InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the “Global Cloud Adoption in Banking Market – (By End User (Retail Banks, Commercial Banks, Investment Banks, Credit Unions, and Regulatory Bodies), By Type (Cloud Identity and Access Management Software, Cloud Email Security Software, Cloud Intrusion Detection and Prevention System, Cloud Encryption Software, and Cloud Network Security Software)), Trends, Industry Competition Analysis, Revenue and Forecast To 2031.”

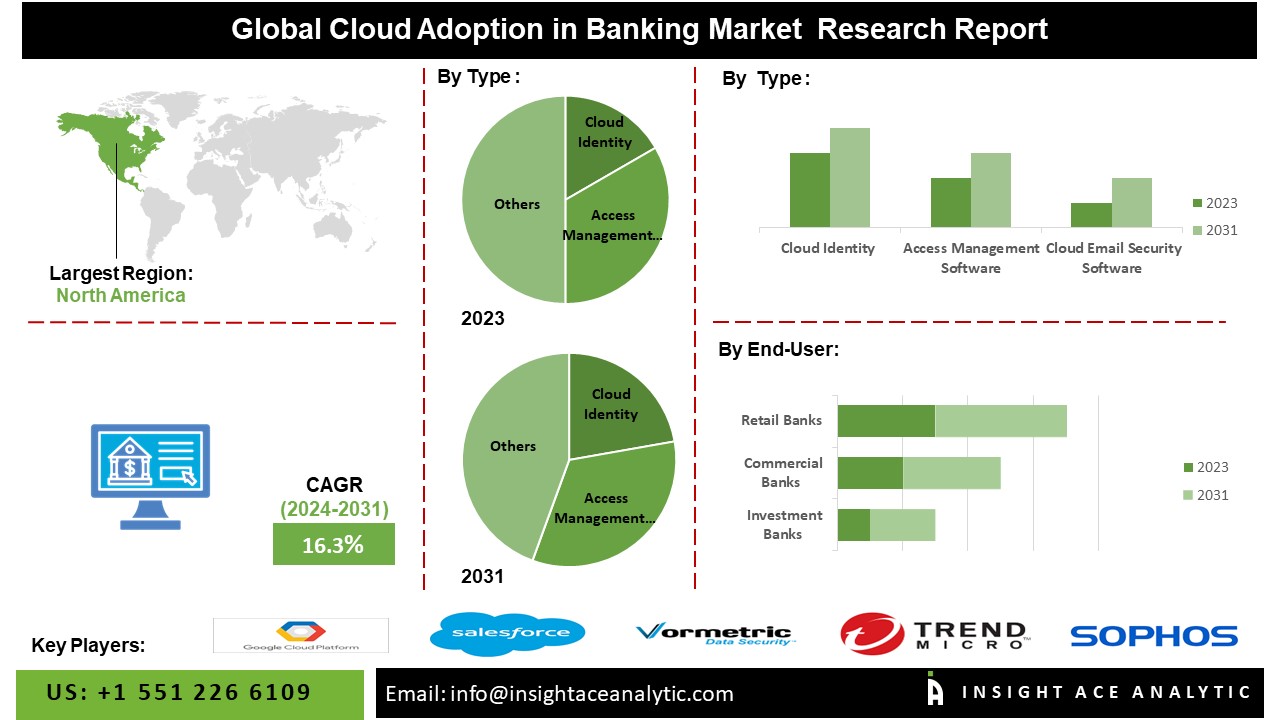

According to the latest research by InsightAce Analytic, the Global Cloud Adoption in Banking Market is expected to develop with a CAGR of 16.3% during the forecast period of 2024-2031.

Cloud adoption in banking describes the current trend in the banking business toward using cloud computing services and technology to advance innovation, scalability, and operational efficiency. The rising demand for cloud computing in banking is driven by various factors such as rapid and easy resource scaling, enhanced confidence in cloud security, more effective regulatory requirements, less data loss, better analytics and artificial intelligence, and an increasingly digital society. Furthermore, banks are being pushed to move to cloud solutions due to the necessity for increased security measures and regulatory compliance. These solutions provide strong data protection and disaster recovery capabilities. Cloud computing allows for the quick rollout of new services and apps to suit the changing demands of customers, which is another way the competitive environment forces banks to innovate. Implementing cloud computing enables banks to adapt to evolving business needs while swiftly preserving operational efficiency. This integration is a key factor for organizations aiming to complete digital transformations, which boosts competitiveness and customer satisfaction. However, security is a top priority for cloud providers due to the prevalence of data breaches. Some financial institutions are hesitant to embrace cloud solutions completely due to the sensitive nature of financial data, which requires strict security measures.

Request for Sample Pages: https://www.insightaceanalytic.com/request-sample/2393

List of Prominent Players in the Cloud Adoption in Banking Market:

- Google Cloud Platform

- Salesforce

- Vormetric Inc.

- Boxcryptor

- Trend Micro

- Sophos

- Wave Systems

- Microsoft Azure

- Temenos

- nCino

- Oracle Corporation

- Dell Technologies

- Amazon Web Services

- SAP SE

- IBM Corporation

- VMware

- Other Prominent Players

Market Dynamics:

Drivers-

In the ever-changing digital landscape, the banking industry is seeking more agility, scalability, and better service delivery, fueling the need for cloud adoption in banking. Banks are turning to cloud computing in banking to improve efficiency, cut costs, and provide customers with new and exciting services. Better decision-making and individualized customer service are two outcomes of banks’ increased use of cloud computing to store as well as analyze enormous amounts of data. In addition, the pandemic has hastened the transition to digital banking, increasing the demand for the reliable and extensible IT systems offered by cloud providers. Banking finds it easier to comply with stringent data security and privacy regulations, which is helping to facilitate cloud adoption in banking.

Challenges:

The prime challenge is data privacy, worries about data residency regulations, and a lack of norms and protocol, which is predicted to slow the growth of Cloud adoption in the banking market. One potential obstacle to cloud adoption is the uncertainty surrounding data residency rules, access controls, and ownership, slowing market growth. Challenges for banks considering cloud adoption include regulatory uncertainty and varied compliance norms across geographies, especially regarding data residency and privacy. Financial institutions depend on long-standing systems that are integral to their daily operations. Integrating these systems with cloud-based alternatives may take a lot of effort and money. Due to the high cost and uncertainty, the banking industry must adopt cloud computing.

Regional Trends:

The North American cloud adoption in the banking market is anticipated to hold a major market share in revenue. It is projected to grow at a high CAGR soon because of the region’s banking sector’s rising use of cutting-edge networks, including big data analytics, AI, AR, VR, ML, and advanced network technologies (4G and 5G). Additionally, market participants are adding to the region’s anticipated domination in the banking industry’s cloud adoption. Besides, Asia Pacific is predicted to grow with a remarkable share in the market because of the assertive measures implemented by the administrations of numerous nations in the area and advancements in digital infrastructure, the rising popularity of mobile banking apps, and the ever-expanding cloud adoption in Banking fuel market expansion in the Asia Pacific.

Curious About This Latest Version Of The Report? Enquiry Before Buying: https://www.insightaceanalytic.com/enquiry-before-buying/2393

Recent Developments:

- In Dec 2023, Cloud banking company nCino and Salesforce have recently strengthened their partnership. The 12-year-old partnership between nCino and Salesforce was extended. In order to aid financial institutions (FIs) that utilize both nCino and Salesforce in modernizing customer experiences such as onboarding, loan origination, deposit account opening, and portfolio management, the new agreement saw nCino strengthen its integration with Salesforce platform tools, including its financial services cloud.

- In Dec 2023, The Reserve Bank of India (RBI) has implemented a cloud infrastructure specifically designed for the financial industry in order to bolster data security. Banks and financial institutions have consistently accumulated a growing amount of data. A significant number of individuals employed a range of public and private cloud services for this objective.

Segmentation of Cloud Adoption in Banking Market-

By Type-

- Cloud Identity and Access Management Software

- Cloud Email Security Software

- Cloud Intrusion Detection and Prevention System

- Cloud Encryption Software

- Cloud Network Security Software

By End-User-

- Retail Banks

- Commercial Banks

- Investment Banks

- Credit Unions

- Regulatory Bodies

By Region-

North America-

- The US

- Canada

- Mexico

Europe-

- Germany

- The UK

- France

- Italy

- Spain

- Rest of Europe

Asia-Pacific-

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

Latin America-

- Brazil

- Argentina

- Rest of Latin America

Middle East & Africa-

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

For More Customization @ https://www.insightaceanalytic.com/customisation/2393

Media Contact

Company Name: InsightAce Analytic Pvt. Ltd

Contact Person: Diana D’Souza

Email: Send Email

Country: United States

Website: https://www.insightaceanalytic.com/