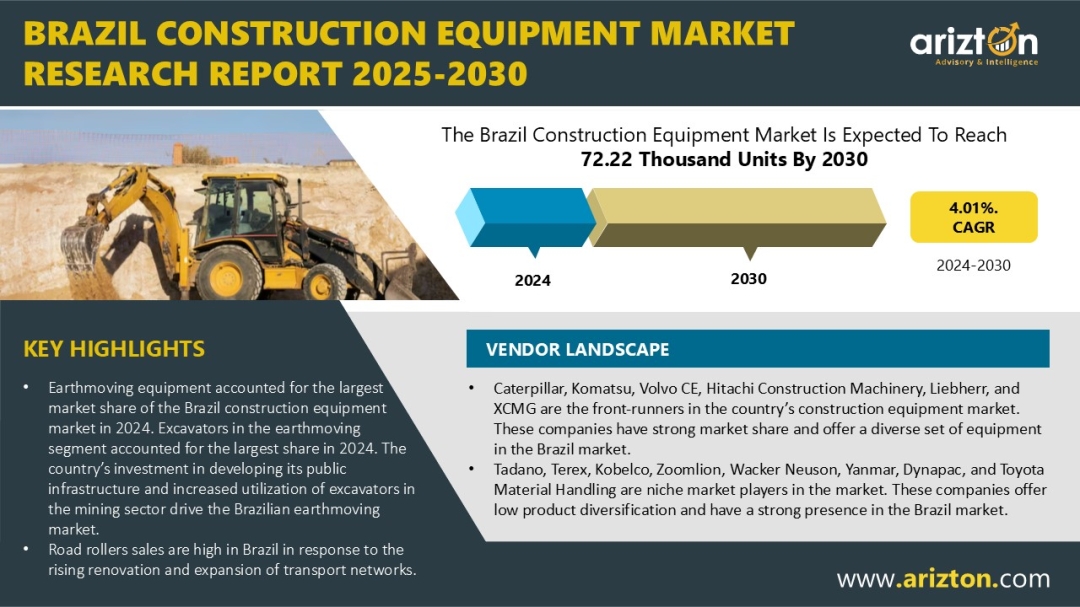

The Brazilian construction equipment market is on a clear growth trajectory, with an estimated 57.03 thousand units sold in 2024 and projections to reach 72.22 thousand units by 2030, reflecting a CAGR of 4.01%, according to a new report by Arizton. The market demonstrated a strong recovery in 2024, fueled by a combination of attractive manufacturer incentives, expanding infrastructure projects, and improving conditions in the real estate sector. These factors collectively are driving renewed demand, positioning Brazil’s construction equipment industry for sustained growth in the coming years.

Download an Illustrative overview: https://www.arizton.com/market-reports/brazil-construction-equipment-market

Report Summary:

MARKET SIZE- VOLUME (2030): 72.22 Thousand Units

MARKET SIZE- VOLUME (2024): 57.03 Thousand Units

CAGR- VOLUME (2024-2030): 4.01%

MARKET SIZE- REVENUE (2030): USD 4.15 Billion

HISTORIC YEAR: 2021-2023

BASE YEAR: 2024

FORECAST YEAR: 2025-2030

EQUIPMENT TYPE: Earthmoving Equipment, Road Construction Equipment, Material Handling Equipment, and Other Equipment

END-USERS: Construction, Mining, Manufacturing, and Others

Construction Equipment Demand Strengthens as Brazil’s Mining Sector Expands

Brazil’s mining sector is driving the next wave of construction equipment demand. The industry delivered BRL 86 billion ($15.9B) in taxes and royalties in 2023, generated a $32B trade surplus, and contributes nearly 4% of national GDP, highlighting its importance to the economy. With strong production of iron ore, niobium, manganese, graphite, and bauxite concentrated in Minas Gerais and Pará, Brazil is now pushing further into strategic minerals such as nickel, copper, rare earths, and lithium to support the global energy transition. This expansion is increasing exploration activity and attracting more investment into mining hubs. As projects scale, demand for construction equipment is rising across the full mining lifecycle, from land clearing and site preparation to drilling, extraction, processing, and long-distance haulage, making mining one of the strongest growth drivers

Brazil’s Mini Excavator Revolution: Gaining Ground

Brazil’s mini excavator market is on the rise, fueled by a growing need for compact, versatile machinery across infrastructure, agriculture, and urban projects. As small- to medium-scale construction gains momentum, operators are increasingly drawn to equipment that combines agility, fuel efficiency, and smart controls. Features like zero-swing design and digital management interfaces are no longer optional—they are becoming essential for maximizing productivity in tight spaces. At the same time, sustainability is shaping choices, with fuel-efficient engines, lower emissions, and adaptable designs meeting both environmental and operational demands. Supported by favorable import conditions and a surge in infrastructure investments, construction machinery sales in Brazil grew 22.2% in 2024, underscoring the strategic role mini excavators now play in powering the country’s evolving construction landscape.

Brazil’s Infrastructure Acceleration Sparks Soaring Machinery Demand

Brazil’s construction equipment market is growing steadily in 2025, driven by economic recovery and stronger public and private investment. The Novo PAC program is pushing major upgrades in transport, cities, energy, water access, and digital connectivity, creating consistent demand for machinery across the country. Brazil’s renewable energy push, aiming to lift its share from 16% in 2023 to 45% by 2030, along with ANEEL’s BRL 11.3 billion transmission auctions, is further boosting equipment needs. Housing construction is also rising, supported by a national deficit of 6–7 million homes and the Minha Casa, Minha Vida plan to build 2 million units by 2026. Together, these initiatives are keeping equipment utilization high and reinforcing Brazil’s position as a key growth market in Latin America.

Is Brazil’s New Equipment Market Losing Ground to Rentals and Used Machinery?

Amid rising machinery prices and economic uncertainties, contractors in Brazil are increasingly turning to equipment rental, unlocking new growth avenues for rental firms and manufacturers alike. Flexible lease agreements and innovative financing solutions are making high-quality machinery more accessible, while the market itself is gaining strategic importance, valued at approximately $1.8 billion in 2025. Over the past decade, leasing’s share of total machinery sales has doubled from 15% to 30%, reflecting a clear shift in industry behavior. While demand for rental and used machinery may moderate new equipment sales, it simultaneously opens opportunities for service providers to expand offerings, optimize fleet utilization, and strengthen long-term relationships with contractors across the country.

Request Customization: https://www.arizton.com/market-reports/brazil-construction-equipment-market

Market Players of Brazil Construction Equipment Market

Key Vendors

- Caterpillar

- Komatsu

- Volvo Construction Equipment

- Hitachi Construction Machinery

- Liebherr

- SANY

- Xuzhou Construction Machinery Group (XCMG)

- JCB

- Zoomlion

- HD Hyundai Construction Equipment

Other Prominent Vendors

- Kobelco

- Liugong Machinery Co., Ltd.

- CNH Industrial N.V.

- Toyota Material Handling International (TMHI)

- DEVELON

- Tadano

- Terex Corporation

- Manitou

- BOMAG GmbH

- Bobcat

- JLG Industries

- John Deere

- Yanmar Holdings Co., Ltd.

- Ammann

- Dynapac

- Wacker Neuson

Distributor Profiles

- Noroeste Máquinas e Equipamentos LTDA

- FW Máquinas

- Mason Equipment

- Engepeças Equipamentos Ltda

The Brazil Construction Equipment Market Research Report Includes Segments By

Earthmoving Equipment

- Excavator

- Backhoe Loaders

- Wheeled Loaders

- Other Earthmoving Equipment (Other loaders, Bulldozers, Trenchers, Motor Graders)

Road Construction Equipment

- Road Rollers

- Asphalt Pavers

Material Handling Equipment

- Crane

- Forklift & Telescopic Handlers

- Aerial Platforms (Articulated Boom Lifts, Telescopic Boom lifts, Scissor lifts)

Other Construction Equipment

- Dumper

- Concrete Mixer

- Concrete Pump Truck

End Users

- Construction

- Mining

- Manufacturing

- Others (Power Generation, Utilities, Municipal Corporations, Oil & Gas, Cargo Handling, Power Generation Plants, Waste Management)

Related Reports That May Align with Your Business Needs

What Key Findings Will Our Research Analysis Reveal?

- What are the trends in the Brazil construction equipment market?

- Who are the key players in the Brazil construction equipment market?

- How big is the Brazil construction equipment market?

- Which are the major distributor companies in the Brazil construction equipment market?

- What is the growth rate of the Brazil construction equipment market?

Why Arizton?

100% Customer Satisfaction

24×7 availability – we are always there when you need us

200+ Fortune 500 Companies trust Arizton’s report

80% of our reports are exclusive and first in the industry

100% more data and analysis

1500+ reports published till date

Post-Purchase Benefit

- 1hr of free analyst discussion

- 10% off on customization

About Us:

Arizton Advisory and Intelligence is an innovative and quality-driven firm that offers cutting-edge research solutions to clients worldwide. We excel in providing comprehensive market intelligence reports and advisory and consulting services.

We offer comprehensive market research reports on consumer goods & retail technology, automotive and mobility, smart tech, healthcare, life sciences, industrial machinery, chemicals, materials, I.T. and media, logistics, and packaging. These reports contain detailed industry analysis, market size, share, growth drivers, and trend forecasts.

Arizton comprises a team of exuberant and well-experienced analysts who have mastered generating incisive reports. Our specialist analysts possess exemplary skills in market research. We train our team in advanced research practices, techniques, and ethics to outperform in fabricating impregnable research reports.

Media Contact

Company Name: Arizton Advisory & Intelligence

Contact Person: Jessica

Email: Send Email

Phone: +1 3122332770

Country: United States

Website: https://www.arizton.com/market-reports/brazil-construction-equipment-market