- Cold storage warehousing space per capita still remain low at 0.12 cubic meters in China, versus global average of 0.20 cubic meters showcasing a huge potential growth for the Chinese cold chain sector.

- Increasing Number of Logistics service providers are focussing on improving their Value Added Services and streamlining their business operations using Big Data, Data Analytics Tools, IoT, AI and others.

- China has been witnessing an average 4-5%annual increase in its per capita disposable income levels. This has led to rise in consumption of Food and Beverages and higher demand for supermarket retailing leading to increase the demand for warehousing in the country.

Rising Investment in technology: Major Logistics Players of China are increasingly focussing on improving IT and investing in technology in order to retain their customers in the highly competitive market of the country. China’s freight networks are already responding to the advent of big data, open data and digital technologies. Technologies such as 3D Printing, Autonomous Vehicles, Artificial Intelligence, Alternative Fuel Vehicles, Drones and more adoption levels are expected to increase in the future in the country.

Improving Infrastructure:Chinese Government is investing heavily for improvinginfrastructure owing to which Intermodal Freight Logistics Parks and other infrastructure projects are expected to rise in future paving way for better logistic services in the country. Moreover, China is expected to witness an increase of ~15% in number of Logistic Parks from ~2000 in 2020 to 2300+ in 2025 in the country.

Increasing Multi-storey Warehouses: China’s booming E-commerce Market, especially after COVID pandemic, has led to soaring demand for warehousing facilities in the country which are nearer to the end users. Hence, as land in major Urban Hubs is scarce and expensive, real estate developers such as Goodman, Prologis are setting their sights higher by adding floors to their logistics centres.

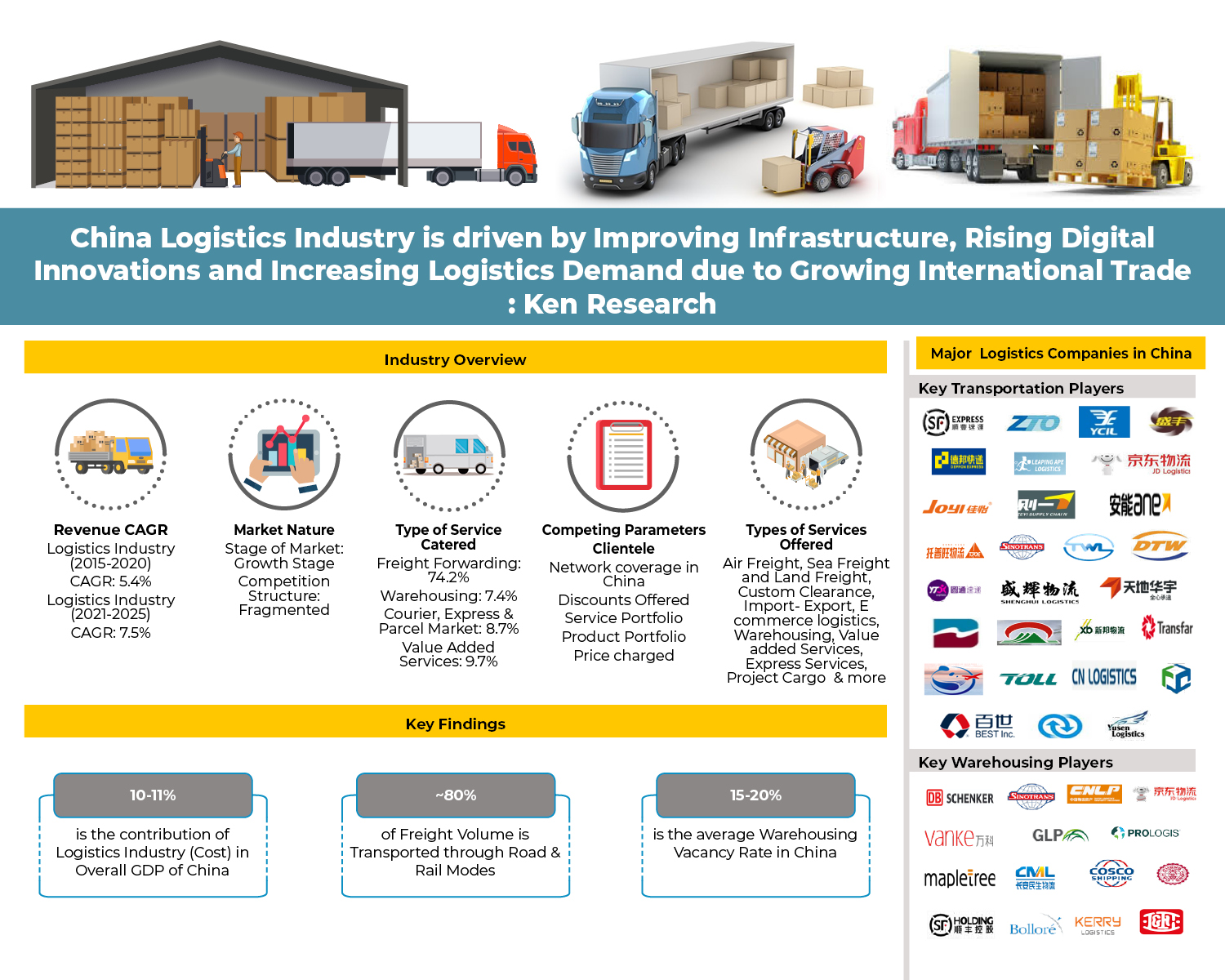

Analysts at Ken Research in their latest publication “Chinese Logistics and Warehousing Market Outlook to 2025- Led by Growth in Road Freight Services, Improving Infrastructure and Rising Digital Innovations” the Chinese Logistic Market has been evolving in the country due to factors such as increasing Logistics demand owing to reasons such as higher E-commerce penetration due to changing consumer patterns and increasing consumer expenditure; improving transportation and warehousing infrastructure due to multiple government projects; rising investment in technologies such as IoT, Big Data Open Data, AI, Automation and more; growing international trade with other major economies such as Japan, Republic of Korea, India and more. The market is expected to register a positive CAGR of 7.5% in terms of revenue during the forecast period 2020-2025.

Key Segments Covered:-

By Mode of Service- Freight Forwarding Market (Revenue and Volume)

Road Freight

Sea Freight

Rail Freight

Air Freight

By Type of Load- Road Freight Forwarding Market (Revenue)

LTL

FTL

By Type of End Users – Road Freight Forwarding Market (Revenue)

Agriculture

Non- Agriculture

Commodities

FMCG Products

Electronic Equipments

Chemicals

Automotive Products

Pharmaceutical Products

By Business Model-Warehousing Market (Revenues)

Industrial Retail

Cold Storage

IFS/ICD

Grain Storage

By End User-Warehousing Market (Revenues)

FMCG Products

Commodities

Agricultural Products

Pharmaceutical and Medical Devices

Automotive Products

Electronics

Others

Companies Covered:-

(Freight Forwarding Companies)

SF Express

ZTO

Deppon Logistics

Yuancheng Group Co Ltd

Fujian Shengfeng

Leaping Express Group

Shandong Jiayi Logistics Co

Shanghai Zeyi Logistics

Aneng Logistics

Topone Logistics

Sinotrans Hi-Tech Logistics

Topwin Logistcs

Tianjin Datian Group

HOAU Logistics Co.

Yuantong Express Co. (YTO)

Shenghui Logistics Group Co.

Guangzhou Xinzhihong Logistics

Dazhong Transportation Group

Toll Global Logistics

Shandong Taian Transportation Group

Guangzhou City Star Transportation

Tianjin Lion Bridge

Beijing Xianglong Logistics Group

JD Logistics

CN Logistics

Zhejiang Xinbang Logistics Co

DB Schenker

Noatum Logistics

Best Freight

Dadi Logistics

PG Logistics

Shanghai Jiao Yun Co.

Transfar Logistics

Yusen Logistics China

(Warehousing Companies)

GLP

Vanke (VX Logistics Properties)

JD Logistics

China Logistics Property Holdings

Maple Tree Logistics

Proligis

Sinotrans

Li & Fung

SF Holdings

Kerry Logistics

COSCO SHIPPING Logistics

DB Schenker

DCH Holdings Ltd.

Changa Minsheng APLL Logistics

Bollore

(FMCG Companies)

WH Group

Pesico

Yili Group

Mengniu Group

Master Kong (Tingyi Holding Corp.)

Nestle

P&G

Coca Cola

China Resource Beer

Unilever

Nongfu Spring

Want Want China Holdings Ltd

Johnson and Johnson

Beijing Sanyuan Foods Company Limited

Mars Group

Nestle Waters

Key Target Audience:-

Industry Associations and Consulting Companies

Third Party Logistic Providers

Potential Market Entrants

Freight Forwarding and Warehousing Companies

Time Period Captured in the Report:-

Historical Period: 2015-2020

Forecast Period: 2020-2025

Key Topics Covered in the Report:-

Comprehensive analysis of China Logistics Market and its segments.

Listed major players and their positioning in the market.

Identified major industry developments in last few years and assessed the future growth of the industry.

China Logistics Market

China Warehousing Market

China Logistics and Warehousing Market Revenue

China Logistics and Warehousing Market Future Outlook

Covid-19 Impact China Logistics and Warehousing Industry

Covid-19 Impact China Logistics and Warehousing Market

China Number of Logistic Companies

China Transportation Market Size

Warehousing Hubs China

China Third Party Logistics Market

China Road Freight Network Market

China Sea Freight Network Market

China Air Freight Network Market

China Transportation Market Growth

China Digital Freight Aggregator Industry

China Digital Truck Aggregators Market

China New Energy Vehicle Market

Suzhou Warehousing Market

China FMCG Market Growth Analysis

China Cold Chain Industry

China Co-Packing Industry Market Size

China Major Road Freight Companies

China Courier, Express and Parcel Service

China Drone Technology Market

Warehousing Automation Market China

Road Freight International Companies China

Road Freight Domestic Companies China

Transportation Industry Pain Points China

Warehousing Industry Pain Points China

China Transportation Industry Future Technologies

China Grade A and Grade B Warehousing Space

China Transportation Industry Future Revenue

China Transportation Market COVID Impact

SF Express Freight Forwarding Market Shares

ZTO Freight Forwarding Market Sales

Deppon Logistics Freight Forwarding Market Shares

Yuancheng Group Freight Forwarding Market Size

Fujian Shengfeng Freight Forwarding Market Size

Leaping Express Group Freight Forwarding Market Shares

Shandong Jiayi Logistics Co Freight Forwarding Market Size

Shanghai Zeyi Logistics Freight Forwarding Market Sales

For More Information On the research report, refer to below link:-

China Logistics and Warehousing Market

Related Reports:-

Philippines cold chain market was evaluated grow at a CAGR of 12.7% during 2014-2019 owing to the launch of ‘Philippines National Cold Chain Program’ in 2004 which helped in establishment of cold chain facilities in major areas of North, Central and South Philippines. Government initiatives such as ‘Philippines Cold Chain Project’ launched in 2014, ‘Build, Build, Build’ initiative in 2018 and the annual Philippines cold chain expos conducted by CCAP have been vital for the market growth. The market has been driven primarily by the cold storage over transport business. Corespondingly, the cold chain industry has also been driven by rising meat consumption, consistent seafood production and rise in preventable diseases among Filipinos thereby augmenting the demand for vaccines and pharmaceuticals.

India has been ranked at 4th position in the world in railway freight traffic after China, the US, and Russia. Under the land freight corridors, 65% of domestic freight volume carried through the road; high compared to ~50% in developed countries. India Logistics Market has witnessed an average CAGR during FY14-FY19 due to favorable policy reforms from the government, continued investment in infrastructure by both the government and the private sector; the influx of foreign players in the market in recent years, increasing consolidation, and investing in innovative technologies has stimulated the growth in the market.

Turkey logistics and warehousing market displayed a consistent growth during the period 2013 to 2018. The growth in the automotive exports coupled with rising e-commerce sector was witnessed to drive the Turkey logistics market. The country also has a robust manufacturing sector that contributes to almost 25% of the country’s GDP and provides the boost to the logistics industry in Turkey. In addition to this, the implementation of Vision 2023 and Logistics Master Plan 2023 by the government also indicates a positive outlook for the industry. The market has increased owing to high domestic consumption and the efforts of government to boost infrastructure. The investments in infrastructure and technology have impacted Turkey logistics market positively.

Follow Our Social Media Pages:-

Facebook: https://www.facebook.com/kenresearch

Twitter: https://twitter.com/KenResearch

LinkedIn: https://www.linkedin.com/company/ken-research

Contact Us:-

Ken Research

Ankur Gupta, Head Marketing & Communications

Support@kenresearch.com

+91-9015378249

Media Contact

Company Name: Ken Research Private Limited

Contact Person: Ankur Gupta

Email: Send Email

Phone: 919015378249

Address:Unit 14, Tower B-3 Spaze i Tech park Sohna Road

City: Gurugram

State: Haryana

Country: India

Website: www.kenresearch.com