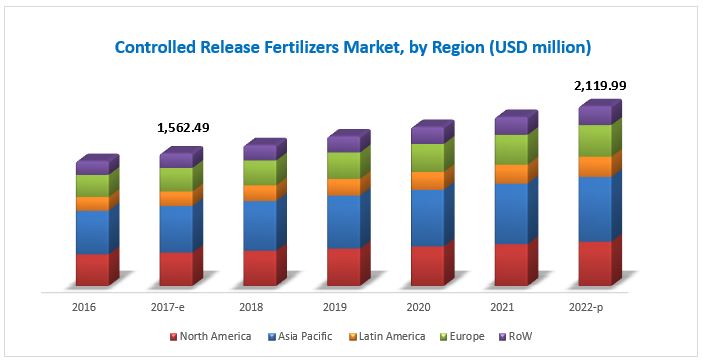

The report “Controlled-Release Fertilizers Market by Type (Slow-release, Coated & Encapsulated, N-Stabilizers), Crop Type (Cereal & Grain, Oilseed & Pulse, Fruit & Vegetable, Plantation, Turf & Ornamental), Application Method, and Region – Global Forecast to 2022″, The controlled-release fertilizers market is projected to grow at a CAGR of 6.29% from an estimated value of USD 1.56 Billion in 2017 to reach USD 2.12 Billion by 2022. The market is driven by factors such as the rise in demand for high efficiency fertilizers, growth in research on cost-effective polymer coatings for coated & encapsulated fertilizers, and the impact of controlled-release fertilizers on controlling nutrient losses to the environment.

The objectives of the report:

1. Determining and projecting the size of the controlled-release fertilizers (CRFs) market with respect to their types, crop types, application methods, and regional markets, over the period ranging from 2017 to 2022

2. Identifying attractive opportunities in the market by determining the largest and fastest-growing segments across regions

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=136099624

Favorable government policies and regulations

Government policies and regulations have always been one of the key factors at propelling and promoting the production of a particular commodity or system.

Labeling and manufacturing guidelines for controlled-release fertilizers, which serve as a mark of a superior standard or trust, have been mandatorily adopted and regulated in many nations, especially the US and also the European countries. These products are promoted by domestic fertilizer regulatory agencies in accordance with the view of the government policy frameworks to minimize the environmental hazards caused by leaching and nutrient loss. For instance, China’s guiding catalog of Industrial Infrastructure Adjustment (2011 edition) classified CRF as one of the encouraged items, indicating the development of CRF to speed up during China’s 11th five-year plan, from 2011-2015. After the proposal of China’s 11th five-year plan, the growth of CRF in the country spiked up by 30% during the last 15 years. Such government policies and well-defined regulations act as a boosting factor for the growth of this market at the global level.

Limited adoption of controlled-release technology

Controlled-release fertilizers have been in use since a long time in countries such as the US and in Western European countries. However, the technology has been relatively nascent for developing countries. Limited awareness on the advantages of CRF with respect to application cost and environmental concerns has been hampering the growth of this market to a large extent. The main reason for the low rate of adoption of this technology is the established conventional fertilizers market, since the demand for conventional fertilizers among farmers has been strongly fueled by their belief in high crop returns.

Though there is a high impact on the long-term cost associated with the application of fertilizers, the initial cost to be invested by the farmers is quite high which restrains the farmers to adopt this technology. Also, beliefs among the farmers from developing countries on the advantages of using large amounts of fertilizers multiple times would increase crop yield and quality, is not the same with controlled-release fertilizers, which further leads to the rising unwillingness in adopting the technology. Moreover, in developing countries, large amounts of subsidies are provided by the government over conventional fertilizers. For instance, in India, there are a number of subsidies extended to the farmers for NPK fertilizers such as Nutrient-Based Subsidy (NBS), Essential Commodities Act 1955 (ECA), and Concession Scheme for P&K Fertilizers; however, not much subsidy is granted for smart fertilizers, which further impacts the adoption of this technology among farmers.

On the other hand, in countries such as India and China, where agriculture is the major source of income for more than half of the country’s population, farmers are not willing to take risks against their crop production. According to the Institute of Management Development and Research (IMDR), India, small retailers and shopkeepers are unwilling to stock and sell smart fertilizers in the country as they feel their quality is unreliable.

Coated & encapsulated segment, by type, is projected to remain in the higher growth curve in the next five years

The adoption of these fertilizers is increasing globally due to the growth in awareness about the benefits associated with coated fertilizers and government support provided by various countries in terms of subsidies and policy amendment. Due to the simplicity and low cost of using sulfur as a coating material, sulfur-coated fertilizers have been the most commonly used coated products in the developing nations. To obtain a further reduction of the total fertilizer costs, coated & encapsulated fertilizers are increasingly used in blends with conventional fertilizers in different ratios, owing to which, coated fertilizers in conjunction with nutrients are researched on by key players.

Speak to Analyst: https://www.marketsandrkets.comam/speaktoanalystNew.asp?id=136099624

Significant competition to capitalize the market potential among international manufacturers in the Asia Pacific and South American regions

Rise in export quality requirements for agricultural products and increasing adoption of sustainable agriculture practices in countries such as China, India, Brazil, and Argentina are expected to drive the demand for controlled-release fertilizers among the farmers in the Asia Pacific and South American regions during the forecast period. This would increase the inflow of various international manufacturers to set up their business units and distribution networks, thereby leading to a strong market competition.

This report includes a study of marketing and development strategies, along with the product portfolio of leading companies. These companies include Agrium (Canada), Yara (Norway), ICL (Israel), Kingenta (China), and Helena Chemical (US), which are some of the well-established and financially stable players that have been operating in the industry for several years. Other players include ScottsMiracle-Gro (US), SQM (Chile), Haifa Chemicals (Israel), Koch Industries (US), AGLUKON (Germany), COMPO EXPERT (Germany), and JCAM AGRI (Japan).

Media Contact

Company Name: MarketsandMarkets

Contact Person: Mr. Shelly Singh

Email: Send Email

Phone: 1-888-600-6441

Address:630 Dundee Road Suite 430

City: Northbrook

State: IL

Country: United States

Website: https://www.marketsandmarkets.com/Market-Reports/controlled-release-fertilizers-market-136099624.html