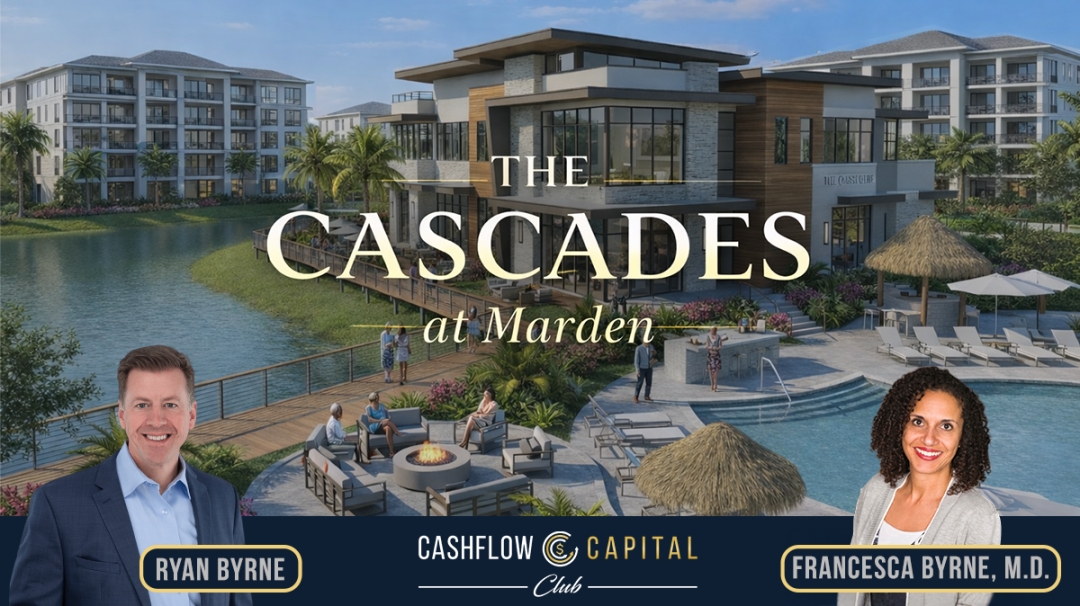

Cashflow Capital Club, led by CEO Ryan Byrne, announced the launch of The Cascades at Marden, a planned ~362-unit, purpose-built 55+ rental community in Apopka, Florida (Orlando MSA).

The firm said the project is structured with a focus on front-end risk reduction and defined execution roles, including a co-development partnership with an established national homebuilder that is funding approximately $14.5 million of site work.

“Investors don’t need a bigger story, they need stronger structures,” Byrne said. “From the start, we’ve prioritized experienced partners and a risk-mitigated structure designed to reduce early execution exposure.”

“Investors see a stock market that is wild and confusing. Idle cash in the bank is getting destroyed by inflation. Yet direct real estate ownership often means tenants, toilets, and time-consuming management. Cashflow Capital Club was built to solve that tension by confidently delivering cashflows and appreciation without a lot of risk and hassle of normal real estate investing,” Ryan Byrne states.

Byrne added that the firm’s focus is to provide investors with access to professionally managed real estate opportunities without the day-to-day operational burdens of direct ownership.

Project Overview

The Cascades at Marden is planned as a Class-A 55+ rental community designed for independent, active-adult residents seeking maintenance-free living, amenities, and community without the responsibilities of homeownership. Cashflow Capital Club said the community will be designed around lifestyle preferences common to the 55+ renter: flexibility, convenience, wellness, and social connection.

Execution Partners and Capital Protection Features

Cashflow Capital Club said the project team and development plan are designed to emphasize capital protection features and reduce early-stage execution risk factors associated with ground-up development.

According to the firm:

- An established national homebuilder is serving as a co-development partner and is funding approximately $14.5 million of site work. The sponsor described this as meaningful front-end risk reduction, reducing required equity and helping protect early execution phases.

- General Contractor is a top five player in south Florida, bring over $1 billion bonding capacity on deliver and execution with tunnel form construction methods intended to support schedule predictability and consistent delivery quality.

- An experienced 55+ operating team is expected to manage lease-up and resident experience, with the sponsor noting that operating performance and retention are central to stabilized outcomes.

The firm also stated that sponsor capital will be invested alongside investors, positioning the project as an alignment-focused offering.

Why Apopka in the Orlando MSA

Apopka is located within the Orlando MSA, a region that has experienced sustained population growth and housing demand. The sponsor cited local demand drivers, supply realities, and execution planning as the primary determinants of the project’s location and timing.

“Macro narratives come and go,” Byrne said. “What matters is local demand, the lack of supply, and a team with a plan and quality execution.”

Investor Information

Cashflow Capital Club said it expects interest from accredited investors seeking passive real estate investing in Orlando and exposure to demographic-driven rental housing demand in Central Florida. The firm noted that its approach emphasizes underwriting discipline, experienced partners, and structured execution planning.

Additional information about Ryan Byrne and Cashflow Capital Club, including the firm’s investment approach and updates on The Cascades at Marden, is available at: www.cashflowcapitalclub.com

About Cashflow Capital Club

Founded by Ryan Byrne, Cashflow Capital Club sponsors private real estate investment opportunities for investors seeking passive exposure to multifamily and senior-housing-adjacent strategies. The firm focuses on Orlando multifamily investing and select opportunities in other growth markets, including Dallas, Texas, partnering with experienced developers, builders, general contractors, and operators to support risk-managed execution. Cashflow Capital Club emphasizes disciplined underwriting, transparency, and alignment of interest by investing sponsor capital alongside investors, within a broader multifamily development fund approach across targeted markets.

Securities Disclosure: This press release is for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy any security. All investments involve risk, including the possible loss of principal. Past performance does not guarantee future results. Any projections discussed are not guarantees.

Media Contact

Company Name: Cashflow Capital Club

Contact Person: Rona Del Torre

Email: Send Email

Country: United States

Website: www.cashflowcapitalclub.com