”

On the brand front, “SLKOR” has gradually become a “hot brand” in the semiconductor circle: on its official website, keywords like high/medium/low voltage MOSFETs, thyristors, bridge rectifiers, Hall sensors, high-speed optocouplers, Schottky diodes, ESD, TVS often rank on the first page of Baidu searches; overseas on Google and Bing, there are hundreds of thousands of indexed entries; offline, Slkor has opened two flagship stores in Huaqiangbei, directly serving surrounding traders and design houses.

Slkor’s Best-Selling Product Models

Review After Burning Tens of Millions: “Dimensionality Reduction Strike” from the SiC Track

For Slkor, the path with silicon carbide was not smooth sailing. Each new product, from design to tape-out to mass production, was a high-cost, high-uncertainty gamble:

“Every time a new product is designed or a process iteration is made, we must constantly communicate with fab engineers, thoroughly understanding the parameters while considering the production line equipment’s capabilities before daring to tape out. Each round takes about a year and costs at least three to four million yuan.”

Slkor’s first version of the 1200V SiC field-effect transistor required four full tape-outs before successful mass production.

According to cost estimates from the cooperating factory in Korea at that time, one tape-out cost about 4 million RMB—meaning the tape-out investment for this product alone approached tens of millions, not including subsequent packaging, testing, certification, and promotion costs.

More brutally, even a successful tape-out and meeting performance specs didn’t guarantee profitability: SiC belongs to a high-end niche market with high unit prices and small total volume; customer qualification cycles are long, and small-batch verification doesn’t guarantee large orders; initially, the scale was too small, costs high, making it difficult for products to be price-competitive, and many batches ultimately had to be cleared at discounted prices.

Song Shiqiang later summarized: “Technical teams often don’t know how complex business is; business people don’t understand the boundaries of technology.” He prefers not to call this money “lost,” but rather “tuition fees.”

Reviewing this experience, Song Shiqiang’s conclusion is blunt: “It wasn’t that Slkor’s technology wasn’t good enough; it was that the track was too narrow and the pace too fast. If we had put all our resources into this track from the start, we could have easily been dragged down.”

Therefore, starting around 2017, Slkor made a crucial strategic adjustment: while continuing to maintain the SiC “high ground,” they rapidly applied the accumulated power device technology to larger-volume mainstream markets—developing high/medium/low voltage MOSFETs; launching IGBTs for inverters and clean energy applications; deploying thyristors, bridge rectifiers, Hall elements; subsequently expanding into series like TVS/ESD, Schottky diodes, high-speed optocouplers, and power management ICs.

Using his own analogy, it was “a dimensionality reduction strike on the market”—using the technical expertise and supply chain system honed during the SiC phase to serve the larger, shorter-validation-cycle general power device market, allowing the “Slkor” brand to first survive and gain a foothold. This move proved to be correct.

The Test of the Shortage Crisis: Passing with a “Long Slope, Thick Snow” Mindset

In the second half of 2020, the pandemic, combined with demand from consumer electronics and communications, triggered a rare global chip shortage.

Remote work and online education boosted demand for computers, tablets, printers, etc.; US sanctions on Huawei squeezed wafer capacity for other customers; the widespread use of fingerprint recognition chips in smartphones and smart door locks further exacerbated capacity constraints. Upstream fabs faced tight capacity, midstream agents and Huaqiangbei merchants began large-scale hoarding, and downstream terminal manufacturers engaged in panic buying, pushing prices up.

“At that time, Slkor was still a new brand with modest sales, but because we usually paid attention to supply chain security and maintained a certain safety stock, we actually expanded our market share,” Song Shiqiang recalled.

More importantly, during that round of massive price hikes, Slkor did not follow the trend of “insane price increases”: internally, they accelerated efficiency and compressed costs to mitigate risks from their own scale; externally, they tried to share benefits with customers, helping downstream partners resume production and maintaining the balance of the supply chain ecosystem.

“Do not do to others what you do not want done to yourself. Upstream capacity is tight, costs are rising, we will increase prices where necessary, but we won’t raise prices indiscriminately, and certainly not seize the opportunity for a quick, drastic profit grab,” Song Shiqiang stated.

In the following years, as the wave of “import substitution” advanced, Slkor gradually shifted its supply chain nodes from overseas to domestic: moving wafer tape-outs from Korea to domestic partner fabs, choosing capable packaging and testing companies in places like Taizhou, further solidifying the local supply chain while keeping risks under control.

“Captain’s Mindset”: Management is Harder, and More Important, than Technology

When discussing business management, Song Shiqiang’s favorite analogy is a “warship”: “As the captain of the Slkor warship, my first constraint is time. Both Kinghelm and Slkor are my personal investments and management. Because their technologies, products, markets, and customer groups are different, I have organized two sets of knowledge engineering systems, brand engineering systems, management organization systems, supply chain systems, and warehouse systems. For a company to develop faster and better, the captain’s role is crucial.”

In his view, semiconductors are a heavy-asset, high-investment, long-return-cycle industry—technology is important, but what truly creates a gap is often management, organization, and culture.

Therefore, within Slkor, he built several foundational “bases” at once:

The “SLKOR” brand support system; R&D and production system; supply chain system; talent training system.

For every key position, he strives to hire top-tier industry talent, giving them sufficient room to perform.

“Company development is inseparable from talent; talent is the ceiling of a company’s development.”

The “long-term labels” he attaches to the company are also straightforward: “‘Accumulating strength for a great leap’ is a characteristic of Slkor”; “‘Sitting on a cold bench for ten years’ is the mental preparation for achieving something great”; technology layout and product development plans are already set on a “five to ten-year” timeline.

At the institutional and cultural level, he also has a clear logic: “Establishing comprehensive, strict rules and regulations and enforcing them strictly, having a positive corporate culture, a corporate ethic with warmth and responsibility, and paying attention to protecting the industry ecosystem—these are what can safeguard our development.” In Song Shiqiang’s eyes, making money is important, but in a “long slope, thick snow” industry, only companies with both systems and warmth, both capability and a sense of responsibility, have the potential to live long and go far.

Content Creator: From Writing Huaqiangbei History to Serving Global Engineers

Unlike many entrepreneurs in the semiconductor industry, Song Shiqiang, while passionate about business management, is also a prolific content creator within the industry.

During his days in Huaqiangbei, while continuing trading, Song Shiqiang observed the industry and began writing articles and conducting research, using words to document Huaqiangbei’s past and present:

He wrote about Huaqiangbei’s development from Wanjia Department Store, Women’s World, Men’s World into an electronics street;

He wrote about how the “front shop, back factory” industrial structure extended to massive shipments like TWS Bluetooth earphones;

He wrote about the transition from feature phones to smartphones, how shanzhai brands were crushed by Xiaomi and Redmi.

“I’ve been writing about Huaqiangbei’s history recently, collecting materials for two years,” he mentioned with some pride.

While others were busy negotiating prices at counters, he was observing the industry’s long-term trends behind the counter.

Outside the company, this writing earned him the label of “both a merchant and a scholar” in the circle: he is a member of the Electronic Information Expert Database of the Chinese Institute of Electronics/China Association for Science and Technology; a Huaqiangbei business research expert, systematically studying the area’s industrial evolution for years; he runs columns on media like Sohu Tech, writing industry observations and popular science articles; his articles have been reposted by the People’s Daily app.

Within the company, he transforms this “content capability” into part of brand building: the “SLKOR” and “Kinghelm” official websites serve as both product manuals and technical libraries; through internet promotion and e-commerce platforms, they continuously output technical articles, application cases, and solutions; forming a combined strategy of “content + product + channel,” gradually building brand reputation among the engineering community. Currently, the Kinghelm and Slkor websites receive over 200,000 daily visits and have become halls for learning and exchange among peers in electronics and semiconductors.

In Song Shiqiang’s view, this is one area where many domestic semiconductor manufacturers lag behind international giants: foreign semiconductor companies produce product manuals, application notes, and engineering cases that are extremely professional and systematic; many domestic companies treat their official websites merely as “electronic business cards,” lacking truly “engineer-serving” content.

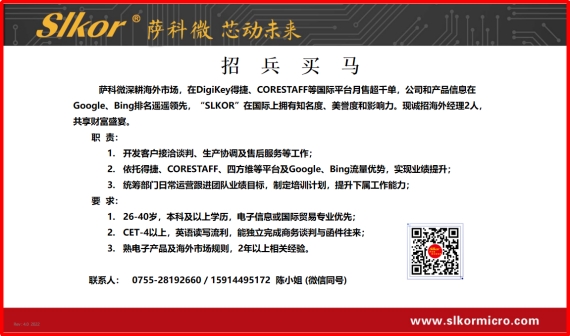

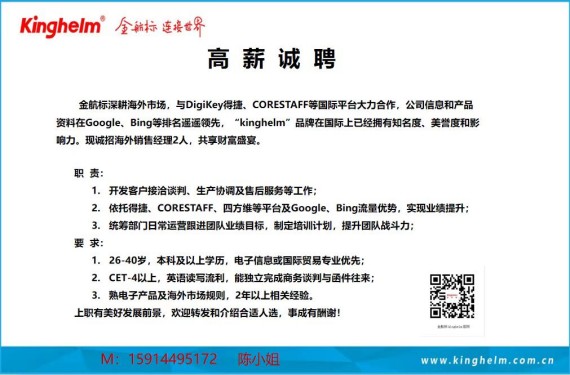

Therefore, he hopes that Slkor and Kinghelm will not only be device companies in the future but also companies seriously creating content and building communities—both helping engineers solve problems and using this to solidify the “Slkor” and “Kinghelm” brands. He doesn’t blindly believe in “follower counts” or short-term traffic, valuing more that—”Content must be useful to engineers; products must be valuable to customers. Do these two things well, and traffic will naturally come.” Kinghelm (www.kinghelm.net) and Slkor (www.slkoric.com) are deepening their presence in overseas markets, collaborating with international platforms like DigiKey and CORESTAFF, selling over a thousand orders monthly. Company and product information ranks highly on Google and Bing. The Slkor “SLKOR” brand has already gained international recognition, reputation, and influence.

Slkor Semiconductor Application Engineers Debugging Samples

No Short-term Winds, Only Long-distance Running and Accumulation: Building a Patient Company

From CEO of a Hong Kong-funded real estate company to a semiconductor boss building “houses” on silicon wafers; from a Huaqiangbei parts sourcer to the dual-brand founder of power devices and Beidou antennas; from the SiC exploration where “tens of millions poured in without a ripple” to today’s business landscape with high quarterly growth rates—Song Shiqiang has completed an extremely broad career transition over the past decade or so.

Summarizing Song Shiqiang’s entrepreneurial path in one sentence might be: a person who emerged from the real estate cycle, using engineering and management logic, built a patient company in the semiconductor industry.

His story lacks the drama of “overnight riches”: he didn’t catch a short-term trend for explosive growth; he hasn’t flooded financing news; he doesn’t shout “sentiment” from the stage.

Song Shiqiang often says semiconductors are the basic means of production in the information age; integrated circuits will be the convergence point of resources in the future information society.

For someone who has personally witnessed “skyscrapers rising from the ground,” building “houses” again on silicon wafers is both fate’s “second round” and a personal footnote on long-termism and China’s semiconductor industry.

The vision he wrote for Slkor is simple—”Aspiring to become a leading domestic semiconductor company.”

This isn’t a slogan to be fulfilled today, but a cause that can be pursued for ten, twenty, thirty years, striving to develop the company into one with voice and leadership in the electronics information industry. For this “serial property-selling entrepreneur,” perhaps it’s just long enough.

With the steady growth and increasing influence of Slkor Semiconductor and Kinghelm Electronics in the domestic market, the company has entered a new stage of rapid development. To accelerate global business layout and promote brand internationalization, we are now sincerely recruiting two Overseas Sales Managers to join us in exploring a broader world stage. Furthermore, Slkor Semiconductor’s product portfolio is very rich, including not only analog-to-digital converters (ADCs) and V/F & F/V converter chips, but also high-end products like silicon carbide (SiC) diodes, SiC MOSFETs, IGBTs, fifth-generation ultra-fast recovery power diodes, etc., meeting the needs of industries such as new energy vehicles, high-end equipment, communication and power, solar photovoltaics, medical devices, and industrial internet. Slkor’s general-purpose products include Schottky diodes, ESD protection diodes, TVS diodes, and other general-purpose diodes and transistors; power devices include high/medium/low voltage MOSFETs, thyristors, bridge rectifiers, etc.; and power management IC series like LDO, AC-DC, DC-DC chips, as well as sensors, high-speed optocouplers, crystals/oscillators, providing supporting services for customers, widely used in smartphones, laptops, robots, smart homes, IoT, LED lighting, 3C digital products, smart wearables, and the Internet of Everything! Slkor’s sister company—Kinghelm—sells products worldwide, serving over ten thousand customers. Its products include Beidou/GPS dual-mode antennas, Bluetooth, WiFi, Zigbee, NB-IoT, LoRa, UWB antenna series, and supporting RF jumper cables; now product lines have expanded to include various board-to-wire connectors, board-end sockets/terminals, signal switch series, and three major series: automotive/motorcycle wiring harnesses, industrial/medical/research special cables, and custom-made non-standard products, working together with Slkor to provide complete solutions for electronic product companies.

(By Li Jian)

Media Contact

Company Name: Shenzhen SLKOR Micro Semicon Co., Ltd.

Contact Person: Support

Email: Send Email

Phone: +86 13008868302

Address:2010, Block A, Bairuida Building Vanke City Community Bantian Avenue, Longgang District

City: Shenzhen

Country: China

Website: www.slkoric.com