Cartea, a leading automotive media platform in the MENA region (Middle East and North Africa), has conducted a behavioral study on car buyers in Saudi Arabia and the UAE, releasing an analysis report that profiles consumers by gender, age, and location, and systematically analyzes their purchase motivations and after-sales needs.

User Profile

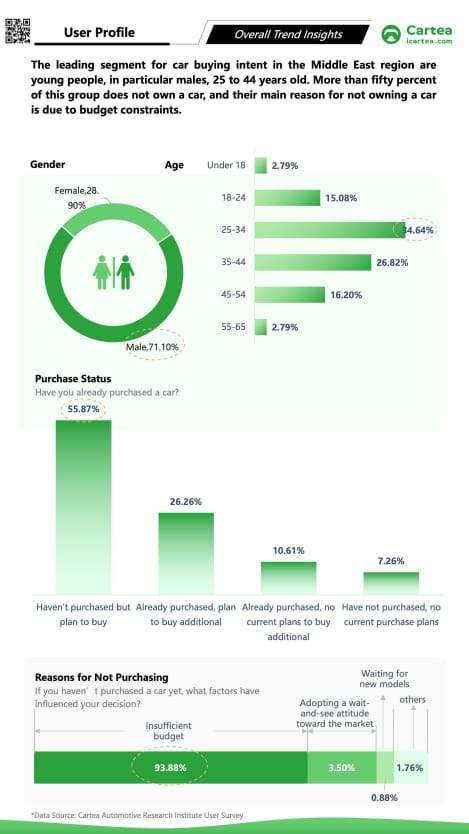

The leading segment for car buying intent in the Middle East region are young people, in particular males, 25 to 44 years old. More than fifty percent of this group does not own a car, and their main reason for not owning a car is due to budget constraints.

Car Purchase Preferences

The primary demand is for daily commuting, and the market is dominated by fuel-powered vehicles. Consumers‘ top picks are new cars, and they prefer sedans and SUVs.

With the greatest emphasis on high-temperature adaptation features like run-flat tires, air conditioning cooling, and battery heat protection, local characteristics are noticeable. Furthermore, consumers are most willing to pay for rear-seat independent seats and panoramic sunroofs, screens for entertainment.

Car Purchasing Process

Social media and vertical media platforms are the main sources of information during the three-month-long user purchase decision cycle. Practical tools like fuel, cost calculators, and3Dcarviewing features are highly desired.

Price and promotional policies are the core factors of concern for users when purchasing a car.Beyond this, users primarily focus on quality-related aspects such as performance parameters and exterior/interior design.

Only 40% of users think about making an appointment for a test drive. The main avenues for purchasing a car are still dealership outlets and dealer stores. There are serious worries regarding the security of online payments. The biggest problem when buying a car is going over budget. The most common form of payment is an installment loan, which prefers small down payments (10-30%).

After-Sales Service

The two main ways to schedule after-sales service appointments are via phone calls and WhatsApp. The most common request is for maintenance, and the main problems are long wait times and a shortage of parts. Almost 50% of users, think about paying for extra services; maintenance packages are the most common.

Focus on Chinese Automotive Brands

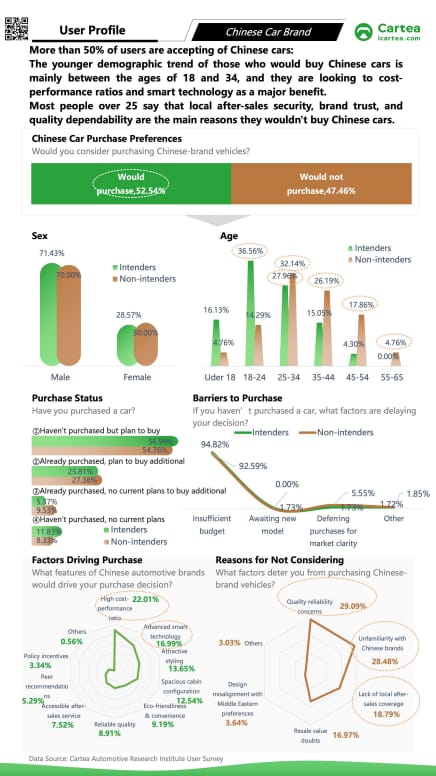

Purchase intent in the Middle East shows an obvious age divide, with younger groups(particularly those aged 18 to 34) displaying stronger preference, making quick decisions in favor of NEVs and flexible payments, while older groups show lower purchase intent, making cautious decisions, insisting on gasoline-powered vehicles, and making outright purchases.Middle Eastern market acceptance of Chinese vehicles has surpassed 50%.

The advantages of Chinese cars are their smart technology and high cost-performance ratios, but they also have three major problems: poor after-sales coverage, low brand trust, and poor local adaptation. Of these, improving A/C output and battery capacity for extreme heat is the most important localization requirement.

Future enhancements must prioritize building brand trust, expanding the after-sales network, and optimizing digital experiences for younger users.

To view the full report click here: https://www.icartea.com/en/news/cartea-2025-middle-east-car-buyer-behavior-analysis-insights-from-the-uae-saudi-arabia-and-beyond

Media Contact

Company Name: Cartea

Contact Person: David Jason

Email: Send Email

City: New York

Country: United States

Website: https://www.icartea.com/