The pandemic turned the real estate market upside down with real estate values surging throughout the country. With values rising everywhere, everyone seemed like a winner. Unfortunately, the boom town days are coming to an end. Real Estate fundamentals or lack thereof will define the winners and losers in this cycle. Here are three trends that will influence the winners in 2026. What will be the safest real estate bets in the years to come?

Three trends to guide your investing in 2026 and beyond

Fundamentals in real estate will be the decider of winners and losers as we transition to a new phase in the pandemic. The past winners will not perform in this cycle. Peloton was a darling during the pandemic, and now it is down substantially; this is a warning to real estate owners/investors that everything does not always go up. The pandemic changed people’s attitudes towards work, play, and family. Here are three trends that will influence the winners in the next cycle.

1. Family: US birth rates were already falling before the pandemic, now they are the lowest in 50 years to 1.64 for each woman (down from 3.65). With less children, the amount of space and location are altered.

2. Work: Old trends hard to break. Business travel and back to office will continue to gain steam. Delta is forecasting huge demand for business travel. This leads us to the question, if business travel is going to roar back, who are the travelers visiting? Others in the office! I don’t foresee where all the business meetings will now take place in pajamas in a basement home office. With business travel coming back and offices transitioning to more normalization, employee location will come into play. If you now have to go back in the office, it is not feasible to live 100 miles from the office.

Note, this trend was supercharged in 25 and will continue in 26 as the unemployment rate continues to rise and businesses continue to gain leverage.

3. Play: Millennials largest cohort of borrowers making up 37% of all purchases, many of these younger buyers are childless. With a younger cohort of buyers, they will coalesce around areas that have the amenities they desire: restaurants, nightlife, similar age cohorts, etc… which are typically found in more urban areas. Note some cities will come back strong, while others will languish as the demand moves to urban areas just outside the city core. A good example is Cherry Creek in Denver that is thriving versus areas in downtown Denver that are struggling.

How are the three trends above going to shape real estate values going forward:

Delta Airlines CEO in their recent earnings call said: “When we get to spring and summer, we’ll see a robust demand for business and consumer travel,”. Delta is anticipating this surge in demand by increasing hiring and plane capacity. On the flip side, Peloton shares have plummeted as investors play the reopening trade. Work continues to “normalize” in 2026 while low birth rates will continue, and Millennials will continue to be the largest buyers in the housing market. How does this influence where you should invest in real estate?

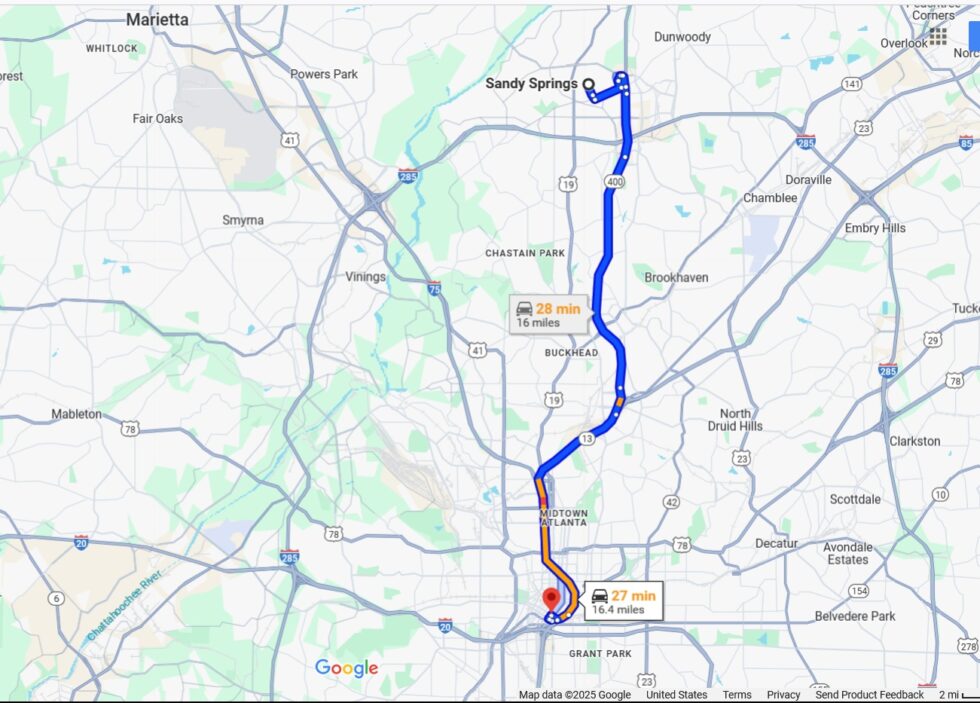

1. Cities and Suburbs will come back albeit a bit differently. All three long term trends point to a reemergence of cities but the winning cities and places within cities will little different. For example, you are seeing a decline in population in older cities like Chicago that are migrating to “younger” cities like Nashville, Atlanta, Miami, Salt Lake City, etc… All the predictions about the mass exodus from cities are overblown as child birth rates and millennials are the drivers in the next cycle. Furthermore, buyers will migrate closer to work which is typically in the more urban areas. This will benefit closer in Suburban locations the most as this is also where many businesses are relocating to. Think of Atlanta, a hot area is Sandy Springs which is about 15 miles from Downtown. These will be the hottest areas as real estate transitions to more normalcy.

2. Outlying suburbs/ex urbs have peaked: The suburbs 50+ miles away from the large employment zones will struggle. As back to work happens and the economy normalizes it is not feasible for most to commute 2 hours a day. These areas will no longer be the hot areas.

3. Far out rural areas will struggle: The far-out rural areas are already past their peak. Don’t get me wrong some that moved out of the cities will not come back, but the overwhelming majority will be drawn closer into the more urban areas as work and play are once again centered in many of these locations.

2026 will be challenging for real estate

Look for volumes to continue at historically low levels in 26 as the market continues to adjust to the new normal of higher interest rates and the end of free government money. 2026 will be similar to 25 with values declining moderately in some markets while others hold better. The real story will be declining volumes that will continue to hurt the industry from realtors, title companies, attorneys, etc..

2026 will begin to reveal the true market fundamentals as the real estate feast where everything goes up with four walls is over. Buyers and lenders will continue to be very cautious in the market as there is more downside risk than upside in many locations.

2026 will see some opportunities as there will be some stress in the market. It will not be a 2008 redo, but there will be some substantial opportunities in fundamentally strong areas. In summary, the sky is not falling on real estate, but 2026 is setting up to be a challenging year with some big winners and losers. My advice would be to lower your leverage so that you have the ability to take advantage of opportunities as they present themselves as 2026 will continue the shake out of weaker property owners/markets.

About the Author

Glen Weinberg COO/ VP Fairview Commercial Lending personally writes these weekly real estate blogs based on his real estate experience as a lender and property owner. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics.

About Fairview Commercial Lending

Fairview Commercial Lending is an actual private lender, lending our own money. We service our own loans and own commercial and residential real estate throughout the country.

Media Contact

Company Name: Fairview Commercial Lending

Contact Person: Glen Weinberg

Email: Send Email

City: Atlanta

State: GA

Country: United States

Website: fairviewlending.com