Sickle Cell Disease Market Summary

In 2023, The United States Sickle Cell Disease (SCD) market was valued ~USD 603 million (~92% share), followed by France and the UK. SCD is a genetic disorder caused by an HBB gene mutation, producing abnormal hemoglobin that distorts red blood cells, leading to anemia, painful crises, organ damage, and reduced life expectancy. Current management includes NSAIDs, blood transfusions, chelating agents, supplements, and antibiotics, alongside FDA-approved therapies such as DROXIA (hydroxyurea), ENDARI (L-glutamine), ADAKVEO (crizanlizumab), and OXBRYTA (voxelotor). Recently approved gene therapies, CASGEVY and LYFGENIA, are expected to drive future market growth, with pipeline candidates like EDIT-301, Mitapivat, Inclacumab, and Osivelotor showing promise. Despite progress, barriers such as delayed diagnosis, high treatment costs, adherence issues, and limited awareness remain. Ongoing research in gene therapy and gene editing offers potential for transformative treatments and long-term cures.

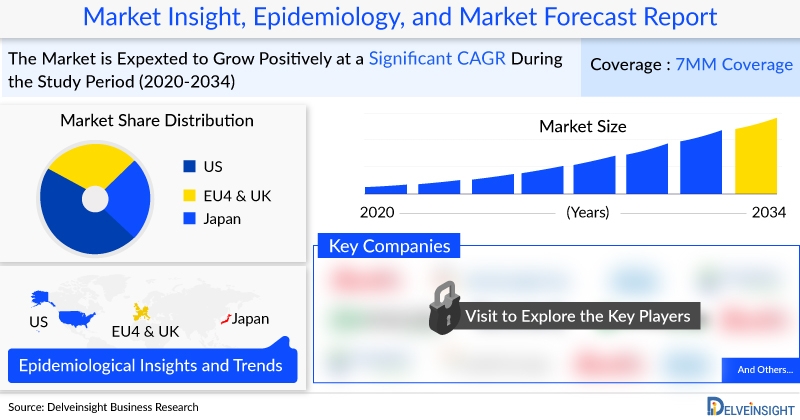

DelveInsight’s report, “Sickle Cell Disease Market Insights, Epidemiology, and Market Forecast – 2034”, offers a comprehensive analysis of Sickle Cell Disease, including historical data, future epidemiological projections, and market trends across the United States, EU5 (Germany, Spain, Italy, France, and the United Kingdom), and Japan. The study examines current treatment approaches, investigational therapies, therapy-wise market share, and market size forecasts from 2020 to 2034 across the seven major markets. Additionally, it provides insights into treatment algorithms, key market drivers and challenges, unmet medical needs, and potential opportunities shaping the future of the Sickle Cell Disease market.

Request for a Free Sample Report @ Sickle Cell Disease Market Forecast

Some facts of the Sickle Cell Disease Market Report are:

- According to DelveInsight, Sickle Cell Disease market size is expected to grow at a decent CAGR by 2034.

- Leading Sickle Cell Disease companies working in the market are Cellectis, Sana Biotechnology, Global Blood Therapeutics, Inc., CSL Behring, Pfizer, Aruvant Sciences, Graphite Bio, Novartis, Agios Pharmaceuticals, Forma therapeutics, Vertex Pharmaceuticals, Global Blood Therapeutics, Inc., Alfasigma, Novo Nordisk, bluebird bio, ExCellThera, Gamida Cell, KM Biologics/Takeda, Editas Medicine, and others.

- Key Sickle Cell Disease Therapies expected to launch in the market are BPX-501 T cells, Canakinumab, EPI01, CTX001, ADAKVEO, DROXIA, ENDARI, OXBRYTA, and many others.

- On 25 August 2025, Oryzon Genomics, S.A. (ISIN Code: ES0167733015, Ticker: ORY), a clinical-stage biopharmaceutical company and a European leader in epigenetics, today announced that the European Medicines Agency (EMA) has approved its Clinical Trial Application (CTA), the European equivalent to an IND, to initiate a Phase Ib trial of iadademstat in sickle cell disease (SCD). This will be the first clinical trial investigating iadademstat in a non-malignant hematological indication.

- In August 2025, Beam Therapeutics Inc. (Nasdaq: BEAM), a biotechnology company developing precision genetic medicines through base editing, today announced that the United States (U.S.) Food and Drug Administration (FDA) has granted Regenerative Medicine Advanced Therapy (RMAT) designation to BEAM-101, an investigational genetically modified cell therapy for the treatment of sickle cell disease (SCD).

- In July 2025, Fulcrum Therapeutics, Inc.® (Fulcrum) (Nasdaq: FULC), a clinical-stage biopharmaceutical company focused on developing small molecules to improve the lives of patients with genetically defined rare diseases, today reported positive results from the 12 mg dose cohort of the Phase 1b PIONEER trial of pociredir in sickle cell disease (SCD).

- In May 2025, Beam Therapeutics Inc. (Nasdaq: BEAM), a biotechnology company specializing in precision genetic medicines via base editing, announced it will share new findings from its BEACON Phase 1/2 clinical trial of BEAM-101 at the upcoming European Hematology Association 2025 Congress (EHA2025), scheduled for June 12–15, 2025, in Milan, Italy. BEAM-101 is an investigational ex vivo genetically modified cell therapy being developed to treat sickle cell disease (SCD), specifically in patients experiencing severe vaso-occlusive crises (VOCs).

- In November 2024, BioLineRx Ltd. (NASDAQ: BLRX) (TASE: BLRX), a commercial-stage biopharmaceutical company focused on oncology and rare diseases, announced that an abstract featuring initial results from a Phase 1 trial of motixafortide—both as a monotherapy and in combination with natalizumab for CD34+ hematopoietic stem cell (HSC) mobilization in gene therapies for sickle cell disease (SCD)—has been accepted for oral presentation at the 66th American Society of Hematology (ASH) Annual Meeting & Exposition, taking place December 7-10, 2024, in San Diego, California. Conducted in collaboration with Washington University School of Medicine in St. Louis, this proof-of-concept study aims to explore alternative HSC mobilization approaches to enhance the treatment experience for SCD patients undergoing gene therapy.

- In May 2024, Afimmune announced results of an Open-label Mechanistic Study to Assess the Pharmacokinetics, Pharmacodynamics and Safety of Orally Administered Epeleuton in Patients With Sickle Cell Disease

- In April 2024, Pfizer announced results of an Open-label Extension Study to Evaluate the Long-term Safety of GBT021601 Administered to Participants With Sickle Cell Disease Who Have Participated in a GBT021601 Clinical Trial

- In April 2024, Novo Nordisk A/S (Forma Therapeutics, Inc.) announced results of an adaptive, Randomized, Placebo-controlled, Double-blind, Multi-center Study of Oral Etavopivat, a Pyruvate Kinase Activator in Patients With Sickle Cell Disease (HIBISCUS).

- In July 2023, Novartis announced results of an Open-label, Multi-center, Phase IV, Rollover Study for Patients With Sickle Cell Disease Who Have Completed a Prior Novartis-Sponsored Crizanlizumab Study.

Sickle Cell Disease Overview

Sickle cell disease (SCD) is a hereditary blood disorder characterized by the production of abnormal hemoglobin, known as hemoglobin S. This defect causes red blood cells to assume a rigid, sickle-like shape, which impedes their ability to flow smoothly through blood vessels. Consequently, these misshapen cells can obstruct blood flow, leading to severe pain, organ damage, and an increased risk of infection.

Sickle cell disease is most prevalent among individuals of African, Mediterranean, Middle Eastern, and Indian ancestry. Symptoms typically appear in early childhood and include episodes of pain (called sickle cell crises), chronic anemia, fatigue, swelling in the hands and feet, and delayed growth. Complications can be severe, including stroke, acute chest syndrome, and organ failure.

Management of Sickle cell disease involves both preventive and therapeutic strategies. Preventive measures include regular vaccinations, antibiotics to prevent infections, and hydroxyurea, a medication that reduces the frequency of pain crises and the need for blood transfusions. Pain management, blood transfusions, and bone marrow transplants are critical therapeutic options for managing acute and chronic complications.

Recent advancements in gene therapy and CRISPR technology hold promise for more effective treatments and potential cures for Sickle cell disease. Ongoing research and clinical trials aim to improve the quality of life for patients and reduce the burden of this debilitating disease.

Do you know what will be the Sickle Cell Disease market share in 7MM by 2034 @ Sickle Cell Disease Treatment Market

Sickle Cell Disease Market Outlook

The Sickle Cell Disease (SCD) market, valued at ~USD 650 million in 2023 across the 6MM, is projected to grow significantly through 2034, driven by the introduction of novel therapies. The United States dominated with ~USD 603 million in 2023, followed by France and the UK. Key players including Pfizer, Agios Pharmaceuticals, Editas Medicine, and Roche are actively developing new treatments. Pipeline therapies such as Etavopivat, Inclacumab (PF-07940370), Reni-cel (EDIT-301), and Osivelotor (GBT-601) are expected to be major growth drivers during 2024–2034. Among these, Casgevy (Exa-cel) is anticipated to capture the largest market share by 2034 in the 6MM. While gene therapies hold transformative potential, they face hurdles related to market access, reimbursement, and limited eligible patient pools, which may restrict their overall market share despite high efficacy.

Sickle Cell Disease (SCD) is a chronic inherited blood disorder caused by mutations in the β-globin gene, resulting in abnormal hemoglobin (HbS) that distorts red blood cells into a sickle shape. This leads to vaso-occlusive crises, hemolysis, anemia, organ damage, and reduced life expectancy. While symptomatic management remains the mainstay, an effective cure is still a major unmet need. Current treatments include NSAIDs, opioids, blood transfusions, and supportive measures, with FDA-approved drugs such as hydroxyurea (DROXIA), ENDARI (L-glutamine), ADAKVEO (crizanlizumab), and OXBRYTA (voxelotor). In December 2023, gene-editing therapies CASGEVY (exa-cel) and LYFGENIA (lovo-cel) were approved, marking a milestone in curative approaches.

Non-pharmacological therapies, including cognitive behavioral therapy and relaxation techniques, are used adjunctively for pain management. Opioids remain the cornerstone for acute vaso-occlusive crises, though their adverse effects limit long-term use. The treatment landscape is evolving with a robust pipeline, including Inclacumab, Etavopivat, Mitapivat, EDIT-301, and others. Screening at birth is mandatory in the US, aiding early diagnosis and intervention.

Despite advances, barriers such as limited access to comprehensive care, poor treatment adherence, and economic burden persist. However, rising healthcare investment and ongoing R&D suggest a promising outlook for improved management and potential cures in the forecast period (2024–2034).

Sickle Cell Disease Epidemiology

In 2023, the United States recorded the highest number of Sickle Cell Disease (SCD) prevalent cases among the 6MM, with sickle cell anemia (HbSS or HbS/β⁰-thalassemia) being the dominant subtype. Within the EU4 and the UK, France had the largest SCD prevalence, followed by the UK, while Spain reported the lowest prevalence.

Sickle Cell Disease Epidemiology Segmentation

- Total prevalent cases of Sickle Cell Disease trait

- Total prevalent cases of Sickle Cell Disease

- Diagnosed cases of Sickle Cell Disease

- Age-specific prevalent cases of Sickle Cell Disease

- Type-specific prevalent cases of Sickle Cell Disease

Interested to know how the emerging diagnostic approaches will be contributing in increased Sickle Cell Disease diagnosed prevalence pool? Download report @ Sickle Cell Disease Market Dynamics and Trends

Sickle Cell Disease Drugs Uptake and Pipeline Outlook

Mitapivat (Agios Pharmaceuticals): Mitapivat is a first-in-class oral activator of the pyruvate kinase enzyme, enhancing ATP production and reducing 2,3-DPG levels. Already FDA-approved as PYRUKYND for pyruvate kinase deficiency (2022), it is being evaluated in sickle cell disease. The Phase II portion of the RISE UP trial (2023) met its primary endpoint, showing positive hemoglobin responses at both 50 mg and 100 mg BID doses.

Inclacumab (Pfizer): Inclacumab is a fully human monoclonal antibody targeting P-selectin, a key mediator of cell adhesion and vaso-occlusive crises (VOCs). With the potential for quarterly dosing, it may offer best-in-class efficacy in VOC reduction. Inclacumab has completed Phase II studies and is in Phase III development for SCD. Pfizer advanced this program after acquiring Global Blood Therapeutics (GBT) in 2022, a company focused on sickle cell therapies.

Download report to know which TOP 3 therapies will be capturing the largest Sickle Cell Disease market share by 2034? Click here @ Sickle Cell Disease Companies and Medication

Sickle Cell Disease Therapeutics Assessment

Major key companies are working proactively in the Sickle Cell Disease Therapeutics market to develop novel therapies which will drive the Sickle Cell Disease treatment markets in the upcoming years are Cellectis, Sana Biotechnology, Global Blood Therapeutics, Inc., CSL Behring, Pfizer, Aruvant Sciences, Graphite Bio, Novartis, Agios Pharmaceuticals, Forma therapeutics, Vertex Pharmaceuticals, Global Blood Therapeutics, Inc., Alfasigma, Novo Nordisk, bluebird bio, ExCellThera, Gamida Cell, KM Biologics/Takeda, Editas Medicine, and others.

Do you know how market launches of New drugs will be impacting the Sickle Cell Disease market CAGR? Download sample report @ Sickle Cell Disease Therapies and Clinical Trials

Sickle Cell Disease Report Key Insights

1. Sickle Cell Disease Patient Population

2. Sickle Cell Disease Market Size and Trends

3. Key Cross Competition in the Sickle Cell Disease Market

4. Sickle Cell Disease Market Dynamics (Key Drivers and Barriers)

5. Sickle Cell Disease Market Opportunities

6. Sickle Cell Disease Therapeutic Approaches

7. Sickle Cell Disease Pipeline Analysis

8. Sickle Cell Disease Current Treatment Practices/Algorithm

9. Impact of Emerging Therapies on the Sickle Cell Disease Market

Table of Contents

1. Key Insights

2. Executive Summary

3. Sickle Cell Disease Competitive Intelligence Analysis

4. Sickle Cell Disease Market Overview at a Glance

5. Sickle Cell Disease Disease Background and Overview

6. Sickle Cell Disease Patient Journey

7. Sickle Cell Disease Epidemiology and Patient Population

8. Sickle Cell Disease Treatment Algorithm, Current Treatment, and Medical Practices

9. Sickle Cell Disease Unmet Needs

10. Key Endpoints of Sickle Cell Disease Treatment

11. Sickle Cell Disease Marketed Products

12. Sickle Cell Disease Emerging Therapies

13. Sickle Cell Disease Seven Major Market Analysis

14. Attribute Analysis

15. Sickle Cell Disease Market Outlook (7 major markets)

16. Sickle Cell Disease Access and Reimbursement Overview

17. KOL Views on the Sickle Cell Disease Market

18. Sickle Cell Disease Market Drivers

19. Sickle Cell Disease Market Barriers

20. Appendix

21. DelveInsight Capabilities

22. Disclaimer

About DelveInsight

DelveInsight is a leading Life Science market research and business consulting company recognized for its off-the-shelf syndicated market research reports and customized solutions to firms in the healthcare sector.

Media Contact

Company Name: DelveInsight Business Research LLP

Contact Person: Ankit Nigam

Email: Send Email

Phone: +14699457679

Address:304 S. Jones Blvd #2432

City: Albany

State: New York

Country: United States

Website: https://www.delveinsight.com/consulting/conference-coverage-services