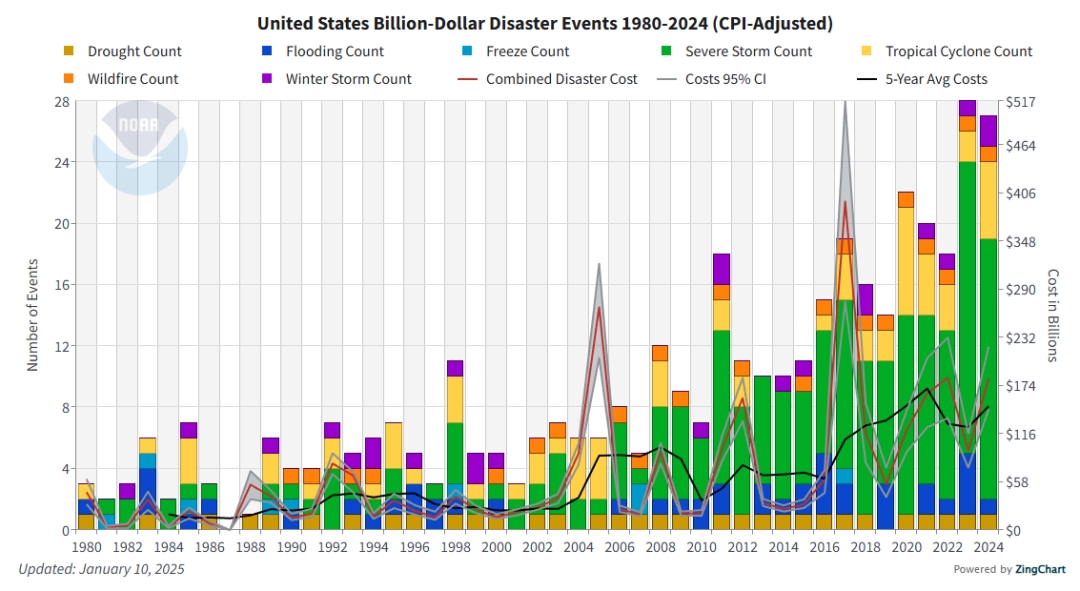

Salt Lake City, Utah – America’s flood maps are falling behind a rapidly growing reality: flood disasters are escalating nationwide, exposing millions of households to rising risk. New national data from NOAA’s National Centers for Environmental Information (NCEI) shows a sharp escalation in the number of billion-dollar weather and climate disasters across the United States from 1980 to 2024. This includes the most common natural disaster, flooding.

Yet many communities still rely on FEMA flood maps that have not been updated in years or decades, creating a widening gap between mapped risk and actual risk.

“Flooding is evolving faster than FEMA’s mapping cycle,” said Brian Adamson, spokesperson for FloodPrice.com. “Homeowners who believe they’re ‘low risk’ based solely on FEMA maps may be facing far greater exposure today than those maps suggest.”

Flood Disasters Are Increasing — Even in Areas Considered “Low Risk”

The long-term national trend is unambiguous: the U.S. is experiencing more frequent and more costly flood-related disasters. NOAA’s Billion-Dollar Disasters analysis shows a dramatic increase in severe storm, tropical cyclone, and flooding events over the past several decades, with cumulative annual costs often surpassing $100 billion.

The chart shows losses adjusted for inflation (CPI), meaning all costs are converted into today’s dollars so they can be accurately compared across decades. It represents direct losses from major weather events, including flooding, severe storms, tropical systems, and winter storms.

*Chart Source: NOAA National Centers for Environmental Information (NCEI) U.S. Billion-Dollar Weather and Climate Disasters (2025). https://www.ncei.noaa.gov/access/billions/, DOI: 10.25921/stkw-7w73

Additional information can be found here: https://www.ncei.noaa.gov/access/billions/state-summary/US

A New Challenge: NOAA Will No Longer Update the Billion-Dollar Disasters Dataset

NOAA recently announced that its National Centers for Environmental Information (NCEI) will discontinue updates to the Billion-Dollar Weather and Climate Disasters dataset due to changing priorities, statutory requirements, and staffing limitations. All existing reports from 1980–2024 will remain fully archived and authoritative, but no new annual updates are planned. NOAA has invited public feedback through the NESDIS Notice of Changes website.

This change has significant implications. For more than four decades, the dataset has been one of the clearest nationwide indicators of the financial toll of severe weather and flood-related events. Without future updates, homeowners, insurers, local governments, and researchers may have less visibility into emerging risk trends at a time when flood hazards continue to intensify.

“This type of information gap affects preparedness,” added Adamson. “As major national datasets sunset and FEMA’s maps continue to lag behind reality, homeowners will need additional tools to understand their true flood exposure.”

Outdated FEMA Maps Leave Millions Vulnerable

Federal and independent analyses continue to show that FEMA flood maps underrepresent real-world flood risk:

- Nearly two-thirds of FEMA flood maps are more than five years old, and many communities still rely on decades-old data.

- Current maps do not fully account for climate-driven rainfall, land-use changes, or sea-level rise.

- More than 25% of flood insurance claims occur outside FEMA’s “high-risk” zones — areas where coverage is often optional.

As flood disasters increase and updated mapping becomes less frequent, the burden shifts to homeowners to proactively identify their exposure.

How Homeowners Can Stay Ahead of Rising Flood Risk

1. Check your property’s flood zone using updated tools.

FloodPrice.com offers a free lookup tool that pulls official FEMA data while providing clear guidance.

Visit: https://www.floodprice.com/fema-flood-zone-map

2. Review your homeowners policy.

Standard homeowners insurance typically does not cover flood damage from a natural source.

3. Compare NFIP and private flood insurance.

Private flood insurance options may offer different coverage features and improved pricing, depending on eligibility. For a fast online quote that offers a side-by-side comparison, visit FloodPrice.com.

4. Consider mitigation steps.

Improving drainage, installing backflow valves, elevating mechanical systems, and other steps can reduce flood impact and may reduce the cost of a flood policy.

About FloodPrice.com

FloodPrice.com is a national flood insurance marketplace helping homeowners understand flood risk and compare NFIP and private flood insurance options online in minutes. With easy-to-use tools and transparent guidance, FloodPrice.com empowers homeowners to make informed decisions about protecting their property.

Learn more or check your property’s flood zone at:

https://www.floodprice.com/fema-flood-zone-map

Media Contact

Company Name: FloodPrice.com

Contact Person: Nancy Reveles

Email: Send Email

City: Salt Lake City

State: Utah

Country: United States

Website: www.floodprice.com