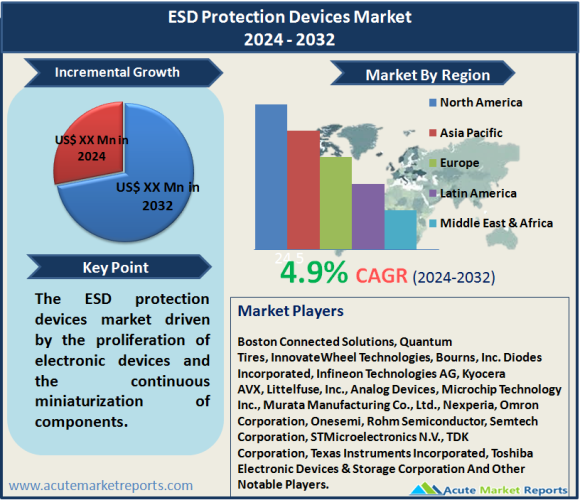

The ESD protection devices market is anticipated to expand at a compound annual growth rate (CAGR) of 4.9% during the forecast period of 2024 and 2032. Demand for dependable ESD protection solutions is anticipated to increase across industries due to the proliferation of electronic devices and the ongoing miniaturization of components, according to market research. Companies are currently experiencing a notable upswing in technological advancements, strategic partnerships, and innovations in response to the increasing difficulties presented by electrostatic discharge in electronic circuits. Geographic trends reveal a distinct differentiation in terms of revenue dominance and growth rates. North America boasts the highest revenue percentage, while the Asia-Pacific region demonstrates the highest compound annual growth rate (CAGR). A strong emphasis is placed on innovation, strategic collaborations, and the development of resilient ecosystems due to the competitive environment. The leading contenders are not only engaged in current competition but also actively influencing the trajectory of the connected tire industry. With the ongoing evolution of the industry, there is a high probability that a multitude of inventive solutions will emerge. These solutions will fundamentally alter how vehicles and their tires interact, ultimately improving driving safety and efficiency for consumers across the globe.

Key Market Drivers

The exponential growth of semiconductor manufacturing processes serves as a critical catalyst for the market of ESD protection devices. The proliferation of cutting-edge technologies, including sub-10nm semiconductor nodes, has led to heightened susceptibility to electrostatic discharge. With the reduction in size and increase in complexity of electronic components, the susceptibility to ESD damage intensifies. Prominent entities in the industry, such as suppliers of ESD protection devices and semiconductor manufacturers, are making substantial R&D investments to develop state-of-the-art safeguards for these fragile components. The efficacy of ESD protection devices in high-performance semiconductor devices has been improved through the incorporation of advanced materials, including carbon nanotubes and graphene, as supported by the numerous patents awarded for novel ESD protection designs.

Browse for a report at: https://www.acutemarketreports.com/report/esd-protection-devices-market

The significant growth of Internet of Things (IoT) devices in diverse sectors functions as a substantial catalyst for the market of ESD protection devices. The proliferation of interconnected devices within the IoT ecosystem gives rise to significant apprehension regarding the potential for ESD-induced malfunctions in these devices. There is an increased demand in the market for ESD protection solutions that are designed specifically for Internet of Things applications. The increasing sales of ESD protection devices specifically designed for IoT devices, in conjunction with the rapid adoption of IoT devices in various sectors including healthcare, smart homes, and industrial automation, provide evidence in support of this driver. As a result of the interconnectedness of IoT devices, robust ESD protection is required to guarantee their dependability and endurance; this drives the market forward.

The increasing focus on automotive electronics, which includes components for electric vehicles, infotainment, and advanced driver-assistance systems (ADAS), emerges as a substantial factor propelling the market for ESD protection devices. Due to the extensive integration of electronic components in contemporary vehicles, they are vulnerable to problems associated with ESD. There is a growing trend among automakers and component suppliers to integrate sophisticated ESD protection devices into automotive electronics to bolster their resilience. The strategic collaborations between automotive industry leaders and ESD protection device manufacturers, in addition to the integration of robust ESD protection measures into the design of next-generation automotive electronic systems, provide clear evidence in support of this driver. The increasing adoption of electric and autonomous vehicles in the automotive industry increases the demand for efficient ESD protection, thereby stimulating market expansion.

Market Restraint: Cost Sensitivity in Consumer Electronics

Although the market for ESD protection devices is expanding rapidly, it is primarily constrained by cost sensitivity, which is most pronounced in the consumer electronics sector. Electronic devices must be economical, in response to consumer demand, and manufacturers endeavor to minimize production expenses. As a result, suppliers of ESD protection devices face a challenge, as the incorporation of sophisticated ESD protection measures can increase overall production expenses. The market dynamics of consumer electronics provide indications of this restraint, as manufacturers frequently place a higher value on cost-effectiveness rather than the integration of sophisticated ESD protection technologies. Ensuring sufficient ESD protection while maintaining cost-effectiveness continues to be a formidable task, especially in the fiercely competitive consumer electronics industry.

Market Segmentation Analysis

Market by Materials

Analyzing the market for ESD protection device materials, it is anticipated that silicon-based devices will generate the most revenue in 2023. This is supported by their ubiquitous existence and essential function in the semiconductor sector and an extensive variety of electronic apparatus. Silicon, owing to its widely recognized applications and dependable nature, maintains a leading position in terms of generating revenue. In contrast, ceramic-based devices are expected to experience the highest CAGR over the forecast period. The rapid expansion of ceramic material can be ascribed to its remarkable qualities that effectively cater to the requirements of emerging electronic sectors and applications.

Market by Technology

The market by technology presents a thought-provoking narrative regarding the contrast between Multilayer Varistors (MLV) and Transient Voltage Suppressor Diodes (TVS). Due to its ability to promptly react to voltage surges, TVS achieved revenue dominance in 2023. Because TVS devices are ubiquitous and provide rapid protection for a variety of electronic circuits, they are revenue leaders. Conversely, the CAGR for MLV is anticipated to be the highest. The rapid expansion of MLV technology can be attributed to its adaptability and its widespread implementation in applications that require efficient suppression of voltage surges.

Market by Directionality

The selection between unidirectional and bidirectional ESD protection devices is contingent upon the specific requirements of the application. The unidirectional devices generated the most revenue in 2023, especially in applications that require protection in a particular orientation. However, it is anticipated that bidirectional devices, which are more adaptable, will experience the greatest CAGR. This highlights their versatility and appropriateness for an extensive range of uses, which propels their rapid expansion.

Market by Protection

The market for ESD protection is segmented into power-line and data-line segments, which compete for the highest revenue. Due to the varied requirements of electronic circuits, these two segments shared the revenue leadership in 2023. In contrast, the power-line protection sector is anticipated to maintain the highest CAGR. The rise in the integration of electronic components into power systems and devices has resulted in a heightened demand for resilient protection mechanisms.

Market by Application

Audio circuit protection and antenna circuit protection dominated the revenues in 2023, within the intricate tapestry of applications. The increasing need for ESD protection in electronic circuits and communication devices is driving this prominence. On the other hand, the SD/MMC Card Protection and Machine Elements sectors are anticipated to experience the highest CAGR. The observed increase in activity is suggestive of the growing prevalence of ESD protection in industrial apparatus and memory cards, thereby indicating a trajectory of diverse expansion.

Get Free Sample Copy From: http://www.acutemarketreports.com/request-free-sample/140206

Commercial by End-Use

The revenue leadership in the Electronic Devices and Communication Equipment segments for the year 2023 was disclosed by the end-use spectrum. Support for this market positioning is provided by the widespread incorporation of ESD protection in communication and consumer electronics. Concurrently, the electric vehicle segment is projected to earn the highest CAGR. This forecast reflects the increasing implementation of ESD protection measures in response to the automotive industry’s transition to electric vehicles, highlighting the changing dynamics within this domain.

North America Remains the Global Leader

Geographic trends exert a significant influence on the dynamics of the Connected Tyre market, which is a vast field. As of 2023, North America was identified as the region that exhibited the highest percentage of revenue. The aforementioned factors include a resilient technological infrastructure, the automotive industry’s early embrace of connected technologies, and a discerning clientele. The region’s revenue dominance is substantially influenced by the prevalence of high-end vehicles furnished with connected tire solutions and its proclivity for cutting-edge innovations. Concurrently, the Asia-Pacific region is demonstrating the greatest CAGR. The increased demand for advanced safety and monitoring systems, in conjunction with the expanding automotive industry, drives the implementation of connected tire technologies in this region. The expansion of the market is further bolstered by government initiatives that promote road safety and by the rapid urbanization that contributes to an increase in vehicle ownership. Due to its dedication to intelligent mobility solutions, APAC is ahead of the competition in terms of growth rate.

Strategic Alliances to Enhance Market Share

Key participants in the Connected Tyre market are strategically positioning themselves to take advantage of emerging opportunities while navigating the competitive landscape. Boston Connected Solutions, Quantum Tires, InnovateWheel Technologies, Bourns, Inc. Diodes Incorporated, Infineon Technologies AG, Kyocera AVX, Littelfuse, Inc., Analog Devices, Microchip Technology Inc., Murata Manufacturing Co., Ltd., Nexperia, Omron Corporation, Onesemi, Rohm Semiconductor, Semtech Corporation, STMicroelectronics N.V., TDK Corporation, Texas Instruments Incorporated, and Toshiba Electronic Devices & Storage Corporation are notable industry leaders. These corporations are leading the way by implementing a comprehensive strategy to strengthen their positions. Key market trends include strategic collaborations and partnerships, with established players collaborating with automakers to incorporate connected tire solutions into new vehicle models in a seamless fashion. Furthermore, a shared characteristic among these participants is the implementation of Internet of Things (IoT) and Artificial Intelligence (AI) technologies, which facilitate instantaneous surveillance of tire conditions, preemptive upkeep, and improved safety functionalities.

Access all the latest reports: http://www.acutemarketreports.com/market-research-reports

Media Contact

Company Name: Acute Market Reports, Inc.

Contact Person: Chris Paul

Email: Send Email

Phone: US/Canada: +1-855-455-8662, India: +91 7755981103

Address:90 Church St, FL 1 #3514, New York, NY 10008, USA

City: New York

State: New York

Country: United States

Website: www.acutemarketreports.com