Overview of the North America Mutual Fund Market

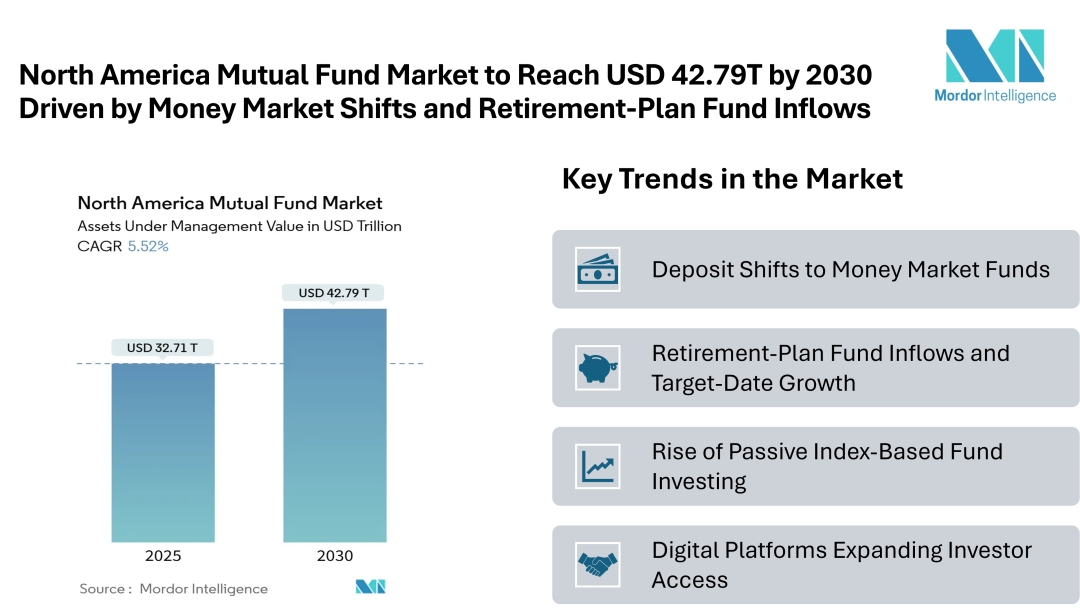

According to Mordor Intelligence, the North American mutual fund market size reached USD 32.71 trillion in 2025 and is forecasted to expand to USD 42.79 trillion by 2030, advancing at a 5.52% CAGR. The North America Mutual Fund Market share remains highly concentrated, with the United States holding the largest portion of assets under management.

Growth Drivers Shaping the North America Mutual Fund Market

Deposit Shifts to Money Market Funds

Investors are moving bank deposits into money market funds for higher returns and liquidity, supported by regulatory changes and fund consolidation.

Retirement-Plan Fund Inflows and Target-Date Growth

Workplace retirement plans, especially target-date funds, are attracting steady inflows due to default enrollment and structured glide-path strategies.

Rise of Passive Index-Based Fund Investing

Passive funds dominate assets, driven by cost efficiency, tax benefits, and blending with active strategies for diversified investor portfolios.

Digital Platforms Expanding Investor Access

Online trading and advisory services are increasing accessibility for investors, enabling easier portfolio management and broader fund market participation.

Segmentation in the North America Mutual Fund Market

By Fund Type:

-

Equity

-

Bond

-

Hybrid

-

Money Market

-

Others

By Investor Type:

-

Retail

-

Institutional

By Management Style:

-

Active

-

Passive

By Distribution Channel:

-

Online Trading Platform

-

Banks

-

Securities Firm

-

Others

By Country:

-

United States

-

Canada

-

Mexico

Key Players in the North America Mutual Fund Market

-

Vanguard – Offers a wide range of mutual funds and ETFs, known for low-cost, passive investment options.

-

Fidelity Investments – Provides diversified mutual fund products and retirement solutions with strong digital platforms.

-

American Funds – Focuses on long-term growth with actively managed mutual fund offerings for retail and institutional investors.

-

T. Rowe Price – Specializes in actively managed equity and fixed-income funds with research-driven investment strategies.

-

BlackRock – A global investment firm offering both active and passive funds, including iShares ETFs, across multiple asset classes.

Conclusion

The North America Mutual Fund Market is expected to continue its steady growth through 2030, driven by retirement-plan inflows, passive investing, and digital adoption. While the U.S. maintains a dominant position, Canada and Mexico offer emerging opportunities for fund managers seeking diversification and regional expansion.

Get the latest industry insights on North America Mutual Fund Market: https://www.mordorintelligence.com/industry-reports/north-america-mutual-fund-industry?utm_source=abnewswire

Industry Related Reports:

North America ETF Market

The North America ETF Market reached USD 11.82 trillion in 2025 and is projected to grow to USD 18.53 trillion by 2030, at a 9.40% CAGR. Growth is driven by rising investor preference for low-cost, diversified investment options and increasing adoption of passive and smart-beta ETFs, enhancing accessibility and portfolio flexibility across retail and institutional segments.

Get more insights: https://www.mordorintelligence.com/industry-reports/north-america-etf-industry?utm_source=abnewswire

US Mutual Fund Market

The US Mutual Fund Market holds USD 30.09 trillion in assets in 2025 and is projected to reach USD 39.22 trillion by 2030, growing at a 5.44% CAGR. The market’s expansion is driven by rising retirement-plan inflows and growing popularity of passive index funds, supporting both retail and institutional investor participation.

Get more insights: https://www.mordorintelligence.com/industry-reports/us-mutual-funds-industry?utm_source=abnewswire

North America REIT Industry

The North America REIT Industry is projected to grow from USD 284.43 billion in 2025 to USD 323.53 billion by 2030, at a 3.03% CAGR. Growth is supported by increasing demand for commercial and residential real estate investments and favorable regulatory frameworks that enhance liquidity and investor confidence.

Get more insights: https://www.mordorintelligence.com/industry-reports/north-america-reit-industry?utm_source=abnewswire

About Mordor Intelligence:

Mordor Intelligence is a trusted partner for businesses seeking comprehensive and actionable market intelligence. Our global reach, expert team, and tailored solutions empower organizations and individuals to make informed decisions, navigate complex markets, and achieve their strategic goals.

With a team of over 550 domain experts and on-ground specialists spanning 150+ countries, Mordor Intelligence possesses a unique understanding of the global business landscape. This expertise translates into comprehensive syndicated and custom research reports covering a wide spectrum of industries, including aerospace & defense, agriculture, animal nutrition and wellness, automation, automotive, chemicals & materials, consumer goods & services, electronics, energy & power, financial services, food & beverages, healthcare, hospitality & tourism, information & communications technology, investment opportunities, and logistics.

For any inquiries or to access the full report, please contact:

media@mordorintelligence.com https://www.mordorintelligence.com/

Mordor Intelligence, 11th Floor, Rajapushpa Summit, Nanakramguda Rd, Financial District, Gachibowli, Hyderabad, Telangana – 500032, India.

Media Contact

Company Name: Mordor Intelligence Private Limited

Contact Person: Jignesh Thakkar

Email: Send Email

Phone: +1 617-765-2493

Address:11th Floor, Rajapushpa Summit, Nanakramguda Rd, Financial District, Gachibowli

City: Hyderabad

State: Telangana 500008

Country: India

Website: https://www.mordorintelligence.com/