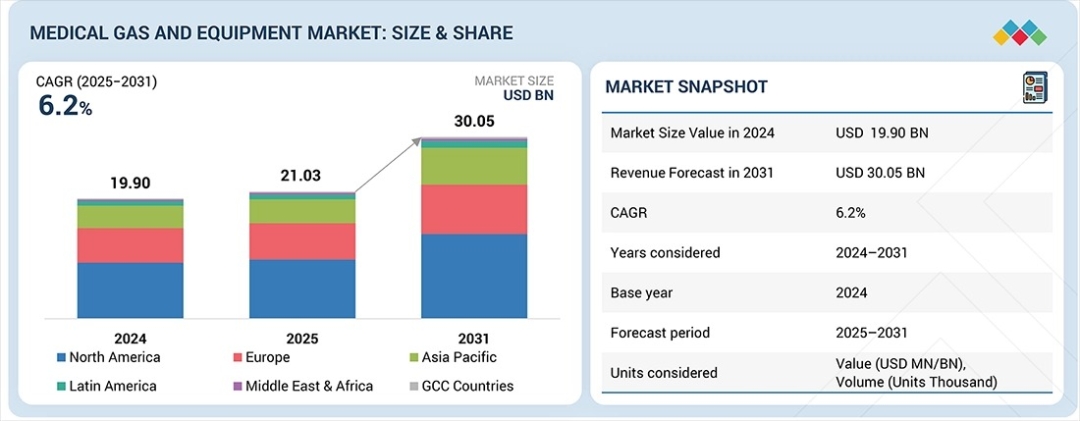

The global medical gas and equipment market is entering a critical growth cycle, presenting strategic implications for healthcare executives, infrastructure investors, and medical technology providers worldwide. Valued at US$19.90 billion in 2024, the market reached US$21.03 billion in 2025 and is projected to expand at a resilient CAGR of 6.2% through 2031, ultimately reaching US$30.05 billion by the end of the forecast period.

What is driving this sustained momentum, and why does it matter now? The answer lies in the rising demand for advanced healthcare services across hospitals, clinics, and homecare settings, combined with structural shifts in demographics and disease prevalence.

Download PDF Brochure:https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=217979261

Market Overview

The medical gas and equipment market plays a foundational role in enabling modern healthcare delivery by ensuring a safe, reliable, and uninterrupted supply of essential gases and associated systems. It encompasses medical gases such as oxygen, nitrous oxide, and medical air, along with gas delivery devices, pipeline infrastructure, monitoring systems, and on-site gas generation solutions.

Growth is closely linked to increasing requirements for respiratory care, anesthesia, and critical care, as well as rising surgical volumes and outpatient procedures. As healthcare providers intensify their focus on patient safety, regulatory compliance, operational efficiency, and supply chain reliability, adoption of smart gas management systems and integrated pipeline solutions continues to accelerate. These technological advancements, coupled with ongoing healthcare infrastructure development, are reshaping the competitive landscape.

United States Market Insights

In the United States, growth in the medical gas and equipment market is strongly influenced by the rising burden of chronic respiratory diseases, including COPD and asthma. An aging population requiring long-term oxygen therapy and a growing number of surgical and critical care procedures are driving consistent demand for anesthetic and respiratory gases.

Modernization of healthcare facilities, increasing healthcare expenditure, and the expanding adoption of home healthcare solutions such as portable oxygen concentrators are reinforcing market expansion. How healthcare systems respond to these trends will directly influence procurement strategies and long-term infrastructure investments.

Driver: Rising Demand for Medical Oxygen

The escalating demand for medical oxygen remains the primary catalyst for market expansion. Medical oxygen is indispensable for treating acute and chronic conditions, including COPD, asthma, pneumonia, and cardiovascular diseases. It is essential in respiratory therapy, intensive care, anesthesia, emergency medicine, and post-surgical recovery.

As the incidence of respiratory diseases rises and populations age, hospital admissions and ICU utilization continue to grow. At the same time, the expansion of home healthcare and long-term oxygen therapy is increasing demand for portable oxygen concentrators and advanced delivery systems. Investments in hospital infrastructure, on-site oxygen generation systems, and supply chain resilience further reinforce oxygen’s central role in driving the medical gas and equipment market.

Restraint: Declining Reimbursements for Respiratory Therapies

Despite strong demand fundamentals, declining reimbursements for respiratory therapies present a notable constraint. Cost-containment initiatives by government and private payers in advanced healthcare systems have reduced reimbursement rates for home oxygen therapy and related respiratory care services.

This shift places financial pressure on hospitals, durable medical equipment suppliers, and homecare providers, limiting capital allocation toward advanced gas delivery and monitoring technologies. Lower reimbursement levels may also slow adoption of higher-cost respiratory equipment, particularly in mature markets where respiratory therapies account for a significant share of usage. As a result, profitability considerations are increasingly shaping investment decisions across the sector.

Opportunity: Expansion of the Healthcare Industry

The ongoing expansion of the global healthcare industry represents a substantial opportunity for the medical gas and equipment market. Rising investments in healthcare infrastructure across developed and emerging economies are driving the construction of new hospitals, clinics, ambulatory surgical centers, and diagnostic facilities.

Simultaneously, existing facilities are undergoing modernization and capacity expansion to meet higher safety, regulatory, and operational standards. Increasing healthcare access, expanding insurance coverage, and higher healthcare spending are contributing to greater patient volumes and procedural intensity. This growth translates directly into increased demand for medical gas pipeline systems, bulk gas storage, delivery equipment, and monitoring technologies, reinforcing positive long-term market prospects.

Challenge: Limited Availability of Medical Gases

One of the most pressing challenges remains the limited availability of medical gases in regions with underdeveloped healthcare infrastructure or unstable supply chains. Constraints such as limited production capacity, reliance on centralized manufacturing facilities, transportation bottlenecks, and shortages of cylinders and storage systems can disrupt the continuous supply of essential gases like oxygen and medical air.

These vulnerabilities become more pronounced during periods of heightened demand, such as public health emergencies or sudden surges in hospital admissions. Additionally, high production, storage, and distribution costs, combined with strict regulatory requirements, can restrict access in remote and low-income communities. Strengthening localized production capabilities and building more resilient supply networks are therefore emerging as strategic priorities.

Segment Analysis

By type, medical gases account for the largest share of the medical gas and equipment market due to their indispensable and continuous use across healthcare settings. Unlike equipment, which is typically purchased periodically, gases require uninterrupted and recurring supply, resulting in sustained demand.

By application, therapeutic uses represent the largest segment, as medical gases are central to treating acute and chronic diseases across hospitals, clinics, and homecare environments. Rising rates of respiratory and cardiovascular disorders, along with increased surgical volumes, continue to support high utilization levels.

From an end-user perspective, hospitals and clinics dominate the market. These facilities deliver acute, chronic, and critical care services and require continuous, compliant medical gas infrastructure to support operating rooms, ICUs, neonatal units, and recovery wards. Strict regulatory requirements further reinforce consistent investment in reliable gas systems.

Regional Outlook

Asia Pacific is projected to be the fastest-growing region in the global medical gas and equipment market during the forecast period. Rapid healthcare infrastructure development in China, India, and Southeast Asian countries, combined with rising populations and increasing chronic disease prevalence, is generating significant demand for medical gases and related equipment.

Government-led investments in hospital construction and modernization, expansion of critical care capacity, and improved healthcare accessibility are accelerating installations of medical gas pipeline systems and local gas production facilities. Growing healthcare spending and the expanding presence of global market players further strengthen the region’s growth trajectory.

Request Sample Pages-https://www.marketsandmarkets.com/requestsampleNew.asp?id=217979261

Competitive Landscape

The global medical gas and equipment market features established industry participants, including Air Liquide (France), Linde Plc (Germany), Taiyo Nippon Sanso Corporation (Japan), Air Products and Chemicals Inc. (US), Atlas Copco AB (Sweden), GCE Group (Sweden), Messer SE & Co. KGaA (Germany), Rotarex (Europe), and Norco Inc (US). These companies continue to expand capacity, enhance technological innovation, and strengthen supply chain networks to address rising global demand.

Why This Matters Now

As healthcare systems worldwide confront rising chronic disease rates, aging populations, and increasing procedural volumes, the medical gas and equipment market has evolved into a strategic infrastructure segment. For CEOs, CFOs, and healthcare leaders, decisions made today regarding supply security, infrastructure modernization, and technology integration will shape operational resilience and long-term financial performance through 2031 and beyond.

Media Contact

Company Name: MarketsandMarkets™ Research Private Ltd.

Contact Person: Mr. Rohan Salgarkar

Email: Send Email

Phone: 18886006441

Address:1615 South Congress Ave. Suite 103, Delray Beach, FL 33445

City: Florida

State: Florida

Country: United States

Website: https://www.marketsandmarkets.com/