London, UK – October 13, 2025 – Expense Hub (https://expensehub.io), a leading provider of expense management software for business, today announced the launch of its AI-powered expense tracking app and expense report software designed for small businesses, startups, and growing enterprises across the UK, USA, and Canada. The platform eliminates inefficiencies from manual expense tracking vs automated solutions, reduces expense processing time by 75%, enabling finance teams to automate workflows, maintain full regulatory compliance, and gain real-time financial insights with enterprise-grade analytics.

“Small businesses and startups are drowning in admin when they should be focused on growth,” said Ayug S, CEO of Expense Hub. “Expense Hub eliminates the friction in expense reporting, travel management, and mileage reimbursement—enabling finance teams to stay compliant and data-driven without the burden of manual work. With availability across the UK, USA, and Canada, intelligent expense management is now within reach for every business.”

Tackling the £2.3 Billion Manual Expense Problem

Recent research shows UK small businesses lose more than £2.3 billion annually through manual expense processes that average 8.5 hours weekly and carry error rates up to 23%. Expense Hub’s AI-driven platform directly addresses these challenges by automating receipt capture, approvals, and financial analysis—reducing expense processing time by up to 75% and improving accuracy with built-in policy compliance.

“Finance leaders want outcomes, not overhead,” said Abhiranjan Shukla, VP of Products at Expense Hub. “Expense Hub unifies expense tracking, mileage calculation using the latest HMRC mileage rates, and policy enforcement in one intuitive workflow. From spend management software to expense forecasting tools, the platform helps teams move from month-end firefighting to proactive financial planning.”

Complete Expense Management for Modern Businesses

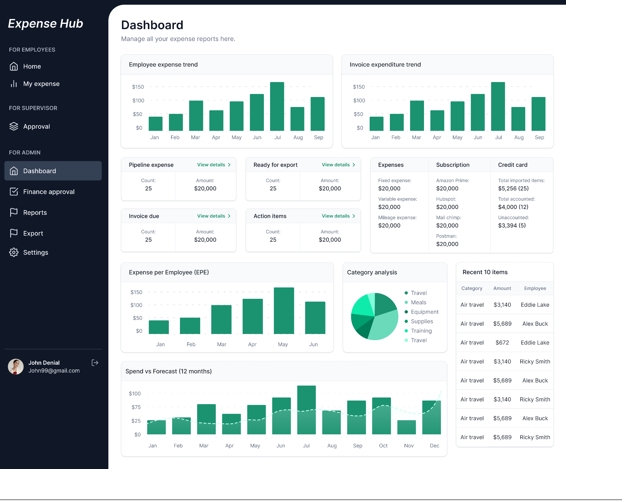

Expense Hub provides a unified expense management software for business that combines expense tracking, compliance management, spend controls, and advanced analytics—built for global SMBs and finance teams.

Key features include:

- Intelligent Receipt Processing: AI-powered OCR scans, categorizes, and validates receipts automatically, flagging duplicates and policy exceptions.

- HMRC-Compliant Mileage Tracking: Built-in mileage tracker app calculates reimbursements using up-to-date HMRC mileage rates and calculation methods.

- Advanced Financial Analytics: Real-time dashboards surface spending trends, vendor and subscription costs, budget adherence, and expense forecasting for scenario planning.

- IRS Compliant Expense Reports: Expense reports designed to meet all Internal Revenue Service (IRS) requirements, ensuring full compliance and accuracy for small and medium-sized businesses.

- Seamless Integrations: Native Xero expense integration plus connections to QuickBooks Online, and leading CRMs and banking apps for instant, reliable data synchronization. Whatsapp integration to make expense management simplest.

“From day one, we engineered for scale, security, and precision,” said Ashish Kumar, (VP Technology at Expense Hub). “Our platform runs on a secure, microservices-based architecture with ISO 27001 controls, end-to-end encryption, and audit-grade data lineage. The result is a responsive system that finance teams can trust for compliance, accuracy, and performance.”

Smarter Travel and Subscription Expense Control

With travel costs often accounting for up to 35% of SME spending, Expense Hub’s travel expense management tool and corporate travel management software features automate approvals, enforce policy compliance, and analyze travel spend in real time. Early adopters report 68% faster travel expense processing and a 45% improvement in compliance.

The platform also includes subscription and recurring expense management for proactive control of software and vendor spend, preventing unnoticed renewals and overspending through automated alerts and vendor-level analytics.

For deeper travel insights, travel expense analytics highlight out-of-policy trends, route anomalies, and budget variance by department and project—turning cost control into a data-driven habit.

Built for Startups and Growing Teams

Expense management for startups demands speed, visibility, and cost efficiency. Expense Hub delivers enterprise-grade capability at a startup-friendly price point, with tiered plans.

- Financial compliance for startups: Built-in guidance and templates to maintain compliant policies and audit-ready records.

- Smart budgeting planner: Allocate, track, and adjust budgets across departments, projects, and events.

- Expense forecasting tool: Predict spending using historical trends, seasonality, and growth signals to improve cash flow planning.

- Company bills and subscription management: Track, approve, and manage business Expenditures with complete visibility. The platform automatically categorizes vendor subscriptions, flags duplicate renewals, and provides real-time spend analytics to help finance teams control recurring costs.

- Vendor and supplier management: Centralize vendor information and manage invoice categories seamlessly. Assign Supervisors for Vendors and get automated workflows with approval routing, and compliance validation, reducing manual touchpoints.

- Invoices and expenses workflows: Streamline invoice processes with automated matching, policy checks, and approval chains for faster reconciliation, and a clear audit trail across every transaction.

“Startups need tools that scale with them—powerful but simple to use,” added Abhiranjan Shukla (VP-Products at Expense Hub). “We designed Expense Hub so teams can launch in days, not months, and unlock ROI from the first cycle.”

Enterprise-Level Integrations and Automation

Expense Hub’s expense management integration ecosystem spans accounting, CRM, banking, and productivity stacks—ensuring a smooth data flow across systems. In addition to Xero expense integration, customers can connect to QuickBooks Online and other accounting suites, as well as popular CRMs and project tools.

Expense Hub

Automation capabilities include:

- AI-driven expense categorization aligned to chart-of-accounts

- Policy compliance checks and duplicate detection

- Role-based approval routing and dynamic spend limits

- Predictive analytics for budget planning and risk detection

This turns traditional, reactive expense reporting into proactive financial process optimization with clear guardrails and measurable outcomes.

Proven Results and Customer Success

Since beta launch, Expense Hub has processed over £15 million in expense claims for 250+ businesses across the UK, USA, and Canada. Users report an average time saving of 12 hours per month and accuracy improvements exceeding 85%, with multi-entity finance teams citing improved month-end close times and cleaner audit trails.

“Expense Hub turned our expense reporting from a painful monthly chore into a seamless workflow,” said Mark Roberts, Finance Director at GoldenLondon Pvt Ltd. “HMRC compliance and analytics now happen automatically, and our managers finally trust the numbers.”

Designed for Growth and Global Operations

- Multi-currency support with real-time FX for international teams

- Advanced approval hierarchies and granular roles for complex organizations

- Machine-learning-based forecasting for headcount, travel, and vendor planning

- VAT handling, tax coding, and audit-ready exports for the UK, plus support for US and Canadian mileage reimbursement rates and regional policy profiles

Pricing and Availability

Expense Hub is available now globally, with plans starting at $3 per user/month. Every plan includes unlimited receipt processing, policy compliance tools, mileage tracking, and core analytics. Advanced features such as custom reporting, premium integrations, and enterprise controls are available on higher tiers.

Start a free 30-day trial.

Recognition and Awards

Expense Hub was named “Best Expense Management Solution” at the UK Fintech Awards 2025 and received the “Innovation in Financial Technology” honor from the Small Business Technology Excellence Awards. Industry analysts cite Expense Hub’s integrated approach—combining AI automation, compliance, and predictive analytics—as a benchmark for modern finance teams.

“Expense Hub elevates expense management from a manual task to a strategic capability,” said Dr. Helen Parker, Senior Analyst at Financial Technology Research Institute. “Their use of AI and predictive analytics sets a new benchmark for the category.”

Industry Leadership and Market Position

Expense Hub enters a rapidly growing expense management market projected to reach $16.48 billion by 2032. The platform differentiates itself through AI automation, regulatory compliance, and competitive pricing in a landscape dominated by established players.

Top 5 Expense Management Solution for Businesses in 2025:

| Platform | Pros | Cons | Features | Ideal for | Pricing |

| Expense Hub.io | AI-driven automation; Global compliance; instant deployment, Budgeting, Bills and Subscription | Not suited for Enterprise | OCR receipt capture; mileage tracker; real-time analytics; Xero, QuickBooks integrations; forecasting, budgeting, Accounts Payable | SMBs, Startups, Mid market and Growth Oriented Businesses | $3/user/month |

| SAP Concur | Global compliance; deep travel expense integration | High cost; complex implementation | Travel booking integration; policy enforcement; multi-country support | Large enterprises | Enterprise pricing |

| Expensify | SmartScan receipt tech; intuitive interface | Limited compliance automation; higher per-user cost | Mobile receipt capture; reimbursement workflows; card reconciliation | Mid-market businesses | $5/user/month |

| Zoho Expense | Tight integration with Zoho suite; multi-currency support | Basic AI features; less robust compliance | Automated expense reports; approval workflows; project tracking | Small to mid-market businesses | $4/user/month |

| Ramp | Free tier; corporate card + expense management combo | US-only compliance; no HMRC support | Virtual cards; spend controls; real-time notifications | US companies; finance teams with card programs | $ Enterprise Pricing |

| Rydoo | Broad international compliance; strong travel expense features | Higher cost; steeper learning curve | Automated compliance checks; travel booking; policy alerts; invoice matching | Mid-sized to enterprise organizations | Mid-tier pricing |

Looking Ahead

The roadmap includes expanded AI capabilities for anomaly detection and policy optimization, deeper integration options across ERP and payments, and enhanced mobile features. Upcoming releases will deliver predictive spend management, automated budget recommendations, and advanced travel policy modeling. R&D initiatives include blockchain-backed audit trails and AI-driven expense fraud detection to further strengthen accuracy, transparency, and trust.

About Expense Hub

Founded: 2024

Headquarters: London, UK; New Delhi, India

Website: https://expensehub.io

Expense Hub is an AI-powered expense and invoice management platform for small and medium-sized businesses across the globe. Serving over 250 companies, the platform helps finance teams save time, reduce errors, and maintain full compliance with HMRC & IRS, and regional reimbursement standards. Expense Hub’s mission—“Simple, Smart, and Done”—reflects a commitment to eliminating administrative burden and empowering strategic financial decisions.

Start your free 30-day trial at Expense Hub

Additional Resources

- Guide to Small Business Expenses in the UK (2025):https://blog.expensehub.io/sundry-small-business-expenses-uk-2025-what-you-can-and-cant-claim-the-complete-guide/

- Mileage Expense Management Guide (2025): https://blog.expensehub.io/the-complete-guide-to-mileage-expense-management-and-business-expense-software-in-2025/

- XERO vs SAGE vs Quickbooks : Which is best for your business?: https://expensehub.io/xero-vs-sage-vs-quickbooks-2025

- HMRC Mileage Rates 2025:https://expensehub.io/hmrc-mileage-rates-2025

For media inquires please contact at:

ayug@expensehub.io

Media Contact

Company Name: Expense Hub (www.expensehub.io)

Contact Person: Ayug S

Email: Send Email

Country: India

Website: https://expensehub.io