Introduction

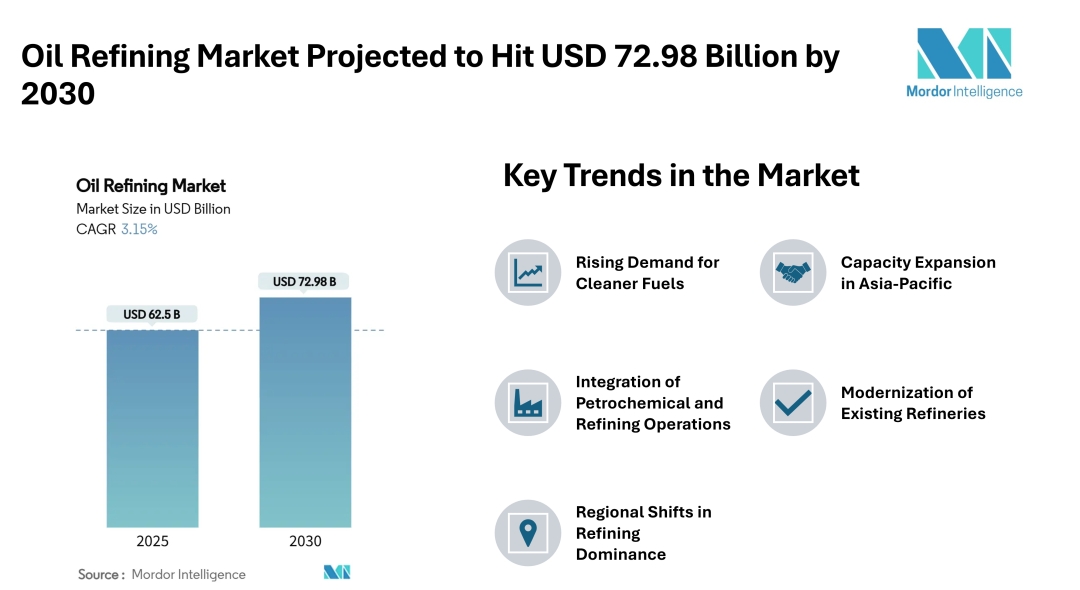

According to a 2025 report on the Oil Refining Market by Mordor Intelligence, the market is projected to reach USD 72.98 Billion by 2030, growing at a CAGR of 3.15% during the forecast period. The report provides comprehensive insights into the structural, technological, and regulatory developments shaping the oil refining sector worldwide.

The oil refining market play a crucial role in converting crude oil into usable fuels and petrochemical feedstocks. It supports global energy demands across transportation, power generation, and industrial sectors.

Key Trends in the Oil Refining Market

1. Rising Demand for Cleaner Fuels : Refineries worldwide are upgrading their processes to meet stricter environmental regulations. This includes the production of ultra-low sulfur diesel and cleaner gasoline blends. Government mandates and emission norms are pushing refineries to reduce sulfur content and other pollutants in their output.

2. Capacity Expansion in Asia-Pacific : The Asia-Pacific region, led by countries like China and India, continues to expand refining capacity to meet growing domestic fuel consumption. This regional growth is being driven by industrial development, urbanization, and rising vehicle ownership, making Asia-Pacific the largest contributor to global refining capacity additions.

3. Integration of Petrochemical and Refining Operations :There is a growing trend toward integrating refining units with petrochemical production. This approach improves profitability by maximizing the use of feedstocks and producing higher-margin chemical products alongside traditional fuels.

4. Modernization of Existing Refineries : Older refineries in regions such as Europe and South America are investing in modernization to remain competitive. Upgrades often focus on energy efficiency, emissions reduction, and adapting to changes in crude oil quality and product demand.

5. Regional Shifts in Refining Dominance : While North America and Europe maintain high complexity and technical capabilities, the center of refining activity is shifting toward emerging markets. Countries in the Middle East and Asia are increasing their capacity, often supported by domestic oil production and favorable policy frameworks.

Market Segmentation

By Product Scale

-

Light Distillates: This category includes gasoline and naphtha, which are widely used in transportation and petrochemical production. Light distillates are high-value outputs and are prioritized in regions with strong vehicle fuel demand.

-

Middle Distillates: Comprising diesel (gasoil) and jet fuel (kerosene), these are essential fuels for commercial transport and aviation. The global shift toward cleaner-burning diesel has increased focus on this category.

-

Fuel Oil and Residuals: These heavier products are typically used in marine transport and power generation, although their demand is declining due to environmental restrictions and fuel switching.

-

Petrochemical Feedstocks: This includes products such as propylene and aromatics, which serve as key inputs for petrochemical manufacturing. Integrated refineries often prioritize the production of these to enhance profitability and diversification.

By Ownership

-

National Oil Companies (NOCs): State-owned entities like Saudi Aramco and Indian Oil Corporation typically operate large-scale refineries to meet domestic energy needs and export objectives. These companies often receive policy support and invest in expanding national refining capacity.

-

Integrated Oil Companies (IOCs): Major global players such as ExxonMobil and Shell operate refining units as part of vertically integrated businesses, enabling greater control over the value chain from exploration to retail distribution.

-

Independent/Merchant Refiners: These standalone entities focus solely on refining operations. They often rely on strategic location advantages, such as proximity to ports or consumption centers, and maintain agility in product supply and pricing.

By Geography

-

North America : This region is characterized by high refinery complexity, integration, and a strong emphasis on light and middle distillate production. The U.S. leads with some of the most advanced and efficient refining facilities.

-

Europe : Europe’s refining sector is marked by aging infrastructure, stringent environmental policies, and a significant shift toward conformity with the EU’s Green Deal. Existing refineries are being modernized to reduce carbon dioxide and sulfur emissions. The region also focuses increasingly on producing petrochemical feedstocks to stabilize margins amid volatile fuel demand.

-

Asia‑Pacific : The fastest‑growing refining region globally, Asia‑Pacific is expanding capacity rapidly due to rising energy consumption in countries like China and India. Investment is channeled toward both greenfield and brownfield projects, with a dual emphasis on clean fuels and integrated petrochemical destinations.

Major Players

-

Sinopec Corp. China’s largest oil refining company by capacity, Sinopec stands out for its vast throughput and growing international partnerships. Recent collaboration with Saudi Aramco includes an expansion of the Yasref complex, underscoring its strategy to strengthen downstream integration.

-

Exxon Mobil Corporation : ExxonMobil remains a leading player with several high-complexity refineries, including the Baton Rouge and Baytown facilities in the U.S. Their integrated model enables supply chain control from crude production to retail which helps manage margins and market flexibility.

-

Saudi Aramco (including JV capacity) : The world’s largest oil producer is rapidly ramping up global refining output, including significant joint ventures like Motiva’s Port Arthur refinery and Saudi–China refiners. In 2024, its owned and affiliate refineries processed over half of its total crude, with ambitious growth plans aligned to a broader “liquids-to-chemicals” push.

-

Shell plc : Shell operates major refining assets worldwide and recently exited its Motiva JV, enabling Saudi Aramco to attain full ownership. Shell’s remaining complex facilities continue to serve as key hubs for fuel and petrochemical outputs.

-

BP plc : BP maintains a strategic footprint in global refining, particularly across Europe and North America. With a balance between fuel production and petrochemical feedstock, BP’s refining strategy emphasizes integration and premium product focus.

Conclusion

The oil refining market continues to evolve as energy demands shift, and governments implement stricter environmental policies. While traditional fuels still dominate the landscape, refiners are under increasing pressure to diversify outputs and improve operational efficiency. Growth in Asia-Pacific remains a focal point due to rising consumption, while mature markets are leaning toward integration and emissions management

さらに詳しい情報を得るには: https://www.mordorintelligence.com/ja/industry-reports/oil-refining-market?utm_source=abnewswire

Industry Related Reports

Southeast Asia Oil and Gas Downstream Market: The Southeast Asia Oil and Gas Downstream Market report is segmented by type into refineries and petrochemical plants, and by geography into Thailand, Singapore, Indonesia, Malaysia, Vietnam, and the rest of Southeast Asia. The report provides market size and forecasts for each segment in terms of refining capacity, measured in thousands of barrels per day.

Africa Oil Refining Market: The African oil refining market report is segmented by geography into Nigeria, Algeria, Egypt, South Africa, and the rest of Africa. The report provides market size and forecasts for each segment in terms of refining capacity, measured in million barrels per day.

Get More Insights: https://www.mordorintelligence.com/industry-reports/africa-oil-refining-market?utm_source=abnewswire

Indonesia Oil and Gas Downstream Market: The report covers oil and gas companies in Indonesia and segments the market by type into refineries and petrochemical plants.

About Mordor Intelligence: Mordor Intelligence is a trusted partner for businesses seeking comprehensive and actionable market intelligence. Our global reach, expert team, and tailored solutions empower organizations and individuals to make informed decisions, navigate complex markets, and achieve their strategic goals. With a team of over 550 domain experts and on-ground specialists spanning 150+ countries, Mordor Intelligence possesses a unique understanding of the global business landscape. This expertise translates into comprehensive syndicated and custom research reports covering a wide spectrum of industries, including aerospace & defense, agriculture, animal nutrition and wellness, automation, automotive, chemicals & materials, consumer goods & services, electronics, energy & power, financial services, food & beverages, healthcare, hospitality & tourism, information & communications technology, investment opportunities, and logistics.

For any inquiries or to access the full report, please contact:media@mordorintelligence.com https://www.mordorintelligence.com/

Media Contact

Company Name: Mordor Intelligence Private Limited

Contact Person: Jignesh Thakkar

Email: Send Email

Phone: +1 617-765-2493

Address:5th Floor, Rajapushpa Summit, Nanakramguda Rd, Financial District, Gachibowli

City: Hyderabad

State: Telangana 500008

Country: India

Website: https://www.mordorintelligence.com/