BOISE, ID – January 13, 2026 – Retlia has released the January 12 edition of The Register, its ongoing retail data analytics brief that tracks headline sentiment alongside official retail and manufacturing indicators.

The latest report characterizes the current environment as neutral but increasingly fragile, with retail demand holding while manufacturing weakness intensifies.

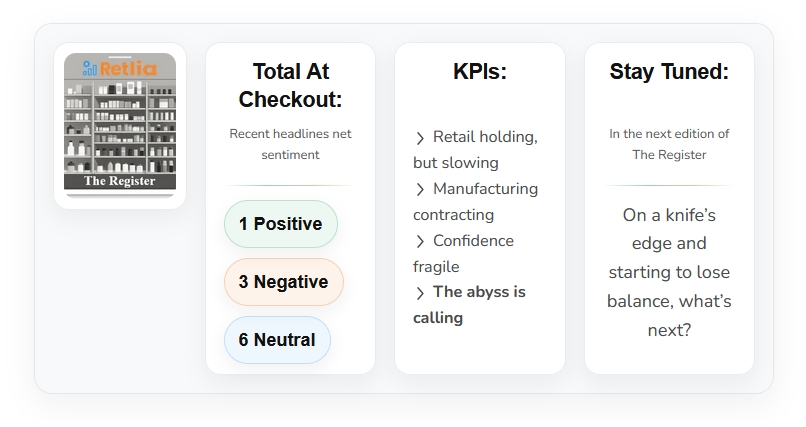

Key findings include headline analysis which reinforced the caution. Of ten major retail headlines reviewed, only one was classified as positive, narrowly avoiding the first Register edition with zero positive indicators. Of ten major retail headlines analyzed:

-

One was categorized as positive

-

Three as negative

-

Six as neutral

Even positive headlines covered, such as Me+Em’s West Coast flagship debut, were noted as narrow and brand-specific rather than broad market signals.

“Words like resilience and volatility are replacing confidence,” the report notes, “even when topline demand remains positive.”

According to other key market indicators covered in the report:

-

Retail Sales Year-over-Year increased 3.5% in October 2025, down from 4.2% in September

-

Retail Sales Month-over-Month were flat at 0.0%, signaling stalled near-term momentum

-

ISM Manufacturing PMI fell to 47.9 in December, marking the third consecutive month of contraction

-

Manufacturing new orders and backlogs remained below 48, indicating continued softness

“Retail demand is still supporting topline growth, but at a slowing pace,” the report notes, “while manufacturing contraction and elevated costs signal rising risk that goods supply and pricing pressures could weigh on retail performance in the months ahead.”

The Register is published by Retlia, a retail data and analytics company, to help retail leaders contextualize economic data, headlines, and operating signals through a practical, decision-oriented lens. The publication is designed for executives navigating inventory planning, margin management, and demand uncertainty.

The full January 12, 2026 edition of The Register, including detailed headline analysis and retail KPI trends, is available here: January 12, 2026 edition of The Register

Media Contact

Company Name: Retlia

Contact Person: Nick Wynkoop

Email: Send Email

Country: United States

Website: retlia.com