The growth of Contract Development Manufacturing Organizations and the manufacturing of APIs has been credited to a rise in the demand for generic drugs, patent expirations, and biological innovations. However, the COVID-19 pandemic has drastically increased the demand for innovations and generic drugs, recently. Although there has been an increased demand for APIs catering to these fields, the supply of API has proved challenging.

The pandemic has resulted in business lockdowns in several parts of the world. China is the first country to face the devastations of the pandemic and as such has extended periods of lockdown. This resulted in over 44 Chinese API manufacturers closing their operations temporarily due to the government-imposed lockdown restrictions. Since China is a leading API manufacturing hub and also the major region, where the raw materials for API manufacturing are found, these non-operational Chinese CDMOs severely affected the supply of API at a global scale.

Various countries and governments worldwide have opted to boycott APIs made in China. However, this also means that they need to either manufacture or source API from other regions. This dichotomy in the decision versus the supply scenario has resulted in two major changes. First, other regions like Singapore, Belgium, and India are focusing more on API manufacturing, thereby aiming to become the API hubs of the future. Also, corporates are focusing on CDMO from multiple regions to serve locally, thereby omitting the chances of supply chain disruptions like the ones caused by the COVID-19 pandemic. They are also looking to operate from countries where CDMO can import from Chinese players.

Contract Development Manufacturing Organization Market Procurement Intelligence report, by Grand View Research, deep dives into the following insights from the industry:

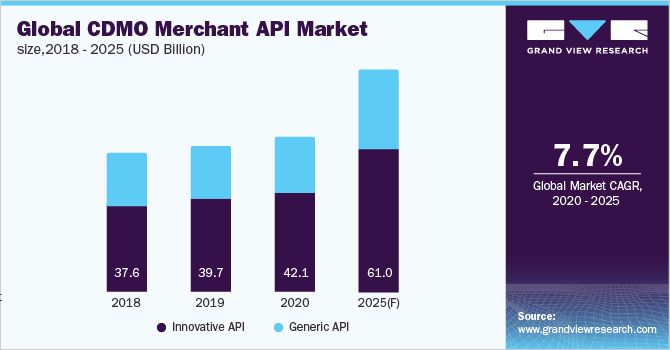

- The CDMO market is poised to grow at 7.3 % CAGR between 2020 and 2025 with the potential to reach a revenue of USD 61 billion in 2025 – The global contract development manufacturing organization market is expected to witness sustainable growth (CAGR of 7.3%) from 2020 to 2025 with innovative APIs driving market growth. The COVID pandemic has had several positive as well as negative impacts on the industry. The demand for investigational treatments and ICU medications, to aid medical centers tide over the pandemic, has substantially increased resulting in increased demand for APIs. At the same time, scarcity of APIs, especially in countries that procure them from China, has led to supply chain disruptions.

- The global merchant API market is fragmented with small scale CROs having limited contract manufacturing capabilities operating regionally, affecting the market share of larger CDMOs – The API manufacturing market for contract development manufacturing organization is fragmented. The top 8 players in the industry barely make up 41% of the share. Remaining 59% approvals are supported by CDMOs with less than 3% market share.

Several large-scale contract development manufacturing organizations are leading the API manufacturing marketplace. Some of the major players are Pantheon, Lonza, Siegfried. The presence of several API manufacturers, both contractual, like CDMOs, as well as pharmaceutical companies with in-house manufacturing capabilities, limits the bargaining power of suppliers. At the same time, this also increases competitive rivalry between the market players

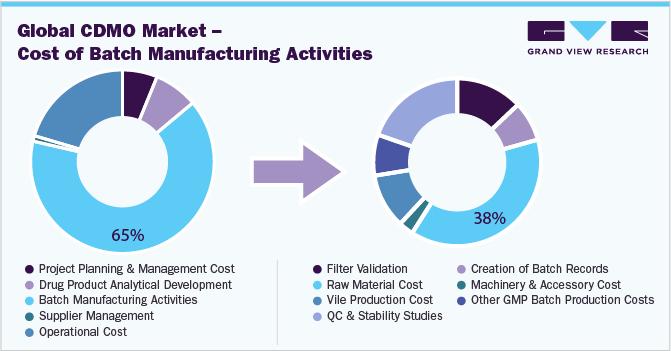

- Batch manufacturing activities are the largest component and makeup approximately around 65% of the overall cost for manufacturing APIs – The cost heads for CDMOs manufacturing can be segregated into five major categories. There are project planning and management costs, drug product analytical development, batch manufacturing activities, supplier management, and operational cost. Of these, batch manufacturing practices occupy 65% of the overall cost. For batch manufacturing, raw material costs are the largest cost head, occupying 38% of the total cost of batch manufacturing activities.

In addition to these costs, there are several costs that gets added up to the lifetime cost. Three of the major cost heads are the cost of quality control, custom clearance cost, and insurance cost. In fact, the cost of quality control supersedes the other manufacturing costs.

- The supply chain disruptions caused by the pandemic have forced companies to think about diversifying and venturing outside China to set up their manufacturing bases – For API manufacturers, China has been the largest exporter of their raw materials. However, the COVID pandemic has resulted in disrupted supply chains for several contract development manufacturing organizations. This has led API manufacturers to realize the need for diverse sourcing options. Singapore and Belgium are thus becoming two other hotspots from where API manufacturers are sourcing their requirements.

In-house product development and full service outsourcing are the two most commonly followed engagement models followed. Pharmaceutical companies either manufacturer their medicines and APIs or outsource the job entirely to contract development manufacturing organizations.

Contract Development Manufacturing Organization Market – Cost Intelligence Highlights:

Grand View Research has identified the following key cost components for availing CDMO API manufacturing:

- Project Planning and Management Costs

- Drug Product Analytical Development

- Batch Manufacturing CostsSupplier Management

- Filter Validation

- Creation of Batch Records

- Raw Material Costs

- Machinery and Accessory Cost

- Vile Production Costs

- Other GMP Batch Production Costs

- Stability Studies

- Operational Costs

- Insurance

- Freight

- Service Fee

- Storage

- Admin

Batch manufacturing cost is the major cost component of a CDMO API manufacturer, accounting for 65% of the total cost of manufacturing.

Contract Development Manufacturing Organization Industry – Supplier Intelligence – Capability based ranking & selection criteria with weightage:

Operational Capabilities –

- Years in Service – 15%

- Geographical Service Presence – 30%

- Employee Strength – 5%

- Revenue Generated – 10%

- Key Clients – 10%

- Certifications – 30%

Functional Capabilities –

- Use molecule – 35%

- Cyclosporine

- Tetracycline

- Daptomycin

- Vancomycin

- Steroids

- Others

- Type – 30%

- Innovative

- Generic

- Sysnthesis – 30%

- Biotech type

- Synthetic type

- Other functionalities offered by CMOs15%

List of Key Suppliers in the Contract Development Manufacturing Organization Industry:

- Pantheon

- Evonik

- Lonza

- AMRI

- Siegfried

- Fabbrica Italinana Sintetici

- Hovione

- Esteve

Addon Services offered by Grand View Research:

- Should Cost Analysis – In the CDMO market procurement intelligence report, we have estimated and forecasted pricing for the key cost components while availing services from CDMOs. For our research, we have considered API CDMO services. The cost structure of API CDMO services can be categorized into type major segments; production costs and overhead costs. The production cost accounted for more than 80% share of the overall CDMO service cost. Key cost components of production cost include project planning, medical writing, project management, regulatory affairs, data management, machinery and accessory, raw materials, drug assay, etc. These cost components are majorly driven by the salary fluctuations of personnel involved in the same. Major cost components in the overhead segment include insurance, taxes, and site management cost.

- Rate Benchmarking – As we have considered API production cost for small molecules, the size of the batch is one of the most important aspects while analyzing the rate benchmarking of an API CDMO service. In our research, we have analyzed the rates of 100,000 and 50,000 vials batch size in the APAC. By using rate benchmarking analysis, we found that running two production batches of 50,000 vials is 5%-6% more cost-efficient than running one production batch of 100,000 vials. Hence, it is advisable to have multiple small batch production lines rather than having a single large batch production line.

- Salary Benchmarking – Labor is one of the key cost components incurred while offering a product or service. Understanding the pricing structure of salary is important for organizations in selecting the appropriate supplier and to build a good negotiation strategy. It is also an important factor in determining whether the category under focus should be outsourced or built in-house.

- Supplier Newsletter – It is cumbersome for any organization to continuously track the latest developments in their supplier landscape. Our newsletter service helps them remain updated, to avoid any supply chain disruption which they may face, and keep a track of the latest innovations from the suppliers. Outsourcing such activities help clients focus on their core offerings.

A smart and effective supply chain is essential for growth in any organization. Pipeline division at Grand View Research provides detailed insights on every aspect of supply chain which helps in efficient procurement decisions.

Our services include (not limited to):

- Market Intelligence involving – market size and forecast, growth factors, and driving trends

- Price and Cost Intelligence – pricing models adopted for the category, total cost of ownerships

- Supplier Intelligence – rich insight on supplier landscape, and identifies suppliers who are dominating, emerging, lounging, and specializing

- Sourcing / Procurement Intelligence – best practices followed in the industry, identifying standard KPIs and SLAs, peer analysis, negotiation strategies to be utilized with the suppliers, and best suited countries for sourcing to minimize supply chain disruptions

Browse through Grand View Research’s collection of procurement intelligence studies:

- Paraffin Market Market Procurement Intelligence Report – The global production for paraffin was valued at 3.7 million MT in 2020. This demand is expected to increase by a CAGR of 1.6% between 2020 to 2025. OF the 3.7 million MT produced, APAC manufacturers approximately 1.5 million MT. However, this only represents 92% to 95% of the overall demand for paraffin in APAC. To improve the production capacity to meet the demand of the market, there were planned installations in Vietnam. However, due to the COVID pandemic and the supply chain disruptions, the additional capacity could not be added in time. Moreover, a recent fire accident in an Iranian petroleum plant resulted in a supply shortage of paraffin in the market.

- Food & Beverage ERP Solution Market Procurement Intelligence Report – The products involved in food and beverage industry are highly perishable in nature, hence mitigating factors arising due to inventory management is a major concern for the suppliers. A shift of consumer preferences towards a healthy diet and lifestyle has negatively aided the growth of the products with added preservatives.

Media Contact

Company Name: Grand View Research, Inc.

Contact Person: Sherry James, Corporate Sales Specialist – U.S.A.

Email: Send Email

Phone: 1888202951

Address:Grand View Research, Inc. 201 Spear Street 1100 San Francisco, CA 94105, United States

City: San Francisco

State: California

Country: United States

Website: www.grandviewresearch.com/pipeline/cdmo-market-procurement-intelligence-report