Introduction

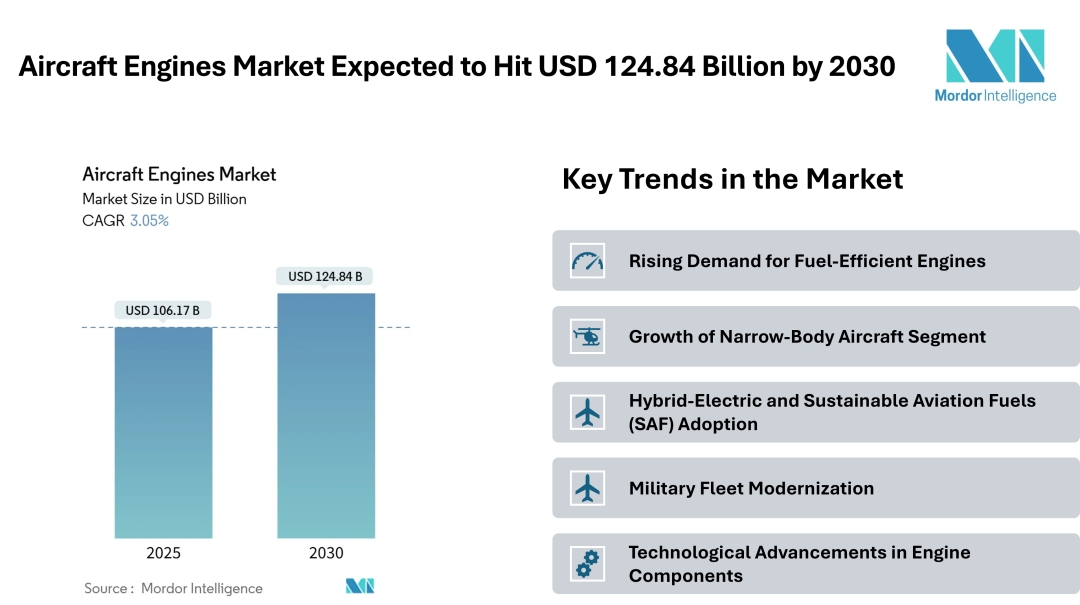

According to a 2025 report, the Aircraft Engines Market is projected to grow from USD 106.17 billion in 2025 to USD 124.84 billion by 2030 at a CAGR of 3.05%.

The aircraft engines market form the backbone of the global aviation industry, powering commercial, military, and general aviation aircraft worldwide. Over the years, the market has evolved from traditional propulsion systems to highly fuel-efficient and environmentally conscious technologies. Airlines and defense organizations are steadily upgrading fleets with engines that reduce fuel consumption, minimize emissions, and support lower operating costs.

Key Market Trends

Rising Demand for Fuel-Efficient Engines: Airlines worldwide are prioritizing engines that offer lower fuel burn and reduced operating costs. Modern turbofan and geared-turbofan engines provide significant fuel savings compared to older models, making them attractive options for both narrow-body and wide-body aircraft programs.

Growth of Narrow-Body Aircraft Segment: Short-to-medium haul routes are becoming the backbone of commercial aviation. Narrow-body aircraft such as the Boeing 737 MAX and Airbus A320neo are leading this demand, increasing the need for engines with higher efficiency and reliability for frequent, shorter flights.

Hybrid-Electric and Sustainable Aviation Fuels (SAF) Adoption: The push for greener aviation is accelerating research in hybrid-electric propulsion systems and engines compatible with SAF. This trend is driven by stricter emission norms and the global goal of carbon-neutral aviation by 2050, encouraging manufacturers to invest in low-emission technologies.

Military Fleet Modernization: Defense organizations are upgrading older fighter jets and aerial refueling tankers with new-generation engines offering higher thrust, improved fuel efficiency, and lower maintenance requirements. Programs like the KC-46A Pegasus and A330 MRTT are prime examples of this shift.

Technological Advancements in Engine Components: Manufacturers are focusing on innovations in turbine blades, gearboxes, and adaptive-cycle engine technologies to improve performance and extend engine life. These advancements also aim to lower maintenance costs while supporting higher flight frequencies.

Market Segmentation

By Aircraft Type

-

Commercial Aviation: This includes narrow-body, wide-body, and regional aircraft used in passenger and cargo operations. It represents the largest segment of the aircraft engines market, driven by global air traffic growth and fleet modernization programs.

-

Military Aviation: Covers combat and non-combat aircraft such as fighter jets, transport planes, and refueling tankers. Demand in this segment is influenced by defense budgets, modernization efforts, and strategic air mobility requirements.

-

General Aviation: Encompasses smaller civil aircraft like business jets, helicopters, turboprops, and piston-engine planes. It supports private, corporate, training, and utility missions across various regions.

-

Unmanned Aerial Vehicles (UAVs): Represents drones and unmanned platforms used for military reconnaissance, commercial applications, and emerging civil uses. Engine demand here focuses on compact, efficient, and lightweight propulsion systems.

-

Advanced Air Mobility (AAM) Vehicles: Refers to electric or hybrid-electric vertical takeoff and landing (eVTOL) aircraft, air taxis, and other next-generation urban mobility solutions aimed at sustainable and short-distance air transportation.

By Engine Type

-

Turbofan: Widely used in commercial aviation due to high fuel efficiency, low noise levels, and suitability for long-haul flights.

-

Turboprop: Preferred for regional and short-haul routes, offering better performance at lower speeds and shorter runways.

-

Turboshaft: Primarily used in helicopters and rotorcraft, optimized for vertical takeoff and landing operations.

-

Piston: Common in smaller general aviation aircraft, providing lower thrust and cost-effective performance for short distances.

-

Hybrid-Electric: An emerging segment aimed at reducing carbon emissions through partial electrification of aircraft propulsion systems.

By Technology

-

Conventional Turbofan/Turboprop: Traditional engine technology dominating current commercial and military fleets.

-

Geared Turbofan (GTF): Uses a gearbox to optimize fan and turbine speeds, improving fuel efficiency and reducing noise.

-

Contra-Rotating Open Rotor: Features dual counter-rotating propellers for higher efficiency in future aircraft concepts.

-

Adaptive-Cycle Engines: Provides variable operating cycles, delivering high efficiency in both subsonic and supersonic flight conditions.

-

Hybrid-Electric Propulsion: Focuses on integrating electric power sources to reduce fuel consumption and emissions.

By Thrust Class

-

Less than 10,000 lbf: Used in small regional aircraft, business jets, and certain rotorcraft.

-

10,001 to 25,000 lbf: Powers regional jets and some narrow-body commercial aircraft.

-

25,001 to 50,000 lbf: Suits larger narrow-body and medium wide-body aircraft fleets.

-

Greater than 50,000 lbf: Deployed in wide-body long-haul aircraft and military transport planes needing high thrust levels.

By Component

-

Compressor: Increases air pressure before combustion for greater engine efficiency.

-

Turbine: Extracts energy from hot gases to drive the compressor and fan systems.

-

Nozzle: Expels exhaust gases to generate thrust for forward propulsion.

-

Gearbox: Synchronizes engine components, improving efficiency in geared engine designs.

-

Other Components: Includes ancillary parts like bearings, seals, and casings that support engine functionality.

By End-User

-

OEM Factory-Fit: Engines supplied directly with new aircraft during manufacturing.

-

Replacement/Aftermarket: Engines or components delivered for maintenance, repair, and overhaul (MRO) needs throughout the aircraft’s lifecycle.

By Geography

-

North America: A mature and significant player in the aircraft engines market, North America benefits from a large installed base of both commercial and military aircraft. The region’s focus on modernizing fleets and meeting stringent emission standards supports robust demand for next-generation engines and MRO services.

-

South America: Although smaller in comparison to other regions, South America is gradually growing, with expanding domestic air travel and regional connectivity projects boosting the need for reliable engine solutions, especially for narrow-body and turboprop aircraft.

-

Europe: Europe remains a steady market driven by strong airline networks, defense investments, and regulatory encouragement for cleaner, more efficient engines. The presence of renowned OEMs and a well-established maintenance infrastructure underpin the region’s sustained demand.

-

Asia-Pacific: The fastest-expanding region and currently the largest market by volume. Rapid economic growth, booming passenger air traffic, and ongoing investments in fleet expansion and modernization are propelling demand across commercial, military, and emerging AAM segments.

-

Middle East & Africa: While smaller in absolute terms, this combined region exhibits one of the fastest growth trajectories. High-growth carriers, long-haul traffic hubs, and strategic overhaul programs for defense aviation are central to increasing engine demand and aftermarket services.

Major Players

-

Safran SA A French aerospace and defense group known for designing and manufacturing aircraft engines for both commercial and military sectors, as well as launch vehicle propulsion systems.

-

General Electric Company (GE Aerospace) An American manufacturer that produces jet and turboprop engines for commercial, military, business, and general aviation, including engines made via its joint venture CFM International.

-

Rolls-Royce plc A British aerospace and defense company recognized as the world’s second-largest aircraft engine maker, with strong presence in both civil and military aviation.

-

RTX Corporation A major U.S.-based aerospace and defense conglomerate that includes Pratt & Whitney, supplying engines and propulsion systems across commercial, military, and business aviation.

-

Honeywell International, Inc. (Honeywell Aerospace) A U.S. company that produces aircraft engines, auxiliary power units (APUs), and avionics, serving both commercial and defense markets with a broad product portfolio.

Conclusion

The aircraft engines market is poised for steady growth through 2030, supported by rising passenger traffic, fleet modernization programs, and increasing demand for fuel-efficient propulsion technologies. Commercial aviation continues to dominate, while military upgrades, unmanned aerial vehicles, and advanced air mobility platforms contribute to emerging opportunities.

Get More insights: https://www.mordorintelligence.com/industry-reports/aircraft-engines-market?utm_source=abnewswire

Industry Related Reports

Asia-Pacific Aircraft Engine Market: The Asia-Pacific Aircraft Engine Market is segmented by engine type (turbofan, turboprop, turboshaft, and piston), end user (commercial aviation, military aviation, and general aviation), and geography (China, India, Japan, Singapore, South Korea, and the rest of Asia-Pacific). The report provides the market size and forecasts for each segment in terms of value (USD).

Commercial Aircraft Engines Market: The report covers global commercial aircraft engine manufacturers and segments the market by aircraft type (narrow-body, wide-body, and regional aircraft), engine type (turbofan and turboprop), and geography (North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa). Market size and forecasts are provided in terms of value (USD) for all these segments.

Get More insights: https://www.mordorintelligence.com/industry-reports/commercial-aircraft-engines-market?utm_source=abnewswire

Aircraft Engine Testbed Market: The Global Aircraft Engine Testbed Market is segmented by engine type (piston engine, turboprop, and turbofan jet engine), aircraft type (fixed-wing and rotary-wing), and geography (North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa). The report provides market size and forecasts in terms of value (USD million) for all these segments.

About Mordor Intelligence: Mordor Intelligence is a trusted partner for businesses seeking comprehensive and actionable market intelligence. Our global reach, expert team, and tailored solutions empower organizations and individuals to make informed decisions, navigate complex markets, and achieve their strategic goals.With a team of over 550 domain experts and on-ground specialists spanning 150+ countries, Mordor Intelligence possesses a unique understanding of the global business landscape. This expertise translates into comprehensive syndicated and custom research reports covering a wide spectrum of industries, including aerospace & defense, agriculture, animal nutrition and wellness, automation, automotive, chemicals & materials, consumer goods & services, electronics, energy & power, financial services, food & beverages, healthcare, hospitality & tourism, information & communications technology, investment opportunities, and logistics.

For any inquiries or to access the full report, please contact: media@mordorintelligence.com

https://www.mordorintelligence.com/

Media Contact

Company Name: Mordor Intelligence Private Limited

Contact Person: Jignesh Thakkar

Email: Send Email

Phone: +1 617-765-2493

Address:5th Floor, Rajapushpa Summit, Nanakramguda Rd, Financial District, Gachibowli

City: Hyderabad

State: Telangana 500008

Country: India

Website: https://www.mordorintelligence.com/