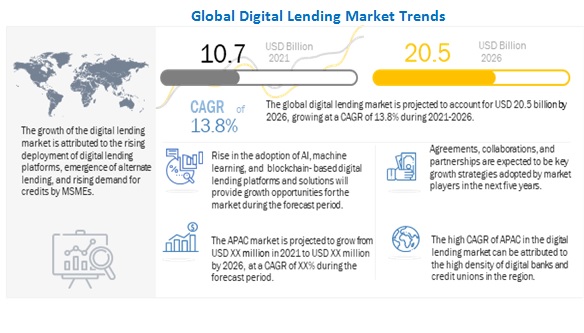

MarketsandMarkets forecasts the global Digital Lending Market size to grow from USD 10.7 billion in 2021 to USD 20.5 billion by 2026, at a Compound Annual Growth Rate (CAGR) of 13.8% during the forecast period. Proliferation of smartphones and growth in digitalization, need for better customer experience, government actions to safeguard digital lending, greater visibility and options for borrowers and lenders, growing demand for digital lending platforms among SMEs, and surge in digital lending during the pandemic are key factors for the growth of the Digital Lending market.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=70396306

By Offering, the Solutions segment to hold the larger market size during the forecast period

The Solutions segment of the Digital Lending Market is projected to hold the larger market size in 2021. The solutions segment of the digital lending market is further classified into digital lending platforms and point solutions. Various solutions are offered in the digital lending platforms, right from loan origination to loan closing. The point solutions help banks and financial institutions to address a single section of the entire loan processing life cycle.

By Point Solutions, the P2P Lending Software segment to grow at the highest CAGR during the forecast period

Under the Point Solutions segment, the Peer-to-peer (P2P) Lending Software sub-segment is expected to grow at the highest CAGR during the forecast period. It is a form of online lending that enables individuals or businesses seeking loans to apply and get loans online directly from other individual investors without the need for any middlemen. It helps This helps lenders to make an informed decision before giving out unsecured loans, while also helps borrowers to compare and evaluate their choices.

Request Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=70396306

The key and emerging market players in the Digital lending market include Fiserv (US), ICE Mortgage Technology (US), FIS (US), Newgen Software (India), Nucleus Software (India), Temenos (Switzerland), Pega (US), Sigma Infosolutions (US), Intellect Design Arena (India), Tavant (US), Docutech (US), CU Direct (US), Abrigo (US), Wizni (US), Built Technologies (US), Turnkey Lenders (US), Finastra (UK), RupeePower (India), Roostify (US), JurisTech (Malaysia), Decimal Technologies (India), HES Fintech (Belarus), ARGO (US), Symitar (US), EdgeVerve (India), TCS (India), Wipro (India), SAP (Germany), Oracle (US), BNY Mellon (US), and Black Knight (US). These players have adopted various strategies to grow in the Digital Lending market.

Fiserv is one of the leading providers of digital lending solutions. The company offers electronic payments, digital channels, card services, biller solutions, output services, investment services, and risk management under its payments segment. The company’s various lending solutions include automotive finance, loan servicing, loan origination, and business process outsourcing. In March 2020, Fiserv partnered with Interior Savings Credit Union to enable digital transformation. The credit union implemented Fiserv’s DNA platform to optimize operations.

ICE Mortgage Technology is one of the leading cloud-based loan origination platform providers for the mortgage industry, with solutions that enable lenders to originate more loans, lower the origination costs, and reduce the time to close, all the while ensuring the highest levels of compliance, quality, and efficiency. The company offers Encompass, which empowers lenders to originate more loans, reduce the time to close and make smart business decisions. In September 2020, ICE Mortgage Technology acquired Ellie Mae, a leading digital lending platform provider. The acquisition helped ICE to accelerate the automation of mortgage processes.

Media Contact

Company Name: MarketsandMarkets™ Research Private Ltd.

Contact Person: Mr. Aashish Mehra

Email: Send Email

Phone: 18886006441

Address:630 Dundee Road Suite 430

City: Northbrook

State: IL 60062

Country: United States

Website: https://www.marketsandmarkets.com/Market-Reports/digital-lending-platform-market-70396306.html