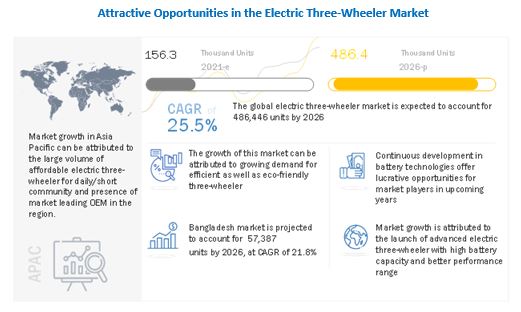

The Asia Pacific Electric Three-Wheeler Market is estimated to be 156,397 units in 2021 and is projected to grow to 486,446 units by 2026, at a CAGR of 25.5% during the forecast period. The automotive industry is at the cusp of technological evolution to develop zero-emission vehicles, while electric three-wheelers for daily commuting have become the steppingstone for the same. However, before deploying these as primary usages, electric three-wheelers need to have the necessary charging infrastructure and optimum performance. Electric three-wheelers are also noise-free. They are therefore expected to be the building block for the success of emission-free vehicles of the future.

As of 2020, the Asia Pacific electric three-wheeler market was dominated by low-speed, affordable electric three-wheelers, having a top speed of less than 25-35 km/h. To extract more performance out of these vehicles, a bigger battery and advanced motor components are required, which will increase the overall price of the vehicle. Thus, manufacturers around the region, especially from cost-sensitive markets, have stuck to the low-performance electric three-wheelers, as they make more sense economically.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=59408226

The market for electric three-wheelers with 3-6 kWh battery capacity is estimated to cover the largest market share by 2026 because of the growing demand for higher battery capacity vehicles that can be used for longer distances without energy drain of the battery. E-rickshaws and electric autorickshaws have a battery capacity of 3–6 kWh. These batteries have higher energy density and thermal stability. They are used in high-performance electric three-wheelers as they offer a high current rate, optimum thermal stability, and a long lifecycle. These batteries are preferred for long-haul as they are large enough to accommodate heavy battery packs built with low-density cells and can offer the required range. Fewer range-related issues, affordability, and a better value proposition in the shared mobility space are the three core USPs of three-wheelers with battery capacity within the range of 3–6 kWh. Industry experts claim that with more daily rides, electric three-wheelers are more lucrative. A petrol-powered three-wheeler has a running cost of about INR 4 per km, while the running cost of its electric three-wheeler is around INR 0.5 per km. Affordable three-wheelers with battery capacity within the range of 3–6 kWh are a fast-moving segment, providing last-mile connectivity and expected to grow further in the countries of Asia Pacific where transportation still poses a challenge.

The 1,000–1,500 W segment by motor power is the largest due to its extensive usage in electric three-wheelers, as it provides a better range compared to below 1,000 W in low-speed electric three-wheelers. Players such as Atul Auto and Piaggio have experienced huge growth in electric three-wheelers with motor power of 1,000–1,500 W. It is estimated that electric three-wheelers with above 1,500 W power are expected to grow at a higher rate than other segments due to their higher energy efficiency and increasing demand for high-performance electric three-wheeler freight carriers. Motor power is one of the important deciding factors in this shift as synergy of motor power with the system helps run the electric three-wheelers.

The lithium-ion segment by battery type is projected to be the faster-growing segment in the electric three-wheeler market during the forecast period. Established market players are attempting to develop electric three-wheelers equipped with advanced lithium-ion batteries. The limited lifecycle and usable capacity are likely to shift the focus from lead-acid to lithium-ion batteries and drive the electric three-wheeler market during the forecast period. Another advantage of a lithium-ion battery is lightweight, which helps maintain the energy-to-weight ratio of the vehicle. Its electrodes are made of lithium and carbon. It can store more energy per kilogram of weight compared to a lead-acid battery. High energy density helps drivers to deal with range anxiety, and hence, this factor is estimated to drive the lithium-ion battery segment during the forecast period.

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=59408226

India is the largest market in the region, followed by Bangladesh and the Philippines. India is the largest market in the region due to its government policies to support the adoption of electric three-wheelers. In August 2020, the government introduced the new Delhi Electric Vehicle Policy, 2020, intending to increase the adoption of EVs in the national capital region. The new policy proposed tax waivers, charging and swapping infrastructure establishment, battery cycling ecosystem, and creating a non-lapsable State EV Fund. In 2019, Delhi proposed open permits for electric three-wheelers. Moreover, India already has a well-established market for three-wheelers. This is because of the country’s high taxes on petrol, which increases the demand for alternative fuel vehicles. The government’s new vehicle scrappage policies will also support the growth of electric three-wheelers, besides lowering the cost by providing subsidiaries in the country. In 2020, the purchasers of e-carriers were eligible for a scrapping incentive for scrapping and then registering the old ICE goods carriers registered in Delhi. Up to ~USD 104 (INR 7,500) of the incentive shall be reimbursed by the GNCTD for the purchase of e-carriers. Regulatory support would play a key role in electric three-wheeler adoption. A combination of both fiscal and non-fiscal incentives is critical in the medium term. In terms of charging infrastructure, a mix of plug-in charging and battery swapping models must be carefully deployed for the growth of electric three-wheelers. For instance, in 2021, electric vehicle startup Zypp plans to set up 5,000 battery swapping stations for three-wheelers across India over the next three years. The last-mile delivery company, now operational in six cities, has set up 50 battery swapping stations across Delhi NCR and Jaipur.

Key Market Players:

The report analyzes all major players in the Asia Pacific electric three-wheeler market including Mahindra & Mahindra Ltd. (India), Atul Auto Ltd. (India), Piaggio Group (Italy), Lohia Auto Industries (India), and Kinetic Engineering Limited (India).

Speak to Analyst @ https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=59408226

Media Contact

Company Name: MarketsandMarkets

Contact Person: Mr. Aashish Mehra

Email: Send Email

Phone: 18886006441

Address:630 Dundee Road Suite 430

City: Northbrook

State: IL 60062

Country: United States

Website: https://www.marketsandmarkets.com/Market-Reports/asia-pacific-electric-3-wheeler-market-59408226.html