Hyperphosphatemia Market Summary

Hyperphosphatemia, defined as elevated serum phosphate levels (>4.5 mg/100 mL), commonly affects CKD patients due to impaired renal function. The United States accounted for nearly 50% of total cases in 2023 and represents the largest market, followed by the EU4, the United Kingdom, and Japan. Hyperphosphatemia market growth is expected from improved uptake of existing drugs, increased awareness, and the anticipated launch of advanced therapies, including one-time gene treatments. In 2023, the U.S. had about 600,000 end-stage renal disease (ESRD) patients on dialysis, a number expected to rise. Approved phosphate binders include KIKLIN, AURYXIA/RIONA, and VELPHORO/P-TOL. Recently, XPHOZAH gained FDA approval for dialysis patients intolerant to binders, while Oxylanthanum Carbonate (OLC) is emerging as a promising therapy.

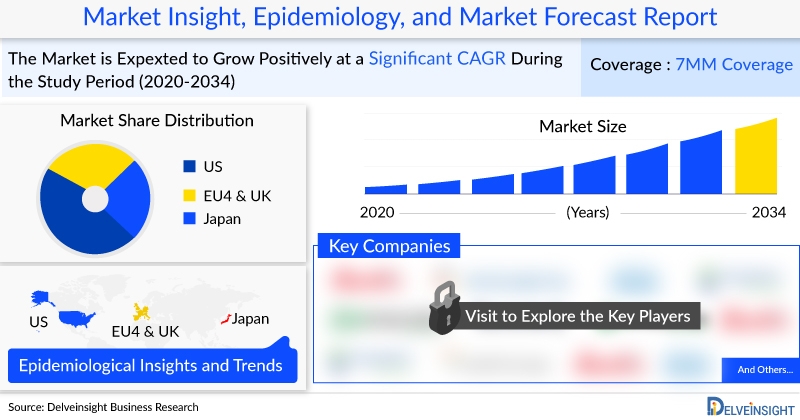

DelveInsight’s “Hyperphosphatemia Market Insights, Epidemiology, and Market Forecast–2034” report provides a comprehensive evaluation of Hyperphosphatemia, encompassing historical trends and projected epidemiology, along with market dynamics across the United States, EU5 (Germany, Spain, Italy, France, and the United Kingdom), and Japan. The analysis details current therapeutic practices, emerging treatment options, market share distribution among available therapies, and the estimated market size for Hyperphosphatemia from 2020 to 2034 across seven major markets. Additionally, the report examines prevailing treatment algorithms, key market drivers and barriers, and existing unmet clinical needs, thereby identifying strategic opportunities and assessing the growth potential of the Hyperphosphatemia market.

The $4B Hyperphosphatemia market is evolving fast with new therapies like XPHOZAH & OLC. Get DelveInsight’s latest Hyperphosphatemia Market Forecast (2020–2034) for growth trends, pipeline insights & strategic opportunities @ Hyperphosphatemia Market Outlook

Some facts of the Hyperphosphatemia Market Report are:

- According to DelveInsight, The hyperphosphatemia market in the 7MM was valued at approximately USD 4 billion in 2023.

- Leading Hyperphosphatemia companies working in the market are Phosphate Therapeutics, Bayer, Shire, Kyowa Kirin Co Ltd, Shanghai Alebund Pharmaceuticals Limited, Ardelyx, Kissei Pharmaceutical Co. Ltd., Taisho Pharmaceutical Co. Ltd., Sanofi, Chugai Pharmaceutical, Astellas Pharma Inc., Alebund Pharmaceuticals, Mitsubishi Tanabe Pharma Corporation, KDL Inc., Denver Nephrologists, CM&D Pharma Limited, Daiichi Sankyo and others.

- Key Hyperphosphatemia Therapies are Oxylanthanum Carbonate (OLC), KIKLIN, VELPHORO/P-TAL, AURYXIA/ RIONA, and many others.

- In June 2025, Unicycive Therapeutics, Inc. (“Unicycive” or the “Company”) (Nasdaq: UNCY), a clinical-stage biotechnology company developing therapies for patients with kidney disease, announced that the U.S. Food and Drug Administration (FDA) has issued a CRL for its New Drug Application (NDA) for oxylanthanum carbonate (OLC) to treat hyperphosphatemia in patients with chronic kidney disease (CKD) on dialysis.

- In June 2025, Alebund Pharmaceuticals (“Alebund” or the “Company”), an integrated biopharmaceutical company focusing on developing innovative therapies for renal diseases and related chronic conditions, announced the database lock was achieved on June 16, 2025 for the pivotal phase 3 study of its investigational drug AP301, a new generation of oral iron-based phosphate binder, in dialysis patients with hyperphosphatemia. The trial met its primary endpoint, demonstrating a statistically significant and clinically meaningful improvement in serum phosphorus control with AP301. The safety profile of AP301 is favorable and consistent with previous studies.

- In February 2025, Ardelyx Gains Approval for Tenapanor to Treat hyperphosphatemia. Ardelyx has announced that China’s National Medical Products Administration (NMPA) has approved tenapanor for controlling serum phosphorus levels in dialysis patients with chronic kidney disease (CKD).

Hyperphosphatemia Overview

Hyperphosphatemia is a metabolic disorder characterized by abnormally elevated serum phosphate levels, typically defined as concentrations exceeding 4.5 mg/dL. It is most commonly observed in patients with chronic kidney disease (CKD), particularly those in advanced stages or undergoing dialysis, due to the kidneys’ reduced ability to excrete phosphate efficiently. The condition is clinically significant because persistently high phosphate levels can lead to vascular calcification, cardiovascular complications, secondary hyperparathyroidism, and bone-mineral disorders, collectively increasing morbidity and mortality in CKD patients.

The prevalence of hyperphosphatemia closely parallels the rising global burden of CKD and end-stage renal disease (ESRD). In 2023, the United States accounted for nearly half of the total hyperphosphatemia cases across the seven major markets (7MM), highlighting its substantial clinical and economic impact. Current management strategies primarily involve dietary phosphate restriction, dialysis optimization, and the use of phosphate binders, which are classified into calcium-based and non-calcium-based agents. Despite their effectiveness, treatment adherence remains a challenge due to pill burden and gastrointestinal side effects.

Ongoing research focuses on novel therapies such as iron-based binders, new molecular agents, and gene therapy approaches to address unmet needs. Rising awareness, better diagnostics, and emerging treatment options are expected to reshape the market outlook.

Access in-depth insights on Hyperphosphatemia key players, therapies, market drivers, barriers, and opportunities across the 7MM @ Hyperphosphatemia Clinical Trials and FDA Approvals

Hyperphosphatemia Market Outlook

In the hyperphosphatemia landscape, companies such as Unicycive Therapeutics are advancing lead candidates through various stages of clinical development to expand treatment options. The 7MM market is largely driven by the use of phosphate binders (both calcium-based and calcium-free) along with off-label therapies. In 2023, the United States accounted for the largest share, with a market size of approximately USD 2,400 million. Within the EU4 and the UK, Germany contributed the most, with around USD 150 million.

Hyperphosphatemia Market Drivers

- Rising CKD and ESRD prevalence: Growing patient pool, particularly those on dialysis, increases hyperphosphatemia incidence.

- Improved diagnostic rates: Enhanced awareness and early detection of CKD-associated complications drive treatment demand.

- Pipeline innovations: Emerging therapies (e.g., Oxylanthanum Carbonate, novel gene therapies) expected to expand treatment landscape.

- Regulatory approvals: New drug approvals (e.g., XPHOZAH, 2023 FDA approval) strengthen treatment options.

- Shift toward non-calcium-based binders: Preference for safer, effective alternatives fuels adoption.

- Rising awareness among physicians and patients: Better disease education promotes compliance and treatment uptake.

Hyperphosphatemia Market Barriers

- Treatment compliance issues: Phosphate binders often require multiple daily doses, impacting adherence.

- Adverse effects of therapies: Gastrointestinal intolerance and other side effects limit long-term use.

- Cost constraints: High pricing of newer therapies poses affordability challenges, especially in emerging markets.

- Limited novel mechanisms of action: Market still dominated by phosphate binders with incremental innovations.

- Slow penetration of advanced therapies: Gene therapies and novel drugs face long regulatory and clinical timelines.

- Unmet needs in refractory patients: Some patients remain unresponsive or intolerant to existing binders.

Interested to know how the emerging diagnostic approaches will be contributing in increased Hyperphosphatemia diagnosed prevalence pool? Download report @ Hyperphosphatemia Patient Pool

Hyperphosphatemia Epidemiology

The Hyperphosphatemia epidemiology section provides insights into the historical and current Hyperphosphatemia patient pool and forecasted trends for seven individual major countries. It helps to recognize the causes of current and forecasted trends by exploring numerous studies and views of key opinion leaders. In 2023, the United States recorded the highest prevalence of hyperphosphatemia in the 7MM, with ~500,000 cases, alongside ~2.4 million CKD stage 3–5 patients. Japan ranked second, contributing ~300,000 cases, while Germany led among the EU4 and the UK with ~56,000 cases.

Hyperphosphatemia Epidemiology Segmentation:

- Total Prevalent Cases of Chronic Kidney Disease (CKD)

- Total Diagnosed Prevalent Cases of CKD

- Stage-specific Distribution of CKD

- Total Prevalent Cases of End-Stage Renal Disease (ESRD)

- Number of ESRD Patients Undergoing Dialysis

- Total Prevalent Cases of Hyperphosphatemia

Hyperphosphatemia Drugs Uptake

VELPHORO/P-TOL (Fresenius Medical Care/Vifor Pharma)

Approved in the US (2013) and Europe (2014), VELPHORO (sucroferric oxyhydroxide) is widely marketed, including Japan (as P-TOL since 2018 through Kissei). It is available in over 30 countries, benefitting more than 100,000 patients annually.

KIKLIN (Astellas Pharma)

An amine-functional polymer (bixalomer) approved in 2012 for CKD patients on dialysis, with its indication expanded in 2016 to include all CKD-related hyperphosphatemia. It lowers phosphate absorption by binding in the GI tract.

Oxylanthanum Carbonate (OLC, Unicycive Therapeutics)

A novel nanoparticle-based phosphate binder designed to reduce pill burden by enabling smaller, easier-to-swallow tablets. Phase II trials have shown strong safety and tolerability, with FDA submission planned via the 505(b)(2) pathway.

Discover how VELPHORO, KIKLIN, and OLC are shaping the Hyperphosphatemia market. Get insights on drug uptake trends, pipeline shifts, and growth opportunities.

Download your sample report now! @ Hyperphosphatemia Medication and Companies

Hyperphosphatemia Therapeutics Assessment

Major key companies are working proactively in the Hyperphosphatemia Therapeutics market to develop novel therapies which will drive the Hyperphosphatemia treatment markets in the upcoming years are Phosphate Therapeutics, Bayer, Shire, Kyowa Kirin Co Ltd, Shanghai Alebund Pharmaceuticals Limited, Ardelyx, Kissei Pharmaceutical Co. Ltd., Taisho Pharmaceutical Co. Ltd., Sanofi, Chugai Pharmaceutical, Astellas Pharma Inc., Alebund Pharmaceuticals, Mitsubishi Tanabe Pharma Corporation, KDL Inc., Denver Nephrologists, CM&D Pharma Limited, Daiichi Sankyo and others.

Discover how leading pharma innovators are reshaping the Hyperphosphatemia treatment algorithm with novel therapies? Download sample report @ Hyperphosphatemia Clinical Trials and FDA Approvals

Hyperphosphatemia Report Key Insights

1. Hyperphosphatemia Patient Population

2. Hyperphosphatemia Market Size and Trends

3. Key Cross Competition in the Hyperphosphatemia Market

4. Hyperphosphatemia Market Dynamics (Key Drivers and Barriers)

5. Hyperphosphatemia Market Opportunities

6. Hyperphosphatemia Therapeutic Approaches

7. Hyperphosphatemia Pipeline Analysis

8. Hyperphosphatemia Current Treatment Practices/Algorithm

9. Impact of Emerging Therapies on the Hyperphosphatemia Market

Table of Contents

1. Key Insights

2. Executive Summary

3. Hyperphosphatemia Competitive Intelligence Analysis

4. Hyperphosphatemia Market Overview at a Glance

5. Hyperphosphatemia Disease Background and Overview

6. Hyperphosphatemia Patient Journey

7. Hyperphosphatemia Epidemiology and Patient Population

8. Hyperphosphatemia Treatment Algorithm, Current Treatment, and Medical Practices

9. Hyperphosphatemia Unmet Needs

10. Key Endpoints of Hyperphosphatemia Treatment

11. Hyperphosphatemia Marketed Products

12. Hyperphosphatemia Emerging Therapies

13. Hyperphosphatemia Seven Major Market Analysis

14. Attribute Analysis

15. Hyperphosphatemia Market Outlook (7 major markets)

16. Hyperphosphatemia Access and Reimbursement Overview

17. KOL Views on the Hyperphosphatemia Market

18. Hyperphosphatemia Market Drivers

19. Hyperphosphatemia Market Barriers

20. Appendix

21. DelveInsight Capabilities

22. Disclaimer

About DelveInsight

DelveInsight is a leading Life Science market research and business consulting company recognized for its off-the-shelf syndicated market research reports and customized solutions to firms in the healthcare sector.

Media Contact

Company Name: DelveInsight Business Research LLP

Contact Person: Ankit Nigam

Email: Send Email

Phone: +19193216187

Address:304 S. Jones Blvd #2432

City: Albany

State: New York

Country: United States

Website: https://www.delveinsight.com/consulting/competitive-intelligence-services