Bionomics Limited (Nasdaq: BNOX) (ASX: BNO) shares have kicked into rally mode, surging by over 65% since August 22nd to score an intra-week high thus far of $1.98. The rally is deserved, with the fuse lit after BNOX announced that the last patient visit had been completed in its Phase 2 ATTUNE study in Post-Traumatic Stress Disorder (“PTSD”). Topline results are expected to be released by the end of September. Reaching that milestone isn’t the only thing attracting investors’ attention. Bionomics also disclosed expectations for its End of Phase 2 (EoPh2) meeting with the FDA in September to review results from its Phase 2 PREVAIL study in patients with Social Anxiety Disorder (SAD). Leaving that meeting could include details putting another milestone in play. Specifically, a more determinant date to commence a proposed Phase 3 registrational trial.

That calendar alone has put multiple potential catalysts in the near-term crosshairs. And they could deliver an appreciable boost to the share price. Analysts covering BNOX think so. At least two have modeled for Bionomics shares to surge by over 293% to $7.00 from current levels in the next 12 months. They present a strong case for why, emphasizing the implied value of BNOX drug candidates earning front-line treatment designations for unmet medical conditions, particularly patients suffering from serious central nervous system (“CNS”) disorders. The company is equally optimistic.

Spyros Papapetropoulos, M.D., Ph.D., President and CEO of Bionomics, said, “We continue our strong momentum with our fast track designated BNC210, with a robust clinical and regulatory milestone-rich year in both SAD and PTSD, two highly prevalent neuropsychiatric disorders with significant unmet needs.” With excellent data supporting its drug efficacy and safety profile, September should be filled with value drivers. In fact, with plans to release topline results for its ATTUNE trail and an expected announcement for when it will commence its Phase 3 PREVAIL trial, the $7.00 price target may be conservative. After all, BNOX shares traded as high as $10.90 in the past 52 weeks, and they are better positioned today to advance key drug candidates with data supporting mitigated risk. Re-claiming that high, BNOX investors could be eyeing gains of over 512% from its current $1.78.

Milestones Reached Can Become Catalysts

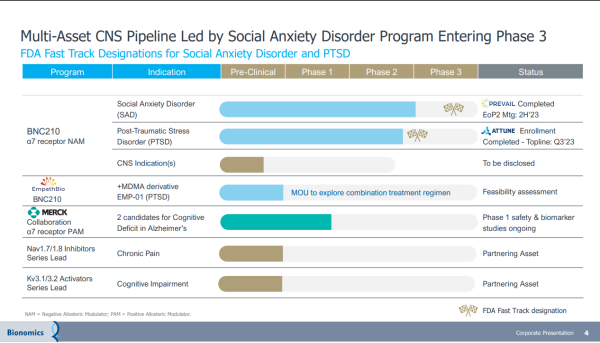

Thus, any weakness from profit-taking should be viewed as an opportunity, not a trend. That’s not an unwarranted presumption. Except for some profit-taking on Wednesday, the BNOX chart over the past month shows a steepening trajectory. That’s no coincidence. Investors are seizing low-priced entry into a company on the precipice of a breakout, leveraging intrinsic and inherent value from its lead drug candidate, BNC210. It’s an oral, proprietary, selective negative allosteric modulator of the α7 nicotinic acetylcholine receptor for the acute treatment of SAD and chronic treatment of PTSD. It’s not the only promising asset.

Beyond BNC210, Bionomics has a strategic partnership with Merck (NYSE: MRK), evaluating two drugs in early-stage clinical trials to treat cognitive deficits in Alzheimer’s disease and other central nervous system conditions. The BNOX pipeline extends further, with preclinical assets targeting Kv3.1/3.2 and Nav1.7/1.8 ion channels being developed for Central Nervous System (“CNS”) conditions with high unmet needs.

As expected, its busy pipeline provides plenty of additions to the BNOX agenda. In addition to topline data from its placebo-controlled Phase 2b ATTUNE study of BNC210 in PTSD expected this quarter, BNOX expects to take guidance from its FDA End of Phase 2 meeting discussing data and plans for its proposed registrational program for BNC210 in Social Anxiety Disorder. In Q4/2023 and Q1/2024, the company expects to dose its first patient in the Phase 3 study of BNC210 in Social Anxiety Disorder. Also leading into next year, the company’s partnership with Merck for Phase 1 candidates targeting cognitive deficits in Alzheimer’s and other CNS disorders is expected to gain clinical trial traction. That’s not all.

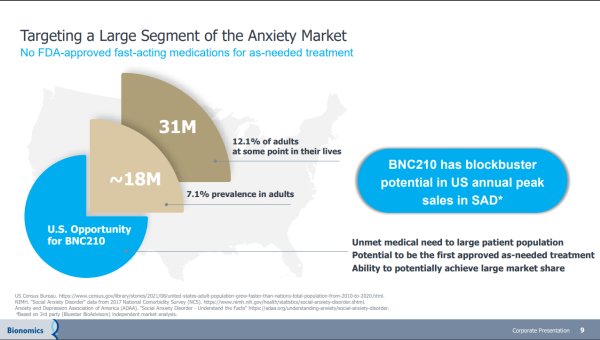

Bionomics has a memorandum of understanding with EmpathBio for the feasibility assessment of EMP-01 (MDMA derivative) & BNC210 for PTSD treatment. If acted on, it represents another value driver that could feed off that drug candidate’s blockbuster potential. A blockbuster drug is one that generates annual sales of $1 billion or more for the company that sells it. The promise of BNC210 checks that box, highlighted by its non-sedating anxiolytic profile and rapid onset of action, which adds to the potential of becoming a first & best-in-class therapeutic for the acute treatment of Social Anxiety Disorder. If approved, it could be the first, as-needed treatment for SAD with a non-sedating, non-habit-forming profile.

Other partnering opportunities are also in play, with BNOX hinting at potential collaborations with preclinical assets targeting potassium (Kv) and sodium (Nav) ion channels. With drug candidates on the pathway to earning front-line designations and scoring blockbuster revenues, future development agreements with big pharma are more likely than not. That makes sense. Big pharma giants like Pfizer (NYSE: PFE), AbbVie (NYSE: ABBV), and Johnson & Johnson (NYSE: JNJ) have become acquirers instead of developers over the last decade, a strategy turning microcap biotechs into development stars while shaving years off of development time.

Assets That Are Attracting Big Pharma

Reasons support these drug sector behemoths to look BNOX’s way. Foremost is BNOX advancing an impressive drug candidate pipeline that has at least two making their way toward Phase 3 status. Moreover, they target significant unmet medical needs, which is more than excellent news for the patients who need better care but also for the companies that develop them. Include Bionomics in that list. And here’s another thing to consider. The Phase IIb ATTUNE study is evaluating BNC210 as a monotherapy to treat PTSD. That’s an indication high on the list of any big pharma company, noting the blockbuster potential. Thus, don’t rule out the possibility of a combination therapy approach to treating that debilitating condition, which would trigger a new potential partnership. They may also get outside interest from its mission to find a better way to treat SAD.

Bionomics is intent on delivering there as well. More than just focused, they have completed evaluating BNC210 in a Phase II PREVAIL study for SAD. The data from the trial is impressive, showing that both 225-mg and 675-mg doses of BNC210 resulted in a decline in anxiety across multiple phases of the public speaking challenge. Notably, patients receiving BNC210 experienced significantly less anxiety during the public speaking task compared to placebo. Treating that indication also comes with over a billion-dollar revenue-generating potential. And with BNOX planning to meet the FDA in mid-September to discuss the clinical requirements for advancing BNC210 into Phase 3 development, a partnership could come sooner than later. That could lead to a windfall.

The value difference between a Phase 2 and a Phase 3 company can be hundreds of millions. Considering data from its PREVAIL study impresses evaluators, confidence is high that the Phase II PREVAIL study results will support this giant clinical step forward. Moreover, developing a Phase III study and its expected data will likely help BNOX submit a new drug application for BNC210 to treat SAD. Meeting expectations and capitalizing on strengths throughout its pipeline adds fuel to turn milestones into catalysts.

Bionomics Pipeline Exposes Multiple Blockbuster-Sized Candidates

Those catalysts are what investors want. Yes, milestones are significant, but the latter turns ambitions into revenues. And with Bionomics having several in its sights, the value disconnect between assets, programs, partnerships, and its share price may be too wide to ignore. Like many biotechs, BNOX took a hit to its valuation as the undercurrent in the markets isn’t as strong as what’s displayed in the Nasdaq 100. However, the selloff may be overdone, especially with BNOX ideally positioned to capitalize on late-stage products that put them on a fast track to approval and commercialization.

In fact, at $1.78, BNOX shares are priced at where investors would pay for a Phase 1, preclinical stage company. That’s certainly not the case. Bionomics is expecting to and is on its way to changing the treatment landscape for PTST, SAD, and other neurologic conditions. Other companies may also be trying, but few, if any, are as near to commercialization, with the amount of supporting data, as Bionomics. That difference can be transformative to BNOX in the back end of 2023 and into 2024.

And better still, it can lead to not only reaching analysts’ price targets 302% higher than its current price but also to re-claim its $10.90 high, 512% higher than the $1.78 price just printed. Companies presenting that value proposition, with evidence to justify the increase, should not be ignored. Based on the ascending trajectory of BNOX shares, investors are certainly paying attention to this one. Rightfully so.

Disclaimers: Shore Thing Media, LLC. (STM) is responsible for the production and distribution of this content. STM is not operated by a licensed broker, a dealer, or a registered investment adviser. It should be expressly understood that under no circumstances does any information published herein represent a recommendation to buy or sell a security. Our reports/releases are a commercial advertisement and are for general information purposes ONLY. We are engaged in the business of marketing and advertising companies for monetary compensation. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The information made available by STM is not intended to be, nor does it constitute, investment advice or recommendations. The contributors may buy and sell securities before and after any particular article, report and publication. In no event shall STM be liable to any member, guest or third party for any damages of any kind arising out of the use of any content or other material published or made available by STM, including, without limitation, any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages. Past performance is a poor indicator of future performance. The information in this video, article, and in its related newsletters, is not intended to be, nor does it constitute, investment advice or recommendations. STM strongly urges you conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D. For some content, STM, its authors, contributors, or its agents, may be compensated for preparing research, video graphics, and editorial content. Shore Thing Media, LLC. has been compensated up to three-thousand-five-hundred-dollars cash via wire transfer by a third party to produce and syndicate content for Bionomics Limited. for a period of two weeks ending on September 14, 2023. As part of that content, readers, subscribers, and website viewers, are expected to read the full disclaimers and financial disclosures statement that can be found on our website. Contributors reserve the right, but are not obligated to, submit articles for fact-checking prior to publication. Contributors are under no obligation to accept revisions when not factually supported. Furthermore, because contributors are compensated, readers and viewers of this content should always assume that content provided shows only the positive side of companies, and rarely, if ever, highlights the risks associated with investment. Thus, readers and viewers should accept the content as an advertorial that highlights only the best features of a company. Never take opinion, articles presented, or content provided as a sole reason to invest in any featured company. Investors must always perform their own due diligence prior to investing in any publicly traded company and understand the risks involved, including losing their entire investment. The Private Securities Litigation Reform Act of 1995 provides investors a safe harbor in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events or performance are not statements of historical fact may be forward looking statements. Forward looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward looking statements in this action may be identified through use of words such as projects, foresee, expects, will, anticipates, estimates, believes, understands, or that by statements indicating certain actions & quote; may, could, or might occur. Understand there is no guarantee past performance will be indicative of future results. Investing in micro-cap and growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investors investment may be lost or impaired due to the speculative nature of the companies profiled.

Media Contact

Company Name: STM, LLC.

Contact Person: Michael Thomas

Email: contact@primetimeprofiles.com

Country: United States

Website: https://primetimeprofiles.com/