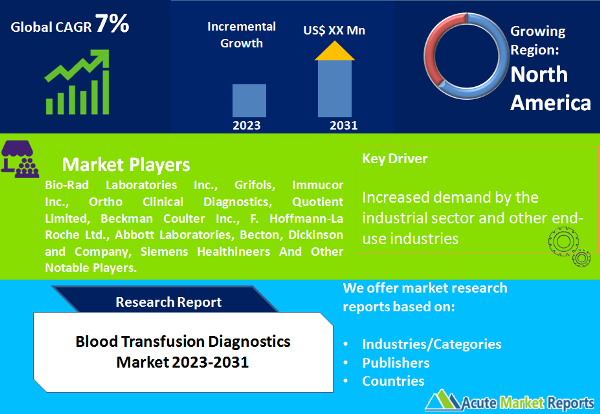

The blood transfusion diagnostics market is a vital sector of the healthcare industry that plays a vital role in ensuring safe and effective blood transfusion practices. During the period between 2023 and 2031, the market is anticipated to grow at a CAGR of 7%. This market is propelled by the rising demand for blood and blood products, the growing awareness of transfusion-transmitted infections, and the demand for accurate and efficient diagnostic methods. The market revenue has been rising consistently, and this trend is anticipated to continue in the coming years. The market’s revenue is affected by factors such as the rising number of surgical procedures, trauma cases, and chronic diseases requiring blood transfusions. In addition, the increasing incidence of blood-related disorders and the aging of the population contribute to the demand for blood transfusion diagnostics. Technological advancements have resulted in the development of innovative diagnostic methods that provide accurate and speedy results, thereby fueling market expansion. There has been a growing emphasis on the prevention and control of transfusion-transmitted infections in recent years. This has resulted in the implementation of stringent regulatory guidelines and quality assurance programs, which drive the adoption of innovative blood transfusion diagnostics. For increased sensitivity and specificity, the market is shifting from conventional serological methods to nucleic acid testing (NAT) and other molecular techniques. The rising demand for blood and blood products is a significant market driver for blood transfusion diagnostics. Surgical procedures, trauma cases, and the treatment of chronic diseases all contribute to this demand. The World Health Organisation (WHO) estimates that approximately 112.5 million units of blood are donated annually. It is anticipated that the demand for blood transfusions will increase due to the increasing prevalence of diseases such as cancer and cardiovascular disorders, which frequently necessitate blood transfusions during treatment. The growing awareness and concern about transfusion-transmitted infections (TTIs) have increased the demand for accurate blood transfusion diagnostics. TTIs are infections that can be transmitted through the transfusion of blood or blood products containing pathogens. The implementation of stringent regulatory guidelines and quality assurance programs by healthcare authorities and blood banks has further highlighted the significance of accurate and trustworthy diagnostics. To reduce the risk of TTIs, the Centres for Disease Control and Prevention (CDC) in the United States has instituted screening and testing guidelines for blood donors. This awareness has led to the adoption of sophisticated diagnostic techniques, such as nucleic acid testing (NAT), to detect infectious agents with greater sensitivity and specificity.

Browse Full Report at https://www.acutemarketreports.com/report/blood-transfusion-diagnostics-market

Innovations in diagnostic technologies have contributed significantly to the expansion of the blood transfusion diagnostics market. Diagnostics for blood transfusions have been revolutionized by the introduction of innovative tests and systems that provide greater accuracy, faster results, and increased automation. NAT techniques, such as polymerase chain reaction (PCR) and real-time PCR, have revolutionized the detection of infectious agents in donated blood, instances. These molecular-based methods have a high level of sensitivity and specificity, allowing for the early detection of pathogens and reducing the risk of transfusion-transmitted infections. In addition, advances in automation and robotics have streamlined laboratory procedures, allowing for increased throughput and efficiency in blood transfusion diagnostics. These technological advances continue to propel the market forward by providing healthcare professionals with dependable and effective tools for ensuring the safety of blood transfusions. The presence of regulatory challenges and stringent compliance requirements is one of the main market restraints for blood transfusion diagnostics. Several regulatory standards and guidelines are involved in the blood transfusion process to ensure the safety and purity of blood products. The purpose of these regulations is to reduce the risk of transfusion-transmitted infections and other adverse events. Compliance with these regulations can be difficult and resource-intensive for hospitals and blood banks. Obtaining regulatory approvals, undertaking validation studies, and adhering to quality control measures can be an expensive and time-consuming endeavor. In addition, constant updates and revisions to regulatory standards exacerbate the difficulties faced by industry participants. In the United States, for instance, blood establishments are governed by the Food and Drug Administration (FDA) and must adhere to its Current Good Manufacturing Practices (cGMP) requirements. Noncompliance can lead to fines, reputational harm, and even the cessation of operations. The complexity and expense of developing and commercializing blood transfusion diagnostics are increased by these regulatory challenges and compliance requirements, which inhibit market growth. On the basis of product, the blood transfusion diagnostics market can be divided into reagents & kits, instruments, and others. Reagents and kits are utilized for numerous tests and assays to detect infectious agents, blood group typing, and compatibility testing, and therefore play a crucial role in blood transfusion diagnostics. Due to their consumable nature and the need for continuous replenishment, these items are in high demand. During the forecast period of 2023 to 2031, the reagents & kits segment is anticipated to grow at the highest CAGR due to factors such as rising blood donation activities and the prevalence of transfusion-transmitted infections. Instruments, such as automated analyzers and laboratory apparatus, are necessary for performing diagnostic tests and guaranteeing accurate results. The enhanced efficiency, accuracy, and throughput of these instruments contribute to their widespread use in blood transfusion diagnostics. In 2022, the instruments segment held a significant revenue share, driven by the demand for advanced diagnostic technologies and the need for efficient laboratory processes. The “others” segment includes blood transfusion diagnostics ancillary products and accessories, such as control materials, calibrators, and quality control solutions. Despite this segment’s relatively modest market share, it plays a crucial role in supporting the blood transfusion diagnostics process as a whole.

Access Free Sample From https://www.acutemarketreports.com/request-free-sample/139607

Based on application, the blood transfusion diagnostics market can be divided into blood classification and disease screening. Blood grouping is the process of determining a person’s blood type and Rh factor to assure compatibility during transfusions. It is essential for assuring the success and safety of blood transfusions. As a routine procedure performed in blood banks, hospitals, and laboratories, the blood classification segment held a significant share of the market’s revenue in 2022. The growth of the blood categorization segment is driven by the rising demand for blood and blood products as well as the rising number of transfusion procedures. Blood transfusion-transmissible diseases and conditions are detected and diagnosed through disease screening. This involves testing for HIV, hepatitis, syphilis, and malaria, among other diseases. In order to prevent the transmission of infections and protect the health of both the donor and the recipient, it is essential to conduct disease screenings. Due to a growing emphasis on blood safety and the implementation of stringent regulations regarding infectious disease testing, the disease screening segment is anticipated to exhibit a higher CAGR over the forecast period of 2023 to 2031. North America will lead in revenue, while Asia-Pacific will lead in growth. During the Forecast Period, North America held a substantial revenue share of the market in 2022 due to its well-established healthcare infrastructure, high blood safety awareness, and stringent regulatory environment. Additionally, the region features sophisticated medical facilities and extensive blood transfusion services. Europe trails North America in terms of market share, as a result of increasing blood transfusion procedures, rising prevalence of blood-related disorders, and growing adoption of advanced diagnostic technologies. Due to factors such as a large patient population, improving healthcare infrastructure, and rising healthcare expenditures in countries like China and India, the Asia-Pacific region is anticipated to exhibit the highest CAGR during the forecast period of 2023 to 2031. Increasing awareness of blood safety and the implementation of stringent regulations for blood transfusion procedures also contribute to the expansion of the market in this region.

The blood transfusion diagnostics market in Latin America and the Middle East & Africa is growing steadily due to improving healthcare facilities, rising blood donation rates, and efforts to improve blood safety. The market for blood transfusion diagnostics is highly competitive, with numerous key players vying for market dominance and competitive advantage. Bio-Rad Laboratories Inc., Grifols, Immucor Inc., Ortho Clinical Diagnostics, Quotient Limited, Beckman Coulter Inc., F. Hoffmann-La Roche Ltd., Abbott Laboratories, Becton, Dickinson and Company, and Siemens Healthineers, among others, are among the market’s most prominent companies. These competitors employ a variety of strategies to maintain their market position and promote expansion. Product development and innovation are one of the main strategies adopted by companies in the blood transfusion diagnostics market. To introduce technologically advanced and trustworthy diagnostic solutions, market participants invest significantly in research and development. They intend to improve the precision, speed, and efficacy of blood transfusion diagnostics, thereby enhancing testing capabilities and ensuring the safety of blood products. Collaborations, partnerships, and acquisitions are also notable strategies that companies in this market employ. Through strategic alliances, businesses seek to capitalize on one another’s assets, expand their geographic reach, and diversify their product offerings. Collaborations with blood banks, hospitals, and research institutions assist businesses in building a solid consumer base and gaining access to a larger market.

Access All Latest Research Reports https://www.acutemarketreports.com/market-research-reports

Media Contact

Company Name: Acute Market Reports, Inc.

Contact Person: Chris Paul

Email: Send Email

Phone: US/Canada: +1-855-455-8662, India: +91 7755981103

Address:90 Church St, FL 1 #3514, New York, NY 10008, USA

City: New York

State: New York

Country: United States

Website: www.acutemarketreports.com