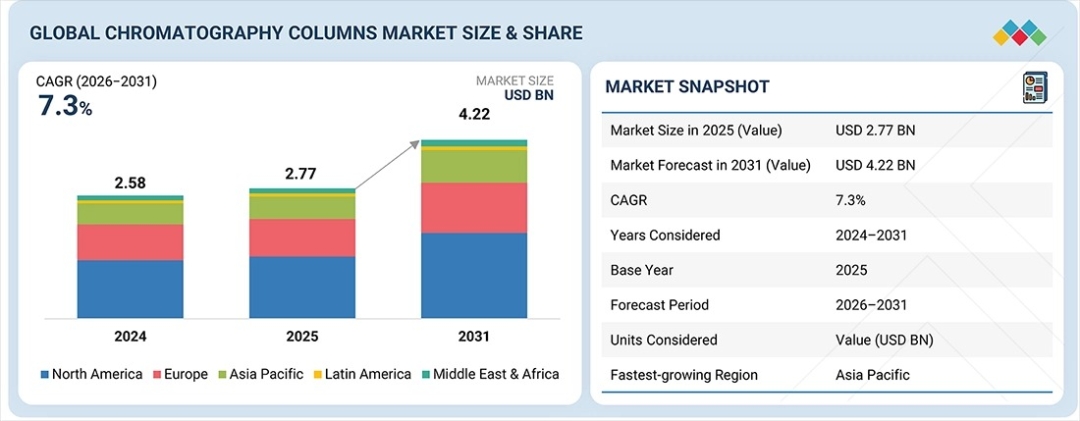

The global chromatography columns market is entering a period of sustained expansion, with valuation rising from $2.77 billion in 2025 to a projected $4.22 billion by 2031, reflecting a compound annual growth rate (CAGR) of 7.3%. This growth trajectory signals a fundamental shift in how pharmaceutical, biotechnology, and clinical research organizations approach analytical precision, purification efficiency, and regulatory compliance in an increasingly complex therapeutic landscape.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=143527928

Why does this matter now?

The surge in demand is directly linked to the accelerating production of biologics—including monoclonal antibodies, mRNA therapeutics, oligonucleotides, and recombinant proteins—where chromatography columns serve as mission-critical infrastructure for ensuring product purity, batch consistency, and regulatory approval. As chronic disease burdens intensify globally and advanced therapies move from R&D to commercial scale, organizations are investing heavily in ultra-high-performance liquid chromatography (UHPLC), specialty column chemistries, and platform-aligned purification systems that deliver reproducibility across multi-site operations.

What is driving strategic adoption?

C-suite executives and procurement leaders are prioritizing chromatography columns that integrate seamlessly with LC-MS platforms, minimize method-transfer risk, and support harmonized workflows across geographies. The emphasis has shifted from treating columns as consumables to recognizing them as strategic assets that directly impact time-to-market, compliance confidence, and competitive differentiation. High-resolution, high-throughput columns are now central to quality control assays, impurity profiling, stability testing, and bioanalytical validation—activities that underpin regulatory submissions to the FDA, EMA, and global pharmacopeias.

Strategic Market Insights: Regional Leadership and Segment Performance

Where is market concentration strongest? North America commands 44.4% of global revenue share in 2025, driven by the region’s dense biopharmaceutical ecosystem, established regulatory infrastructure, and significant contract research organization (CRO) and contract development and manufacturing organization (CDMO) activity. European markets follow closely, supported by stringent quality standards and robust life sciences research networks.

Which segments are experiencing the highest growth?

Packed columns—offering superior separation efficiency, versatility, and compatibility with both HPLC and UHPLC systems—are expected to register the strongest CAGR of 7.5% through 2031. Meanwhile, high-capacity columns exceeding 1,000 ml are projected to grow at 8.0% CAGR, reflecting intensified large-scale biologics purification and production workflows.

Who are the primary end users?

Pharmaceutical and biotechnology companies represent 38.0% of market demand in 2025, leveraging chromatography columns for API analysis, therapeutic drug monitoring, and large-scale downstream processing. Clinical research organizations, CDMOs, academic institutions, and environmental testing labs constitute rapidly expanding customer segments as analytical complexity and regulatory scrutiny increase across industries.

Competitive Landscape: Established Leaders and Emerging Innovators

Who dominates the competitive arena?

Thermo Fisher Scientific (US), Agilent Technologies (US), and Waters Corporation (US) maintain leadership positions based on comprehensive LC-MS/MS portfolios, extensive installed bases, and differentiated application-support capabilities. These organizations are investing in platform-aligned column chemistries, extended column lifetimes, and advanced stationary-phase technologies that address the evolving needs of regulated environments.

How are emerging players positioning themselves?

Restek Corporation (US), Sartorius AG (Germany), and Avantor (US) are establishing competitive footholds through targeted product launches featuring advanced column designs, specialized chemistries for complex biomolecules, and innovations in single-use and pre-packed formats. Their market entry strategies emphasize cost-effectiveness, technical differentiation, and responsiveness to unmet needs in high-growth segments such as peptide therapeutics and oligonucleotide purification.

What recent innovations are reshaping the landscape?

In January 2025, Bio-Rad Laboratories launched Foresight Pro 45 cm inner diameter chromatography columns designed for downstream process-scale applications, enhancing scalability for biologics manufacturers. Waters Corporation expanded its MaxPeak Premier portfolio with OBD Preparative Columns and introduced BioResolve Protein A Affinity Columns with MaxPeak Premier Technology—the company’s first affinity chromatography offering—delivering precise titer measurements and minimizing non-specific adsorption of metal-sensitive analytes.

Market Dynamics: Drivers, Restraints, Opportunities, and Challenges

What factors are propelling market expansion? Rising regulatory compliance requirements and quality control mandates from global health authorities are driving sustained demand for high-performance chromatography columns. Pharmaceutical and biotechnology companies are conducting more stability studies, impurity profiling, and method validation exercises as part of routine batch release procedures, directly increasing column consumption and replacement cycles.

What constraints must stakeholders navigate? The high capital costs associated with advanced chromatography systems—including UHPLC and preparative chromatographs—present barriers to entry for smaller laboratories and institutions in emerging markets. Recurring operational expenses related to column replacement, solvents, reagents, and skilled personnel further compound total cost of ownership concerns.

Where do the most significant opportunities lie? Geographic expansion in the Asia Pacific, Latin America, and Middle East & Africa represents a transformative growth opportunity. Countries such as China and India are modernizing analytical infrastructure, scaling biopharmaceutical manufacturing capacity, and adopting pre-packed, high-performance columns to support regulatory harmonization and quality-control workflows. Rising environmental monitoring and food safety standards in these regions are broadening the addressable market beyond traditional pharmaceutical applications.

What challenges could impact growth trajectories? The shortage of skilled separation scientists and chromatography specialists remains a persistent challenge, particularly in regions with limited formal training programs. Industry surveys indicate that staffing gaps in method development and data interpretation roles are extending validation cycles and reducing laboratory productivity, necessitating investment in workforce development and knowledge-transfer initiatives.

Request Sample Pages : https://www.marketsandmarkets.com/requestsampleNew.asp?id=143527928

Industry Applications: Proven Use Cases Across Pharmaceutical and Biotechnology Workflows

Leading manufacturers are deploying chromatography columns across critical applications that demonstrate tangible business value:

Biopharmaceutical Purification: Pre-packed columns enable high-throughput purification of monoclonal antibodies, vaccines, and recombinant proteins, delivering superior separation efficiency, tight peak symmetry, and excellent resolution for complex biological samples.

Pharmaceutical Quality Control: Advanced column technologies support API assay, impurity profiling, and dissolution testing, helping organizations meet FDA, USP, and ICH requirements while maintaining batch-to-batch consistency.

Trace Compound Analysis: MaxPeak High Performance Surfaces (HPS) technology minimizes non-specific adsorption of metal-sensitive analytes, improving detection and quantification accuracy for organophosphates, chelating compounds, and trace pharmaceuticals.

Large-Scale Downstream Processing: Foresight Pro Process-Scale prepacked columns facilitate capture, intermediate, and polishing stages in commercial biologics production, reducing contamination risk and improving throughput efficiency.

Ecosystem Architecture: From Raw Materials to End-User Integration

The chromatography columns ecosystem encompasses a sophisticated value chain connecting stationary phase developers, silica and polymeric particle manufacturers, precision hardware suppliers, column manufacturers, distributors, and diverse end-user segments. Manufacturers differentiate through proprietary chemistries, UHPLC compatibility, and application-specific solutions, while component suppliers provide packing materials and precision modules that determine column performance and reliability.

Distribution networks manage installation, service, and localized regulatory compliance across North America, Europe, and high-growth Asian markets. Demand-side stakeholders—including pharmaceutical R&D laboratories, CROs, CDMOs, clinical testing facilities, and academic research institutions—leverage chromatography columns for drug discovery, method validation, bioanalysis, therapeutic monitoring, and life sciences research, underscoring the technology’s cross-industry utility.

Strategic Outlook: Why This Matters for Decision-Makers

For C-suite executives, the chromatography columns market represents both a operational necessity and a strategic lever for competitive advantage. Organizations that invest in standardized column platforms, validated method libraries, and skilled analytical teams will accelerate regulatory timelines, reduce validation burden, and enhance cross-site collaboration. The transition from fragmented consumables procurement to strategic platform partnerships reflects broader trends toward operational excellence, risk mitigation, and quality-by-design principles in pharmaceutical manufacturing.

When should organizations act? Market dynamics favor early movers who establish platform alignments, secure supply relationships with differentiated column providers, and build internal capabilities in advanced separation science. The convergence of biologics growth, regulatory intensity, and technological innovation creates a narrow window for organizations to optimize analytical infrastructure before competitive pressures intensify.

Market Outlook Through 2031

The chromatography columns market is evolving from a commodity segment into a strategically critical component of global pharmaceutical and biotechnology infrastructure. Growth will be sustained by expanding therapeutic pipelines, increasing regulatory scrutiny, geographic diversification of manufacturing capacity, and ongoing innovation in column chemistries and formats. Organizations that align procurement strategies with long-term platform roadmaps, invest in workforce development, and prioritize suppliers with proven regulatory support capabilities will be best positioned to capitalize on this high-growth opportunity.

Media Contact

Company Name: MarketsandMarkets™ Research Private Ltd.

Contact Person: Mr. Rohan Salgarkar

Email: Send Email

Phone: 18886006441

Address:1615 South Congress Ave. Suite 103, Delray Beach, FL 33445

City: Florida

State: Florida

Country: United States

Website: https://www.marketsandmarkets.com/Market-Reports/chromatography-columns-market-143527928.html