Key Takeaways

People need to know these seven essential facts about BESS in the capacity market:

- BESS helps balance the grid and supports reliability.

- The UK Capacity Market uses auctions to secure energy supply.

- They must meet strict rules to participate and qualify.

- Revenue comes from capacity payments and other markets.

- Market rules and policy changes shape their success.

- Trends like new technology and market growth drive opportunity.

Up-to-date knowledge on market participation, trading, and policy changes lets them adapt quickly, optimise revenue, and stay ahead in the 2025 UK Capacity Market

BESS in the Market

Definition

Battery Energy Storage Systems, or BESS, play the key roles in the UK Capacity Market. These systems use large batteries stored in containers. They store electricity when there is an extra supply and release it when demand rises. People can think of BESS as a buffer between renewable energy sources, like wind and solar, and the electricity grid. This buffer helps keep the power supply steady and reliable. When the sun shines or the wind blows, BESS stores the extra energy. When the weather changes and renewables produce less, BESS releases stored electricity to the grid. This process supports a low-carbon power supply and helps homes and businesses get the energy they need.

Role in Grid Stability

BESS does much more than just store energy. These systems enable the electricity grid to be stable as the UK moves away from traditional power plants. In the past, large turbines in thermal plants provided stability by spinning and creating inertia. Now, with increasing renewable resources, the grid loses some of its natural stability. BESS steps in to fill this gap. They provide synthetic inertia, which helps the grid handle sudden changes in supply or demand. BESS also supports the grid by managing voltage and providing short circuit level during faults. In Scotland, new projects utilize grid-forming batteries to set their own frequency and voltage, just like old power stations did. This makes it easier to add more renewables and cut carbon emissions. People can see how BESS helps the UK reach its clean energy goals while keeping costs down and the lights on.

UK Capacity Market

Structure

The UK Capacity Market uses a centralised system to keep the lights on. The government, with help from system operators and technical experts, decides how much electricity capacity to buy each year. This process aims to avoid shortages but also tries not to buy too much, which could raise people’s energy bills. Independent experts check these decisions to make sure they are fair and based on real needs.

The Capacity Market pays energy providers, storage operators, and demand response units for being ready to supply electricity when needed.

Auctions set the price, ensuring a competitive and cost-effective outcome.

The market includes cross-border links, but full use of foreign resources is still a work in progress.

Extra tools, like reserve pricing and strategic reserves, add more security to the system.

Key Stages

People can break down the Capacity Market process into clear steps:

-

Capacity Setting: Experts forecast how much electricity the UK will need in the future. They adjust for different technologies to make sure the plan is realistic.

-

Pre-qualification: Participants register and show they can deliver capacity. This step checks that only reliable providers join the auction.

-

Auction: Qualified participants bid in a descending clock auction. The lowest price wins, ensuring value for money.

-

Published Results: The market shares results after each auction round, so people know who won and at what price.

-

Agreement Management: If a participant wins, they must follow rules based on their type of unit—new, existing, or demand response.

-

System Stress Event: When the grid is under pressure, participants must deliver the promised capacity or face penalties.

Participation

Eligibility People can take part in the UK Capacity Market if they own or operate a qualifying energy asset. This includes generators, demand-side response units, and battery storage projects. For BESS projects, participants must pass an Extended Performance Test (EPT). This test checks if a system can deliver at least 95% of its full capacity during a contract period, usually tested on a winter day every three years. People need to plan for battery degradation over time. They might oversize their battery, add new batteries, repower, or trade their capacity in the secondary market to keep meeting their obligations. The government expects full capacity to be available, but it may make it easier to upgrade or trade assets in the future. These steps help ensure only reliable providers join the market.

Auction Process

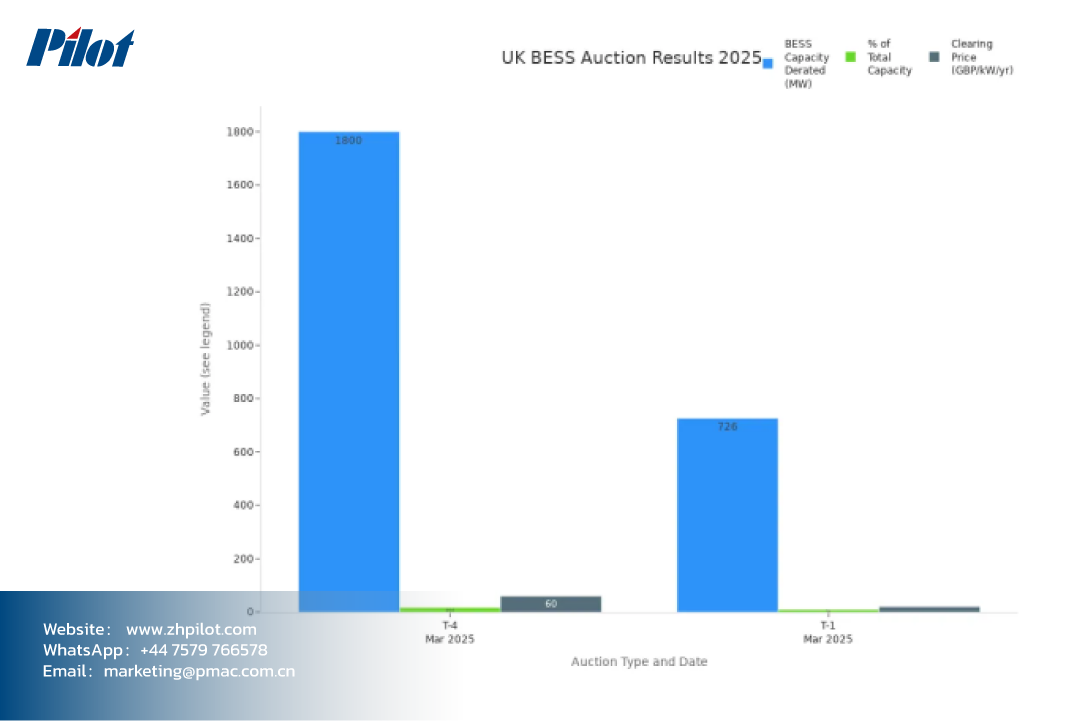

Participants will join the Capacity Market through two main auctions: T-4 and T-1. The T-4 auction happens four years before the delivery year, while the T-1 auction takes place one year before. Both auctions use a sealed-bid format. Participants must first qualify by showing they have a valid connection agreement and can meet the technical requirements. In the 2025/2026 T-1 auction, the market awarded nearly 726 MW to BESS, about 9% of the total. In the T-4 auction, BESS secured 1.78 GW, making up over 16% of the total. These numbers show that BESS is becoming more important in the market.

People must also understand de-rating factors. These factors adjust capacity based on how long a battery can deliver power. Longer-duration systems get higher de-rating factors, which means more value in the market.

Key Players

In the UK’s Battery Energy Storage Systems (BESS) market, Zenobē is a leading provider and operator. SSE is also a major player, developing and investing significantly in renewable energy, including battery storage. Besides, Flexitricity, Anesco, InterGen, TagEnergy, and EDF also play as notable developers and operators in UK capacity markets.

At Pilot, the company is devoting leading Chinese BESS devices and technical support to meet the battery storage needs in the UK Capacity Market. Interested parties can contact their dedicated team to start a BESS business now.

Revenue Streams

Capacity Payments

People can earn a steady income from capacity payments when they take part in the UK Capacity Market. These payments reward participants for making their battery system available during times of high demand or grid stress. The market holds auctions either four years (T-4) or one year (T-1) before the delivery year. If a participant wins a contract, they receive a fixed payment for each megawatt of capacity they provide. The amount received depends on the auction clearing price and the system’s de-rating factor. Longer-duration batteries, such as those that last eight hours, get a higher de-rating factor—close to 90%. Shorter-duration batteries, like half-hour systems, get a much lower factor, around 5%. This means longer-duration systems earn more from capacity payments. These payments provide a reliable revenue stream, but they usually make up only a small part of total income.

Special metering requirements for BESS are not needed, but accurate data must be provided to prove performance.

Additional Markets

People can boost their earnings by joining other markets alongside the Capacity Market. BESS operators often stack several revenue streams to get the most value from their assets. Here are the main ways extra income can be earned:

-

Energy Arbitrage: Buy electricity when prices are low and sell it when prices are high. This lets participants profit from price swings in the market.

-

Ancillary Services: Offer services like frequency regulation, voltage control, and spinning reserves. These help keep the grid stable and are paid for by the grid operator.

-

Balancing Mechanism: Take part in the Balancing Mechanism to help the grid match supply and demand in real time. This market is growing and offers more chances for batteries to earn money.

-

Demand Side Response (DSR): Adjust energy use or output to support the grid. This can be done alone or as part of a group of sites.

Battery capacity can be split to provide several services at once. This is called stacking. Stacking lets participants use their battery more efficiently and increase their total revenue. In the UK, most BESS income comes from these extra markets, especially ancillary services. The market for these services changes often, so participants need to stay alert and ready to adapt.

Market Rules

Key Regulations Strict rules must be followed to take part in the UK Capacity Market. These rules make sure the market stays fair and reliable.

-

Pre-qualification: Projects must be registered, and it must be shown that the asset can deliver the promised capacity. This step checks technical and financial readiness.

-

Performance Testing: Regular tests need to be passed to prove the system works as expected. Failure risks losing a contract or facing penalties.

-

Metering and Data: Accurate half-hourly data must be provided. This helps the market operator check performance during stress events.

-

De-rating Factors: The market uses de-rating factors to adjust capacity based on how long a system can deliver power. Longer-duration systems get higher factors.

-

Delivery Obligations: Capacity must be delivered during system stress events. Failure to do so may result in financial penalties.

2025 Amendments

Some important changes will be seen in the 2025 Capacity Market rules. These updates aim to make it easier to join the market and support the UK’s clean energy goals.

-

Self-Declaration for BESS: Battery performance can now be self-declared. This change reduces paperwork and speeds up the qualification process.

-

CO₂ Eligibility: The market now checks if projects meet new carbon limits. It must be shown that a system does not exceed the set CO₂ threshold. This rule supports the move to net zero.

-

Asset Upgrades: Batteries can be upgraded or repowered more easily. The rules now allow capacity to be traded or new batteries to be added without leaving the market.

-

Longer Agreements: New BESS projects may qualify for longer contracts if they meet certain criteria. This gives more financial certainty.

BESS Trends 2025

Market Growth

Rapid growth in battery storage will be seen across the UK and Europe in 2025. The UK now has 4.6 GW of operational battery storage, with a target of 7.4 GW by the end of 2025. Spain is also moving fast, aiming for up to 3.5 GW of storage by 2030 after a major blackout in April 2025. This shows a strong trend across Europe, as countries invest in grid resilience and new storage projects.

This growth can be seen reflected in the latest Capacity Market auctions. In March 2025, the T-4 auction awarded nearly 7 GW of battery storage, double the previous year. The T-1 auction set a new record, with 726 MW awarded. Longer-duration projects are winning more contracts, showing the market’s confidence in large-scale storage.

Technology Advances

Several new trends shaping battery storage will be noticed in 2025:

-

Battery costs are falling quickly, with a further 20-30% drop expected by 2030.

-

Projects are getting bigger, with some reaching 300 MW and plans for 1 GW sites by 2027.

-

Longer-duration batteries, up to 8 hours, are becoming more common to help manage renewable energy.

-

New battery types, such as iron-air and sodium-ion, are starting to compete with lithium-ion.

-

Second life batteries, which reuse old electric vehicle cells, are gaining interest for grid storage.

-

Tolling agreements are helping to secure more stable revenue from battery assets.

Media Contact

Company Name: Zhuhai Pilot Technology Co., Ltd.

Email: Send Email

Country: China

Website: https://www.zhpilot.com/