Miami, Florida – 11 Sep, 2025 – As businesses become more sophisticated in their financial activities, firms are looking for solutions that are more efficient, precise, and compliant. Retail, logistics, and professional services firms are more often employing outsourced accounts payable services to transcend manual in-house AP systems and adopt scalable, technology-supported solutions. Increasing invoice volumes, more stringent regulatory demands, and the urgency of timely vendor settlements are propelling need for outsourced, structured models.

IBN Technologies provides companies with an end-to-end framework consisting of integrated digital platforms, seasoned process teams, and sophisticated workflow management. Automating accounts payable processes and installing sound controls on approval, businesses eliminate the drudgery of human error, enhance visibility on cash flow, and enjoy strong vendor relationships. Early deployers of outsourced accounts payable services experience quantifiable gains in payment cycle speed, accuracy, and financial reporting that attest to the increased worth of professional AP management for supporting operational excellence.

Minimize delays and inaccuracies in financial workflows Get a Free Consultation:

https://www.ibntech.com/free-consultation-for-ap-ar-management/

Industry Challenges

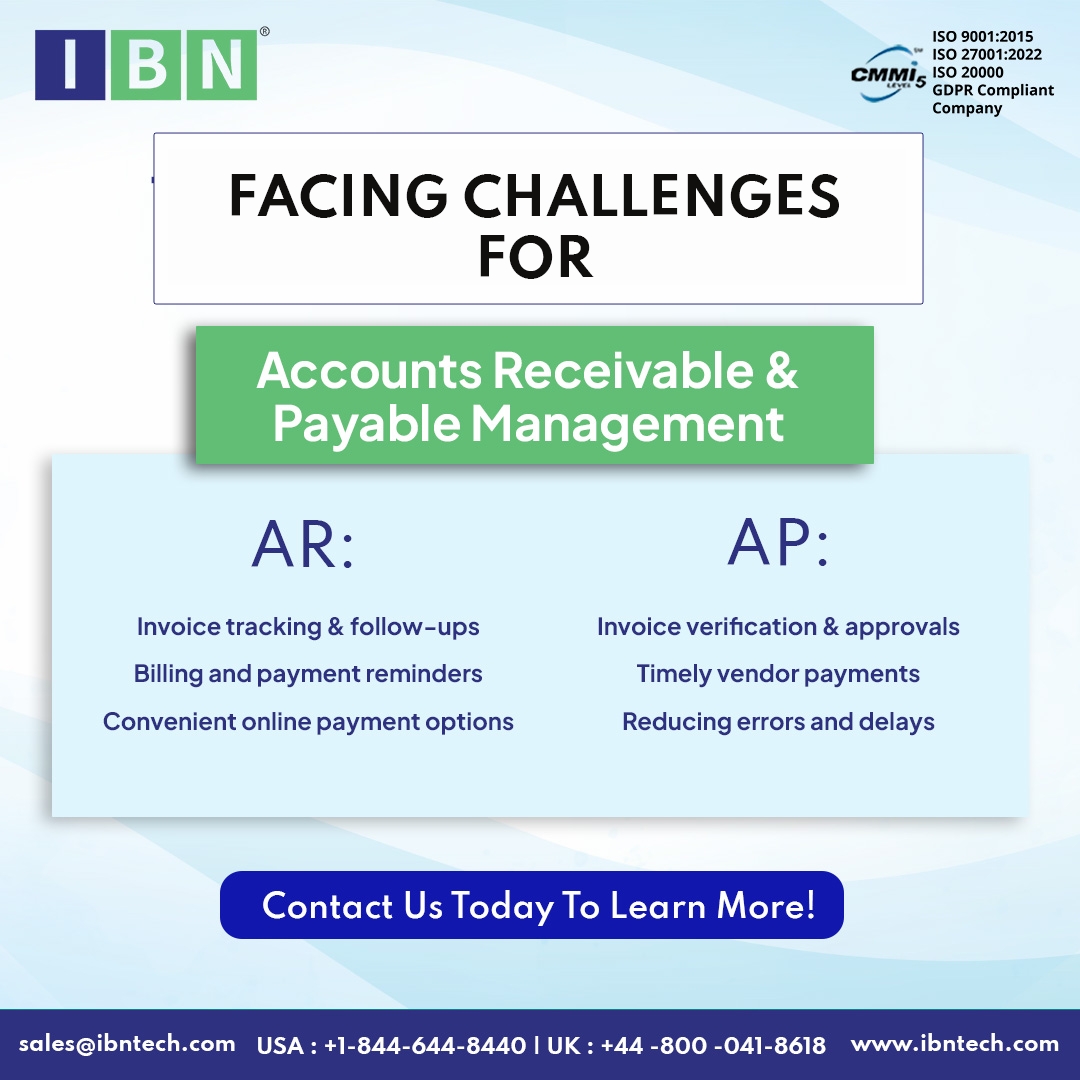

Despite the critical nature of accounts payable management, organizations frequently encounter challenges that hinder efficiency and compliance:

-

Invoice approvals causing delayed payments

-

Increased risk of errors during high-volume periods

-

Limited visibility into payment status across vendors and locations

-

Inefficient reconciliation and reporting processes

-

Difficulty meeting tax and regulatory compliance deadlines

These inefficiencies often result in accounts payable risks, strained vendor relationships, and excessive operational costs. Companies that lack structured accounts payable management systems struggle to maintain accuracy, transparency, and scalability in their financial operations.

IBN Technologies’ Solutions

IBN Technologies addresses these challenges through its outsourced accounts payable services, designed to optimize financial workflows while maintaining strict compliance and control. Key solutions include:

✅ Streamlined invoice handling aligned with retail payment schedules

✅ Unified accounts payable management across multiple locations

✅ Accurate invoice verification for all vendors and shipping points

✅ Real-time visibility into payables and vendor reconciliation reports

✅ Timely vendor payments scheduled according to discount terms

✅ Centralized digital access to all transaction and audit records

✅ Dependable AP processing during peak sales and promotion periods

✅ Consistent tax compliance and documentation oversight for vendors

✅ Financial reporting synchronized with internal audit requirements

✅ Expert assistance from specialized accounts payable teams

With these integrated services, IBN Technologies empowers businesses to reduce operational bottlenecks, mitigate accounts payable audit issues, and enhance vendor satisfaction. The platform supports scalable growth, enabling companies to focus on strategic priorities without sacrificing financial oversight.

New Jersey Retail AP Sees Significant Improvement

Retail companies in New Jersey are achieving higher efficiency in accounts payable by collaborating with external experts. Moving toward outsourced accounts payable services has improved vendor payment timelines and minimized manual processing errors, with successful implementation by IBN Technologies.

● Processing efficiency rose by 40%

● Manual approval gaps replaced with automated checkpoints

● Vendor coordination enhanced through precise payment planning

Organizations working with IBN Technologies report fewer discrepancies and stronger control over processes. Leveraging outsourced accounts payable services provides New Jersey retailers with improved AP reliability and enhanced vendor relationships.

Benefits of Outsourcing

Outsourcing accounts payable management offers several advantages:

-

Faster invoice processing and reduced cycle times

-

Minimized errors and improved compliance with regulatory standards

-

Greater transparency into accounts payable procedures and financial reporting

-

Cost-effective scalability during peak business periods

-

Stronger vendor relationships through timely, reliable payments

By leveraging professional outsourced accounts payable services, organizations gain operational flexibility, ensure audit readiness, and free internal teams to concentrate on core business objectives, ultimately improving financial health and strategic decision-making.

Empowering Financial Efficiency

The evolving landscape of financial operations demands innovative approaches to managing accounts payable. Businesses that adopt outsourced accounts payable services gain not only operational efficiency but also strategic agility. IBN Technologies’ comprehensive approach combines technology, expert personnel, and structured workflows to optimize payment cycles, ensure compliance, and provide actionable insights into cash flow management.

Retailers, logistics companies, and professional service providers that partner with IBN Technologies report faster invoice approvals, fewer discrepancies, and improved vendor engagement. The integration of digital platforms and structured accounts payable management enables organizations to handle increasing invoice volumes while mitigating accounts payable risks. Additionally, timely access to reconciliation data and audit-ready reporting strengthens internal controls and ensures readiness for regulatory scrutiny.

Looking ahead, organizations that invest in outsourced AP solutions position themselves to remain competitive, reduce operational costs, and enhance financial transparency. The shift toward outsourcing represents not just a cost-saving strategy but a transformation in how companies manage vendor payments and operational workflows.

For businesses seeking measurable improvements in accounts payable performance, IBN Technologies offers consultation and implementation support to streamline operations, safeguard compliance, and optimize vendor relationships. Get started today by scheduling a free consultation and discover how outsourced accounts payable services can redefine financial efficiency for your organization.

Related Service:

-

Outsourced Bookkeeping Services: https://www.ibntech.com/free-consultation-for-bookkeeping/

About IBN Technologies

IBN Technologies LLC, an outsourcing specialist with 26 years of experience, serves clients across the United States, United Kingdom, Middle East, and India. Renowned for its expertise in RPA, Intelligent process automation includes AP Automation services like P2P, Q2C, and Record-to-Report. IBN Technologies provides solutions compliant with ISO 9001:2015, 27001:2022. The company has established itself as a leading provider of IT, KPO, and BPO outsourcing services in fiance and accounting, including CPAs, hedge funds, alternative investments, banking, travel, human resources, and retail industries. It offers customized solutions that drive AR efficiency and growth.

Media Contact

Company Name: IBN Technologies LLC

Contact Person: Pradip

Email: Send Email

Phone: 844-644-8440

Address:66, West Flagler Street Suite 900

City: Miami

State: Florida 33130

Country: United States

Website: https://www.ibntech.com/